PixelCatchers

Investment Thesis

Strong growth in U.S. RevPAR as well as a further reduction in net debt could continue to propel the stock higher.

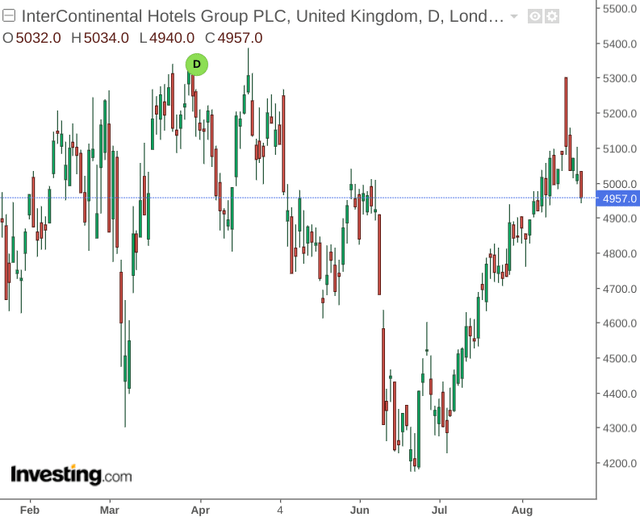

In a previous article back in July, I made the argument that InterContinental Hotels Group (NYSE:IHG) could see a rebound in upside ahead – if we continue to see strong growth in U.S. domestic travel demand and a further rise in free cash flow.

Since the beginning of July, we can see that the stock has appreciated strongly to near prior levels seen earlier in 2022.

The purpose of this article is to assess whether such growth can continue given recent half-term performance.

Performance

In my previous article, I cautioned that while the rebound in revenue growth has been encouraging – investors will be likely to pay particular attention to cash flow when analysing the company’s 2022 half-year results, in order to ensure that the revenue growth is not being eroded by the effects of higher operating expenses.

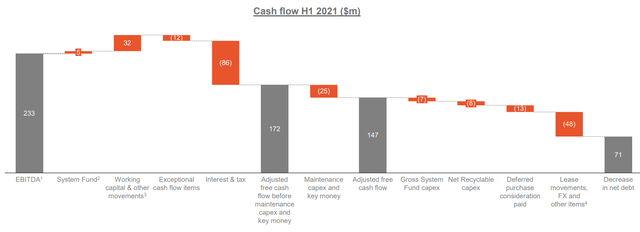

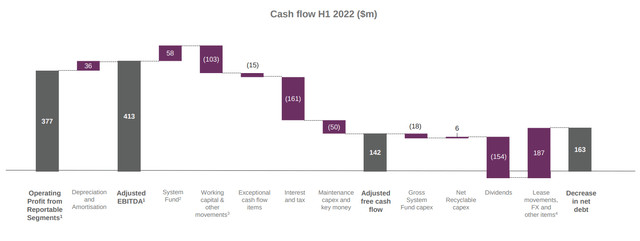

When looking at 2021 and 2022 half-year results, we can see that growth in EBITDA and adjusted free cash flow has continued, while the reduction in net debt has accelerated – from a reduction of $71 million in H1 2021 to a reduction of $163 million in H1 2022.

H1 2021

IHG Hotels and Resorts – 2021 Half Year Results

H1 2022

IHG Hotels and Resorts – 2022 Half Year Results

This is an encouraging sign – as it indicates that the company is generating sufficient earnings growth to sustainably lower its debt levels and reinstate its dividend of 43.9 cents per share. While the company’s recent $500 million buyback scheme will have also played a role in the recent rise in share price – further growth in cash flow will allow the company to increase its rate of reinvestment into the business, which could still drive further upside in the stock.

