syahrir maulana

The last few weeks have been interesting for Jazz Pharmaceuticals (NASDAQ:JAZZ). The company paid $50 million upfront for the option on Zymeworks’ (ZYME) zanidatamab in late October, it reported Q3 results in early November and the U.S. Federal Trade Commission took issue with the company’s patent covering a system for distributing Xyrem and argued this patent should be de-listed. As a reminder, this is the patent that is preventing Avadel’s (AVDL) competing drug from entering the market prior to June 2023.

But overall, the company made good progress with the exception of nabiximols – it failed in the phase 3 trial in MS spasticity and the company decided to scrap the whole program.

Jazz Pharmaceuticals Q3 results – continued conversion to Xywav and Xywav’s steady progress in the IH market

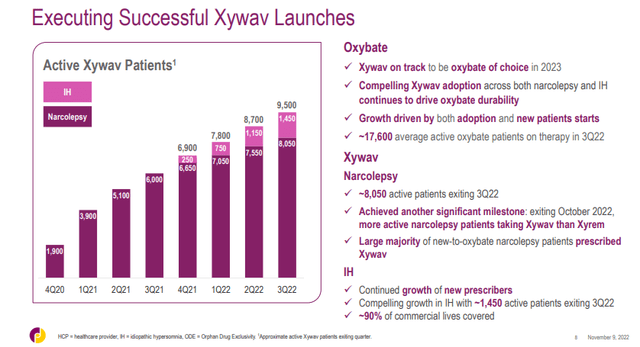

The conversion of patients continued at a steady pace and Xywav generated $255.9 million in net sales in Q3, just $0.1 million shy of Xyrem’s $256 million. There were 9,500 patients on Xywav at the end of the quarter, up from 8,700 in the second quarter and it overtook Xyrem as there were 8,100 patients on Xyrem at the end of the third quarter. Getting as many patients converted to Xywav as fast as possible remains the company’s key priority ahead of the expected launch of authorized Xyrem generics in 2023.

Jazz Pharmaceuticals investor presentation

The launch in idiopathic hypersomnia continues to progress well – there were 1,450 IH patients on Xywav at the end of Q3 up from 1,150 at the end of Q2. The implied annualized revenue run rate in the third quarter is approximately $155 million, a pretty good achievement after one year on the market. And there is still a large market to penetrate with an estimated patient population of approximately 37,000. Jazz continues to believe that sales in IH could rival those of Xyrem in narcolepsy at peak, but to get there, nearly 50% market penetration is needed at this year’s net price of Xywav.

Epidiolex had a good quarter as net sales rose 22% year-over-year to $196 million. The pandemic has slowed down this launch, but it seems to be back on track now and it is just getting started in ex-U.S. territories. Jazz has secured reimbursement in the top five countries in Europe and uptake should steadily increase in the following quarters.

The launch of Rylaze was very strong and this product has exceeded my original expectations, having reached an annualized net sales run rate of nearly $300 million in the third quarter. And global expansion is on track with a potential approval in Europe in 2023 and the expected submission in Japan.

Zepzelca sales grew 14% Y/Y when adjusted for a $10 million inventory benefit in Q3 2021, but its growth rates have slowed in the last few quarters. Label expansion may be required for further meaningful market share gains.

Overall, it was a solid quarter and as a result, Jazz increased the low end of its full-year revenue guidance range from $3.5 billion to $3.6 billion. The new range is now $3.6 billion to $3.7 billion.

Pipeline updates – discontinuation of nabiximols

Jazz has previously announced that nabiximols has failed to achieve the primary endpoint in the phase 3 trial in multiple sclerosis spasticity. The company has completed the analysis of the data and has decided to discontinue the nabiximols program and it took a $134 million impairment charge as a result. This is not a huge setback for the company, but it has eliminated a product that the previous owner GW Pharma expected could do up to $450 million in annual sales in the United States, and it was one of the potential revenue drivers to the company’s ambitious goal of reaching $5 billion in annual revenues in 2025.

I previously thought nabiximols and Sunosi could contribute $600-650 million in annual sales by 2025, and both are now gone as Sunosi was sold earlier this year to Axsome Therapeutics (AXSM).

However, since that article was written, there are improvements in the outlook for two products – Xywav in IH given the strong launch to date, and Rylaze which already has an annualized net sales run rate that is on top of my $250-300 million estimate range for 2025. The rest is more or less in line, and I think Xywav in IH and Rylaze could make up for the $600-650 million that is missing.

And there is also the potential upside from business development, including the recently acquired option for zanidatamab (see my previous article for an analysis of this deal with Zymeworks).

Jazz Financial overview – successful deleveraging continues

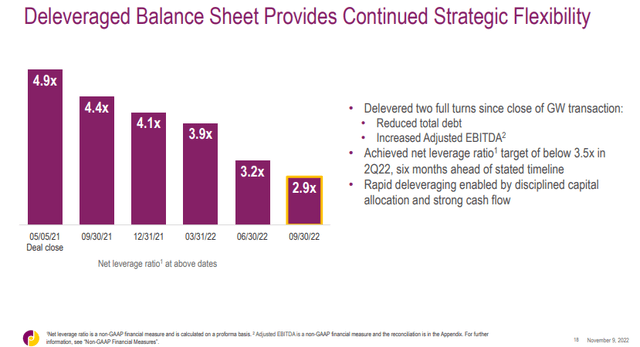

Jazz’s deleveraging is ahead of schedule. The net leverage ratio has dropped to 2.9 times TTM adjusted EBITDA and the company has achieved the goal of being below 3.5 adjusted EBITDA six months ahead of schedule. This was achieved through debt repayment and an increase in adjusted EBITDA.

Jazz Pharmaceuticals investor presentation

The company’s financial position is much healthier now and it looks well-positioned to weather the upcoming competitive storm – the launch of authorized Xyrem generics (though the company is entitled to royalties on net sales of authorized Xyrem generics) and the potential launch of Avadel’s once-nightly candidate for the treatment of narcolepsy.

And this brings me to FTC’s court filing that calls out Jazz’s tactics to hold off competitors. This patent details the Risk Evaluation and Mitigation Strategy, or REMS program for distributing Xyrem and the FTC says it is not a method of use patent and that it should be delisted from the FDA’s Orange Book. If this happens, it would finally bring Avadel’s Lumryz to market. But with June 2023 coming soon, approval of Avadel’s drug a few months earlier would not make a big difference to the long-term prospects of Jazz’s narcolepsy product portfolio.

Conclusion

Jazz Pharmaceuticals delivered good Q3 results, and the company increased the mid-point of the full-year revenue guidance range by $50 million. The discontinuation of nabiximols is a setback for the company’s pipeline, but the better-than-expected performance of Xywav in IH and of Rylaze could be enough to make up for the difference, and the potential addition of zanidatamab, pending positive phase 3 results in patients with biliary tract cancer, could also add revenues that bring the company closer to its 2025 revenue target of $5 billion in annual revenues.

I still think my valuation of Jazz I laid out earlier this year is valid and that the stock is worth at least $190 per share, up from $180 in February due to a passage of time adjustment, and that the long-term upside is higher if the company can come closer to its $5 billion revenue goal in three years.

Be the first to comment