Justin Sullivan

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Sometimes, Just Sometimes, A Little Subtlety Goes A Long Way

Nvidia (NASDAQ:NVDA) is one of those stocks that attracts a lot of attention online. Why this is, no idea. It’s just a semiconductor business after all, and not a particularly well-performing one of late either. Most coverage you see on the name is breathless in one direction or another – fanbois and brickbatters in equal measure.

Our take on the company’s Q3 (ending 31 October) is a little more subtle than that. We think the company is treading water whilst its end markets settle into longer-run trends. The mix shift away from gaming is hurting the top line and the company is using buybacks as an ameliorative ointment to ease shareholder pain during the transition. The company’s Q4 revenue guide (this for the quarter ending 31 January 2023) is carefully set such that at the midpoint of the range, the company would deliver the first sequential growth quarter all year, and would deliver a full-year FY1/23 where revenue was flat on FY1/22. The message is clear – stay the course, shareholders, the ship will be steadied by the end of Q4 and then the revenue rebalancing will result in growth ahead of FY1/24.

We hate to be anything other than opposite day, cynicism-bordering-on-nihilism (that being our preferred style if for no other reason that it makes the absurdity of securities markets entertaining, at least for us) – but unfortunately, we believe them.

Why?

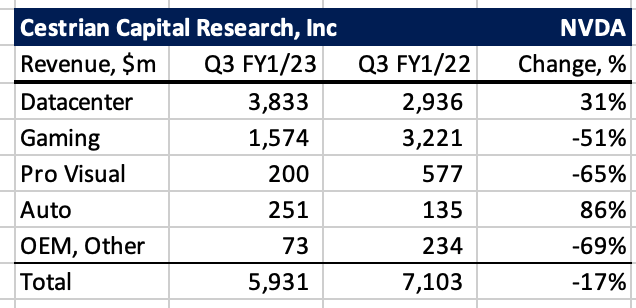

Because the numbers say so. The divisional breakdown tells you that datacenter grew, a lot; that gaming fell, a lot (and in our opinion the bulk of that decline is done, so even if the revenue line continues to fall, the damage it will do to the total topline will be muted); that auto grew, a lot-lot, off of a low base, and that OEM and other fell but is now so low it doesn’t matter.

So – if NVDA can keep growing datacenter and auto, and if gaming doesn’t fall too much more? Then the revenue base can flatten out and then begin to grow once more. You can think of this as bridging from the old world to the new, from the lockdown paradigm of mining and gaming to the next-gen paradigm of highly compute-intensive auto and datacenters which will need fundamental price/performance/cooling enhancements to serve the coming next generation Internet. (We’d call it the Metaverse, but you would laugh at us. It won’t be called the Metaverse. It will just be a more immersive, more graphical, more computationally intensive Internet. Just like m-commerce never became a thing, ‘cept we all spend all day buying stuff on our phones.)

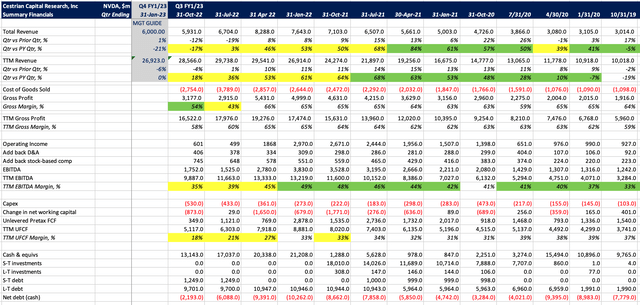

Here’s the headline numbers, including the midpoint of management’s revenue guide for Q4.

NVDA Fundamentals (Company SEC Filings)

And here’s one level down showing the revenue mix shift this quarter vs. the same quarter last year – you can see the impact of the shift and you can see that probably gaming won’t drop that much revenue next year (because it would drop to zero if it did!).

NVDA Revenue Breakdown (Company SEC filings)

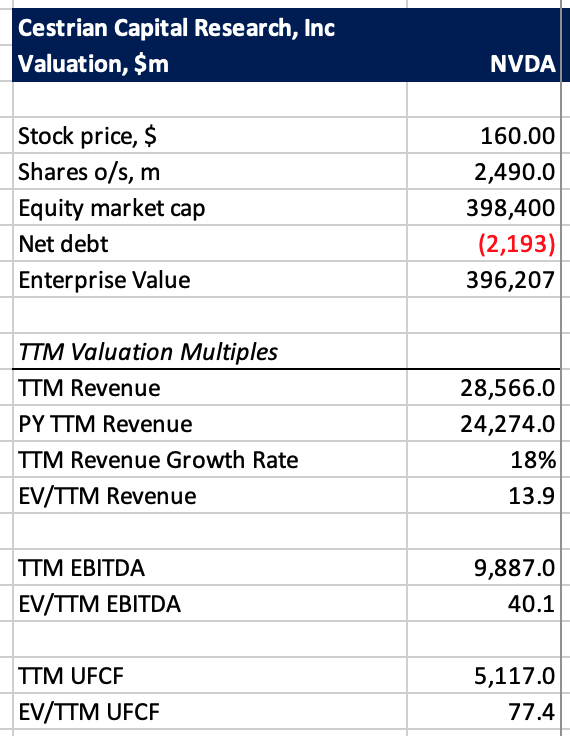

Valuation at the time of writing (the stock price is $160 right now).

NVDA Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

That is a big multiple of everything – clearly the TTM EBITDA and TTM unlevered pretax cashflow multiples are huge but so too is the revenue multiple given the growth picture. The market is asking you to look through that and onto where growth will be in the future – that’s normal for growth stocks which are, to quote everyone’s grandparents, “always too dang expensive.”

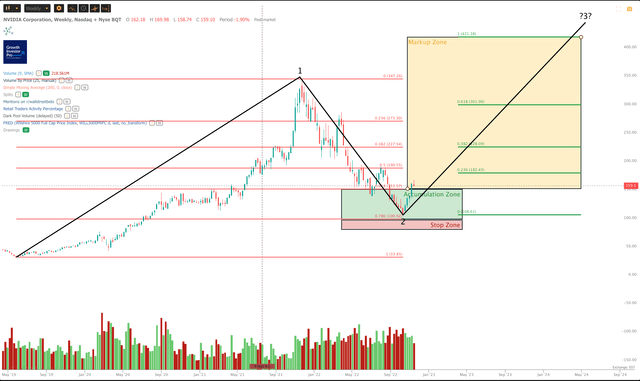

We think the stock is buyable in this region. In our Growth Investor Pro service we use the Wyckoff Cycle motif to define accumulate zones, hold (markup) zones, and sell (distribute) zones for long-term investment ideas. At this level we believe NVDA is in the markup zone, ie. we think that institutions have bought positions already and that momentum investors will now be chasing the stock a little.

If the Jensen Huang Show over the next couple of days convinces folks that the future is bright, we may see this stock climb materially. We have been buying the stock at lower levels and don’t plan to chase now. We lay out our zones below but of course there’s nothing scientific about where we define the zones, we just use Fibonacci levels as a way of making it consistent across stocks. For what it’s worth our Accumulate zone spans $100 (the 78.6% Fibonacci retrace of the big move up off of the 2019 lows) to $154 (the 61.8% retrace of the same). Of course if you buy at $160 and the stock more than doubles, as we believe it can – the additional $6 on your in-cost matters not a jot. So you will, as always, apply your own judgment to our work.

Here’s our take on the chart. You can open a full page version, here.

NVDA Chart (TrendSpider.com, Cestrian Analysis)

In time we think this can make a new high and beyond. For now we’ll say a price target of $350 but in truth we think it can run to >$400 in the next bull market (which will come – it always does – you just have to be patient).

Tomorrow we will see the real reaction to the stock price. Given the move up since the October lows in the market at large and NVDA specifically, there will likely be an opportunity to buy in our Accumulate Zone – but if not, patience will reward anyone who pays just a little over the odds for this company in our experience.

Cestrian Capital Research, Inc – 16 November 2022

Be the first to comment