Christopher Furlong/Getty Images News

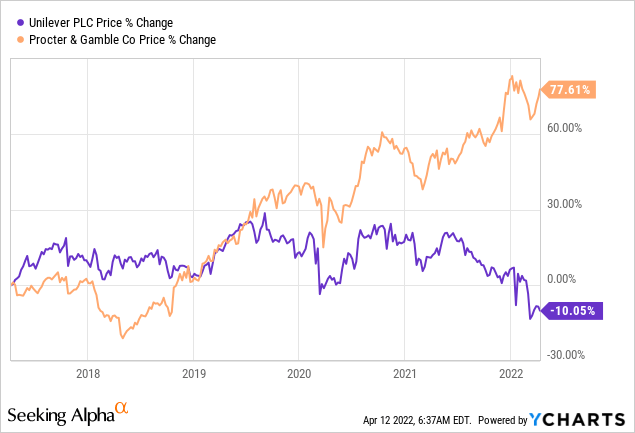

Unilever’s (NYSE:UL) long-awaited transformation has hit a roadblock during the past year and the performance gap between its arch enemy – Procter & Gamble (PG) – has grown even further.

While geopolitical risks and commodity prices are partly to blame, Unilever’s management also took a valuable lesson from its near death experience last year. A mega deal for GSK’s Consumer-Healthcare division most likely would have been a complete disaster for shareholders, even though it was a good fit from a strategic point of view.

As a shareholder, I can’t say that I am content with these results; however, my long-term investment horizon allows me to take advantage of temporary setbacks.

Here Comes The Activist Investor

About two years ago, when I first outlined the opportunity behind Unilever’s transformation, I made the following statement about the company taking the shortcut in its restructuring efforts:

(…) it is possible that there is also a strategy shift behind the management change – from a gradual and sustainable approach to a more aggressive one involving a large deal or an activist investor stepping in.

Source: Seeking Alpha

In hindsight, the management was indeed considering a large deal in order to speed up its transition and now that this route is off the table, we have an activist investor stepping in.

Seeking Alpha

Although this might have come as a surprise to many, it was plain to see why Trian Partners would be interested in taking a stake. Back in July of 2020, I showed why I believe Trian to be among the most likely activist investors to come in:

Apart from Unilever being one of the closest comparable companies to P&G, there are some other factors that might make Unilever a good match for Trian Partners.

Source: Seeking Alpha

At the time, Mr. Peltz continued to reduce Trian’s stake in P&G (PG) and was also involved with Sysco (SYY). This and a number of other factors made Unilever a potential target for the activist investor and roughly two years later, Trian Fund is about to make its way to Unilever’s board of directors.

The fund has a long track record of fixing corporate structures and, more importantly, focusing on the corporate strategy aspect which is where Unilever currently lacks strength.

The Ongoing Transformation

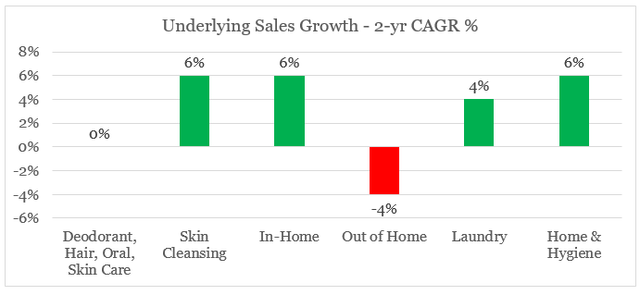

On a segmented basis, Unilever’s underlying sales growth remains at low single-digits in the categories that were not significantly impacted by the pandemic lockdowns. In the rest of the business units, sales increased between 4% and 6% over the challenging two-year period.

Prepared by the author, using data from Unilever Investor Presentations

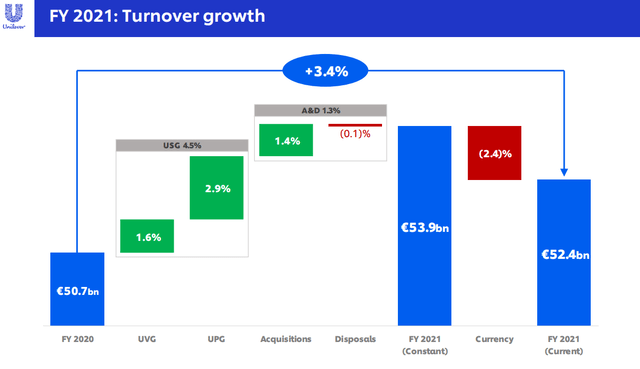

In 2021 alone, USG (underlying sales growth) stood at 4.5%, while currency movements were once again a major headwind for the company.

Unilever Investor Presentation

In addition, rising commodity prices also had a disproportionally larger impact on Unilever, when compared to P&G.

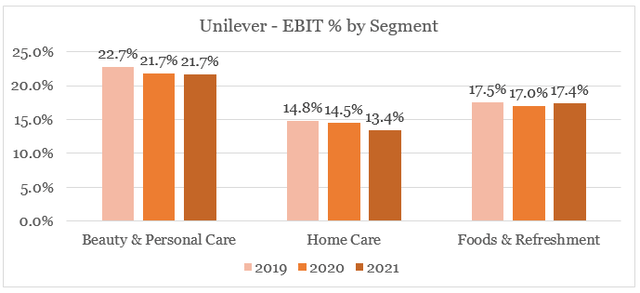

In terms of margins, the highly profitable Beauty & Personal Care remains slightly below pre-pandemic levels, while profitability of the home care division fell significantly in 2021.

Prepared by the author, using data from Unilever Annual Reports

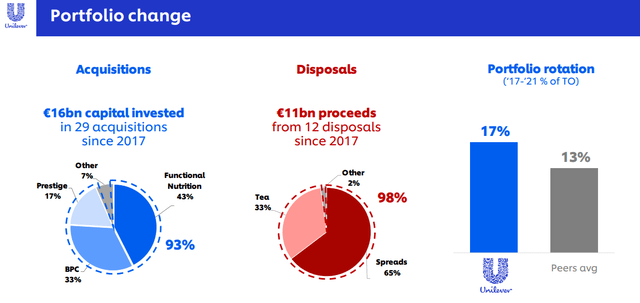

The company’s capital allocation strategy, on the other hand, has been consistent with these trends with acquisitions being focused primarily in the high margin BPC and Functional Nutrition segments.

Unilever Investor Presentation

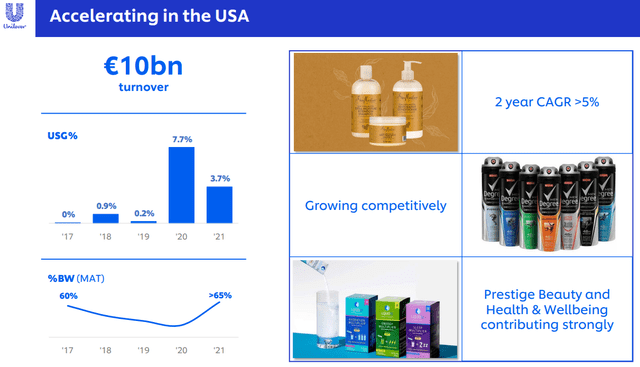

On a regional basis, Unilever has been traditionally strong in large Emerging Markets and Europe, with North American business lagging behind peers. Although a significant proportion of the company’s sales are coming from the U.S., it is ranked 7th in overall market position in the country.

With that in mind, Unilever’s recent pivot towards the U.S. is encouraging and appears to be a step in the right direction over the long term. USG in the market was exceptionally strong during the pandemic with a growth of 7.7% and in spite of the pandemic demand tailwinds cooling off in 2021, it grew at 3.7% during the past year.

Unilever Investor Presentation

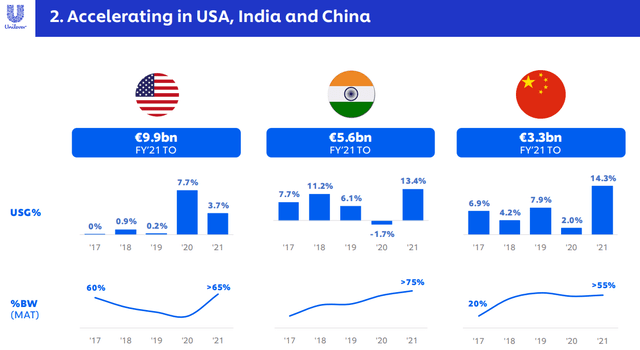

Sales growth rates in the other two largest markets – China and India have been far more impressive, although currency headwinds persisted in these markets.

Unilever Investor Presentation

Conservatively Priced

While operational performance of Unilever remains strong, the company has been struggling with delivering on its strategy. It successfully disposed of its Tea and Spreads businesses and completed its HQ transition, but the long-term direction is in chaos following the failed deal for GSK’s Consumer Health assets.

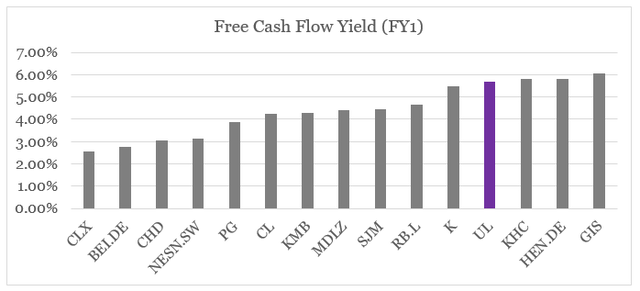

As a result, the company remains very cheap on a free cash flow basis, even after taking into account the potential increase in capital expenditure.

Prepared by the author, using data from Seeking Alpha

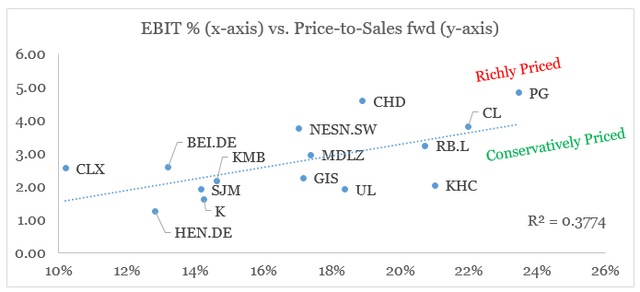

Moreover, on an operating margin versus Price-to-Sales multiple, Unilever is one of the most conservatively valued companies in both Packaged Food and Personal & Home Care sectors.

Prepared by the author, using data from Seeking Alpha

This creates a significant opportunity for a multiple repricing, provided that Unilever lays out a proper long-term strategic framework to reinvigorate its topline growth, while not sacrificing its high return on capital and margins.

Conclusion

So far the transformation of Unilever’s business is not a smooth sailing, with the exogenous environment remaining challenging and an urgent need for a new capital allocation strategy. Even though the management has made a mistake with its offer for GSK’s assets, it has not only scrapped the deal but also seems to have learned from its mistake. In addition, with the activist investor Trian Fund having its foot in the door, I am optimistic that the company will come up with a solid long-term plan for its transformational efforts. Lastly, Unilever’s operational performance remains strong and the company is now priced very conservatively which creates an opportunity for those who are patient enough.

Be the first to comment