Veni vidi…shoot

Almost all of Nvidia’s (NASDAQ:NVDA) revenues come from GPUs. And GPU market demand is about to drop permanently by perhaps in excess of $10 billion. On top of that, GPU margins are also about to take a big dive. The comments to my recent Nvidia articles (here and here), and the NVDA price action following the horrendous Q2 earnings pre-announcement, tell me that the market has no idea what is about to happen. The company’s profits are going to take a big hit, and there is no quick recovery in sight.

GPUs mine Ethereum

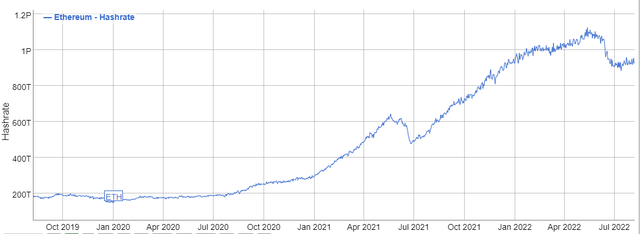

Nvidia is the largest producer of discrete GPUs. GPUs purchased to use in cryptocurrency mining has been big business for a few years. Ethereum can be mined by GPUs, and has been valuable enough to make wide scale mining profitable at recent coin prices and elevated GPU prices. From increases in the Ethereum network hashrate we can tell that millions of GPUs were added in the recent past.

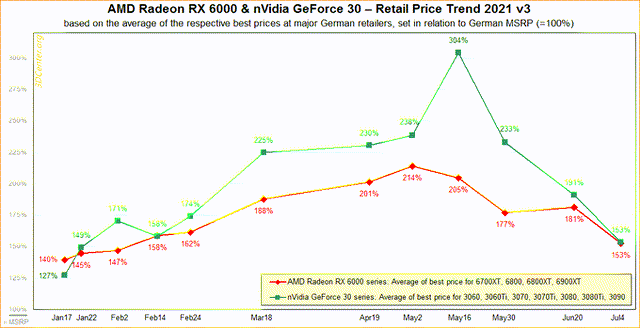

The demand for mining has driven GPU prices to the moon. For example, 3D Center has tracked GPU prices and their data found that NVDA card prices were well over 2x the MSRP during much of 2021.

Estimating Ethereum GPU Demand

Since Nvidia management has obfuscated the amount of demand for their GPUs coming from crypto mining (something the SEC sanctioned the company for), we can’t know for sure what the actual numbers are. But we can get a ballpark estimate. Obviously a wide variety of cards models were added to the Ethereum network during 2021, with differing MH/s capabilities and pricing. But to keep the math simple we’ll just pick a popular card, the Nvidia RTX 3080 Ti. Its MSRP is $1200, but given that during 2021 NVDA cards routinely sold for well over double the MSRP, we’ll just estimate that the average price during the year was something like $2500. And there are different configurations for how many hashes per second a 3080 Ti can compute, but 110 MH/s is a reasonable estimate.

BitInfoCharts says the Ethereum hashrate increased from 294 TH/s on December 31, 2020 to 926 TH/s on December 31, 2021. So during calendar year 2021, the Ethereum hashrate increased by about 632 TH/s. If all of that increase were from 110 MH/s Nvidia RTX 3080 Ti cards, it would mean over 6 million 3080 Ti cards were added to the Ethereum mining network on a full time basis. With an MSRP of $1200, if the cards actually sold for $2500 each, they would have totaled $15 billion. And this is on top of any cards purchased to mine other crypto coins besides Ethereum.

The calculation ignores the increased amount paid for GPUs used only by gamers, and not used to mine Ethereum. Since those cards were selling for over 2x MSRP, the GPU mining demand led to something like a more than doubling of the amount spend on non-mining GPUs as well. This increased cost could easily be in the billions of dollars per year as well.

Some of those cards may have been purchased anyway for use by gamers. But without the mining demand, the pricing (and NVDA’s margins) would have been MUCH lower. It’s safe to say that the crypto mining demand increased GPU sales by over $10 billion in 2021–and likely closer to $15 billion.

Ethereum Will Stop Using GPUs to Mine

And now that demand is going away permanently. Ethereum is scheduled to switch from Proof of Work (generally GPU-based mining) to Proof of Stake (coin ownership) around September 15th. So no more GPUs will be purchased to mine Ethereum. And all the GPUs recently mining Ethereum will need to find other uses (likely many will be dumped into the used GPU market).

Since Nvidia sold the supermajority of discrete graphics cards in 2021, they will take the brunt of the permanent reduction in demand. It would not be surprising to see their revenues drop more than $2 billion per quarter going forward.

AMD (AMD) will also see the effects of this reduction in GPU demand, as forecasted by AMD management on their Q2 earnings call. But it will not affect AMD as much. AMD is in the market share gaining phase and can continue to take share from Nvidia, even while the overall market is getting smaller. Also, discrete GPUs are just a minority of AMD’s business, and all the other business lines are growing rapidly. This is in contrast with Nvidia, which receives nearly all of its revenues from GPUs.

Market Doesn’t Get it Yet

One of the major misconceptions by NVDA bulls is that the Ethereum change is well known and has already been fully priced in by the ~50% decline from the all-time highs. I don’t agree.

Firstly, that decline was at least significantly due to market-wide multiple compression of high multiple stocks. Many high-multiple stocks, or stock with no earnings, went down over 80%. NVDA had a TTM GAAP PE ratio of over 100 at its highs, and corrected down to a PE ratio around 50. Even without the crypto demand going away, NVDA would still be quite expensive.

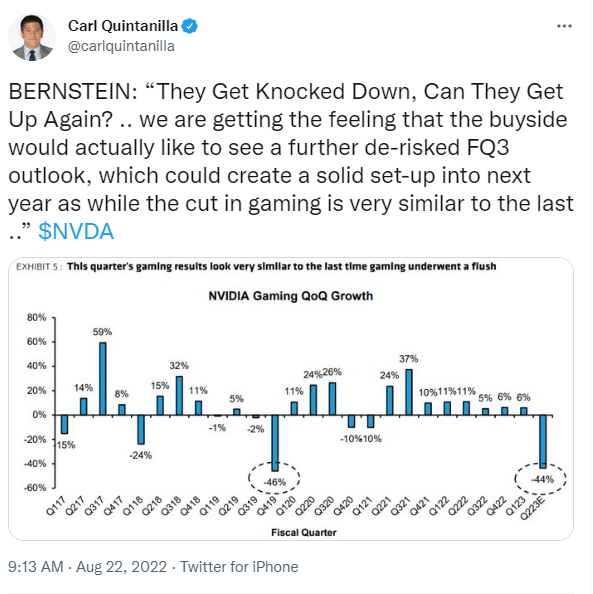

Secondly, as seen in the tweet below, many NVDA bulls and sell side analysts do not realize that the Ethereum change will result in a permanent loss of that revenue. They are thinking about the 2018 crypto crash that caused miners to slow purchasing of GPUs for mining because Ethereum prices dropped so low that mining was not profitable. But within months the Ethereum price began a long run upwards, making mining profitable again. And mining GPU purchases exploded, causing Nvidia GPU sales to increase and the market prices to far exceed MSRP. Nvidia was able to get back to prior revenue levels in only a year. This time is different. The mining demand is gone permanently. The core gamer demand for GPUs is nowhere close to being able to support that level of GPU sales.

Twitter

In addition to losing the revenues, margins are getting squashed, as Nvidia has confirmed. Most gamers are not willing to pay anywhere near recent GPU prices. GPUs in Nvidia’s “Gaming” line, selling for over twice MSRP, had enormous margins. And the MSRP itself was inflated due to the mining demand. And the sales mix was skewed to the higher end cards by the mining demand. Nvidia could charge AIBs (who assemble and market the final GPU cards) much higher prices for cards selling at much higher prices. Going forward, ASPs will decline significantly (as mix shifts), AIBs will require lower prices from Nvidia, and Nvidia’s margins (and profits) will go down significantly.

The pre-announced disastrous Q2 earnings probably does not fully demonstrate the new reality. In Q2 Nvidia GPU prices stayed well over MSRP and the Ethereum hashrate showed millions of GPUs still being used to mine. By the time Q3 and Q4 numbers arrive, GPU sales will be down further, GPU prices will be down further, and miners will likely have dumped millions of used cards into the market. The bloodbath has only just started.

Nvidia pre-announced inventory and capacity charges of $1.32 billion for Q2, and GAAP margins of 43.7% (vs 65.1% expected). I think charges at a similar level will likely be needed to move the rest of their inventory in H2 given that the demand collapse has just begun, there is a huge amount of mining GPUs that may get dumped into the market, and NVDA needs to clear out inventory before launching their anticipated new products in H2. As a result of the decreased revenues, and lower margins, and these charges, I estimate Nvidia’s GAAP earnings are probably going be somewhere around zero for perhaps Q2 and Q3 and are not likely to return to prior levels for years, if ever.

In their FY 2022 (comparable to calendar 2021), Nvidia posted revenues of $26.9 billion. If something like $8 billion of that was from crypto mining demand that is permanently gone, that is a huge hit to their top and bottom lines. And since GPU pricing has dropped from over 2x MSRP to now below MSRP, margins will likely go down heavily as well. Earnings leverage looks great while sales and margins are rising, but it gets very ugly when those reverse downwards. With a current nosebleed TTM PE ratio of around 50, there is a lot of room for multiple compression as the market deals with the reality that Nvidia is a busted growth story with declining revenues, declining margins, and declining earnings.

Valuations and risks

Currently there is not another cryptocurrency that is competitive for GPUs to mine and has a high enough price to make mining profitable with the amount of mining activity that Ethereum supported. Miners generally must pay for the electricity their rigs consume. If the coins earned from mining are not valuable enough to pay the electricity bill, the miner loses money. It’s possible that some GPU-mineable crypto coin suddenly explodes in price and attracts some portion of the flood of GPUs that will be available when they can’t be used for Ethereum. But on the flip side, there will be a lot of pressure on other coins to make their operations more environmentally friendly like Ethereum has. We could see mining for cryptocurrencies going away entirely.

Even before the Ethereum mining demand went away, NVDA was ridiculously overpriced relative to peers. Now the valuation is going to be increasingly absurd without a massive decline in the stock price. For example, in Q2 AMD has caught up to Nvidia in revenues, is growing faster than NVDA, surpassed Nvidia in margins, and likely surpassed Nvidia in earnings. AMD also has a much more diversified set of business lines. Yet NVDA has a market cap 3x AMD’s. There is going to be strong pressure for that mismatch in fundamentals and stock prices to correct. NVDA could drop below $100 and still be overpriced.

Q2 comparison

|

AMD |

Nvidia |

|

|

Revenues |

$6.55 billion |

$6.7 billion (estimated) |

|

Non-GAAP Gross Margins |

54% |

46% (estimated) |

|

YoY growth |

70% |

3% (estimated) |

|

Market Capitalization |

$155 billion |

$450 billion |

NVDA is a cult stock, and has been driven to unsustainable levels. Many NVDA bulls and sell side analysts paint magical stories of future revenue growth unsupported by the fundamentals. It may take some time before the true believers wake up to reality. But the massive deterioration of the company’s fundamentals will start that process in many minds. As with any stock, shorting is a risky proposition. Stocks with nonsensically high valuations (like NVDA) can be pushed up to even more absurd higher valuations. But at least with NVDA there will be little positive financial news for quite some time to embolden speculative stock traders.

NVDA is a strong sell.

Be the first to comment