Looking Forward

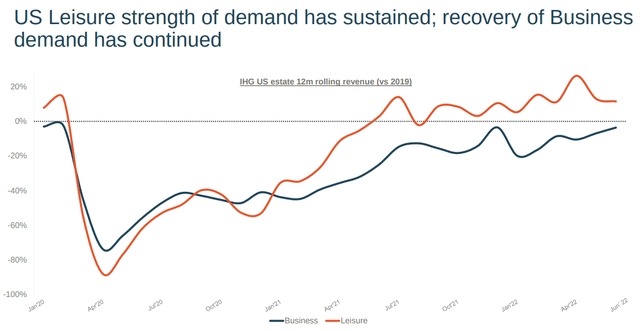

Going forward – the growth that we are seeing across the U.S. market could continue to be encouraging – in spite of inflationary pressures.

For instance, we can see that growth in leisure demand across the U.S. has now exceeded 2019 levels:

IHG Hotels and Resorts – 2022 Half Year Results

While the coming winter months could lead to a typical seasonal decline in demand – I do not envisage that this should be particularly acute given the growth thus far. Business travel has also been making a strong recovery and is on track to also exceed 2019 levels.

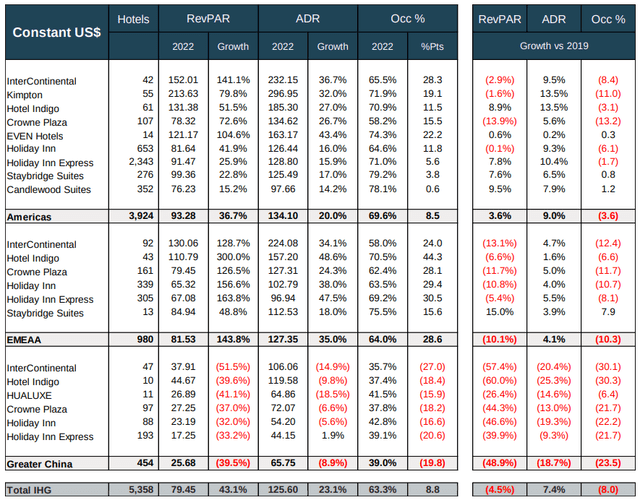

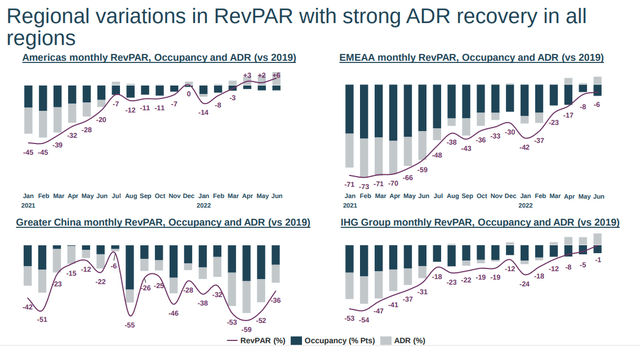

In terms of potential risks, it is evident that U.S. growth has largely been driving the recovery for this company.

IHG Supplementary Information – Q2 2022

While the Americas has accounted for the lion’s share of RevPAR growth – we can see that growth across this metric for EMEAA and Greater China is still negative for most hotels when comparing RevPAR growth to 2019 levels.

In this regard, one risk is that we could see growth across the Americas start to plateau as demand begins to reach a saturation point – while growth across EMEAA and Greater China is not sufficient to continue driving growth overall.

With that being said, we can see that while Greater China RevPAR levels are still significantly below 2019 levels – that of EMEAA has been improving significantly – even if levels are still slightly below that of 2019.

IHG Hotels and Resorts: 2022 Half-Year Results

Moreover, with the downward pressure on Greater China RevPAR in significant part due to the effects of COVID lockdowns in the country earlier this year, I anticipate that RevPAR growth could have significant capacity to rebound over the longer-term – though risks of further lockdowns remain elevated in the short to medium-term.

Conclusion

To conclude, InterContinental Hotels Group has seen strong growth on the back of a reduction in net debt and accelerating RevPAR growth across the United States.

For these reasons, I take a long-term bullish view on the stock.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment