Sundry Photography

There has never been a better time, in my view, to invest heavily into beaten-down small/mid-cap growth stocks. The market’s bias against this space has built up so quickly into rapid-fire sales that for most companies, all of the gains since the pandemic began have been entirely wiped out – despite the fact that bona fide improvements in business fundamentals have been achieved since then.

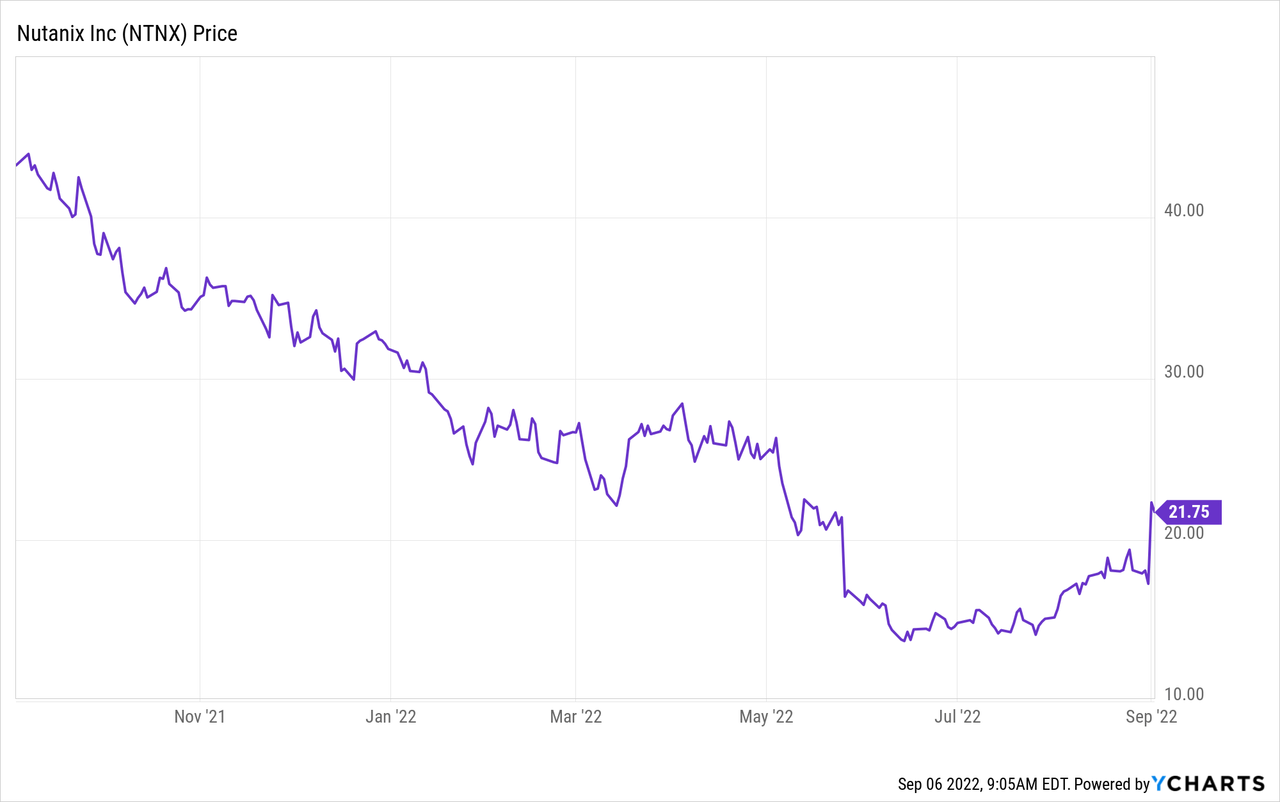

Nutanix (NASDAQ:NTNX), in particular, is one software company that is worth a close second look. This infrastructure provider, best known for its “hyperconverged” infrastructure technology that combines the compute, storage, and networking elements of a corporate datacenter to improve efficiency and reduce total cost, has lost ~30% of its stock value since the start of the year. However, the narrative is turning around. Ever since reporting fiscal fourth quarter results and initiating FY23 guidance in late August, Nutanix has rebounded ~50% off YTD lows seen in June (actually rallying recently while other tech stocks have crumbled alongside interest rate fears). To me, this is the beginning of a long-due rebound for Nutanix, and I think Nutanix has plenty of steam to keep outperforming the broader markets through the end of the year.

I remain very bullish on Nutanix. Recall that much of its YTD slide, at least in recent months, was based on the company’s weak guidance for Q4 (which now came and went, and much better than expected as well). Nutanix expected revenue declines to come into play, which Wall Street never likes to see – however, much of this was driven by continued supply chain challenges.

