typhoonski/iStock via Getty Images

Thesis: A Buyable Dip, But Not For Me

The Nuveen Short-Term REIT ETF (BATS:NURE) is a small ($118 million in assets under management) and specialized exchange-traded fund focused on real estate investment trusts that own the types of real estate that feature short-term leases. “Short-term” here ranges from one day (hotels) to month-by-month (self-storage) to a year or so (apartments, single-family rentals, mobile homes).

The expense ratio of 0.35% is relatively modest for a specialized ETF like this that gives such unique exposure to a certain corner of the market.

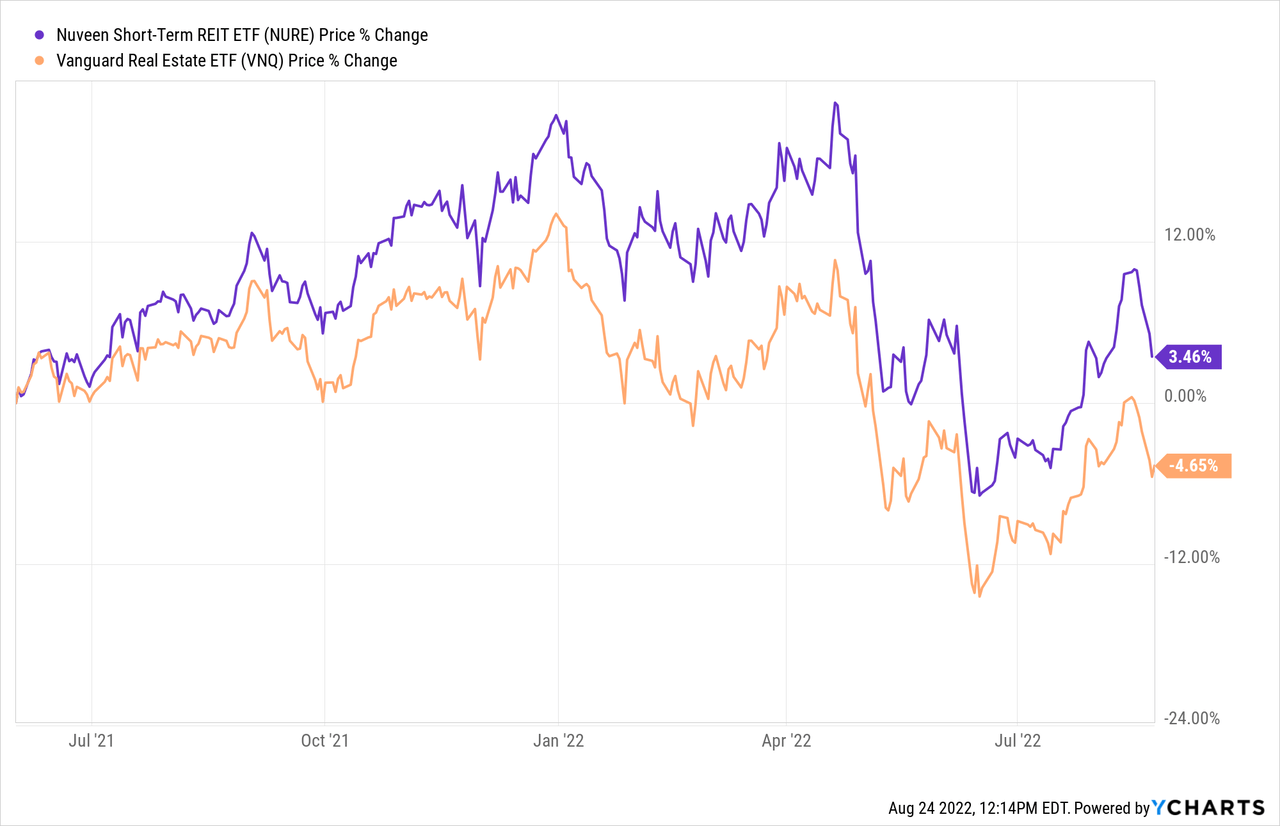

As inflation has gotten hotter and hotter, NURE’s REITs have been able to take advantage by raising their rents faster than REITs with longer lease terms. Hence we find that NURE has outperformed the broader real estate index, as measured by the Vanguard Real Estate ETF (VNQ), for as long as inflation has been elevated:

With the prospects of peaking inflation and increasing signs that rent growth is slowing, is it a good idea to buy NURE on the dip this time?

Let’s dive into the specifics of NURE, highlight some of the developments specifically in the multifamily housing space, then finish with some concluding thoughts. I’ll explain a few reasons why I choose not to buy NURE but instead to selectively buy a few of its holdings.

Overview of NURE

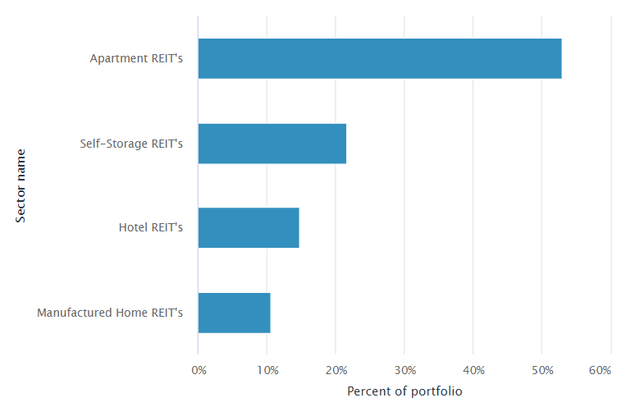

NURE holds 37 REITs in its portfolio, which is heavily weighted toward residential real estate (63.5%), with 22% in self-storage and 15% in hotels.

Nuveen

Part of the reason why hotel REITs have a smaller weighting is because they have not performed as well as apartments or self-storage in the wake of COVID-19. Today, they are enjoying a strong rebound as the pent-up demand for traveling and vacationing is being released across the nation. But in many ways hotel landlords are still getting caught up to where they were before the pandemic hit.

NURE’s top ten holdings does not feature a single hotel REIT. Instead, top holdings are mainly apartment and self-storage REITs, with one single-family rental REIT (INVH) and two manufactured housing REITs (SUI and ELS).

Nuveen

When you buy NURE, you are mainly buying the nation’s largest publicly traded residential and self-storage REITs with a sprinkling of hotel REITs tossed in.

Some investors (including myself) may prefer the fund leave out the hotel REITs and focus solely on residential and self-storage, but that might make the portfolio too small in number to make sense.

Shifting Dynamics of Rent Growth

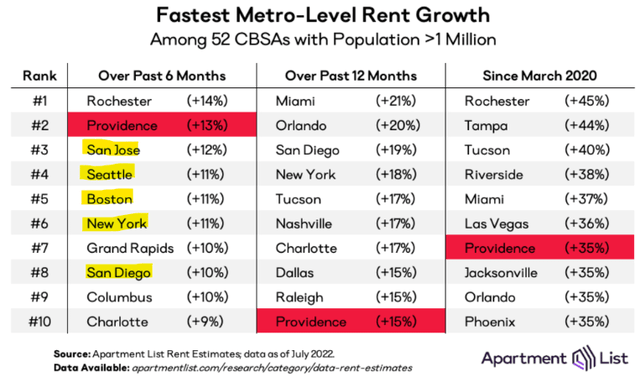

Most investors who pay attention to commercial real estate trends are aware that rent growth has generally been faster in the Sunbelt region of the US than in coastal cities since the beginning of the pandemic. Stricter lockdowns and work-from-home fueled a population reshuffling from high-cost of living cities to lower-cost ones.

In truth, though, COVID-19 simply accelerated a trend of net migration and faster population/job growth in the Sunbelt that had been in motion for the better part of a decade. From March 2020 through July 2022, 7 of the top 10 markets of fastest rent growth were located in the Sunbelt (8 if you count Riverside, California).

Apartment List

But, as you can see on the left side of the image above, coastal markets like San Jose, Seattle, Boston, New York City, and San Diego have been making a comeback in the last six months.

Indeed, data and analysis provider Markerr recently reported that coastal multifamily REITs showed faster rental revenue growth than their Sunbelt peers in Q2 2022 for the first time since the pandemic began.

- Coastal multifamily REITs: 13.1%

- Sunbelt multifamily REITs: 12.4%

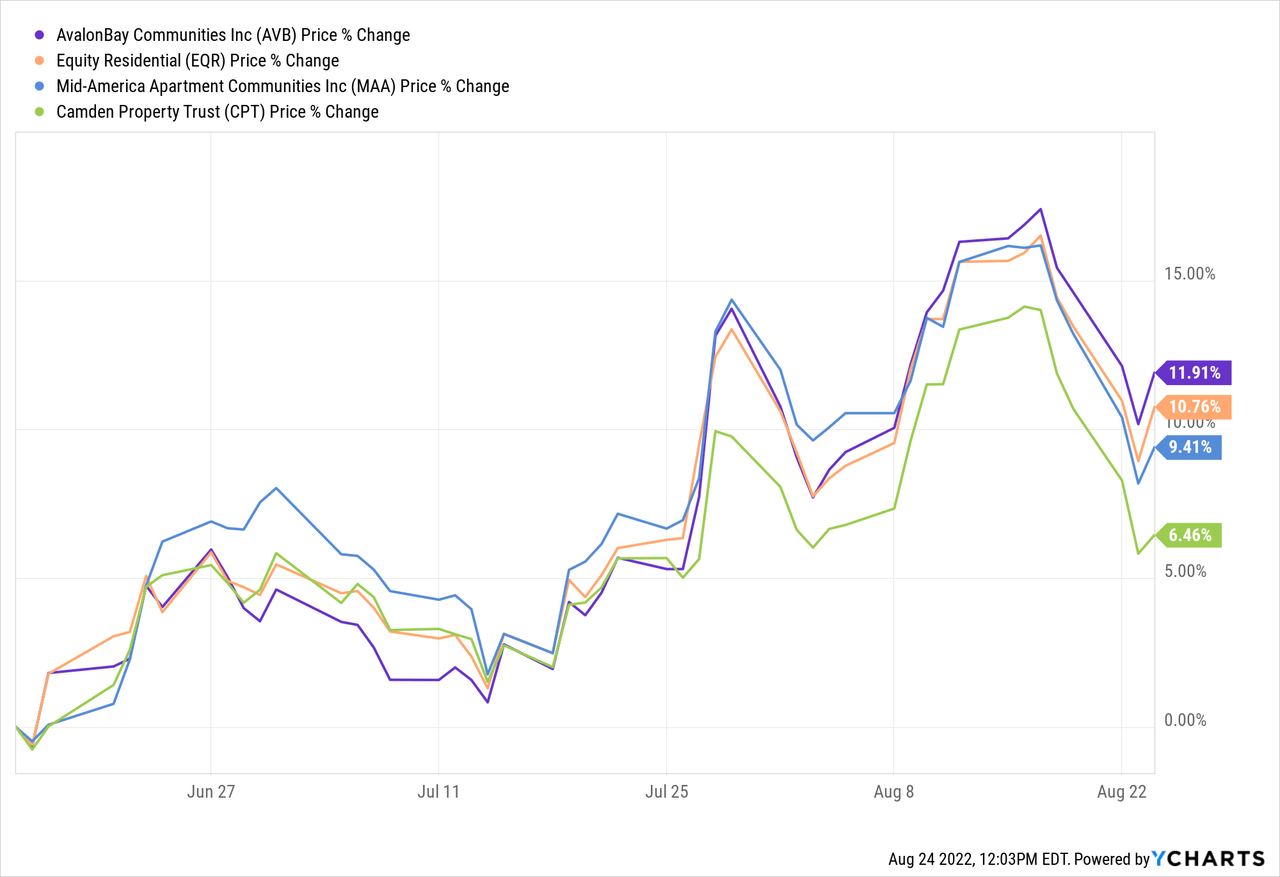

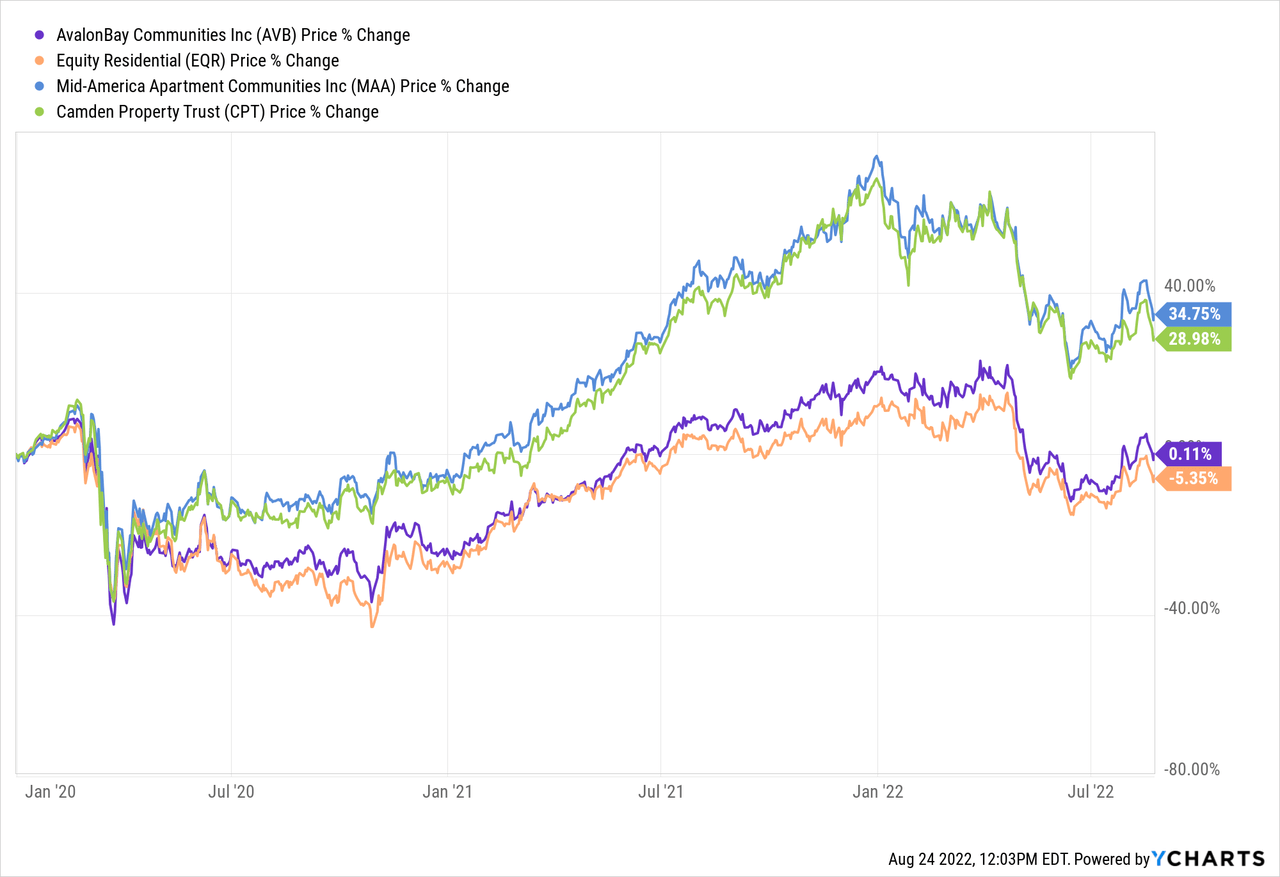

We can see this when comparing same-store net operating income growth between the two largest coastal multifamily REITs (AVB and EQR) and the two largest Sunbelt multifamily REITs (MAA and CPT):

| Q2 AFFO/sh Growth | Q2 Same-Store NOI Growth | |

| AvalonBay (AVB) | 22.3% | 17.0% |

| Equity Residential (EQR) | 23.6% | 19.1% |

| Mid-America Apts (MAA) | 19.5% | 17.1% |

| Camden Property (CPT) | 30.9% | 16.5% |

While AFFO per share growth is influenced by multiple factors, including acquisitions and new developments delivered to market, same-store NOI growth measures the performance of the same set of properties over time. As such, it is interesting to note that the coastal REITs are currently enjoying the same level of same-store NOI growth as or better than the Sunbelt REITs.

This is perhaps why we find these two coastal apartment REITs performing better since REITs bottomed in mid-June.

Is this a reversal of the trend favoring the Sunbelt? I don’t think so. Instead, I think it simply indicates the inevitable rebound of coastal markets following a sharper and longer lasting downturn than the very short and brief one suffered during the pandemic by Sunbelt markets. Coastal REITs still have a long way to go to catch up with their Sunbelt peers.

This is true in both a fundamental sense as well as for stock prices:

Coastal apartment REITs like AVB and EQR are trading at around the same prices as they did in January 2020, while Sunbelt apartment REITs like MAA and CPT are 30-35% higher.

