ArLawKa AungTun/iStock via Getty Images

Thesis

Nuveen Senior Income Fund (NYSE:NSL) is a leveraged loan CEF from the Nuveen family of funds. The vehicle is highly leveraged, with a 39% leverage ratio. Although the fund has a very low leverage adjusted duration (0.38 years) and a middle of the road credit build (overweight BB names), it is down over -13% year to date. The fund has a granular, well diversified build, but from its performance it seems it was forced to deleverage during the Covid crisis. The main risk for this fund is its high leverage and portfolio manager ability to navigate credit widening cycles.

The market has punished the fund for its poor historic performance with a -10% discount to NAV. Expect this discount to persist if the fund does not manage to outperform. Although the fund recently increased its distribution, the vehicle still utilizes around 10% ROC in its distribution, which is disappointing. Looking at the long-term NAV performance for the fund, we can observe an average -2.6% annual give-up, the result of ROC utilization and some poor collateral trading performances. Despite its solid, granular build, it seems the fund has not seen the best management performance in sourcing alpha generating credits. The vehicle lags its peers AIF (which we reviewed here) and VVR (which we reviewed here) on a long term time-frame. Holders of the fund should continue to be in the name given the risk recovery expected for 2023. New money looking to enter the space has better alternatives in the above mentioned CEFs which we have reviewed in the past.

Holdings

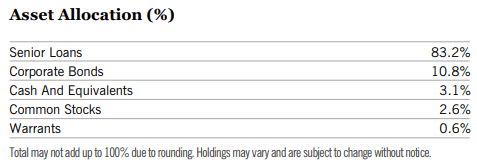

The fund is overweight leveraged loans:

Allocation (Fund Fact Sheet)

We can see that over 83% of the collateral pool is composed of senior loans, with a 10% allocation to fixed rate bonds. This composition results in a low duration profile for the fund:

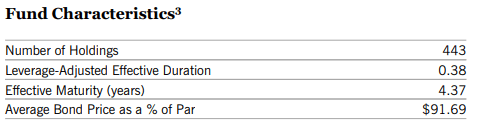

Characteristics (Fund Fact Sheet)

The fund has an extremely low leverage adjusted duration, which comes in at only 0.38 years. This would suggest a low impact for the fund from a rising interest rate environment.

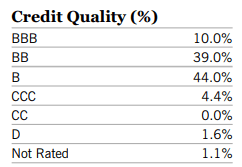

The fund is composed of better quality credits, with a sizable “BB” bucket:

Credit Quality (Fund Fact Sheet)

Unlike other leverage loans / bond funds, this CEF has a very low allocation to “CCC” names, which are under 5% of the portfolio.

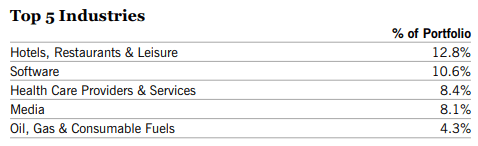

From an industry standpoint the fund also exposes a granular build, with no specific overweight allocations:

Top 5 Industries (Fund Fact Sheet)

We generally do not like industry concentrations that exceed 15%, since they tend to take excessive risks in those particular sectors.

Performance

The fund is down over -13% on a year-to-date basis:

Total Return (Seeking Alpha)

We can see this CEF’s performance is in line with the one we have seen for AIF, which we recently revisited here. VVR is clearly the outperformer in the cohort from the leveraged loan CEFs we have reviewed so far.

On a 5-year time-frame NSL lags the cohort performance:

Total Return (Seeking Alpha)

The longer-term fund performance is a bit disappointing. We can see the CEF severely lagging the up-move in the other CEFs following the Covid sell-off.

Given the fact the fund runs a large leverage ratio, it is possible they had to de-leverage at the Covid lows, which would explain its poor 2020 performance and its lagging performance since:

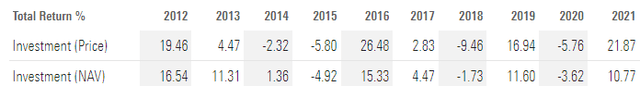

Historic Performance (Morningstar)

We can see from the above table that NSL had a negative 2020 total return, unlike many fixed income CEFs. It might be symptomatic of deleveraging at the lows.

Premium / Discount

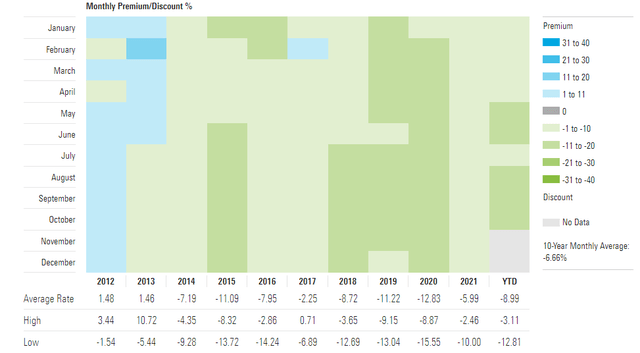

The CEF usually trades at a discount to its net asset value:

Premium / Discount (Morningstar)

We can see from the above table, courtesy of Morningstar, that the fund usually displays a -7% to -10% discount to NAV. We believe this is an appropriate level, given the fund’s performance during the Covid crisis. It seems that the vehicle had to deleverage at the lows, which resulted in a negative performance for 2020, and more importantly in a modest performance into the zero rates recovery period.

More often than not, discounts to NAV indicate investor displeasure with the way a CEF is run. It is a vetting of the management and their ability to generate alpha for the fund shareholders. This CEF needs to outperform the market in order to garner renewed interest in its shares.

Distributions

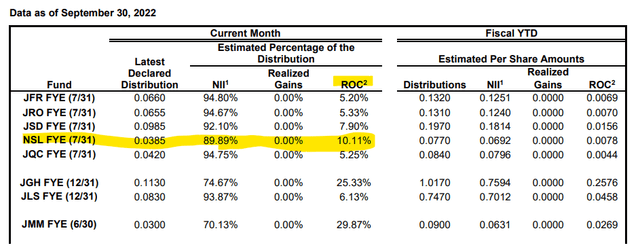

The fund has a 10% dividend yield, which is mostly covered by interest income:

Distributions (Section 19a)

We can see that only 10% of the distribution is currently return of capital. We can see a similar historic performance, with the fund exposing a decreasing NAV in the past decade due to the ROC utilization:

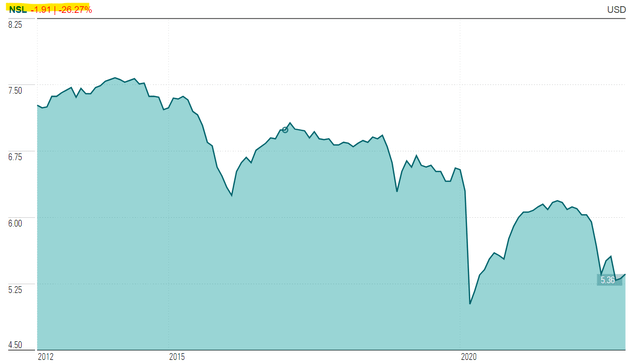

NAV Performance (CefConnect)

We can see the NAV being down almost -27% in the past decade, mostly due to the ROC utilization. That is an average of -2.7% yearly NAV give-up. We like long term NAV graphs because they give us a sense for management’s performance throughout various economic cycles.

Conclusion

Nuveen Senior Income Fund is a fixed income CEF. The vehicle focuses on leverage loans, and has an average credit build, being overweight “BB” credits with a small “CCC” bucket. Despite its granular, middle of the road build, the fund runs a high 39% leverage ratio, which has dragged down its performance in 2022. The story for this fund is one of high leverage and mismanagement during credit cycles. While in 2022 NSL exhibits a similar performance to AIF being down -13%, longer term the CEF significantly lags the better run AIF and VVR. Despite an increase in its distribution this year, NSL is still utilizing 10% ROC in its distributions, which is disappointing. Holders of the fund should continue to be in the name given the risk recovery expected for 2023. New money looking to enter the space has better alternatives in the above-mentioned CEFs which we have reviewed in the past.

Be the first to comment