FinkAvenue/iStock Editorial via Getty Images

Thesis

About one month ago (shortly before its Q1 earnings report), I wrote an article on Nvidia (NASDAQ:NVDA), entitled “Do Not Pull The Trigger Before Q1 Earnings.” The main argument was that its valuation is still elevated, there are major uncertainties with the supply chain shortages, and the cryptocurrency is undergoing an extremely turbulent time.

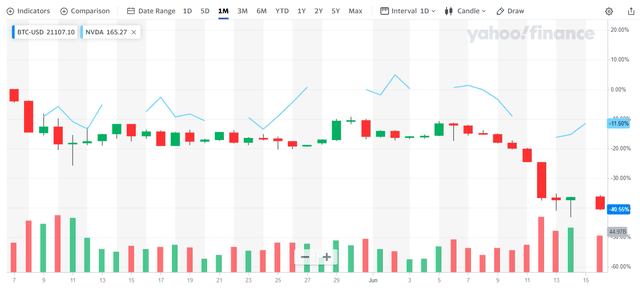

The valuation indeed contracted a bit since then. When I wrote that article, NVDA’s stock price is at $169 per share. And as of this writing, it’s at $160, a 5% contraction. However, the contraction is not sufficient to overcome the other two risks, especially the crash of the cryptocurrency. As you can see from the following chart, Bitcoin USD (BTC-USD) prices suffered more than a 28% loss since I wrote my last article. And we will see the potential impact of such a crash on NVDA immediately below.

NVDA and Crypto are correlated

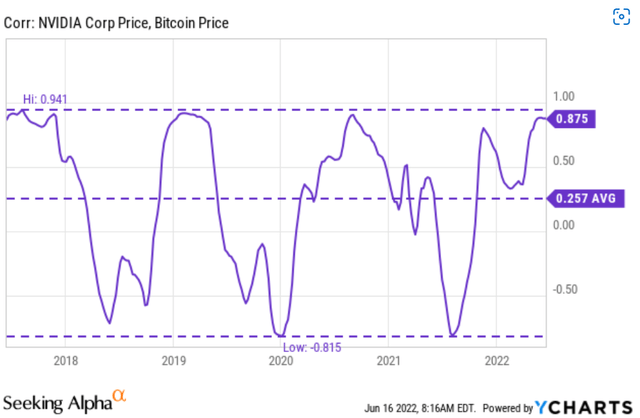

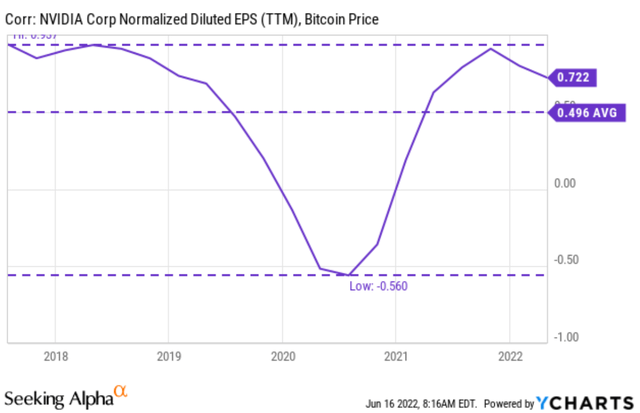

For better or worse, NVDA and crypto mining are closely correlated. The correlation is not only in terms of prices (which largely reflect market psychology) and also in terms of earnings (which reflect business fundamentals) as you can see from the following two charts. Of course, in investing, both are important.

The first chart below shows the correlation between NVDA stock prices and Bitcoin prices. As seen, over the past few years, the correlation fluctuated. Sometimes it was very negative, reaching as low as negative 0.81. And sometimes it’s very high, demonstrating an almost perfect positive correlation with a coefficient of 0.94 (a coefficient of 1 would mean a perfect positive correlation). Although the long-term average is a positive 0.257. And currently, the correlation is at a very high level of 0.875.

