imaginima

Mortgage REITs were a popular high-dividend investment sector that attracted many investors over the past two years. It is among the few market segments where double-digit dividend yields are typical. However, as many have found in 2022, the market rarely provides free lunches; if they do, they rarely last long. As mortgage rates have shot up, most mortgage REITs have seen extreme book value losses, leading the “mREIT” sector ETF (REM) to lose a third of its value this year temporarily. REM has retraced most of its losses and is now hardly down this year after dividends; however, with the market’s renewed volatility spout, I believe many mortgage REITs may face considerable losses.

Not all mortgage REITs are the same, and they differ dramatically based on their portfolio exposures and hedging mechanics. In my view, mortgage REITs with long-term maturity assets, higher leverage, and minimal hedging have the most significant risk of losses. One notable example is Orchid Island Capital (NYSE:ORC) which is currently down around 38% this year. I warned about the stock in late 2020 in “Orchid Island: Shuttering Mortgage Market Signals Potential Bearish Move” and again this February in “Orchid Island Capital: Likely Trading Above NAV Due To Collapse In Mortgage-Backed-Securities.” The stock has declined considerably since both articles were published. The company also recently decided to pursue a 1-for-5 reverse split while cutting its monthly dividend, giving a new forward yield of ~16.6%.

On the one hand, the recent bounce in the RMBS market has boosted ORC’s declining book value by ~8-9% to ~$3.11 on August 16th – up from $2.87 at the end of Q2. However, over the past week, RMBS assets have declined considerably, potentially signaling another wave higher in both interest rates and mortgage spreads. ORC’s sensitivity to interest rates has risen over the past year, so ORC may struggle to survive another sizeable upward move in interest rates. The Federal Reserve is expected to ramp quantitative tightening over the next month and is considering selling its RMBS assets outright. Since banks are still not buying RMBS assets, Orchid’s highly levered portfolio may become illiquid. In my view, this situation raises a clear question as to whether or not ORC can survive this shift.

Why ORC’s Business Model is Unsustainable

Orchid Island has a relatively simple business model compared to most mortgage REITs. As of the end of last quarter, roughly 91.5% of the company’s portfolio was in 30-year fixed-rate residential mortgage-backed securities, 4.2% were in 15-year fixed-rate RMBS, and an additional 4.2% were in various interest-only RMBS. Orchid’s portfolio essentially represents most “qualified” residential mortgages. In my opinion, asset manager skill is no benefit with this simple portfolio strategy, making it a chronic negative-alpha generator.

Notably, the credit risk of these assets is subjectively low since they are backed by agencies such as Fannie Mae (OTCQB:FNMA), which guarantees qualified mortgages in the case of default. However, we must remember that Fannie Mae and Freddie Mac currently operate at debt-to-equity ratios of 75-90X, so it will be nearly impossible for them to guarantee mortgages in the case of a national rise in delinquencies (without a massive and not guaranteed government bailout). This indirectly gives ORC some material credit risk via counterparty risk with these agencies.

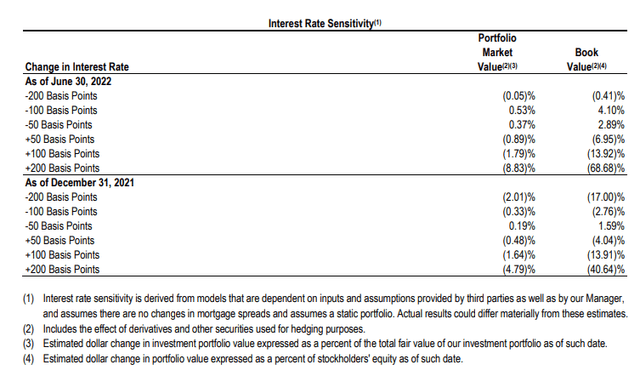

Despite this, Orchid Island operated at a high total debt-to-equity ratio of ~7.5X last quarter. Even if we consider another mortgage market crisis unlikely (see 2008), Orchid’s high leverage gives it immense exposure to changes in interest rates. This factor has considerably decreased ORC’s book value as interest rates have risen. See its most recent interest rate sensitivity below:

Orchid Island Capital Interest Rate Sensitivity (Orchid Island Capital 10-Q 2Q 2022)

After hedges, a 2% rise in interest rates is expected to lower Orchid Island’s book value by 68.7%. Its sensitivity to a smaller 1% rise is nearly the same as at the end of 2021, but the company has dramatically increased its tail-risk exposure. The company’s derivative positions suggest hedging the entire yield curve with particular concentration in “mid-curve” five-year Treasury rates. Its assets are primarily long-dated (“30-year”), so a steepening of the yield curve should also create a negative-interest rate effect on its book value. Additionally, the company has no significant hedge against a rise in “mortgage spreads” or the difference between mortgage rates and Treasury rates (which it has some hedging against).

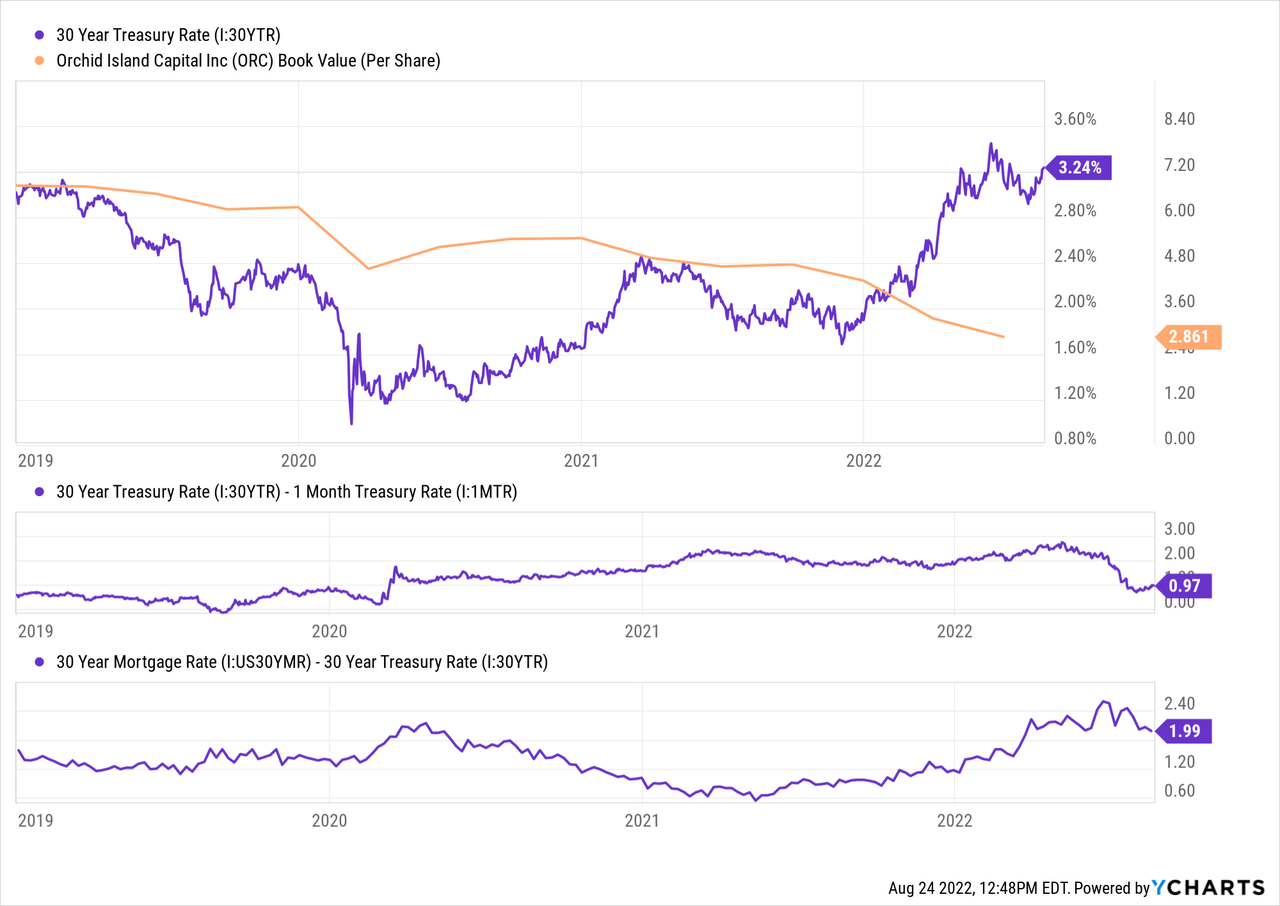

Orchid Island’s book value has declined significantly this year, primarily due to the rise in long-term Treasury rates and the mortgage spread. This came after a poor period from 2019 to 2021, driven by losses from prepayment as mortgage rates collapsed. See below:

The rapid flattening of the curve has likely softened the blow to an extent as long-term rates would be 1-2% higher if the curve steepened to normal levels. Since the end of Q2, interest rates have not risen while the mortgage spread has declined by around 40 bps. This has lifted the company’s book value to ~$3.11 as of August 16th.

Fundamentally, Orchid Island loses from both a rise in interest rates (due to book value losses) and a fall in interest rates (due to refinancing-driven prepayment risk). Put simply, the company positions itself to lose given any positive or negative change in interest rates. Hence, ORC’s book value per share has declined almost yearly over the past decade. The firm’s market value has risen due to immense equity sales. In my opinion, these facts indicate that Orchid Island’s business model is not ideal for shareholders, regardless of the economic situation.

