Douglas Rissing

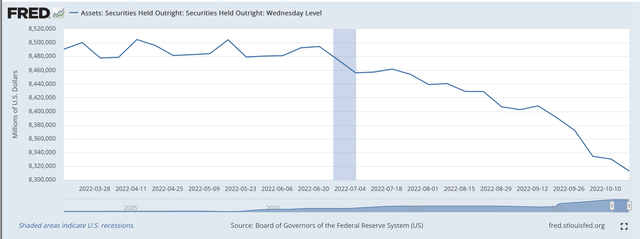

The Federal Reserve continues to reduce the size of its securities portfolio.

In the latest banking week, ending on Wednesday, October 19, 2022, the securities portfolio fell by $17.3 billion.

The total decline in the portfolio since March 16, 2022, including the accounting for unamortized premiums and discounts, is $207.9 billion.

Securities Held Outright (Federal Reserve)

You can see that the reduction really accelerated beginning in June. On June 22, the total amount of securities held outright amounted to just under $8.5 trillion.

On October 19, the total amounted to around $8.3 trillion. Roughly, the decline in the 3 months leading up to the current time period has been about $64.0 billion per month.

This is under the $95.0 billion per month decline discussed in the original program, but it is still a sizable amount.

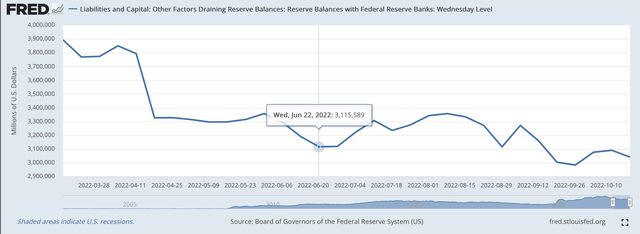

We can look at the Federal Reserve balance sheet in another way, however.

We can focus upon the line item, Reserve Balances with Federal Reserve Banks.

This account is often used as a proxy for the “excess reserves” in the banking system, the “liquidity” that exists in the commercial banks.

On March 16, 2022, the Reserve Balances with Federal Reserve Banks totaled $3,893.4 billion.

On October 19, 2022, Reserve Balances had dropped to $3,040.8 billion, a drop of $852.6 billion.

Take a look at the picture.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

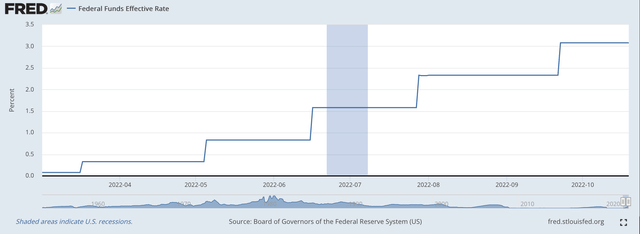

This figure can be tied with the Fed’s efforts to raise the effective Federal Funds rate.

As these “liquid assets” decline, the effective Federal Funds rate rises.

See this picture.

Effective Federal Funds Rate (Federal Reserve)

So, it is very important that the quantity of Reserve Balances with Federal Reserve Banks falls so as to apply pressure to the money markets so that the Fed’s policy rate of interest can be pushed upwards.

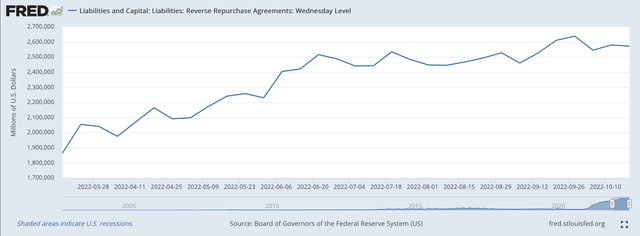

But, how did the Reserve Balances with Federal Reserve Banks fall by about $850.0 billion when the securities portfolio only fell by about $210.0?

The answer to this is that Reverse Repurchase Agreements on the Fed’s balance sheet grew by a fairly sizable amount.

Reverse Repurchase Agreements take place when the Federal Reserve sells securities under an agreement to repurchase the securities, most often in a matter of a day or two.

So, for Reverse Repurchase Agreements on the Fed’s balance sheet to total around $2.6 trillion, a lot of trading must take place to maintain this amount.

Reverse Repurchase Agreements (Federal Reserve)

Notice that this amount of Reverse Repurchase Agreements has been rising for the full time period of the Fed’s “tightening” program. One must assume that these actions must be playing a role in the whole program the Federal Reserve is conducting.

How they will ultimately be used in the achievement of the Fed’s goals still remains unknown.

So, we have the Federal Reserve reducing the size of its securities portfolio.

We have the Federal Reserve reducing bank liquidity so as to support the increases in the Fed’s policy rate of interest.

And, we have the Federal Reserve maintaining its program of “quantitative tightening.”

This is what the Fed said it was going to do.

Going Forward

The next meeting of the Federal Open Market Committee is on November 1 and 2, about a week and one-half from now.

The expectation is that the FOMC will raise the Fed’s policy rate of interest by another 75 basis points.

This increase would bring the effective Federal Funds Rate up to 3.83 percent.

In addition, market expectations have risen to the point where analysts are now predicting that the Fed’s policy rate of interest will hit 5.00 percent by May 2023.

The effective Federal Funds rate has not been around 5.00 percent since September 2007, just before the Great Recession hit the United States.

How much higher the rate will go depends upon how you feel the “tightening” program will work.

Speaking of that, we still have to surmise just how far the Fed will reduce its securities portfolio. In the first plans that were discussed, the monthly reductions in the portfolio would go into 2024 and would total somewhere around $2.4 trillion.

My sense is that the general feeling in the marketplace is that the Fed will not get close to the $2.4 trillion figure. It will have changed the program because of market disruptions.

But, note, the $2.4 trillion is not even close to the amount of funds the Fed has injected into the banking system since January 2020 to fight the effects of the Covid-19 pandemic.

But, 2024 is a long time off and there is much to happen before we get there.

Most important right now is to watch what the Fed is doing and judge how closely it is sticking to its original plans for “quantitative tightening.”

For the time being, the Fed will continue to dominate the news on the economy.

Be the first to comment