4kodiak/iStock Unreleased via Getty Images

Know the difference between your necessary and discretionary expenses. – Alexa Von Tobel

The VanEck Vectors Retail ETF (NASDAQ:RTH), which offers coverage to 25 large retailers, tends to get a lot of investor interest close to the holiday season. The exchange-traded fund (“ETF”) is down by the high teens this year and may tempt some bargain hunters to come on board. Would I consider getting in? Probably not, and here’s why-

Cautious on retail

Based on the summer spending patterns, investors may be forgiven for thinking that the consumer is in decent health: the most recent report showed that consumer spending rose by 0.4%, ahead of street estimates of a 0.2% gain. However, some context is required.

Firstly, spending is not being driven by the goods of the retailers of RTH. Rather, it is coming from services, where it was up by 0.8%. In fact, spending on goods actually declined by 0.5%, picking up from another 0.7% decline in the month before.

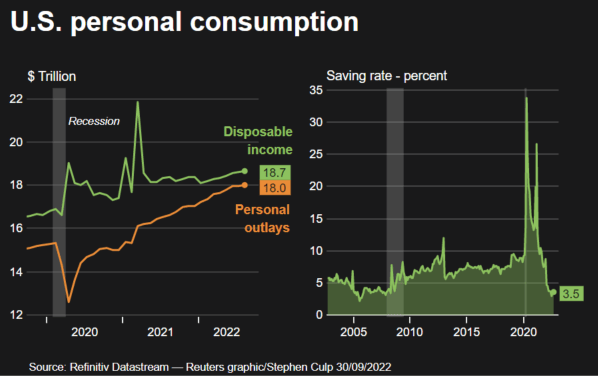

Secondly, it’s fair to say that the health of the consumer is likely to turn sour in the months ahead; as you can see from the image below, the gap between personal spending outlay and disposable income was quite wide over 2 years back, offering an enticing runway for pent-up discretionary spending. That is no longer the case, with the gap narrowing in recent months to a difference of just $0.7 trillion. Besides, the elevated savings reservoirs of around 26% 18 months back seem to have been depleted quite significantly and currently only hover around the 3.5% mark.

Twitter

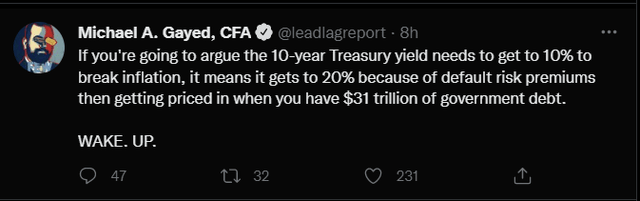

Inflation is already crippling household budgets, so I don’t see how spending appetite improves when the rate is still well above 8%; last week’s reading came in above street estimates of 8.1%, and now you have some illustrious market pundits suggesting that interest rates may have to hit levels of 9% to bring down inflation.

It’s very easy to suggest this in theory, but practically, one ought to consider the systemic damages something like this could inflict when you have $31 trillion of government debt that would need to be serviced.

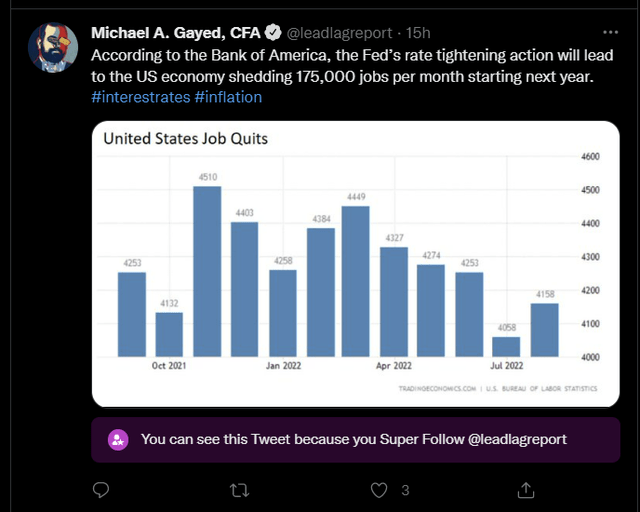

Nonetheless, as the market expects the Fed Funds rate to hit 5%, it’s genuinely hard to make a case for consumers having any appetite for engaging in pronounced discretionary spending. The Fed’s liquidity tightening initiatives will also likely result in close to 175K jobs being lost from next month onwards. Also don’t forget that the pace of growth in wages has been dipping over the past two months (0.8% in July followed by 0.3% in August), and I’m not sure how long this can continue to grow.

