Akarawut Lohacharoenvanich/iStock via Getty Images

There is no such thing as work-life balance. Everything worth fighting for unbalances your life.”― Alain de Botton

May Company Presentation

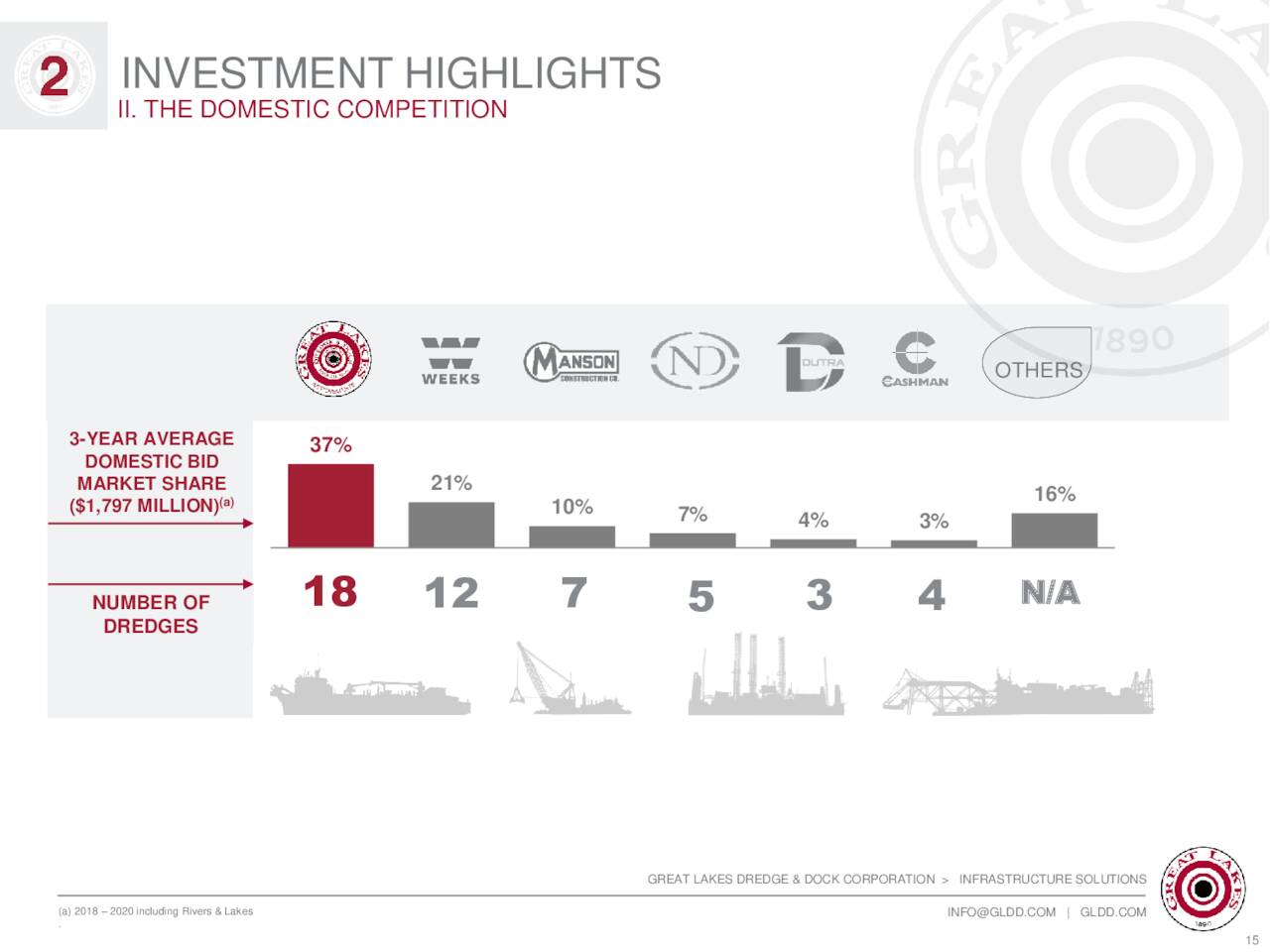

We tee up North America’s largest dredging concern in today’s analysis. Great Lakes Dredge & Dock Corporation (NASDAQ:GLDD) should be a beneficiary of the large amount of funding the government has approved for infrastructure under the current administration. Despite this, the stock is down some 40% over the past year. The shares did see some insider buying in August, the first for 2022 to date. Better times ahead? An analysis follows below.

