Bora030/iStock via Getty Images

Amerigo Resources (OTCQX:ARREF) [ARG.TO] is a small capitalization copper producer that produces copper by processing tailings from the large El Teniente copper mine in Chile. For the right to process the tailings and produce the copper, Amerigo pays El Teniente a sliding scale royalty that averages about 30% of revenue. Sustaining capital costs for the processing operation are reported by the company at $6 million a year.

Debt free and dividend paying; Amerigo states its policy is to pay out free cash flow in dividends or use it to repurchase stock and has repurchased about 20 million shares in the past year while paying a CAD0.03 dividend each quarter at the current rate.

Amerigo trades just under CAD1.00 a share so yield is somewhere around 12% and will rise or fall with cash flows depending on copper prices. At prices of US$3.50 per pound of copper or higher, the dividend and sustaining capital costs are well covered and extra dividends are more likely than not. Breakeven is quite low so in a period of soft copper pricing, the company will cancel the dividend and wait for stronger markets.

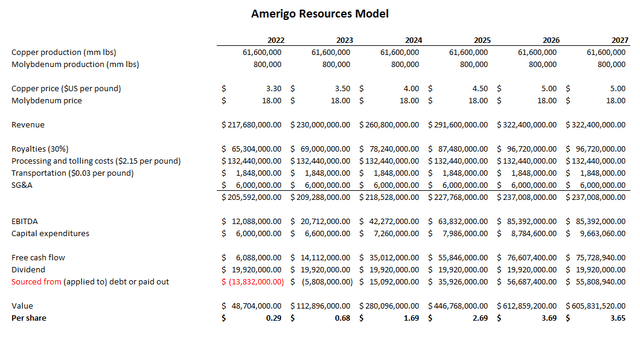

I created a simple financial model of the Amerigo operations. Here it is.

Amerigo model (Blair analysis)

At a copper price of US$3.30 a pound, Amerigo seems overvalued, but at copper prices of US$3.50 a pound or better, the stock is cheap. Copper has been volatile but today is US$3.38 a pound. Amerigo is in its essence a bet on copper prices with the usual operating risks in any processing company.

In the model, I have used constant dollars since the inflation in Chile and foreign exchange outlook is too volatile to model and carries risk in both directions, but I have project higher sustaining costs, rising at 10% a year to reflect the possibility of labor shortages and supply chain effects on processing chemicals, simply for conservatism.

The long term outlook for copper seems robust; seems electric vehicles [EVs] use more than double the amount of copper than internal combustion engine [ICE] vehicles and EVs are rapidly taking share from ICE vehicles. As they do, the electrical grid will need expansion, another tailwind for copper prices, and the likelihood of mine output growing faster than demand seems low given the long lead times for mine approvals in most jurisdictions.

A recession is a short term risk and cannot be discounted since a recession is very likely necessary to curb inflation. Such an event is likely to be a buying opportunity so keep Amerigo on your radar if you worry about recession.

I don’t see much downside risk so I opened a position of 25,000 shares.

Be the first to comment