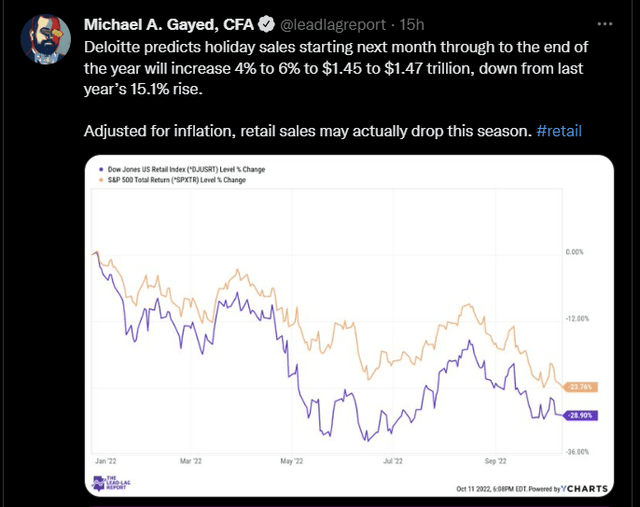

All these factors point to weak purchasing dynamics ahead; as shared in a tweet with my Super Followers on Twitter, Deloitte believes that holiday sales will slow down drastically to just mid-single digit growth (in real terms, growth is expected to actually dip YoY); this is in stark contrast to what we saw last year, where growth came in at 15%.

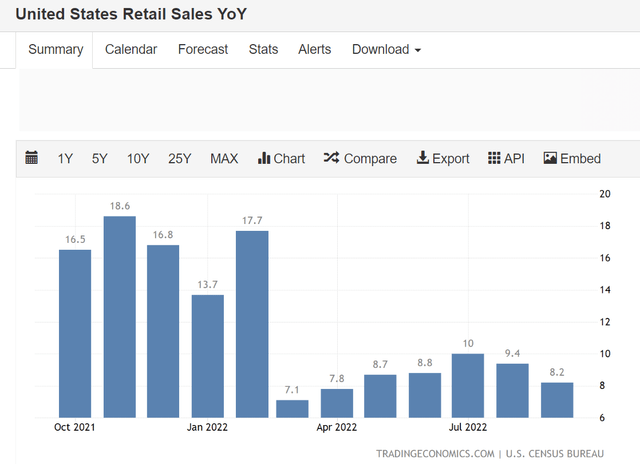

Also consider that the retail sales come up against a very high base effect from October onwards (last October, growth came in at 16.5%) which will likely persist until February.

Meanwhile, if you thought that supply chain pressures were a thing of the past, you’re wrong; as noted in a Lead-Lag Live discussion with J Mintzmyer of Value Investor’s Edge, we’re now witnessing supply chain duplications as stakeholders attempt to diversify their supply chain; these ongoing developments could likely keep shipping costs elevated.

Separately, also consider that the inventory/sales ratio (latest reading of 1.24x) in the retail sector is still a long way from its historical levels, so you’re likely to see inventory build ahead of the holiday season, which could hamper the free cash flow position of these retailers.

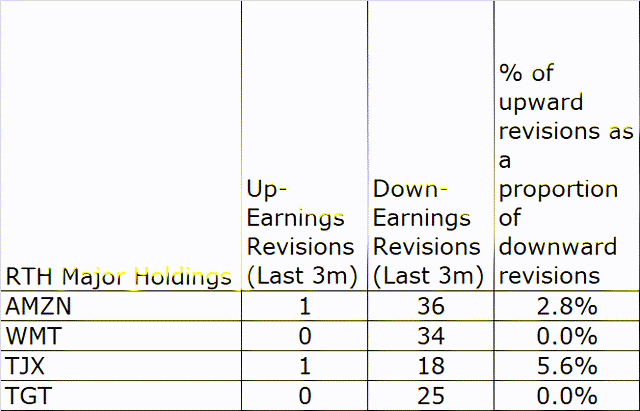

All these factors have prompted analysts to trim the earnings forecasts of some of RTH’s biggest names; data taken from Seeking Alpha show that the likes of Amazon.com (AMZN), Walmart (WMT), Target (TGT), and The TJX Companies, Inc. (TJX) have all seen a greater proportion of EPS downgrades than upgrades over the past 3 months.

Conclusion

Finally, from a valuation angle as well, I don’t believe RTH offers good value. If I were to compare the long-term earnings estimates of RTH vs the S&P500 and, say, another growth sector- Tech – things don’t stack up too well. RTH’s holdings offer a 5-year earnings growth profile of 10.95%, lower than SPY (11.43%), and XLK (12.09%), yet its valuations are the priciest, trading at 19.2 P/E vs 18.6x P/E for XLK and 15x for SPY.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment