fotokostic/iStock via Getty Images

Investment Thesis

Nutrien (NYSE:NTR) is very well positioned for high fertilizer prices. I conclude with the argument that the recent price weakness here is unjustified.

Since my previous bullish coverage of Nutrien, it appears that the bull case has broken off.

However, I contend that not only is this is not the case, but that the investment case is actually a lot better right now.

To be clear, this is not just me talking my book, given that I’m long fertilizer stocks, this is just a balance of facts and common sense.

Concretely, I believe that Nutrien’s 10.6% shareholder return is very attractive and will add steam to these shares.

Here’s why I rate this stock a buy.

Nutrien’s Recent Performance

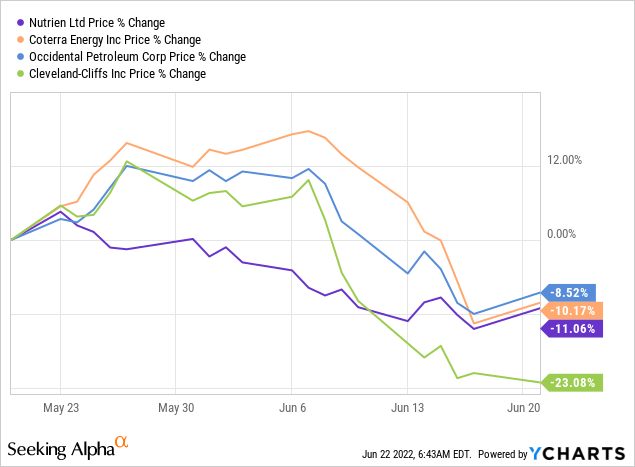

Perversely, it appears that since Nutrien had its investor day on 20 May, Nutrien has been selling off.

Now, remember that correlation is not causation. There’s been a myriad of other factors at play here.

In the graphic above I’ve purposely chosen a wide range of commodity and energy stocks.

The overall direction is very similar for all of them. Investors’ capital has stepped back from this space. Consequently, I contend that Nutrien’s recent sell-off has nearly nothing to do with its near-term outlook.

This is what we’ll discuss next.

Nutrien’s Near-Term Prospects

The overall theme for Nutrien shareholders has been that fertilizer companies are going to have a strong 2022 and that everything reverts back to normal starting in 2023.

To that argument, Nutrien’s Investors Day opened with the following statement:

Nutrien is explicitly noting that the current fertilizer environment could last beyond 2022.

Keep in mind that for 2022, Nutrien expects approximately 50% of its adjusted EBITDA to come from its potash business. With nitrogen contributing approximately 35% to total adjusted EBITDA. While phosphate is the smallest contributor to total adjusted EBITDA.

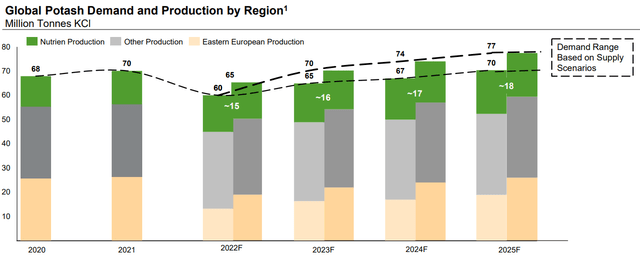

Next, Nutrien went to great lengthens to explain that there’s a structural deficit in the supply-demand balance for potash.

Indeed, Nutrien notes that the real deficit in supply is likely to increase in 2023, rather than revert back to normal. This insight is contrary to what many investors have come to believe.

Next, we’ll discuss what tangible aspects investors can think about when it comes to building a bull case in Nutrien.

Interpreting Nutrien’s Capital Returns Policy

Nutrien’s dividend yield stands at 2.2%. Clearly, there’s a lot of room for improvement. However, Nutrien would much rather repurchase shares, rather than increase its dividend.

The rationale is straightforward. In the event that market conditions deteriorate, Nutrien can always suspend its share repurchases. But it can’t, at least in practical terms, suspend its dividend.

The dividend needs to be at a level that can be sustained through the cycle. This is an obvious point, but it’s worth remembering.

Nutrien wants to get long-term investors on board, and it will do so by having a solid through the cycle dividend. And this is Nutrien’s way of communicating that message.

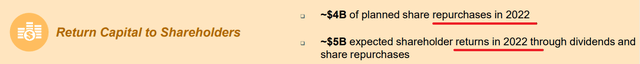

That being said, Nutrien’s share buybacks are certainly substantial. Keep in mind that during Q1 2022, Nutrien returned $885 million.

However, when Nutrien had its Investor Day it announced an increase in its total share repurchase program so that it could deploy $4 billion into buybacks in 2022.

While I do not know just how aggressive Nutrien’s capital return program was in Q2 2022, what I do know is that this implies that from Q2 through Q4, Nutrien will look to deploy $3 billion.

Typically, companies don’t fully exhaust their share repurchase programs, but if we think that Nutrien is on target to return about $1 billion of capital per quarter, I believe this is a fair assessment.

That implies that Nutrien is going to return to shareholders approximately 2.1% of its market cap per quarter. Note, keep in mind the currency exchanges when looking up Nutrien’s valuation.

Said another way, Nutrien’s total shareholder return is approximately 2.7% per quarter. Or 10.6% annualized.

NTR Stock Valuation — Priced At 5x EPS

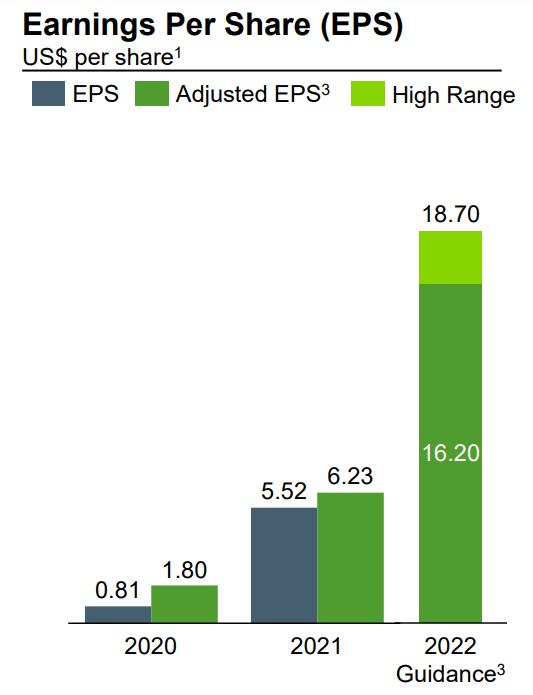

As implied throughout, nobody realistically expects that Nutrien’s EPS remains this high over a prolonged basis. There’s the potential for Nutrien to benefit from high earnings into 2023, but nearly everyone, including Nutrien themselves, is not expecting this high level of profitability to maintain into 2024.

Nutrien’s Investor Day

Consequently, the stock is being priced at 5x EPS, because investors are thinking to themselves that once we get further into 2023 and the back end of 2023, the fertilizer market stabilizes and Nutrien’s profitability reverts lower.

And I don’t have a crystal ball and I’m not able to argue that one way or another. What I will say is that paying 5x earnings means that you only need 5 years of these elevated earnings for the company to pay for itself.

The Bottom Line

Remember, Nutrien came about through the merger of PotashCorp and Agrium. PotashCorp was founded in 1975, while Agrium was founded in 1931. How many fertilizer cycles have these two companies been through?

And more importantly, how many more good years ahead are there likely to be? I believe that the odds are substantial that fertilizer companies could have just as strong a 2023 as 2022.

That would mean that investors paying 5x to EPS, would probably need only another 3 good years for the business to pay for itself.

All the while, the shareholder would be collecting double-digit shareholder returns in 2022, and probably double-digit shareholder returns again in 2023.

From many different angles, I believe that this investment could work out really favorably. I rate the stock a buy.

Be the first to comment