damircudic

Investment Thesis

Opera Limited (NASDAQ:OPRA) has seen great results through year-over-year performance and has much growth potential. It performed well even through macro situations and COVID lockdowns. Their business model revolves around having more active users, which significantly relates to the company’s approach to monetizing its highly specialized audience by meeting specific audiences’ specific needs through functionality and productivity features. Opera can achieve revenue stability and profitability if they manage to accomplish opportunities such as:

- Attain recurring customers.

- Continue to meet the specific needs of specific audiences.

- Pursuing innovation, functionality, and increased productivity.

Opera aims to be the number one choice for users looking for another browser, compared to the standard browser defaults such as Google Chrome by Alphabet (GOOG) (GOOGL) and Safari by Apple (AAPL). The company also has upcoming buyback and share repurchasing programs, making it a great growth stock for both near and long-term performance at which it is currently priced today, leading me to give it a Buy rating.

A Brief Overview of Opera

Opera operates in the Information Technology sector, specifically in the Software industry. The company operates in Ireland, Singapore, Russia, and internationally. It was founded in 1995 and is headquartered in Oslo, Norway. They offer mobile browser products such as Opera Mini, Opera for Android and iOS, Opera GX Mobile, and Opera Touch. They also have PC browsers such as Opera for Computers, Opera GX, and Opera News, an AI-powered personalized news discovery and aggregation service. Opera recognizes three revenue categories: Search, Advertising, Technology Licensing, and Other Revenue. The company’s financials are looking strong as its revenues increased by $85.9 million, or a 52% revenue increase from Opera’s 2020 performance of $165 million, compared to its 2021 performance of $250.99 million. The company beat its revenue estimates by $6.06 million in its recent quarterly earnings of $77.83 million, which exceeds its year-over-year performance of $60 million by 29%.

Opera’s Opportunity and Results

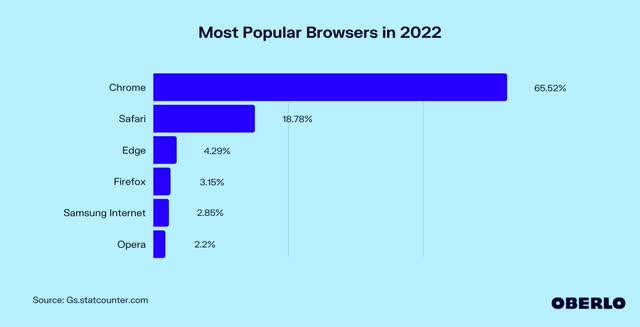

Source from Oberlo – Most Popular Browsers in 2022

I believe that Opera has a significant growth path due to the company’s pursuit of innovation, functionality, and increased productivity. I’ve used their Opera GX browser, and its user experience differs from what you typically get from Google Chrome. The browser is aimed at Gamers (mostly) and has some customized news features tailored to gamers, and I think it’s one of Opera’s most significant selling points, providing functions that other browsers could not. According to Oberlo, Opera is 2.2% of the browser share in 2022, which is relatively low. However, these opportunities and Opera’s proven results are why I believe that this company can provide excellent results if these opportunities are not missed:

Recurring Customers

Opera continues to market and advertise its browsers across different users, such as gamers who are active on their computers that play hours of games. If the company continues to innovate and add additional productivity features to its Opera GX browsers, it can potentially create recurring customers that will stay loyal to their browsers because of its other features, such as:

- Custom Themes

- Light and Dark Mode

- GX Corner – A mini news section for gamers, such as upcoming updates and release dates.

- Sidebars

- Messengers

- Pinboards

- Fast Navigation Features

These simple yet intuitive features make Opera GX better than your regular browser. It is not for everyone, but again, Opera strives to meet a specific set of needs for audiences that general market browsers can’t and find a way to monetize it.

Contextual Advertising – Better Privacy

According to Instapage, contextual advertising refers to the practice of placing ads on web pages based on the content of those pages. It has more privacy than behavior advertising because it’s not constrained by privacy legislation, is brand safe, and is more accessible and affordable to implement. Sometimes, context matters more than behavior, which is what Opera operates on. Since a minority of users prefer some privacy while surfing the internet.

GX ARPU Performance

The company recently announced on its Q1’22 results that Opera GX has over 2 million mobile and 14 million pc users, a 15% sequential increase and over double from the past year with an ARPU of $2.70 on an annualized basis. However, in the company’s Q2’22 results, they have over 2.5 million mobile users (a 500,000 user increase) and 14.5 million PC users (or a 500,000 user increase), resulting in a 78% year-over-year growth of GX with an ARPU of $2.89. The slowdown in growth most likely has something to be with COVID lockdowns being lifted and gamers not being quarantined anymore. Krystian Kolondra, Opera’s EVP of Browsers, stated in the company’s Q2’22 Earnings Call that:

“…I can only say that what we see is that we see continuous growth, and we see the gamer patterns more affected are by when school ends or starts than the pandemic. So we don’t see for gamers. These are mostly Gen Z younger people, we don’t see real impact here.”

When asked how the reopening post-pandemic affects the trend in the company’s gaming-related business segments. Overall, I’m in line with Opera’s outlook regarding how MAUs work, especially in the gaming segment. People take time to adjust to a new user interface and the features that come with it. This further proves my point that once users get hooked on their browsers, they will have recurring customers who could stay loyal to them in the long run.

Opera Investment, Share Repurchase, and Buyback Plans

Opera has two former and one current investment. The company plans to divest its equity stakes in Nano Bank and StarMaker or STAR X. According to the payment schedule, its stake in Star X was sold in April for $83.5 million and collected the first $28.4 million in the quarter. OPay remains classified as held for sale. It’s a 6.4% stake in the company after Opera sold a 2.6% stake for $50 million last year.

Opera also has a share repurchase program of $50 million. The company repurchased 1.26 million ADS (including the 570,000 ADSs repurchased in Q1) for $6.7 million and another 600,000 to date in Q3. The company has repurchased a total of 2.43 million ADSs for $12.7 million so far, leaving a total of $37 million worth of repurchases to be done. On a separate note, Opera has completed its repurchase of shares from 360, a capacity of 23.4 million ADSs, or a 20.6% ownership stake in Opera for $128.6 million for the shares or $5.50 on a per-ADS basis. This buyback program will not affect Opera’s separate ongoing share repurchase program. This means that there can be a temporary share price boost that moves with the company’s performance. Read more about it in Seeking Alpha News by clicking here.

Possible Risks to Opera

Many risks are tied to SaaS companies, and Opera is not immune to that. Opera’s primary strength is its browsers’ innovative functional features that others don’t. Because of this, the company sees an increase in MAUs and ARPUs periodically. However, its greatest strength is also its greatest weakness:

Instability in Traffic

Since most of Opera’s revenue comes from browsers and news, any significant instability in traffic can affect the company’s overall performance and margins. Think about it, one of the fundamental reasons Opera has been doing well during COVID lockdowns was that everybody had more time on their hands, and they happened to come across the Opera/Opera GX browser through the company’s marketing efforts. Since COVID restrictions have been lifted and online class sessions are ending, a traffic slowdown is expected, or worse, a decline in traffic. This will hurt the company’s financials, and margins will be slimmer.

Lack of New Innovative Features

Innovative functions and features are Opera’s most vital selling point. From having customizable themes, and sidebars, the option to force dark mode on sites, an option to make a window pop-up whenever there’s video playback, and more of its additional features make the Opera browser great. However, if other competitors catch up with Opera’s features, wouldn’t that mean they need to innovate more and more creative ideas to maintain its brand being “innovative”? Moreover, if competitors did catch up by adding these features, could we still confidently say they would still use the Opera browser? These won’t be recognized immediately as many factors affect consumer choice, but as an underdog (again, with only a 2.2% share in the global browsers in 2022) amongst well-known browsers, it’s great for investors to keep these in mind.

Decrease in Recurring Users

Similar to the first risk, when there’s a slowdown/instability in incoming traffic, recurring users will decrease. There will be lesser and lesser users that’ll be coming back to use the program, and a much greater risk would be if the users would revert to the old preference of browsers for various reasons such as preference, sync options (available for Chrome), or reverting to accustomed settings from the previous browser. Whatever the reason, if there’s a decrease in recurring users, there will be a decline in ad revenues and even a potentially lower annualized ARPU.

These are risks that current and non-current investors should know about Opera. In essence, the company operates on a business model that relies on customer retention, and losing that would be the start of the company’s downturn.

Financials and Valuation

Price Return – Chart by Seeking Alpha

Opera’s share price has been close to its all-time low for the past 52 weeks. However, due to the share repurchase programs and share buybacks, the stock price could temporarily have a short boost, so considering what it’s priced at today, I believe the stock to be inexpensive.

Price/Sales (TTM) – Seeking Alpha

When compared to similar companies such as Mitek Systems, Inc. (MITK), Rimini Street, Inc. (RMNI), and Blend Labs, Inc. (BLND), Opera is trading at a low P/S rate which leads me to believe that the stock is undervalued considering that MITK had $39.3 in revenues in its Q2’22 reports, RMNI achieved $101.2 million in revenue (which is trading at a lower P/S ratio which can also mean it’s undervalued), and BLND being able to reach $65.5 million in revenues. Comparing these similar companies, we can assume that Opera is potentially undervalued.

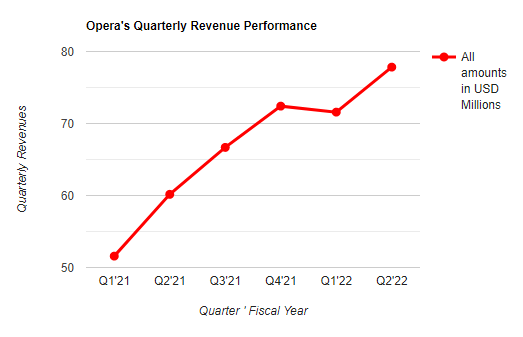

Data from Seeking Alpha – Chart by Author

Opera has been growing its revenues and performing fairly well. On an annual basis, the company has increased its revenues by 52% and continues to grow quarterly. In the past five quarters, the company’s average revenue growth rate was 8.72% and increased by 29% year-over-year on its second-quarter results.

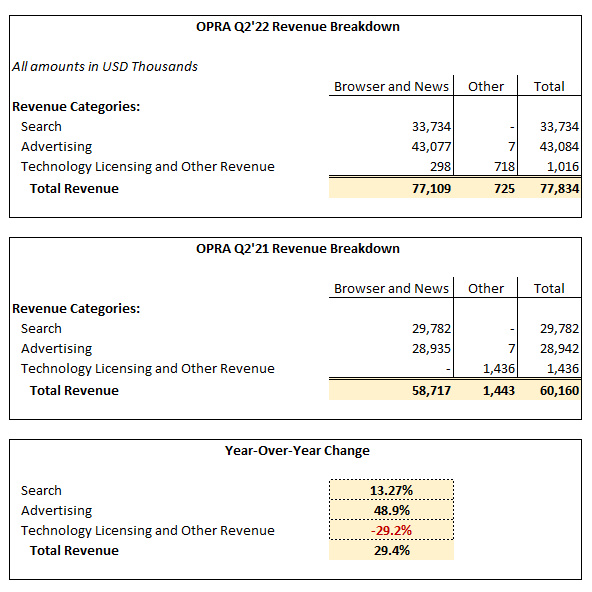

Opera Filings – Image by Author

Opera recorded total revenue of $77.8 million in the company’s second-quarter results, a 29% increase year-over-year. Revenues increased across all revenue categories except in Technology Licensing and Other Revenue which faced a decrease of 29%. However, its decline in revenue is offset by the advertising revenue, which grew by 48.9%, and its search revenue which grew by 13.27%. This may have something to do with GX revenues with its growing user base and increased ARPU.

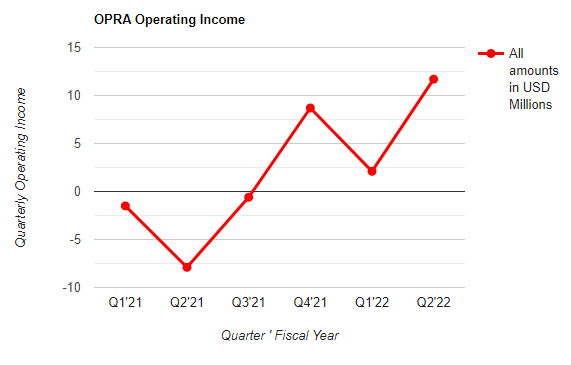

Data from Seeking Alpha – Chart by Author

Opera recognized an operating income of $11.7 million, or a 457% sequential increase compared to its Q1’22 results. Again, this is directly related to the 29% increase in the company’s total quarterly revenue and its reduction in SG&A expenses from $34.1 million in Q1’22 to $25.3 million. Operating income is seeing a trend. However, management did mention that they plan on increasing marketing costs and expect to cost of revenue to grow as well. Management is expecting some reduction in salary costs to keep SG&A expenses lower to mitigate the increase in prices.

I use the rule of 40 to measure a software company’s sustainability, and to get that, we need to get the company’s recent year-over-year revenue growth performance, add that to the EBITDA margin, and if that exceeds 40%, then determine that Opera is sustainable. So with year-over-year revenue growth of 29.38% and an EBITDA of $16.65 million, we get the EBITDA margin by dividing it by the quarterly revenue of $77.8 million, and we get an EBITDA margin of 21.29%. Then we do 29.38 + 21.29 and get 50.67 which exceeds 40, which means that Opera is indeed sustainable.

Final Thoughts on Opera

Overall, I rate Opera as a Buy. Management is trying its best to reduce costs and repurchase ADSs and its business model have a high chance of sustaining its customers, which Opera can later monetize through advertisements. The user base in GX also helps a lot with the company’s revenue mix, and although the user base hasn’t been growing quickly on a sequential basis, its ARPU did increase. The stock is priced at $4.16, close to its 52-week low of $3.97. With the consistent performance and relatively low Price-to-Sales ratio, share repurchasing, cost reduction, and my confidence in the company’s business model, I rate the stock as a Buy.

I hope you’ve had a good read, have a nice day!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment