Serdar Kutlu/iStock via Getty Images

Investment Thesis

Nucor (NYSE:NYSE:NUE) has seen its shares come to life since the summer, with its stock rallying 30% since its recent lows. However, I argue that the stock is still seriously undervalued.

And to illustrate my case, I assume that in 2023 NUE does not buy back any shares and that its EPS figures are cut by more than 50% from 2022.

And even in those conditions, NUE is still expected to be profitable and is priced at less than 11x earnings. I believe that this is a very attractive valuation.

The Uncertainty That Looms Large

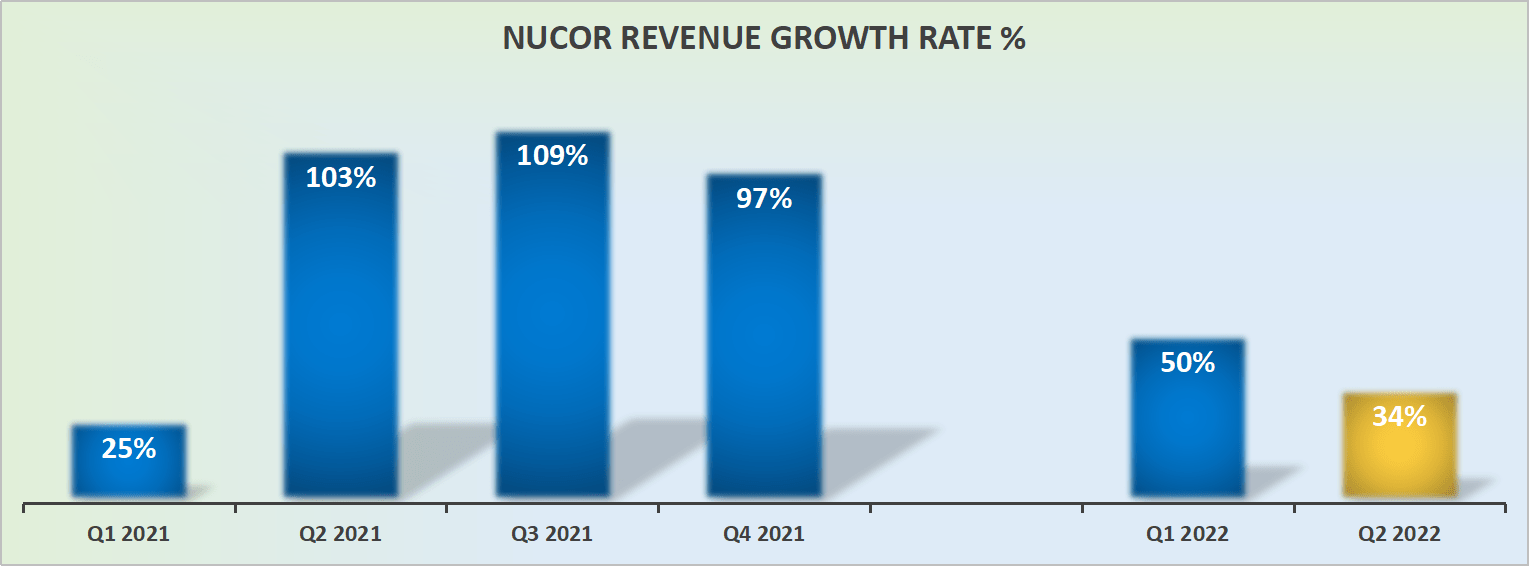

NUE revenue growth rates

In my previous article, I stated that going forward from Q2 the next several months were going to be challenging for NUE, as its revenue growth is expected to turn negative.

And since I made those comments two months ago, a lot has changed. On the one hand, most noticeably analysts have increased both the depth and length of NUE’s negative revenue growth rates.

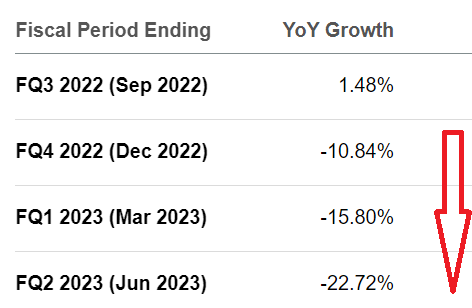

Analysts’ revenue estimates

Indeed, right now there’s the expectation that NUE should simply adopt a brace position because the business is going to face a serious headwind.

