NiseriN/iStock via Getty Images

Thesis update

This is an update to my original AST SpaceMobile (NASDAQ:ASTS) thesis.

With the launch of their first satellite and the deployment of the largest commercial communications array ever, AST has made tremendous strides in recent months. To a large extent, I believe that AST’s early successes have mitigated the risks associated with the company’s technology; however, given the relative youth of the technology, there are still substantial execution risks.

I have faith in ASTS’s long-term viability due to the company’s sizable TAM, groundbreaking technology, strategic alliances with leading mobile network operators, and robust revenue business model.

Earnings update

I believe that AST’s development of BlueWalker 3 has greatly mitigated technical risks to the business strategy. The first AST satellite was launched into orbit on September 10 and is currently performing in-orbit testing of the system’s mechanical and technical components for the first time. Also, it came as a great relief and source of excitement to find out that the array on BW3 was successfully deployed in low Earth orbit. Launching and deploying such a large system in space posed the greatest technical challenge for the fledgling company, so this development is crucial.

Despite the fact that a satellite system of this size and shape has been used in commercial LEO enterprises before, deployment testing was never possible on Earth due to limitations with zero gravity environmental testing. I think the biggest breakthrough in allowing ASTS to work with regular, unmodified cell phones is the array’s size. Even more encouraging is the fact that ASTS has reaffirmed its faith in the design of its Block 1 satellites and does not anticipate any major adjustments as a result of preliminary testing.

Future plans for AST include launching the first five commercial Bluebird satellites in 2H23, at which point the company plans to offer a limited service. I anticipate that early next year, interoperability testing with mass market handsets and wireless networks via BW3 will begin once the array has been fully calibrated. I believe that the system’s stock price would rise if it could prove that it could successfully connect to terrestrial wireless networks and communicate with mass market consumer handsets.

AST reaffirmed that the $200 million in cash it held at the end of the quarter was enough to cover the company’s cash burn for the next 12 months. However, I believe AST will employ careful planning when deciding how to utilize its equity financing options. During the period covered by this report, AST raised $17 million through the issuance of stock under its existing $75 million common stock purchase agreement, and ASTS signed a new equity program with a maximum value of $150 million. Inflation, supply chain issues, and other factors may cause AST’s average cost estimate for the first 20 satellites to rise or fall from the previously stated $16 million.

In my opinion, the company is moving at a slower pace to launch its business compared to its original plans. AST plans to begin limited service after launching its first five commercial satellites in late 2023. This will allow the company to lower its cost of capital before launching the remainder of its fleet in a large scale operation. For high-risk endeavors, where market conditions can shift quickly, I think this periodicity is appropriate.

Valuation

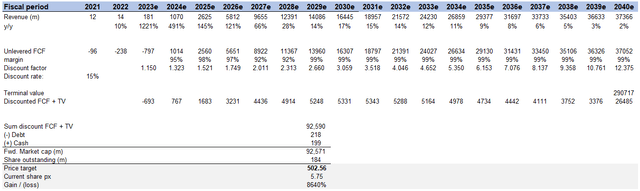

Price target update

The model still suggests a significant upside from what the stock is priced at today. That said, there is still a massive leap of faith that an investor needs to believe in management’s guidance, as such I believe the valuation difference is warranted. As I mentioned previously, this is akin to a venture capital-like investment where results can only be seen far in the future. Thus far, management has been executing well and reducing the downside risk, hence, I believe it is still attractive.

Nonetheless, suppose ASTS meets management’s guidance and the business grows at 2% over time due to market maturing. One can expect a significant upside.

Conclusion

To conclude, I still believe the upside for ASTS is worth a lot more than it is today if it can hit management’s FY30 guidance. The most important thing at this point is that we are gaining incremental evidence that the downside risk is being limited.

Be the first to comment