At The Federal Reserve’s Mercy

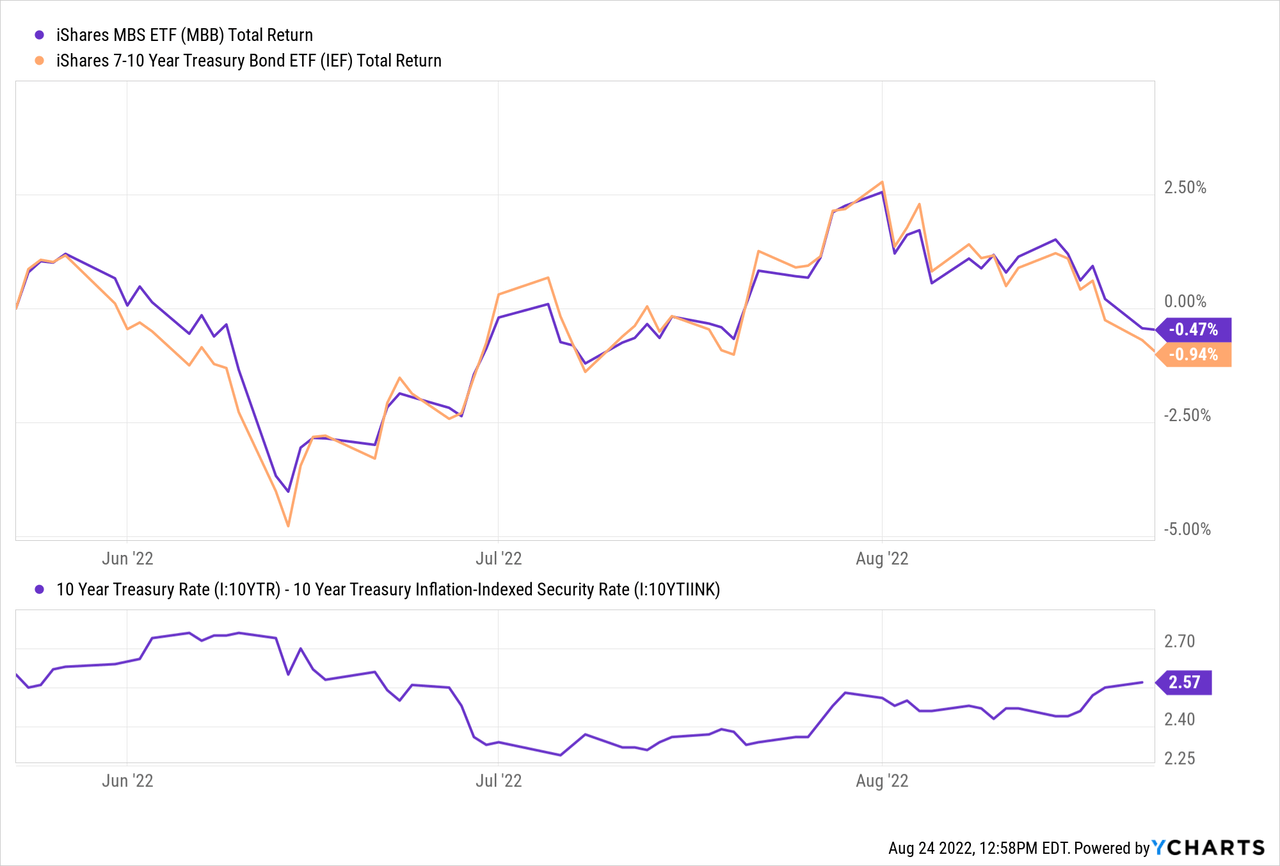

In my view, ORC will unlikely continue to see a book-value recovery and has likely seen its NAV decline over the past week as the market has seen a rise in volatility. Mortgage rates are not updated daily, and Treasury data lags, but the RMBS ETF (MBB) and the Treasury bond ETF (IEF) have both signaled a renewed rise in interest rates. See below:

Both index funds are still well-above their June lows. However, the long-term inflation expectation rate has trended steadily after bottoming in July, signaling the need for higher long-term interest rates. Most expect the Fed’s interest rate hiking cycle to end in 2023, but this is not guaranteed as inflation remains well-above target levels.

Even without interest rate hikes, longer-term rates (and mortgage rates) could continue to rise if the yield curve steepens without interest rate cuts. I strongly believe that, although inflation may moderate, it will remain high for years due to fundamental commodity shortfalls, making it unlikely the Federal Reserve can return to an accommodative policy. If the yield curve steepens without short-term rates declining, higher RMBS yields will likely dramatically lower ORC’s book value, given its nearly 70% book-value risk to a 2% rise in interest rates.

