ansonsaw

ATI Inc. (NYSE:NYSE:ATI) continues to deliver agreements with aerospace partners like GKN Aerospace and large conglomerates, which may contribute to stable sales growth. Let’s also take into account that the large backlog offers a lot of visibility about future free cash flow (“FCF”) generation. Under my discounted cash flow (“DCF”) model with conservative cost of capital, I obtained an implied price that is larger than the current market price. Yes, there are risks coming from the invasion of Ukraine by Russia and the cyclicality of the business. However, ATI appears to be a stock to follow carefully.

ATI: New Agreements And Further Growth

ATI offers technical and manufacturing capabilities to large clients in the aerospace & defense industry and players in the energy markets.

It is a great moment to assess ATI’s business profile considering the most recent quarterly results. The most interesting is the impressive acceleration of revenue growth driven by new contracts and investment in capital expenditures.

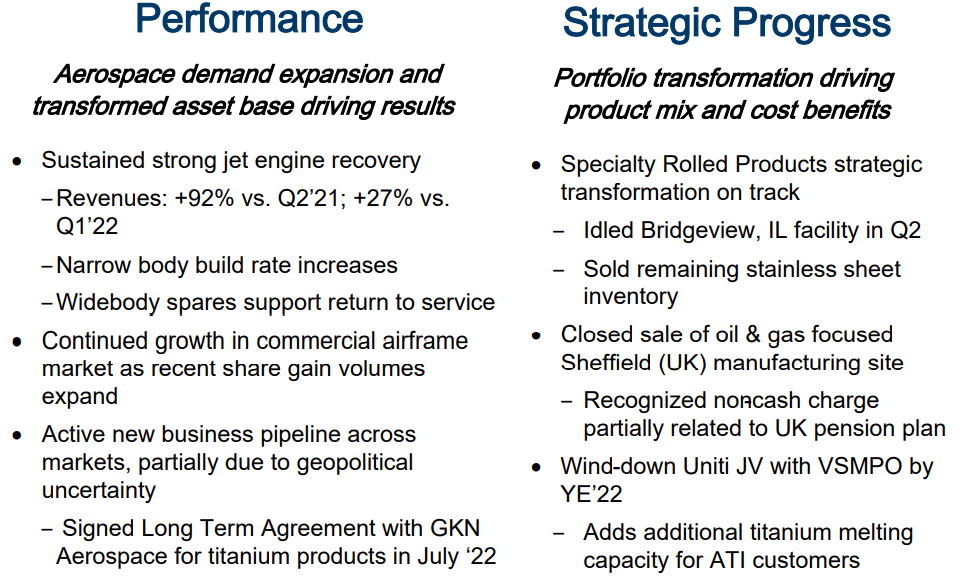

The company recently noted growth in the commercial airframe market, a new agreement with GKN Aerospace, and new information about the Idled Bridgeview facility. In the last presentation, there were many slides, but I believe that the most relevant is the one I included below.

Quarterly Presentation

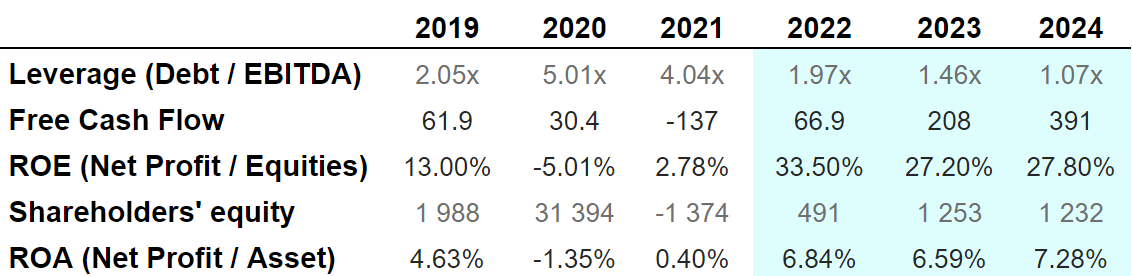

Investment Analysts Expect Growing Free Cash Flow Until 2024 And Double-Digit ROE

I became really interested in ATI’s business model once I got to know the FCF expectations delivered by market analysts. Market estimates include FCF growth from $66 million in 2022 to $391 million in 2024. Most analysts are also expecting double-digit ROE and a significant reduction in the net debt/EBITDA ratio. In my view, if analysts are right, ATI’s valuation will likely trend north in the coming years.

Marketscreener.com

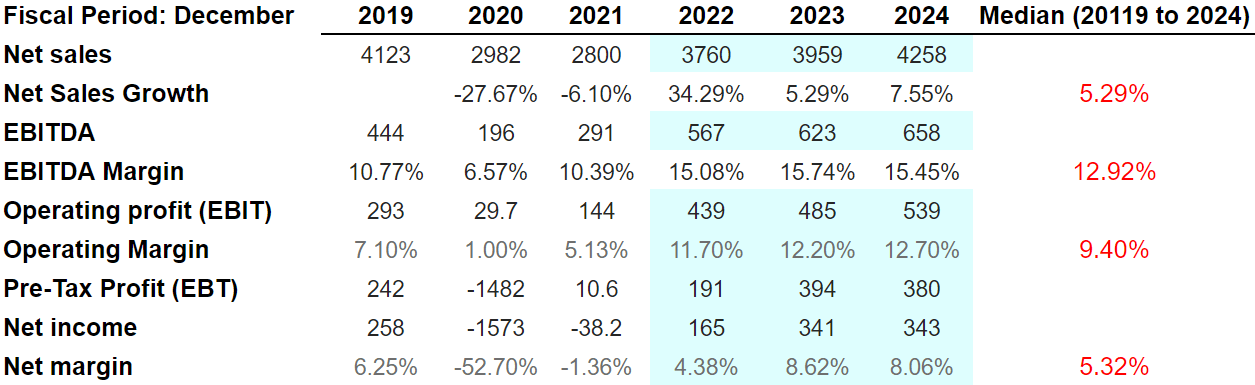

With regards to the income statement, the expectations include stable sales growth close to 7%-5% in 2023-2024. Investors also expect an EBITDA margin around 15% and median operating margin close to 9%. Finally, it is also worth noting that the net margin will likely remain at close to 8% in 2023 and 2024. Considering these solid financial figures, I decided to launch my own financial model.

Marketscreener.com

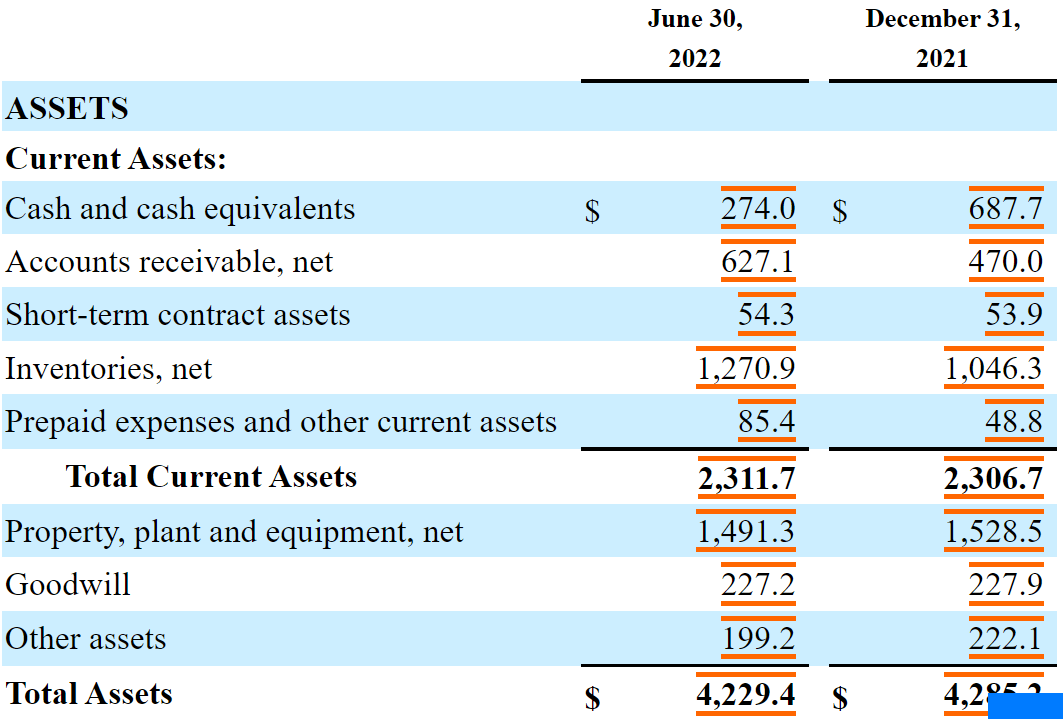

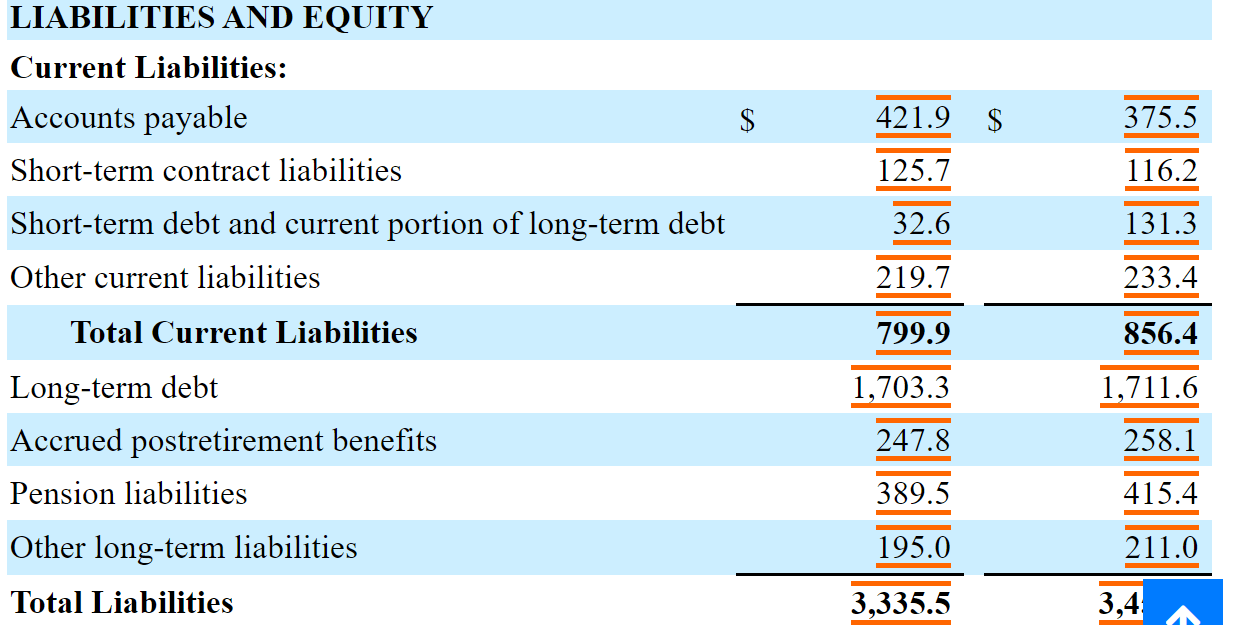

Balance Sheet

As of June 30, 2022, ATI reported $274 million in cash and an asset/liability ratio close to 1x-1.5x. In my view, the balance sheet appears in good shape, but investors will have to take a careful look at the total amount of debt.

10-Q

10-Q

Successful R&D And More Long-Term Contracts Would Imply A Valuation Of $56 Per Share

Under normal conditions, I wouldn’t expect a lot of sales growth volatility because ATI operates for large and established engineering conglomerates. It is also worth considering that many clients operate outside the United States, so there is also significant geographic diversification:

Large aircraft and jet engines are manufactured by a small number of companies, such as The Boeing Company (BA), Airbus S.A.S. (OTCPK:EADSF) including the former operations of Bombardier Aerospace (OTCQX:BDRBF), and Embraer (ERJ) for airframes. GE Aviation (GE), Rolls-Royce plc (OTCPK:RYCEY), Pratt & Whitney, Snecma, and various joint ventures manufacture jet engines.

The operations in this segment include our SRP business, our Specialty Alloys & Components business, including the primary titanium operations in Richland, WA, and the Shanghai STAL Precision Stainless Steel Company Limited PRS joint venture in China, in which we hold a 60% interest. Source: 10-K

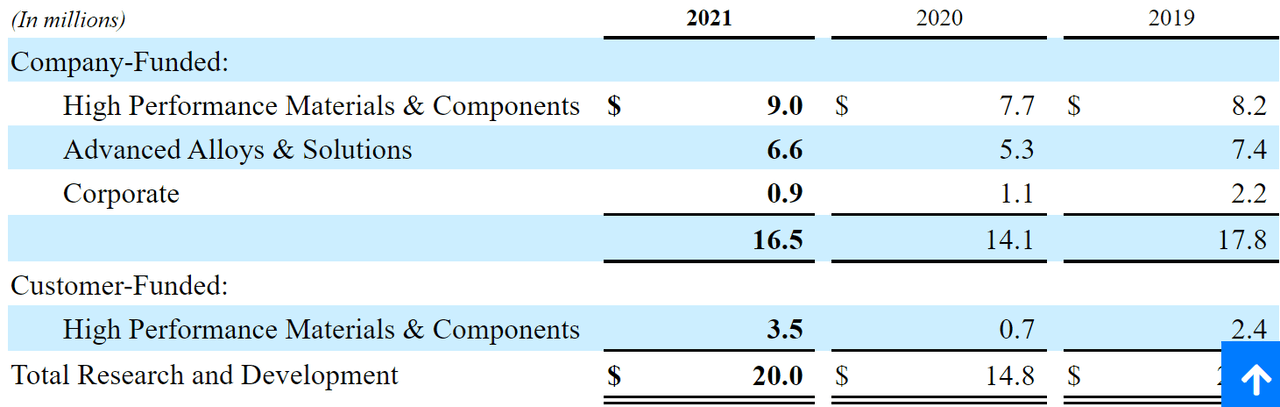

Under normal conditions, I also expect new innovative alloys thanks to the R&D efforts made by ATI. Keep in mind that 2021 R&D expenses increased as compared to that in 2020. Products with better performance and more efficiency will most likely be appreciated by customers. Hence, I would expect further revenue generation. Let’s also keep in mind that ATI did generate hundreds of patents in the United States. New patents would also increase the company’s know-how and recognition in the industry:

ATI’s metallic powder technology delivers alloy compositions and refined microstructures that offer increased performance and longer useful lives in high-temperature aerospace environments, as well as improves the efficiency of jet engines.

We own hundreds of United States patents, many of which are also filed under the patent laws of other nations. Source: 10-K

10-K

The backlog of confirmed orders totaling $2.6 billion as of June 30, 2022 is worth noting. Readers will most likely appreciate that the backlog represents more than 52% of the expected revenue for 2023. ATI reports a significant number of long-term agreements, which offer a lot of visibility to financial forecasters like me.

The Company maintained a backlog of confirmed orders totaling $2.6 billion and $1.6 billion at June 30, 2022 and 2021, respectively. Due to the structure of the Company’s long-term agreements, approximately 80% of this backlog at June 30, 2022 represented booked orders with performance obligations that will be satisfied within the next 12 months. Source: 10-Q

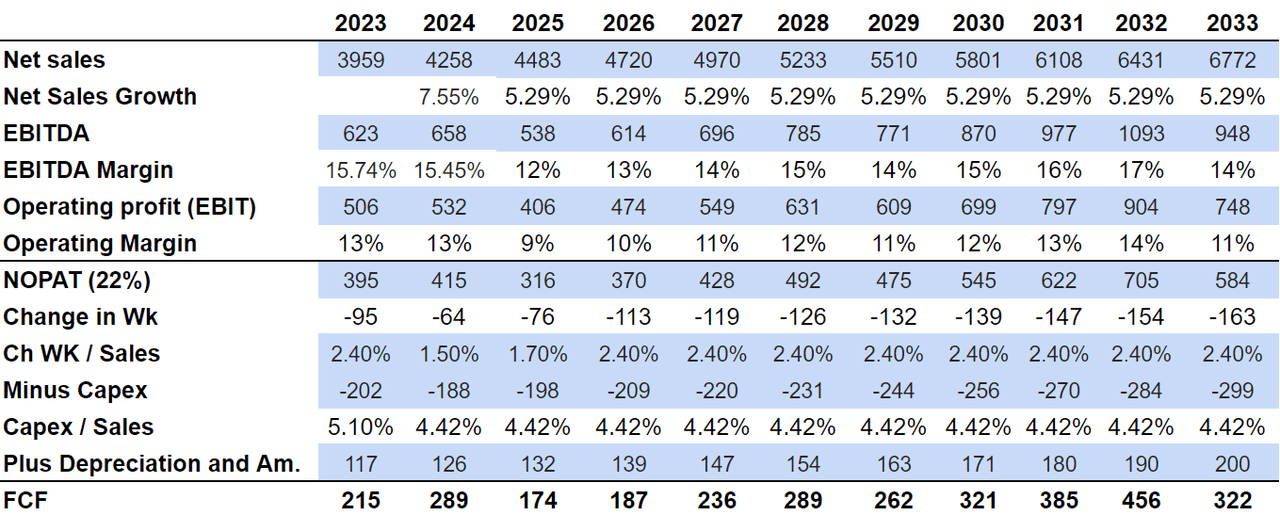

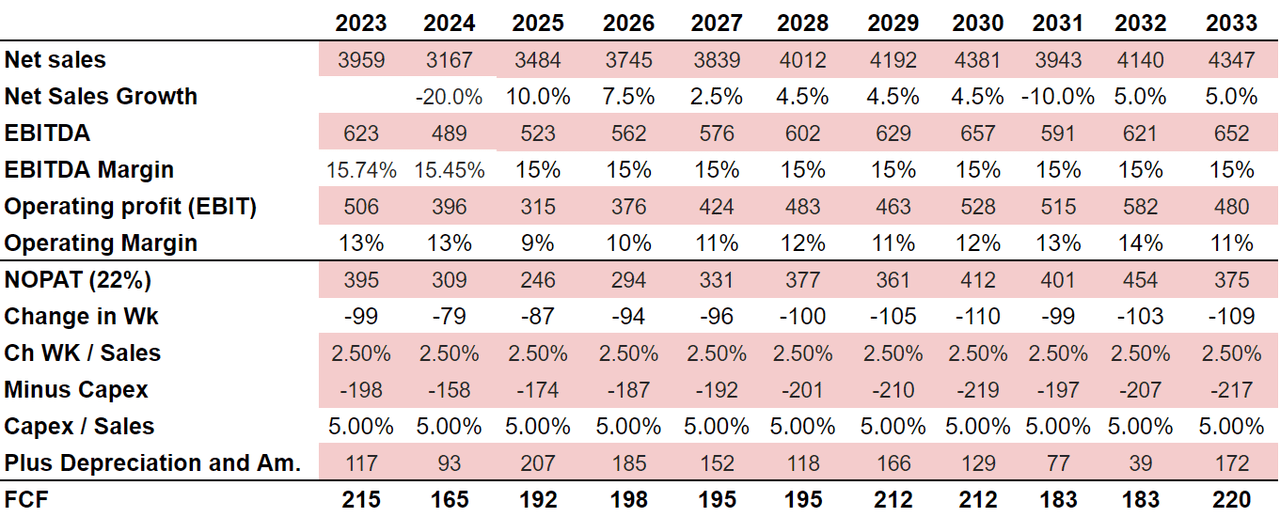

Under these conditions, I assumed sales growth close to 5.29% from 2025 to 2033, which is close to the median observed in the past. Also, with an EBITDA margin around 13% and 17%, I obtained 2033 EBITDA of $948 million. Finally, with an effective tax close to 22%, 2033 NOPAT would be close to $584 million.

