Justin Sullivan

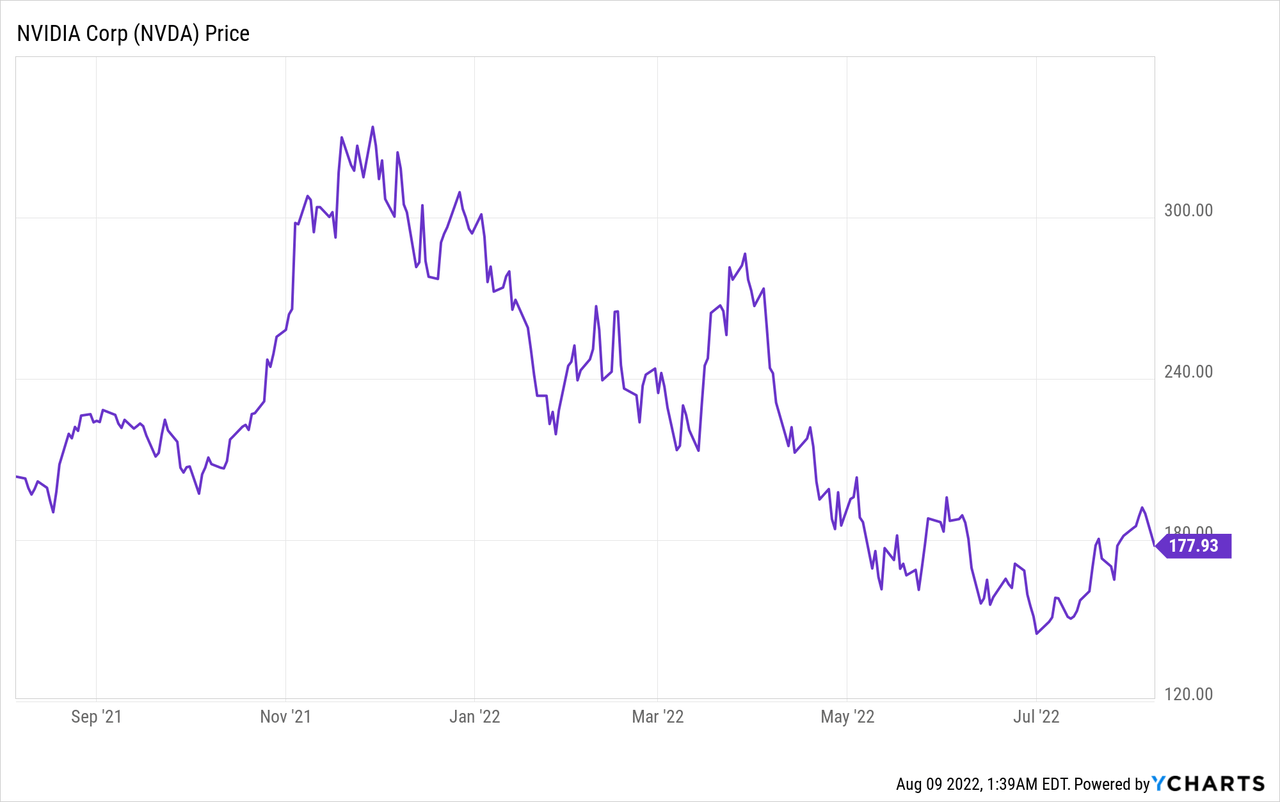

Nvidia (NASDAQ:NVDA) is an industry leader in graphics cards for Gaming, Data Center Computing, Visualization and Automotive semiconductors. They are known as a true “growth stock” having previously grown revenue at a ~50% CAGR for over the past five years (up until Q421). However, the company recently announced its preliminary financial results for the second quarter ending July 31st, 2022. Revenue came in way below analyst estimates, due to a shortfall in gaming revenue. I previously wrote a post on Microsoft (MSFT) and its second quarter earnings which also showed low gaming demand, thus that post could have acted as a leading indicator for Nvidia’s poor results. Nvidia’s stock price has dropped by ~6% on the news and has been butchered by 46% from its all time highs in November 2021. The good news is the company still has best-in-class technology and a strong chance of recovery due to the cyclical nature of the gaming market. In this post, I’m going to break down the recent earnings report and calculate the valuation for Nvidia. Let’s dive in.

Nvidia Q2 Breakdown

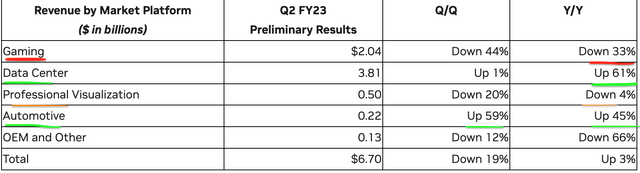

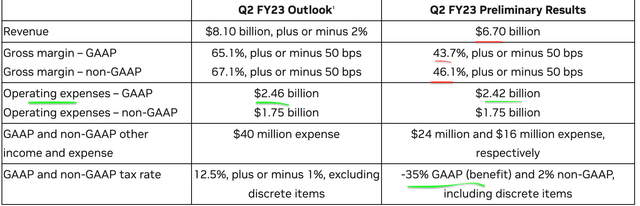

Nvidia reported $6.7 billion in revenue for the second quarter of 2022, which was substantially lower than the prior outlook of $8.1 billion. Revenue was also down a substantial 19% since the last quarter and up just 3% year over year. This revenue decline was driven primarily by a sharp decline in Gaming revenue, which came in at $2.04 billion, down an eye watering 44% sequentially and 33% year over year.

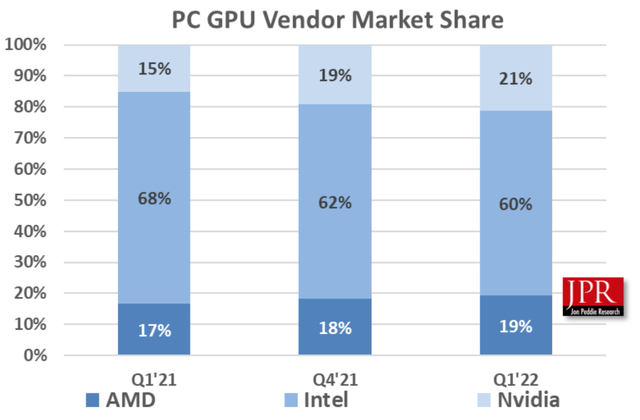

Intel (INTC) has the largest portion of the Graphical Processing Unit (GPU) market, with a 60% market share. However, Nvidia and AMD (AMD) have gradually been eating into Intel’s GPU market share. Nvidia is the leader in “high performance” GPUs and has a 21% market share of the overall market, up from just 15% in Q1 ’21. This is a testament to Nvidia’s best in class technology.

GPU Market share (Jon Peddie Research)

It’s easy to get caught up in one bad quarter of low gaming revenue for Nvidia, but I think it makes sense to zoom out. The gaming market is cyclical and is forecasted to grow at a rapid 31.87% Compounded Annual Growth Rate (CAGR) up until 2028, where it is expected to reach a value of $165 billion. Thus, despite the short-term macroeconomic headwinds, I believe Nvidia is in a strong position to recover long term. In addition, a portion of Nvidia’s GPU revenue came from purchases of Bitcoin Mining rigs in 2020/2021. However, now that the price of crypto has plummeted and we are now in a “Bitcoin Winter”, sales in this area will of course decline. Nvidia has been criticized in the past for not reporting its GPU revenues which came directly from Bitcoin mining rig sales. The company was even recently fined by the SEC for not reporting GPU sales driven by Bitcoin in the first crypto bubble/crash of 2017.

“NVIDIA’s disclosure failures deprived investors of critical information to evaluate the company’s business in a key market” – Kristina Littman, SEC Crypto Unit.

Therefore, if we assume higher than normal GPU sales in 2020 and 2021, from both the boom in gaming and crypto, then the correction now should come as no surprise.

Nvidia’s management stated the lower than expected gaming revenue reflecting a “reduction in channel partner sales due to macroeconomic headwinds”. However, they have implemented inventory adjustments and “pricing programs” with channel partners to reflect the market conditions. My guess is these “pricing programs” are a series of discounts which will of course impact Nvidia’s financials.

