mesut zengin

Overview

Dole plc (NYSE:DOLE) is currently undervalued by ~210%. I believe DOLE’s stock price sell off is unjustified and that the valuation today represents an attractive entry point for investors. At this valuation, we are not demanding high growth, but rather industry-like growth and slight margin expansion. I believe both are possible given DOLE’s leadership position and its business model.

Business description

DOLE is a newly formed entity that resulted from the merger of Total Produce and Dole PLC. The combined entity offers more than 300 products grown and sourced both locally and globally from more than 30 countries in different regions. These products are sold and distributed in more than 80 countries through retail, wholesale, and foodservice channels.

According to pro forma financials for FY21, 36% of DOLE’s revenue comes from diversified EMEA, 19% from diversified Americas, 14% from fresh vegetables, and 31% from fresh fruit.

Large TAM with stable growth

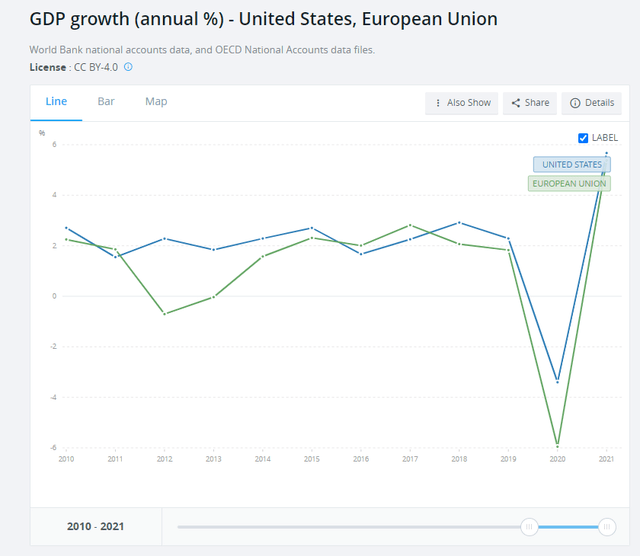

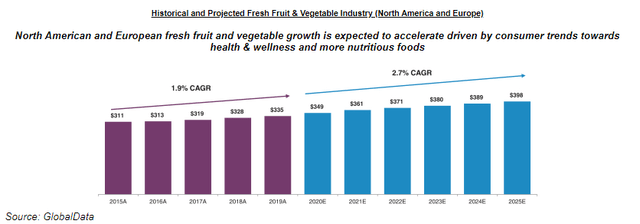

DOLE primarily competes in the NA and European fresh fruit and vegetable markets, which have a TAM of $335 billion ($139 billion in NA and $196 billion in Europe as per DOLE F-1). Historically, these markets have grown at GDP-like rates, and growth is expected to remain stable in the low single digits until 2025.

I believe DOLE is well-positioned for success thanks to a confluence of positive industry trends. To begin with, there has been a recent uptick in the demand for locally grown produce, an area where DOLE can capitalize thanks to its extensive international farming network and domestic sourcing channels. Second, the fresh produce aisle has emerged as a key perimeter-of-store category and footfall driver (DOLE F-1) as food retailers have begun to catch up with the trend toward health and wellness and sustainable consumption. 74% of consumers (Deloitte survey) buy fresh food at least once a week, and 45% (Bain & Company survey) think it’s more important to buy healthy food now than it was before COVID-19.

Consumers’ growing preference for organically grown foods is driving rapid expansion in the organic food sector of the fresh fruit and vegetable market. Consumers are increasingly interested in the advantages of organic foods because of the growing concern for health and nutrition over the past few decades. The market for organic foods is estimated to have expanded by 10.6% per year between 2018 and 2020. Fruit categories like avocados, berries, and Value-Added Salads have all seen increased sales, lending credence to the idea that there is a growing demand for organic foods (DOLE F-1)

Largest player in the industry enjoys economies of scale

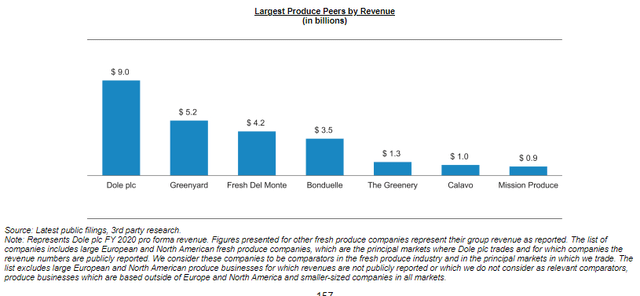

DOLE is the largest fresh produce company in the world. The firm grows and sources more than 300 different products from more than 30 countries across a variety of regions, and then markets and distributes them in more than 80 different countries. At $9 billion in revenue, it is 1.7 times larger than the next player. Scale is crucial in the fresh produce market as it indicates that DOLE can take advantage of economies of scale. DOLE’s size allows it to maintain a low-cost position that differentiates it from the competition and makes it difficult to replicate. For instance, DOLE’s global procurement and storage capabilities allow it to provide the largest selection of fresh produce in all of the markets in which it operates while still maintaining low inventory wastage rates thanks to improved demand forecasting, facilitated by the massive amounts of data it has amassed. To put more meat into DOLE’s leadership, it is the market leader in a wide variety of products across the globe. This includes bananas in North America and Europe, pineapples in both markets, value-added salads in the United States, and grapes (DOLE F-1).