I believe that changes in working capital around $94 million and $163 million would make sense. With capex/sales close to 4%-5% and growing D&A, the free cash flow could reach $322 million if we are conservative.

Arie’s DCF Model

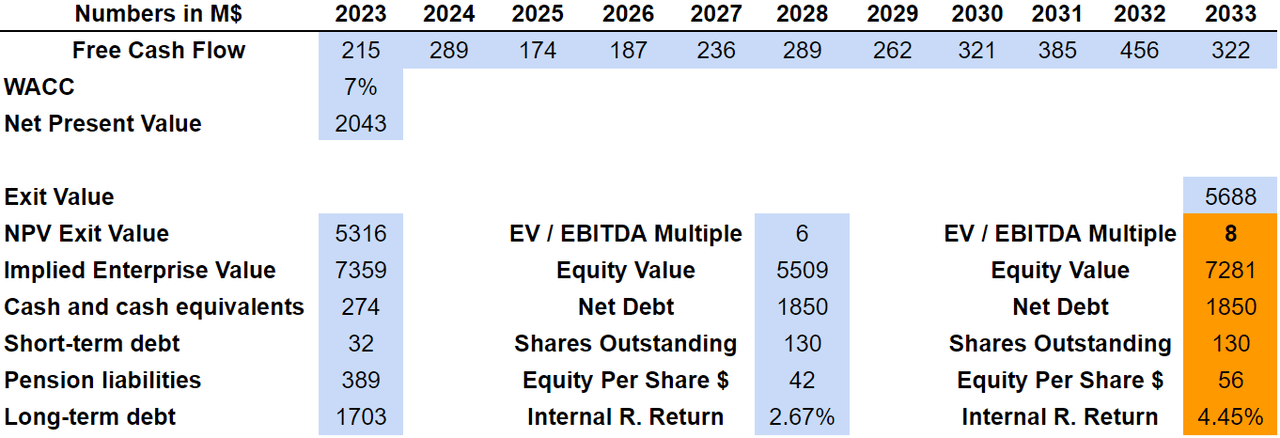

Now, I believe that a weighted average cost of capital of 7% would be higher than what most investors may use. The net present value of future FCF would be close to $2 billion. If we use an EV/2033 EBITDA of 6x and a net debt around $1.8 billion, the equity per share would stay at $42-$43 per share. ATI currently trades at more than 8x EBITDA, so by using this multiple, the equity per share would stand at $56 per share, and the IRR could stand at 4.4%.

Arie’s DCF Model

Risks From Low Demand, Detrimental Conditions In The Aerospace Industry, And Detrimental Relationship With Suppliers Imply A Valuation Of $25 Per Share

ATI could suffer from cyclical changes in demand driven by consumption changes. Besides, international overcapacity, decreases in the price of substitute materials, or changes in the price of raw materials could drive profitability down. In the worst-case scenario, ATI shareholders may suffer a decline in the free cash flow expectations, which may push the stock valuation down:

The cyclical nature of the industries in which our customers operate causes demand for our products to be cyclical. These changes could include decreases in the rate of consumption or use of our customers’ products due to economic downturns. Other factors that may cause fluctuation in our customers’ positions are changes in market demand, lower overall pricing due to domestic and international overcapacity, currency fluctuations, lower priced imports and increases in use or decreases in prices of substitute materials. Source: 10-K

ATI also has significant exposure to the aerospace industry, which is also quite cyclical. In my view, changes in the economic conditions, changes in the fuel price, new COVID-19 outbreaks, or any other risk would affect ATI:

The commercial aerospace industry has historically been cyclical due to factors both external and internal to the airline industry. These factors include general economic conditions, airline profitability, consumer demand for air travel, varying fuel and labor costs. Source: 10-K

Under very adverse conditions, I expect issues with suppliers of nickel and chromium. The fact that the company obtains a lot of such metals from Russia is worrying. Considering the invasion of Ukraine, the United States may not facilitate trade with Russia. As a result, perhaps ATI may have to work with other suppliers, which may damage the company’s free cash flow margin.