Now looking ahead to FY23, however, Nutanix is on much better footing, citing that there’s a light to the end of the tunnel on supply challenges and that on the demand side, secular tailwinds toward digital transformation continue to drive robust deals, especially expansion deals as existing customers increase their reliance on Nutanix’s solutions.

As a refresher for investors who are newer to this name, here is my full bullish thesis on Nutanix:

-

Enabling the hybrid cloud: Not all workloads can be moved to the cloud. These days, IT and computing are all about the cloud. But while the market is chasing after all the hot cloud stocks, the reality is that most companies – especially those in complex or highly regulated industries, or those that simply want more direct control over their data – will never entirely move their systems into the cloud. Nutanix is a champion of the “hybrid cloud” strategy, in which some of a business’s assets are in the cloud and others are in on-prem environments. For the on-prem assets, Nutanix’s hyper-converged technology ensures that customers get the same performance and agility benefits that users receive in the cloud. Most companies today employ some sort of hybrid cloud strategy – meaning Nutanix products are widely applicable to all IT departments.

-

Thought leader in hyper-converged infrastructure. VMware has been chasing Nutanix’s tail ever since the company gained prominence. For multiple years in a row, the company has been recognized as the category leader by Gartner, the software industry’s leading analyst and reviewer.

-

Software-first. Earlier on in Nutanix’s lifespan, the company sold server devices as its primary business, with its proprietary software overlaid as a “package solution.” Now, Nutanix sells only software. This has dramatically raised its margin profile while also making it more palatable for companies who only want to consume software to run on their own hardware.

-

Executing on its new sales strategy. At the beginning of Nutanix’s fiscal 2021, the company made the earth-shaking decision to incentivize its sales staff based on ACV and not TCV. In the past, Nutanix’s account executives sold longer-term contracts and incentivized customers with bigger discounts because they were paid based on the value of the total deal. What’s important for Nutanix and for investors, however, is how much Nutanix can rake in annually and for each customer’s lifetime. So Nutanix shifted its sales compensation in line with this priority and began paying its sales teams based on ACV – and this has yielded very strong results.

-

Prioritizing profitability. Nutanix is shedding 4% of its workforce, which is going to help the company become profitable on both a pro forma operating profit and FCF basis in FY23.

Nutanix’s valuation also remains quite modest. At current share prices near $21, Nutanix trades at a market cap of $4.87 billion. After we net off the $1.21 billion of cash and $1.06 billion of debt on Nutanix’s most recent balance sheet, the company’s resulting enterprise value is $4.72 billion.

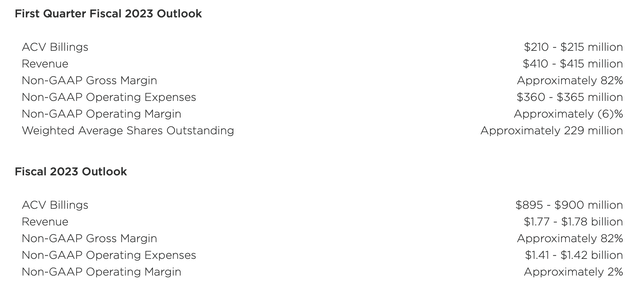

Nutanix outlook (Nutanix Q4 earnings deck)

As seen in the chart above, Nutanix has guided to $1.77-$1.78 billion in revenue for FY23 (the year for Nutanix ending in July 2023). This represents 12-13% y/y growth, representing a return to growth after a flat Q4 driven by supply-chain constraints, and is also well ahead of Wall Street’s $1.65 billion (+4% y/y) consensus. The market is also cheering Nutanix’s workforce reduction and stated goal of becoming profitable in pro forma and FCF terms next year.

Against this outlook, Nutanix trades at just 2.7x EV/FY23 revenue – which I consider to be quite a bargain for a company that has re-stabilized, is returning to mid-teens growth, and is building up an ARR base with gross margins in the 80%+ range.

Stay long here – Nutanix’s recovery rally is just beginning.

Q4 download

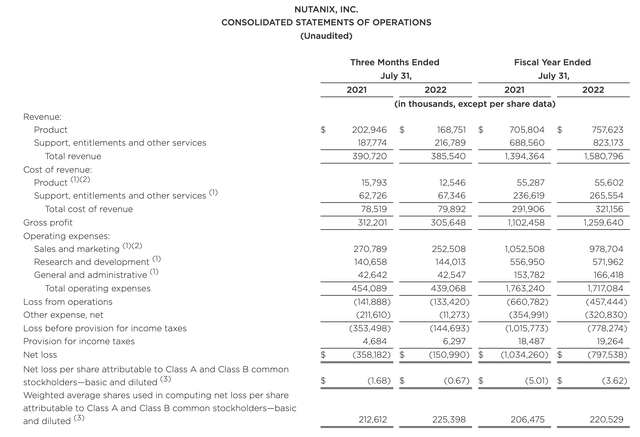

Let’s now cover Nutanix’s latest Q4 results in greater detail. The Q4 earnings summary is shown below;

Nutanix Q4 results (Nutanix Q4 earnings deck)

Nutanix’s revenue in Q4 declined -1% y/y to $385.5 million, driven by aforementioned supply-chain challenges that constrained the company’s server partners. This result, however, came in well ahead of the company’s initial $340-$360 million outlook (which would have represented a decline ranging from -13% y/y to -8% y/y), as well as Wall Street’s consensus mark of $355.6 million (-9% y/y).

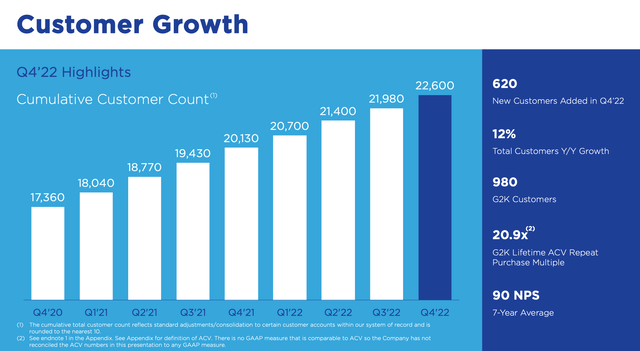

Supply-chain challenges did nothing to hamper Nutanix’s customer growth. The company added 620 net-new customers in the quarter, a faster pace than 580 net adds in Q3. On a y/y basis, the company’s 22.6k customer base is 12% larger than at the same point in time last year.

Nutanix customer trends (Nutanix Q4 earnings deck)

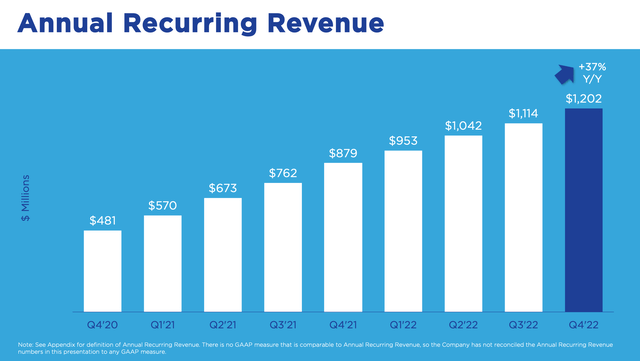

ARR also showed a tremendous 37% y/y boost to $1.202 billion, with the company adding nearly $100 million of net-new ARR in the quarter:

Nutanix ARR trends (Nutanix Q4 earnings deck)

Expansion deals were a major driver of the quarter here. The company cited, as an example, a Fortune 100 client that not only increased its usage of Nutanix’s core Cloud Platform, but also added the Unified Storage and Database Services products as well.

Here are the company’s top priorities looking ahead to FY23, taken from CEO Rajiv Ramaswami’s prepared remarks on the Q4 earnings call:

In closing, I’d like to provide some thoughts on our priorities and outlook. First, our overarching priority remains driving towards sustainable, profitable growth. To enable this, we will continue to judiciously invest in the growth of the business, execute on our growing base of renewals and diligently manage expense levels. Towards this end, as part of our comprehensive review of our business and operating model and along with a number of other expense reduction actions, we made a difficult decision to reduce our headcount by approximately 4%. This is not a decision we made lightly, but it was important to ensuring that we could continue to drive towards profitable growth in a variety of macroeconomic scenarios.

However, we’re also seeing businesses continuing to prioritize digital transformation and believe the challenging macro backdrop is providing further incentive for them to optimize their IT and cloud spend. We see these dynamics as playing to the strength of our hybrid multi-cloud platform, which enables companies to reduce the complexity and cost of their IT environments.”

The company’s base-case expectations assume that supply-chain constraints will remain at similar levels to Q4 through the first half of the year, and then abate in the back half of FY23.

Key takeaways

Equally reassuring is the fact that Nutanix has re-committed to its long-term targets of hitting 10-15% FCF margins by FY25 (two years from now), and delivering a minimum of $300 million in annual FCF. Nutanix has solidly positioned itself as a mission-critical vendor in the hybrid cloud space, and one that is committed to optimizing both growth and profitability. Stay long here.

Be the first to comment