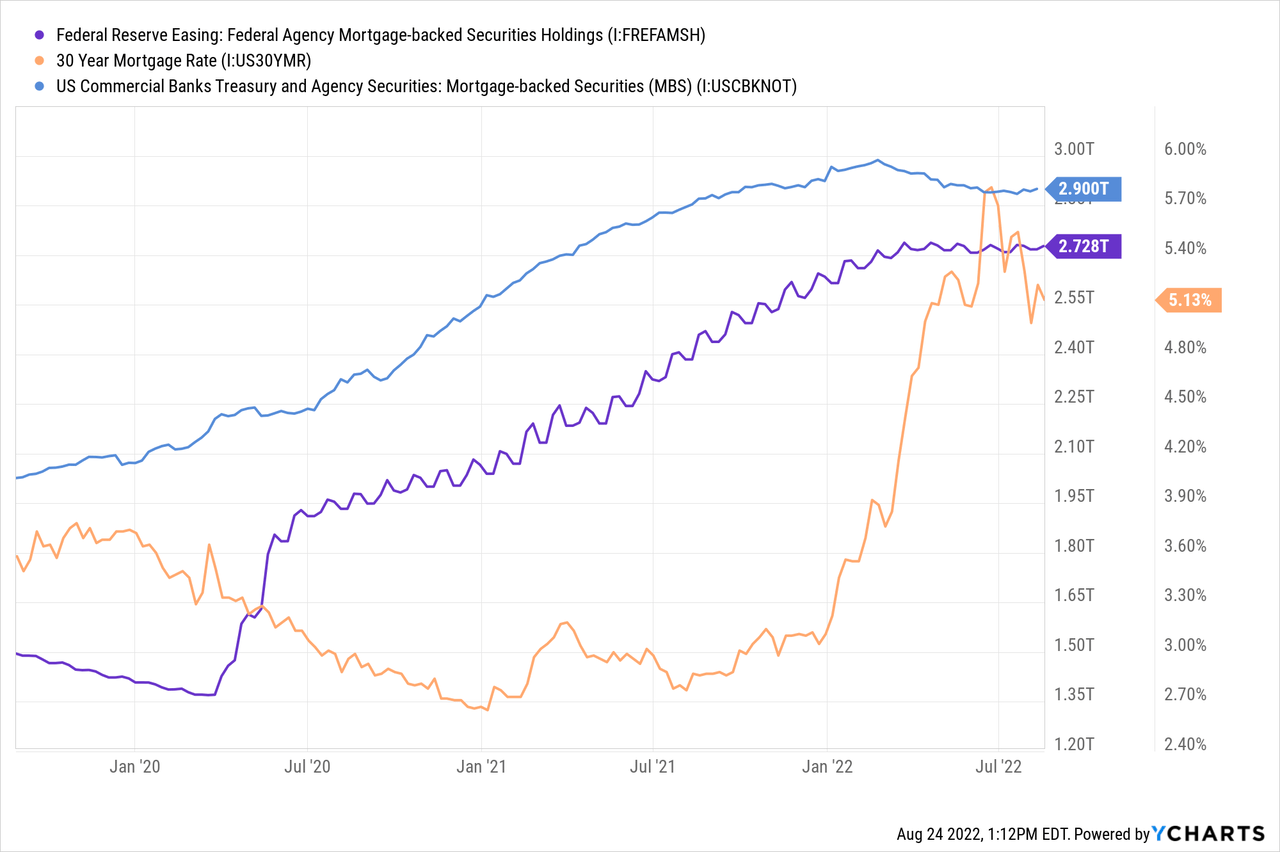

Further, we must remember that mortgage rates have skyrocketed without any material declines in the Federal Reserve’s MBS balance sheet and only slight declines in commercial bank MBS assets. See below:

The sharp rise in mortgage rates began almost precisely as U.S commercial banks and the Federal Reserve stopped accumulating MBS positions. The Federal Reserve had aimed to reduce its MBS portfolio at a monthly rate of $17.5B from June to August of this year and plans to accelerate that figure to $30B from September onward. The Federal Reserve assumed this target would be met from prepayments, but unsurprisingly, far fewer homeowners are refinancing now that mortgage rates have skyrocketed. As such, the Federal Reserve will need to sell MBS assets outright to meet its targets.

The coming Jackson Hole Federal Reserve conference may catalyze such a policy shift. I believe the Federal Reserve will likely consider selling MBS assets to meet its targets, potentially triggering commercial banks to follow suit to avoid asset-value losses. If so, mortgage rates may rise as many billions in MBS assets come on the market each month.

The Bottom Line

On the one hand, ORC’s book value has declined significantly this year and has risen slightly over the past two months as mortgage spreads have waned. However, ORC’s book value per share has consistently trended lower for years due to its “lose-lose” exposure to interest rates. In my view, there is no reason to believe this long-term trend will reverse soon, even if the Federal Reserve forgoes selling MBS assets.

The Federal Reserve may need to sell MBS assets to normalize inflation and meet its QT targets. If this occurs, Orchid Island has much to lose because it could create illiquidity in the MBS market if both banks and the Fed sell simultaneously. Although MBS securities pay higher yields of 4-6% today, I do not believe they are worth buying yet as inflation is much higher, and I have some doubts regarding their safety due to counterparty risks with GSEs. In my view, the immediate risk of MBS asset sales from the Fed directly jeopardizes ORC and could, in the case of a significant MBS sell-off, force the company into margin calls if it cannot reduce its leverage quickly enough.

Based on its sensitivity assessment, a 2-3% rise in mortgage rates would likely bring its book value to zero, bankrupting the company. I believe there are sufficient catalysts that could cause this in 2022. That said, even if Orchid Island manages to survive in the short-run, I doubt it will remain stable long-term given its chronic book value per share losses without diversifying its portfolio away from highly levered RMBS assets.

Be the first to comment