For example, we source both nickel and chromium from Russian sources that could be impacted by current events involving Russia and the Ukraine and any U.S. or other international economic sanctions or other actions in response. These or similar conditions may disrupt supplies or affect the prices of the materials that are necessary to our operations. Source: 10-K

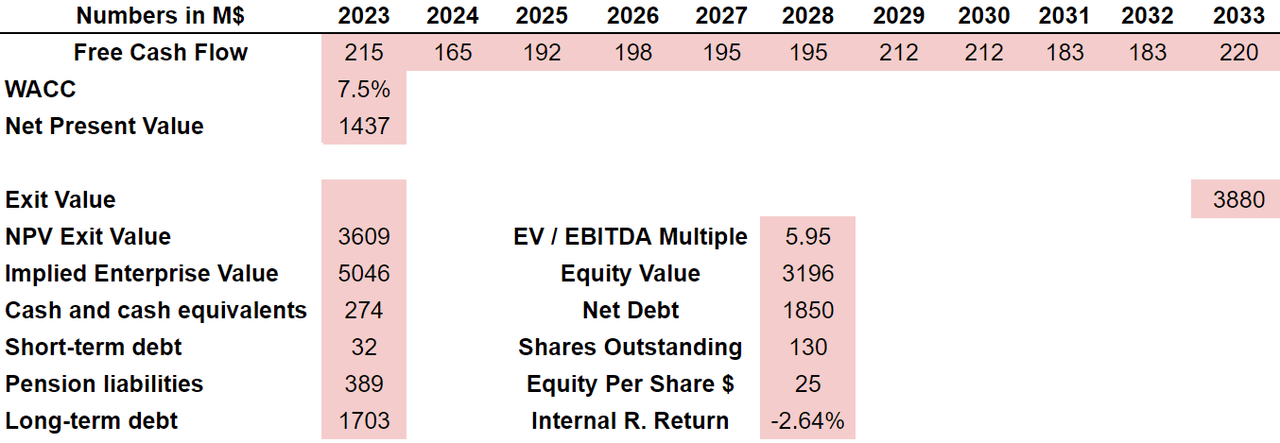

Under these conditions, I assumed a decline in sales growth in 2024 and another decline in 2031. With small growth from 2026 to 2033, 2033 net sales would stand at almost $4.5 billion. With an EBITDA margin around 15% and effective tax of 22%, 2033 NOPAT would be $375 million. I also assumed changes in working capital/sales of 2.5% and capex/sales of 5%. The results would include 2023 FCF of $215 million and 2033 FCF close to $220 million.

Arie’s DCF Model

Now, if we use a discount of 7.5%, which is higher than that in the previous case scenario, the net present value would be close to $1.5 billion. Also, with an EV/EBITDA multiple of 5.95x and 130 million shares outstanding, the equity per share would be $25 per share, and the IRR would stand at close to -2.5%.

Arie’s DCF Model

Conclusion

If ATI continues to develop long-term agreements like that with GKN Aerospace, in my view, the backlog will likely be significant. Besides, if ATI does not lose its connections with large and established conglomerates in the aerospace industry, sales growth may remain stable. In my opinion, the market didn’t take into account future free cash flow and estimates from financial analysts. Under a DCF model with a very conservative discount rate and conservative sales growth, ATI could be worth $56 per share. Even considering the risks from cyclicality and low demand, ATI is, in my opinion, a stock to follow carefully.

Be the first to comment