Does this indicate that Sunbelt REITs are expensive and coastal REITs are cheap? Not necessarily. After all, most Sunbelt markets have seen rent growth ranging from 20% to 40% since the pandemic began, while coastal market rent growth has been mostly in the range of 5% to 20%. San Francisco, a major market for multiple coastal apartment REITs, has seen 0% rent growth according to Apartment List!

Another factor is rent-to-income ratios. Despite faster rent growth, Sunbelt markets on average still feature lower rent-to-income ratios than their coastal counterparts, according to the Markerr report:

- Sunbelt Rent-To-Income: 23.5%

- Coastal Rent-To-Income: 26%

It is worth noting that the gap between rent affordability of coastal and Sunbelt markets is shrinking, but it still exists, arguably leaving more room for rent growth in Sunbelt metros than coastal ones.

Concluding Thoughts

NURE is a unique REIT ETF for those interested in gaining a specific kind of exposure to real estate, one that should benefit from inflation more than the average REIT. For those who do not wish to be stock-pickers, NURE can make a good portfolio addition.

However, I am a stock-picker. I prefer picking my favorite REITs among the list of holdings and leaving out the rest. For instance, my own portfolio heavily favors Sunbelt REITs, whereas NURE’s portfolio favors coastal REITs.

Moreover, I do not like hotel REITs because of their cyclicality, so I do not own any in my portfolio. But if one wants to get exposure to all the residential and self-storage REITs in NURE, one will also need to accept the 15% exposure to hotel REITs.

So, in short, for ETF investors who are bullish on real estate with shorter lease terms, NURE is a solid pick. But stock-pickers would do better hand-picking the REITs in NURE they wish to hold.

Be the first to comment