Vertically integrated model

DOLE’s vertically integrated model gives it a competitive edge in terms of both scale and depth of control over the entire process, from production to distribution to final consumption. The ability to regulate this procedure is essential because of the products’ characteristics. Because of its short shelf life, fresh produce must be sold as soon as possible after harvest, and its price can be affected by a number of factors such as supply and demand. DOLE’s control over the supply chain enables it to consistently and efficiently deliver pristine fresh fruits and vegetables to consumers on a global scale. In monetary terms, this would translate to increased gross margins as a result of decreased waste or a lower cost of goods.

In order to comprehend DOLE’s vertically integrated model, one must learn its inner workings from the bottom up. For starters, DOLE has built lasting partnerships with hundreds of local growers by investing in their companies and offering agronomic, commercial, and promotional support across all of their business verticals. Because of its widespread ownership of production assets in different regions, DOLE is better able to control costs and increase commercial opportunities with independent growers, thereby reinforcing its competitive advantage in terms of low prices. In addition to the aforementioned, DOLE also owns or leases a fleet of self-sustaining refrigerated container carriers, pallet-friendly conventional refrigerated ships with container-carrying capacity on deck, as well as refrigerated containers, dry containers, chassis, generator sets, and facilities around the world. With these, DOLE is now in charge of its own produce delivery, with complete say over timing and routes. The resources needed to meet service, quality, and cost targets are all made available through DOLE’s supply chain. It also provides supply chain transparency, which consumers are increasingly seeking out due to their concern for the environment.

Forecast

Based on my investment thesis, I expect DOLE to continue to sustain its leadership position due to scale and profitability to improve over time as incremental margin kicks in.

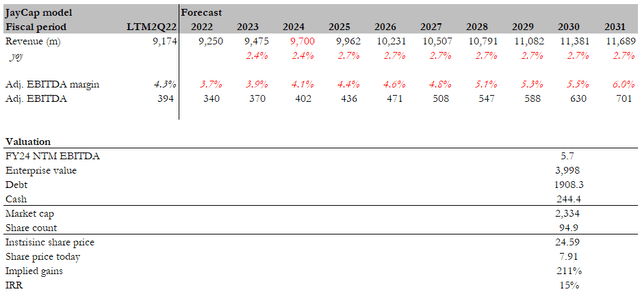

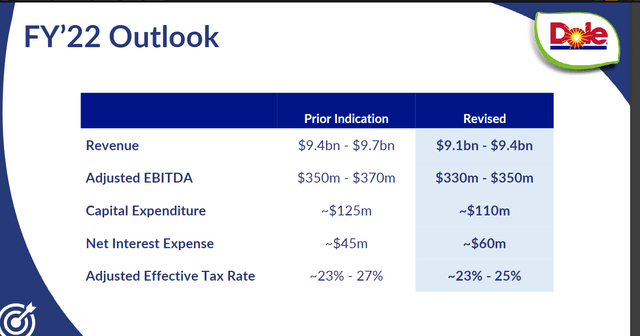

For my model, I expect FY22 revenue to hit the mid-point of management’s revised guidance and FY24 revenue to recover to pre-revised guidance of $9.7 billion. This would imply a 2.4% CAGR from FY22, slightly below the forecasted industry growth, which I believe is reasonable given that the industry was expected to grow at a 2.7% CAGR (before taking into account the severity of the current macro environment).

As for profits, I expect adj. EBITDA margins to hit the mid-point of management’s FY22 revised guidance, suggesting 3.7% margins, and overtime to improve to mid-single digits, as how peers have performed. (Peers: Calavo Growers (CVGW), Fresh Del Monte (FDP), Mission Produce (AVO)).

I calculated an intrinsic value of $24.59 based on the aforementioned assumptions and a 5.7x NTM EBITDA (which is where it is trading today) using a 10-year DCF model, which is 200% higher than the current share price of $7.91. This translates to a 15% IRR over 8 years.

Author’s estimate DOLE 2Q22 earnings ppt

Red Flags

Mercy of global weather conditions

Unfavorable weather is common but difficult to predict, and its effects on fresh produce may be influenced and amplified by ongoing global climate change. If growing conditions aren’t optimal, crop yields and quality can suffer.

Competitive industry despite DOLE being a leader

Though DOLE dominates the market as a whole, it faces stiff competition from a number of niche players. In the international pineapple and diversified fruit categories, there is intense competition among exporters, importers, and cooperatives. There is a chance that these competitors will choose one or two of these markets as their “cash cow” and use the money they make there to pay for their entry into markets where DOLE already does business.

Conclusion

DOLE is undervalued at its current share price as of the date of this writing. DOLE is the leader in a large TAM with stable growth, and its competitive position is well protected by its scale and vertically integrated business model. A quick look at the stock chart clearly indicates that DOLE is a busted IPO, as the stock price has plummeted by 56% from its peak to today. I believe this selloff could be due to the merger as new shareholders dump their shares amid the weak macro environment. I do not think this selloff is justified, and as long as DOLE grows as I expect, it should yield investors decent returns over the long-term.

Be the first to comment