Torsten Asmus/iStock via Getty Images

Investment Thesis

Nutrien (NYSE:NTR) is a story of two tales. There’s the disappointing end to 2022 when investors’ expectations were high. That’s one tale. But it’s the other tale that I find particularly interesting and want to share with you.

The story of Nutrien headed into 2023. And how a lot of bad news is now priced in, and that after Q3, when investors on mass abandoned the fertilizer space, there are now the seedlings of a materially more prosperous period coming in the next twelve months.

A Floor Has Likely Been Found, Post Q3

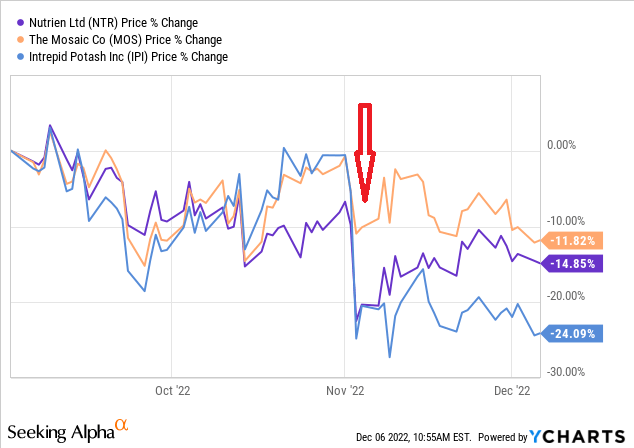

YCharts

In the graphic above, we can see that investors on mass sold out of fertilizer names. Or better said, the companies that were supposed to be benefiting from a potash uplift.

Since the start of 2022, there had been the idea that with the Ukrainian invasion, that potash would be taken out of circulation, and with less supply, this would lead to fertilizer prices going higher.

That clearly didn’t happen. And not only did it not happen how investors were hoping, but Nutrien actually lowered its outlook for the year.

So, I think there are two types of investors when it comes to Nutrien. There are investors that are long and hopeful, but nevertheless have some reservations over Nutrien’s prospects. And then there’s the rest of the fertilizer investment community.

The rest includes everyone that is either doubtful, as well as analysts that simply don’t buy into the story.

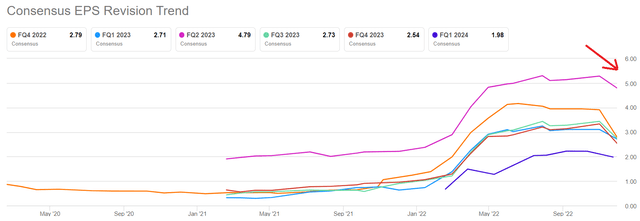

As a reference point, let’s consider Piper Sandler, which essentially cut Nutrien last week from overweight to neutral (Wall Street parlance for ”sell”). But Piper Sandler isn’t alone. Consider the broad consensus EPS view for Nutrien.

Since Q3 results came out earlier in November, analysts have been busy downwards revising Nutrien’s EPS estimates.

And for my part, I don’t believe this makes sense. Indeed, let’s get some further context here for why this view doesn’t match my own expectations.

Nutrien’s Let Down

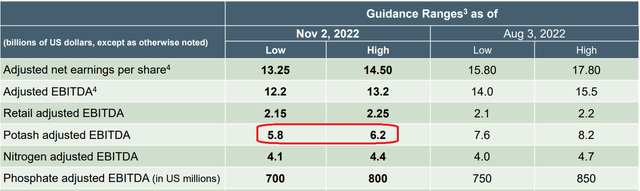

In the graphic that follows, we see that back in the summer +50% of Nutrien’s EBITDA was derived from its potash business:

Yes, the potash EBITDA figure did get cut by nearly 25% at the low end. And the fact that it got cut so significantly over a 90-day period, obviously, is less than satisfactory.

What was ”supposed” to be its profit driver into 2023, and accounted for 52% of its total EBITDA, is now likely to end up only accounting for approximately 47% of its total EBITDA.

Put another way, the one thing that got investors very excited about Nutrien in 2022 is the one segment that truly let down investors.

That being said, I don’t believe this is where the story ends for Nutrien. Why?

The Story Isn’t Over

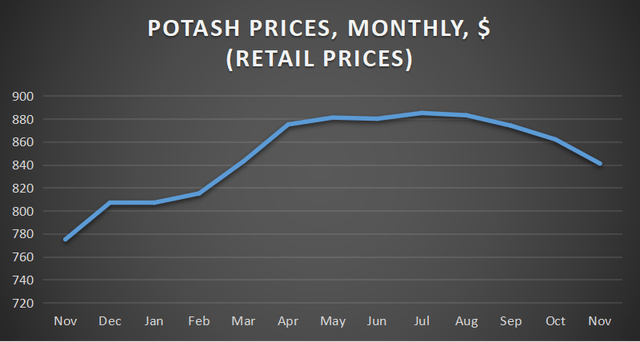

The graphic that follows is for potash prices.

There are a few elements to keep in mind. In the first instance, there’s some seasonality to fertilizer prices.

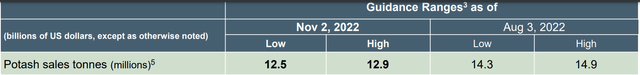

But arguably, one important element of the Nutrien story, is that even though farmers pushed back against high potash prices throughout 2022, and this translated into expected potash volumes falling significantly since the summer, see below, I contend that farmers will have to replenish their inventories in 2023.

What you see above is that between the summer to last month, at the high end, expected potash sales will be down approximately 13%. That’s a pronounced drop in a matter of months.

But I believe that what’s happening here is that farmers will need to return in 2023, as their inventories are running low.

And lastly, the nail in the coffin to my bullish thesis, is that if you look above, potash prices in November are approximately 8% higher than last year as a starting point. The black graph above.

So, not only did farmers defer their purchases in 2022. But when they do resume their purchases, it will be from a higher price point.

The Bottom Line

There’s a lot to be excited about Nutrien. I didn’t want to get caught up in the valuation and describe that the stock is priced at 5x earnings. That’s obviously critical. But at the same time, I know that valuation alone is never a reason to get bullish on a company. Cheap can always get cheaper.

Instead, I dispassionately demonstrated how the setup is favorable for 2023. And that as many weak hands drop the sector after Q3, there are actually the seeds being laid down for a rewarding twelve months in this stock.

Be the first to comment