Nvidia Segment Revenue (Q2 Financial Results)

Nvidia’s Data Center revenue was $3.81 billion in Q2. The growth rate slowed to just 1% sequentially, but is still up 61% year over year. The company states that the recent slowdown was due to “supply chain disruptions”, but I also suspect that the macroeconomic conditions have caused temporary cutbacks in IT spending by businesses.

The good news is the Data Center industry is forecasted to grow by a staggering $615 billion between 2021 and 2026, or a 21.98% CAGR. This growth is expected to be primarily driven by the North American market as enterprises “digitally transform” to the cloud. Therefore, despite the recent headwinds, Nvidia has a vast growth runway for its Data Center segment. Nvidia is also a specialist in Artificial intelligence based computing, which is another rapidly growing industry.

Professional Visualization revenue was $500 million, which represented a decline by 20% sequentially or 4% year over year. However, Automotive revenue showed strong momentum popping by 59% sequentially and 45% year over year.

Revenue Vs outlook (NVIDIA earnings)

Nvidia’s ultra high gross margin of ~65% was compressed to 43.7% in Q2, but management believes their “long-term gross margin profile is intact”. Nvidia also controlled their operating expenses extremely well, as it came in below their outlook of $2.46 billion, with $2.42 billion.

The CFO of Nvidia (Colette Kress) stated

“We plan to continue stock buybacks as we foresee strong cash generation and future growth”.

Management is expected to discuss full financial results and outlook on the pre planned August 24th earnings call.

Advanced Valuation

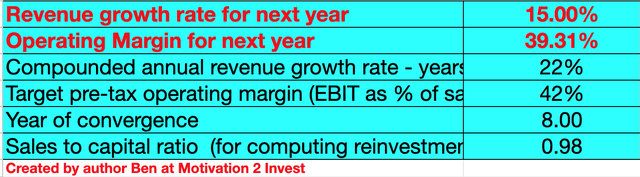

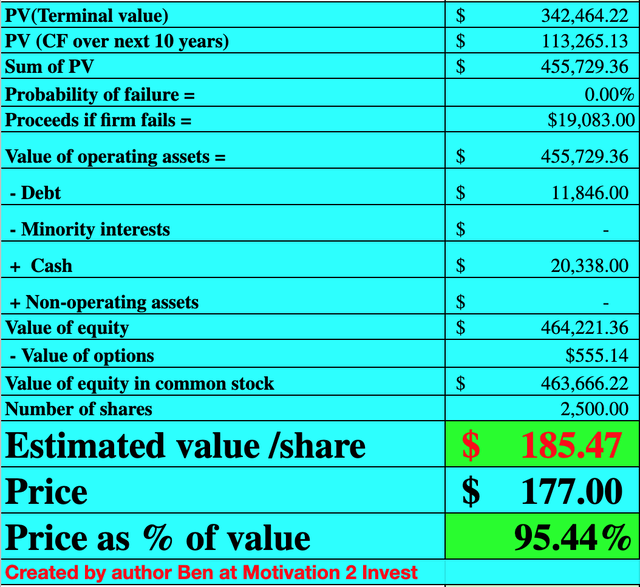

In order to value Nvidia, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have slashed my revenue growth forecast from previous rates of 30% to 40% to a conservative 15% revenue growth rate for next year. Then 22% revenue growth compounded over the next 2 to 5 years. This is assuming cyclical gaming revenue rebounds, Data Center revenue continues to grow as per the year-over-year trend and automotive revenue grows strong.

Nvidia Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted Nvidia’s operating margin to increase to a healthy 42% over the next 8 years as Data Center and Visualization revenue grows strong. In order to increase the accuracy of the valuation, I have capitalized the company’s R&D expenses.

Nvidia Stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $185/share. The stock is currently trading at $177 and thus is ~5% undervalued with these long-term growth estimates.