Something that I believe we should unpack.

Why NUE’s Near-Term Prospects Are Uncertain

There are three different dynamics at hand that we should discuss. China, the European energy crisis, and a US recession.

In the first instance, whenever one discusses steel demand, we should also put China at the center of the discussion. After all, China is one of the biggest consumers of steel. And with China’s lockdown policies in place, this will provide a near cap on steel demand.

That being said, remember that China has recently announced a large stimulus package. This stimulus package is predominantly aimed at reigniting its construction market. And with the very high demand for steel in building construction, China could soon stop being a headwind and become a demand driver for the steel industry.

In the second instance, as has been widely reported, Europe’s energy prices have already gone through the roof and are showing no near-term signs of slowing. This will impact Europe’s steel supply.

Indeed, recently ArcelorMittal (MT) has been forced to close its door at two plants in Germany. But I believe that other companies in Europe will be forced to follow suit.

And thirdly, but by no means less meaningful, investors try to get some sort of a handle on the shape of the US economy and whether or not the FED can stop raising interest rates.

These are three very different cross winds at play. And whenever there are a lot of unanswered questions, investors typically prefer to avoid the space and wait for clarity.

Even if NUE is well positioned to be robustly profitable through the cycle.

The Ultimate Question, Do Profits Matter?

When I discuss tech companies, I ask this question, do profits matter? I rarely get any interest back from my readership. A virtual stare, if you will. Blasphemy to even consider such a plebian topic!

When I discuss the exact same topic with my commodity brethren, I’m met with a stare. Not the same stare. But a stare that translates the blasphemy of my question. What blasphemy! How can I possibly consider anything asides from a company’s profitability?

Having a foot in both pools, I understand that with tech stocks, the future is always brighter ahead, until it suddenly isn’t.

While with commodities, the future is always bleak. There’s money to be made today, but there’s probably none to be made next quarter or next year.

Consequently, it’s vitally important that one comes to terms with the strength of a company’s balance sheet. Here, NUE poses no difficulties. It has approximately $5 billion of net debt. A very manageable sum when we consider that its net earnings for H1 2022 also reached $5 billion.

Hence, given its strong balance sheet, NUE said on their most recent call,

[…] we remain committed to additional direct returns to shareholders in times of strong performance with an overall payout ratio of at least 40% of net earnings.

This highlights the bullish investment thesis. It’s not a thesis where the focus is on taking market share of an ever-growing TAM. The focus is on getting a return on capital. Now.

Indeed, during Q2 2022, NUE returned to shareholders approximately $934 million via repurchases and its dividend. Put another way, NUE returned 2.5% of its market cap back to shareholders during Q2, which annualizes at 10% returns.

NUE Stock Valuation — 11x Next Year’s Earnings, What to Make of It?

I’ve already put a spotlight on the different concerns that investors need to be wary of when it comes to investing in a steel company.

Presently, the overriding bear case is that steel companies will struggle in a deep recession. To that, I would counter that this key metal will be one of the first metals to bounce back out of a recession.

Now, let’s assume that analysts are correct and that in 2023, the EPS numbers become significantly cut. Let’s assume that rather than the $30 of EPS that is expected in 2022, ultimately ends up at $13 of EPS in 2023.

That would put the stock priced at less than 11x next year’s earnings. That’s really not such a terrible outcome for a cyclical commodity through the earnings cycle, now is it?

The Bottom Line

Nucor is well positioned to navigate this downturn. The stock is already very cheap. I assume that its EPS will get more than cut in half next year so that its EPS figures only reach $13 per share.

This figure assumes that Nucor suddenly stops deploying more than $800 million per quarter to buy back its shares.

And even in that case, the stock is only priced at less than 11x next year’s earnings. I believe that the risk-reward here is positive.

Be the first to comment