The second chart below shows the correlation between NVDA’s EPS and Bitcoin prices. And as you can see here, the correlation is even stronger! It has been positive most of the time, except during the period around 2020 to 2021. The average correlation is a stronger 0.50 and currently, the correlation is at 0.722.

Seeking Alpha and YCharts Seeking Alpha and YCharts

How much collateral damage?

So now, the next logical question is how much NVDA earnings rely on crypto mining? Unfortunately, the answer is not that obvious. As CFO Colette Kress commented (the emphases were added by me):

Channel inventory has nearly normalized and we expect it to remain around these levels in Q2. The extent in which cryptocurrency mining contributed to Gaming demand is difficult for us to quantify with any reasonable degree of precision. The reduced pace of increase in Ethereum network hash rate likely reflects lower mining activity on GPUs. We expect a diminishing contribution going forward.

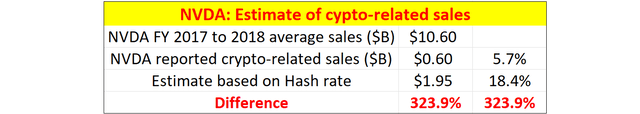

Even its own CFO acknowledges it’s difficult to quantify the contribution from crypto mining with any reasonable precision. Nevertheless, NVDA used to provide an estimate (as imprecise as it may be) in the past. But it has stopped doing that lately. By digging into history a little bit, we can gather a sense of a ballpark range. The following table summarizes two estimates of the fraction of crypto-related sales for NVDA back in 2017~2018 when it still provided its own estimates. The first estimate was provided by NVDA and the second by an independent analyst (Mitch Steves at Business Insider). According to the report:

- Nvidia generated $1.95 billion in total revenue related to crypto/blockchain rather than its reported $602 million, according to RBC analyst Mitch Steves.

- By Steves’ calculation, total crypto revenue from April 2017 to July 2018 should be around $2.75 billion. Nvidia accounted for around 75% and AMD captured around the rest.

As you can, there’s more than a 300% discrepancy between these two estimates. NVDA’s own estimates meant that only about 5.7% (still a sizable fraction nonetheless) of its sales are crypto-related, but Business Insider’s estimate meant as much as 18.4% of its sales are crypto-related.

I’m sure the true answer is somewhere in between these two estimates, and my own estimate is toward the higher end. As of its latest earnings, its gaming segment accounts for 46% of FY22 revenues, the largest contributor (followed by the data center segment at 40%). And if history is of any guidance, crypto mining is a large contributor to the gaming segment. Moreover, it’s very unlikely for it to demonstrate the strong and positive correlations in the LONG-TERM if its earnings were not dependent on crypto mining to a large extent.

Author based on Business Insider and NVDA earnings data

Final thoughts and other risks

Shortly before its Q1 earnings, I wrote an earnings preview to caution readers about NVDA’s valuation, uncertainties with the supply chain, and the cryptocurrency turmoil. Its stock prices have indeed corrected a bit, by about 5% since then. However, the contraction is not sufficient to overcome the other two risks. Cryptocurrency, as represented by BTC-USD, suffered a more than 28% loss since my earnings preview article. NVDA and crypto mining have demonstrated positive correlations in the past, and currently, the correlation is at a very high level of 0.875 in terms of prices (which reflect market psychology) and 0.722 in terms of EPS (which reflects business fundamentals). To me, these data signal that NVDA still derives a large portion of its earnings from crypto mining either directly or indirectly, and the turmoil in cryptocurrency will keep pressuring both its stock prices and profits.

In terms of the supply chain shortage, NVDA still has a large exposure on this front too. As a CNBC report commented below, the company’s supply obligations increase by $2.54B YoY and reached $9B now. To put things in perspective, its FY2023 total revenue is projected to be around $32B. So, a $9B obligation is more than 28% of its total 2023 sales guidance. Other ongoing issues such as the Russian/Ukraine situation and China’s COVID lockdowns further compound the problem.

In a sign of how Nvidia is navigating supply chain issues, the company said it had $9 billion in long-term supply obligations, up from $2.54 billion a year ago.

Be the first to comment