David Becker

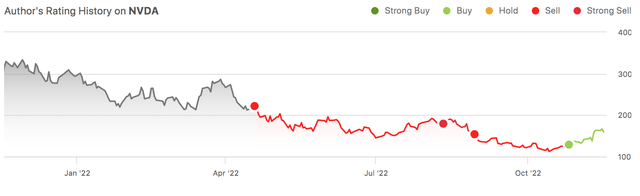

NVIDIA Corporation (NASDAQ:NVDA) has been center-stage for the greater part of 2022, with the crash in gaming demand due to exposure to crypto-mining-related GPU sales and macroeconomic headwinds. We moved NVDA to a buy in late October after being bearish on the stock for months. The stock rebounded around 22% since our upgrade. While the near-term stock price remains volatile, we believe NVDA has put the gaming weakness behind it and is transitioning out of its dark era with new product cycles and demand tailwinds in its data center segment.

The following graph outlines our rating history of NVDA on Seeking Alpha.

Two Sides to the NVDA Coin: Gaming & Data Centers

We’re more constructive on NVDA, as we believe the gaming weakness is in the past. We see NVDA quickly adapting to its challenges on the gaming front with oversupply and on the data center front with the U.S. export restrictions on shipments to Chinese customers. We believe Nvidia was one of the semis that was hit the hardest in 2022 due to its exposure to crypto-mining-related GPU sales and macroeconomic headwinds; simultaneously; we expect it will be one of the first to recover. We believe the gaming weakness has been priced into the stock now and expect NVDA to rebound towards 2H23.

Our bullish sentiment on NVDA is based on its two main segments:

I. Gaming:

NVDA’s gaming segment reported better-than-expected results, dropping 51% Y/Y in 3Q23 to $1.57B in sales. We believe NVDA’s gaming weakness resulted from the company’s exposure to crypto-mining-related GPU demand, which significantly weakened as Ethereum switched to Proof of Stake in September. We also think the post-pandemic macroeconomic headwinds and weakening consumer spending fed into the weak demand. Now, we believe the downside of crypto-mining GPU demand has been priced into the stock.

Simultaneously, we believe NVDA is taking the necessary steps to recover its gaming segment from the negatives. NVDA is already under-shipping end-market demand to allow customers to digest the inventory already on hand. We expect the inventory correction for its gaming business to be completed in the next 1 to 1.5 quarters. The inventory correction underway is crucial to the recovery of NVDA’s gaming segment because there are currently more gaming GPUs in inventory than there is demand for them.

NVDA has had an issue with excess GPU inventory that we believe is now being resolved. We expect the inventory correction to re-balance the supply-demand dynamics and help NVDA overcome the weak demand and the reselling of once-crypto-mining related GPUs on secondary markets. We also expect NVDA’s new 4nm CPU product cycle to support future revenue growth.

II. Data Center:

NVDA’s data center business reported $3.83B in sales, increasing 31% Y/Y this quarter. We’re constructive on NVDA’s data center business, as we expect to see growth in sales due to increased global demand from cloud service providers. While the weak consumer spending might soften cloud demand towards the end of the year, we believe NVDA’s data center segment is well-positioned to grow once macroeconomic headwinds ease.

The recent U.S. export restrictions on A100 and H100 took a bite out of the data center revenue this quarter, but we’re not too worried as we believe NVDA is quickly adapting to the restrictions. We expect NVDA’s data center segment will regain momentum despite the export restrictions with the introduction of the A800 GPU. NVDA’s A800 GPU offers similar performance rates to A100 with lower speed and bandwidth and none of the export restrictions. We also believe NVDA’s new higher ASP data center, new H100, will drive revenue growth throughout 2023 in spite of a possible CAPEX spending softness by the cloud and enterprise markets due to financial stresses.

Valuation:

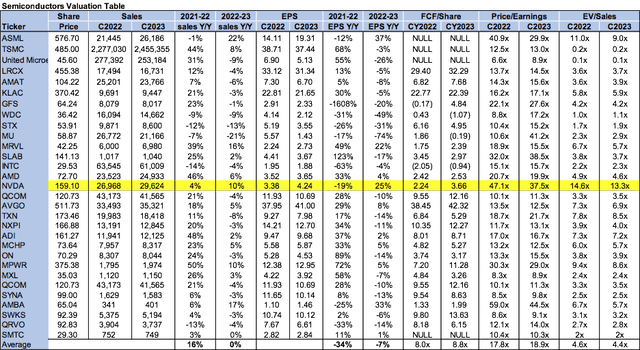

NVDA is richly valued, trading at 37.5x C2023 EPS $4.24 on a P/E basis compared to the peer group average at 18.9x. The stock is trading at 13.3x EV/C2023 sales versus the peer group average of 4.4x. We’re buy-rated on NVDA despite the stock being relatively expensive. We expect NVDA to trade higher over 2023 and hence believe the stock provides an attractive risk-reward profile at current levels.

The following graph outlines NVDA’s valuation compared to the peer group average.

Word on Wall Street:

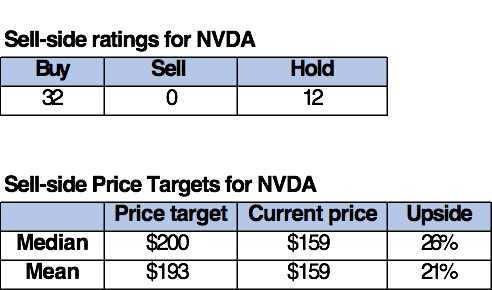

Wall Street is bullish on the stock. Of the 44 analysts covering the stock, 32 are buy-rated, and 12 are hold-rated. Wall Street’s maintained its bullish sentiment on the stock over the past couple of quarters, but we believe only now has the full weakness been priced into the stock. The stock is trading at $159. The median and mean price targets are set at $193 and $200, respectively, with a potential 21-26% upside.

The following graph outlines NVDA’s sell-side ratings and price targets.

TechStockPros

What to do With the Stock

YTD, NVDA is down 48%. We believe Nvidia Corporation stock provides a favorable risk-reward scenario, as the gaming weakness has been priced in and as demand tailwinds in its data center segment materialize. We recommend investors take advantage of the pullback rather than wait for the market to recover and then invest. NVDA has already risen 22% since our upgrade in late October, and we expect Nvidia Corporation stock to continue to rally through 2023.

Be the first to comment