Company Overview:

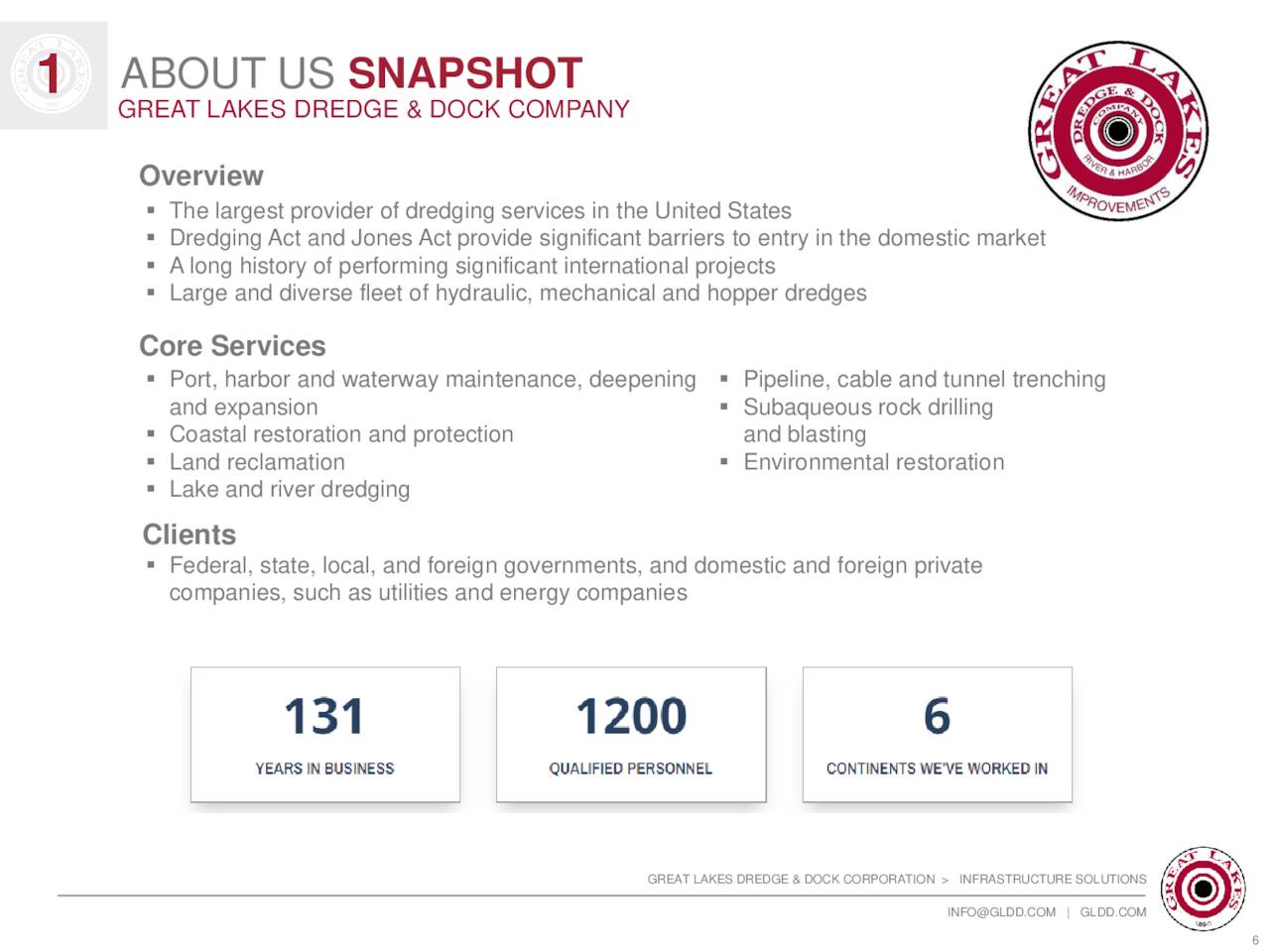

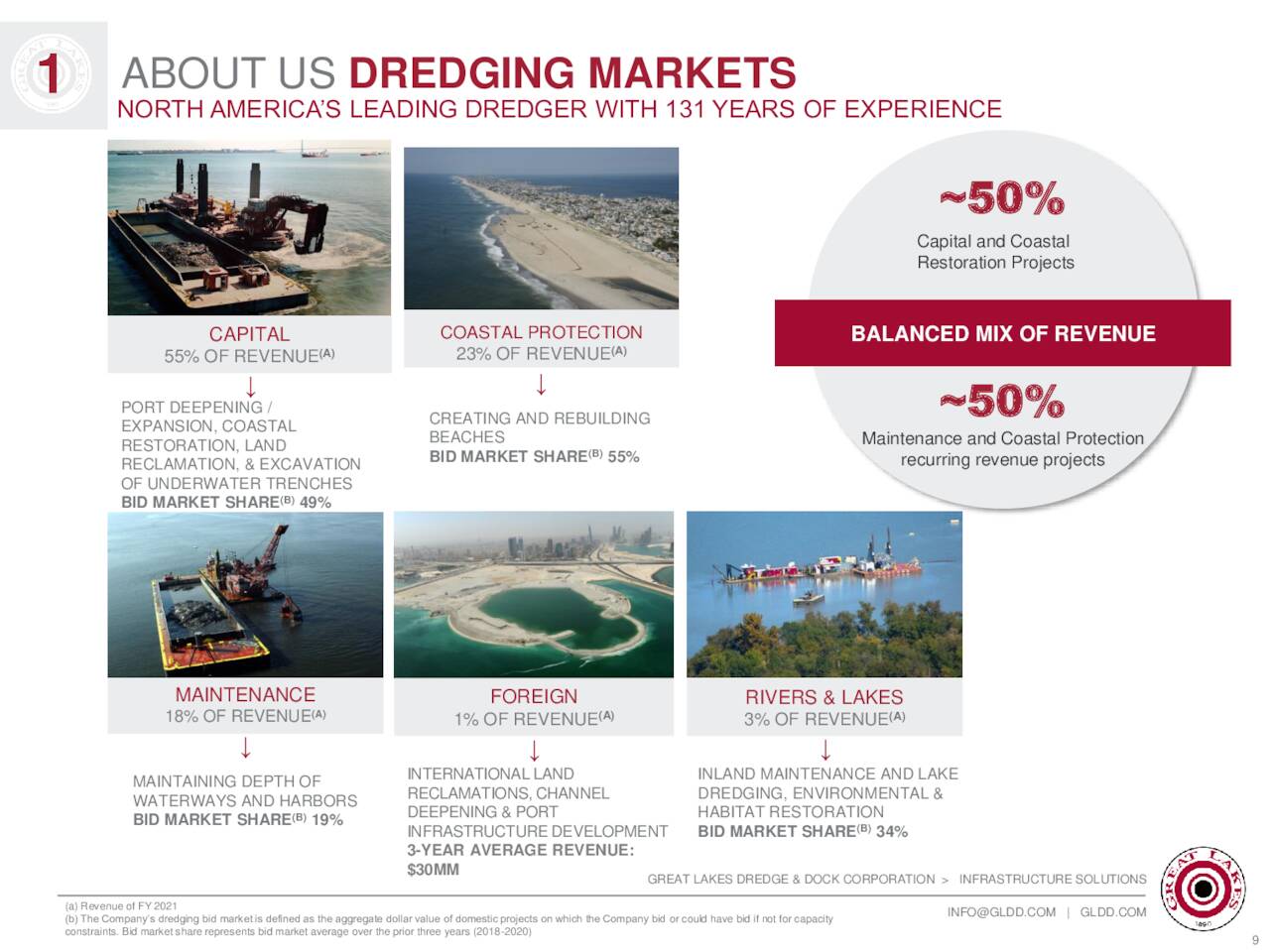

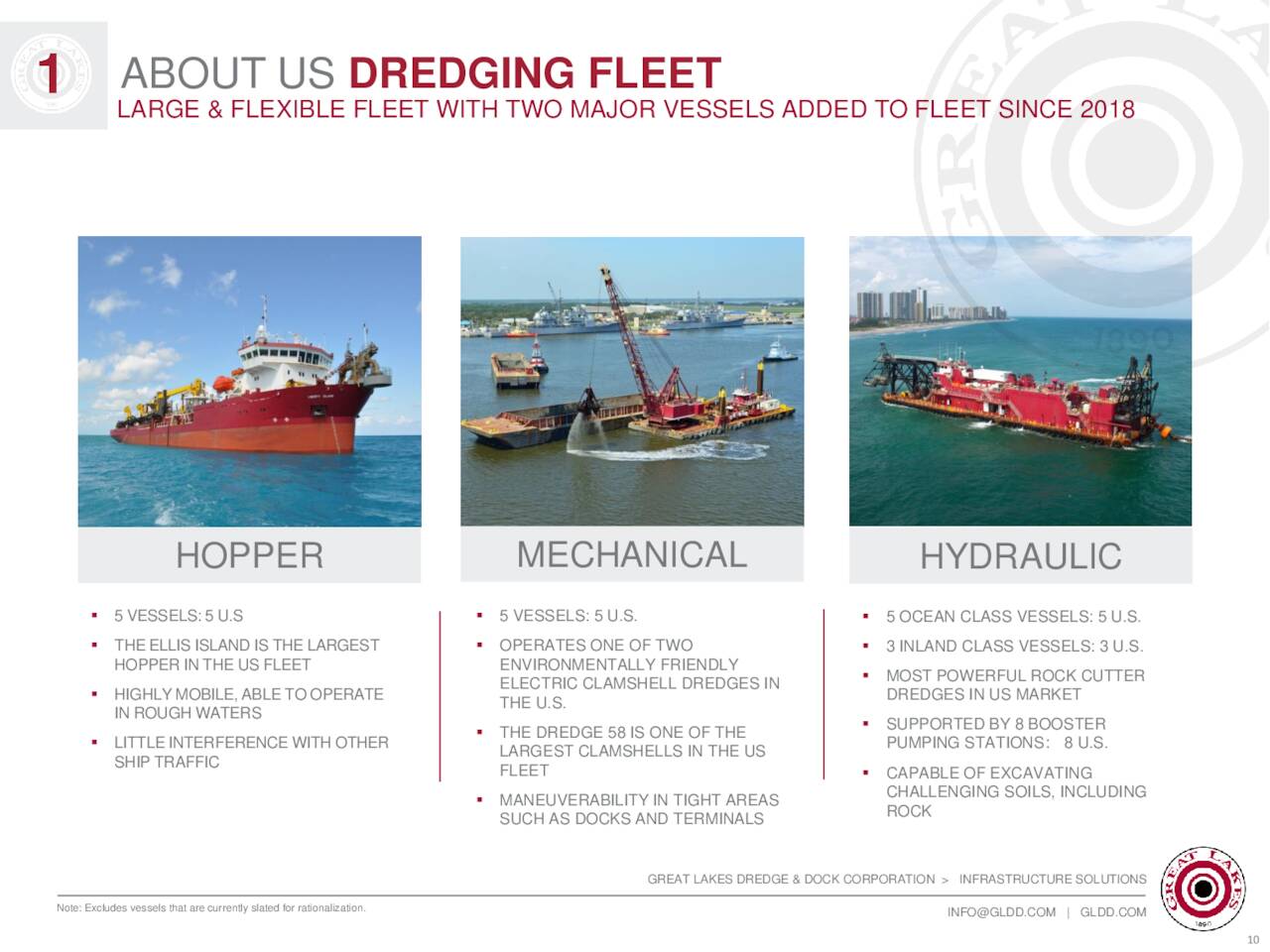

Great Lakes Dredge & Dock is based in Houston and primarily provides dredging services throughout the United States. These services include but are not limited to port expansion projects; coastal restoration and land reclamations; trench digging for pipelines, tunnels, and cables; and other dredging related to the construction of breakwaters, jetties, canals, and other marine structures. The company also provides coastal protection and other services to both the private and public sectors through a fleet of approximately 35 core ships and various other support vessels. The stock currently trades for around $9.50 a share and sports an approximate $620 million market capitalization.

May Company Presentation

Second Quarter Results:

A good portion of the decline in the stock occurred after the company posted second quarter numbers on August 2nd. Great Lakes Dredge & Dock Corporation badly missed expectations, to put it mildly. The company had a GAAP loss of six cents a share when the consensus was looking for a 20 cents a share profit. Revenues fell some 12% on a year-over-year basis to $149.4 million, missing expectations by nearly $35 million.

May Company Presentation

Going through the press release that accompanied these tepid numbers, it appears Great Lakes Dredge & Dock Corporation hit the perfect storm of adverse conditions in the quarter. Management cited ‘supply chain delays, inflationary pressures, adverse weather conditions combined with some atypical dredging project challenges‘ for the poor quarter.

May Company Presentation

The biggest hit to margins and profits it appears to be the delay to their dredging ships Liberty Island and Carolina dry dockings which were caused by supply chain challenges. This caused both dredges to be delayed several weeks mobilizing to their projects. And speaking of the perfect storm, several of the company’s projects were impacted by unseasonably rough sea conditions along the east coast. This caused several vessels to have to stop operating and seek shelter. This extended completion timelines and delayed commencement of subsequent projects as well.

In addition, three of the company’s larger projects encountered differing and unanticipated site conditions which negatively impacted production. Management is renegotiating agreements with their clients on these projects to reflect these conditions. However, until resolved, revenue and profit recognition is delayed. Finally, higher-than-anticipated inflation impacted the cost of labor, operating supplies, and dry dockings in the quarter. The company is accounting for these higher costs within new bids.

Finally, the company’s order backlog shrunk to $373.8 million at the end of the quarter from $454.4 million at the same point in 2021. Looking for some good news on Great Lakes Dredge & Dock Corporation, the company did report it won $107 million worth of new awards in late August that will help its backlog. In addition, adjusted EBITDA was a positive $10.2 million in the second quarter despite very adverse conditions. Ending on a bright note, management mentioned the following positives within their earnings press release.

We continue to see increased market demand backed by strong government support and development of new LNG export facilities that we expect will benefit Great Lakes and our market position in the upcoming years. Our new build program is on schedule with the new hopper dredge, the Galveston Island, expected to be ready for operations in the first half of 2023 and her sister ship expected to be ready for operations in 2025.”

Analyst Commentary & Balance Sheet:

There has been very little in the way of analyst activity around this stock in 2022. Alliance Global Partners maintained their Buy rating and $17 price target on GLDD in mid-March, two weeks ago, Noble Financial took the same action with an identical price target. Those are the only analyst firms I can find that have chimed in around Great Lakes Dredge & Dock Corporation so far in 2022.

The CEO of the company purchased 10,000 shares on August 5th. As previously noted, this is the first insider buying in the shares in the last year. Just over two percent of the shares are currently held short. The company ended the second quarter with just over $75 million in cash and marketable securities on its balance sheet against just over $120 million in long-term debt.

Verdict:

The current analyst consensus has the company making 34 cents a share in FY2022 as revenues fall some four percent to just under $700 million. They do project a bounce-back year in 2023 and expect the company to make nearly 90 cents a share as revenues rise some 12%.

Great Lakes Dredge & Dock Corporation had a very disappointing second quarter; there is no use trying to put lipstick on pig around those results. However, the company should be poised to rebound over the coming year as some of the second quarter’s headwinds dissipate. Increased infrastructure and LNG spending are longer-term positives. The company recently entered the growing offshore wind market with a major project award. This will involve a subsea rock installation vessel currently being built for expected delivery in late 2024. The stock seems reasonably valued at just over 10 times next year’s projected earnings.

It is hard to argue for a large stake in GLDD, given their recent tough quarter. However, there is enough to this story to merit a small ‘watch item‘ position while management works to put some of the company’s recent challenges behind it.

No work is insignificant. All labor that uplifts humanity has dignity and importance and should be undertaken with painstaking excellence.”― Martin Luther King Jr.

Be the first to comment