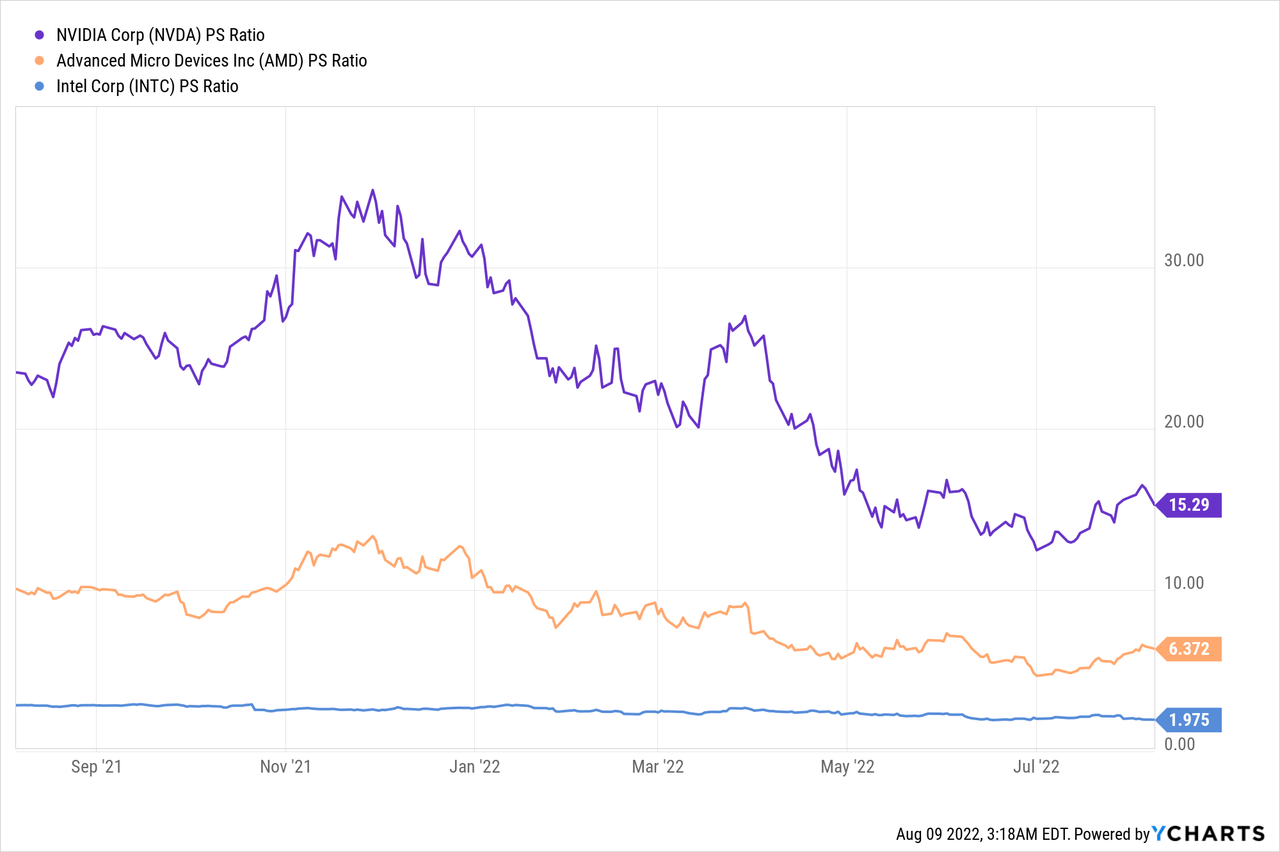

As an extra data point, Nvidia is trading at a Price to Sales Ratio (FWD) = 14.23, which is ~2.75% below its five year average. Therefore, the stock is “fair valued” on a P/S ratio basis. Nvidia does trade at a higher Price to sales ratio than AMD and Intel, but it also has substantially higher margins.

Risks

Lower IT spend/Recession

The high inflation and rising interest rate environment is increasing input costs for businesses and thus we may see a temporary dip in IT spending at least over the next couple of quarters. A “Recession” is also forecasted which will impact consumer sentiment and reduce spending. Depressed crypto prices are also a negative for Nvidia, as it means less GPUs will be purchased for Bitcoin mining rigs.

Final Thoughts

Nvidia is a tremendous technology leader which is the 2nd largest provider of GPUs for gaming. The company’s high performance technology is best in class but I believe this quarter (and possibly next) will be depressed due to macroeconomic headwinds. However, it makes sense to remember that the long-term growth trends in Data Center, Gaming and even Visualization with the “Metaverse” are not going anywhere. Nvidia is fairly valued at the current levels, but I expect lots of volatility in the next quarter till a recovery shows itself.

Be the first to comment