gguy44/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate).

Introduction

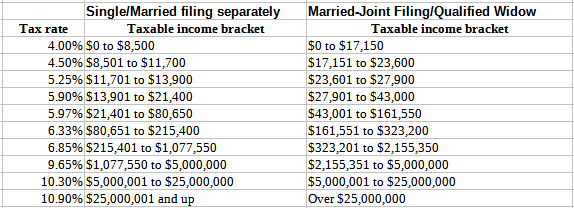

Along with the Democratic Congress and Administration promising that the “rich” will pay their “fair share,” the elected officials in Albany like the same game plan. For New York residents, placing some part of their portfolio in assets that avoid both Federal and State income taxes has to be on their radar screen. From what I have found, residents of New York City avoid city income taxes on New York state and New York City bonds, a triple tax benefit for them. The 2021-22 NY State income brackets are:

nerdwallet.com NY State tax table

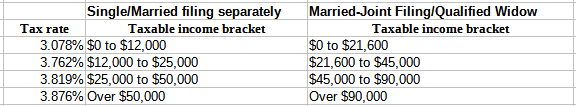

New York City and Yonkers adds their own income tax on top of the above.

propertyclub.nyc NYC Tax tables

Unless the municipal bond is AMT-Free, income received is included, along with other sources, as part of the Alternative Minimum Tax (“AMT”) structure imposed by the IRS. The AMT is very complicated; here is a link to the IRS information.

This article will compare the Nuveen New York AMT-Free Municipal Income Fund (NYSE:NRK) with the Nuveen New York Dividend Advantage Municipal Fund (NYSE:NAN) to help NY-based investors decide what works best for their individual tax situations. I also compared NAN against two taxable funds.

Nuveen New York AMT-Free Municipal Income Fund Review

Seeking Alpha describes this closed-end fund (“CEF”) as:

The Fund’s investment objectives are to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals and New York income tax and to enhance portfolio value. The Fund will invest 100% of its Managed Assets in municipal securities and other related investments the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase. The Fund will invest primarily in municipal securities with long-term maturities in order to maintain an average effective maturity of 15 to 30 years . Benchmark: S&P Municipal Bond TR. NRK started in 2002.

Source: seekingalpha.com NRK

NRK has $1.1b in Net Assets with a price yield of 5.4%. Nuveen charges 160bps, broken down as:

- Management fees: 91bps

- Other expenses: 7bps

- Leverage costs: 62bps for a 41% leverage ratio

NRK Holdings Review

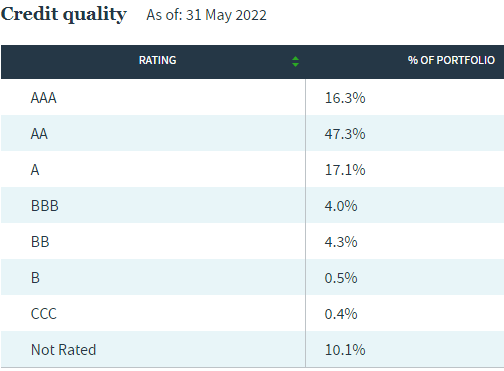

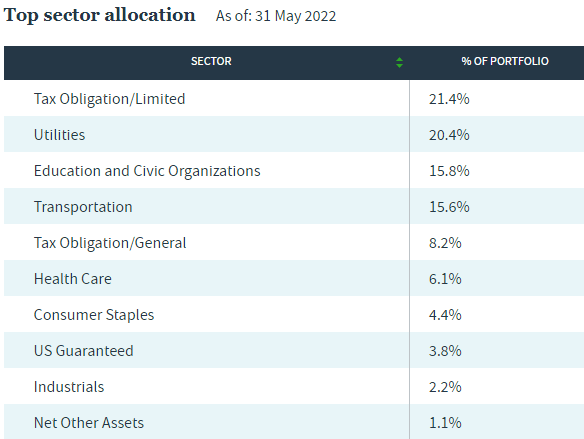

The CEF is allowed to own up to 20% in below investment-grade bonds, with half of that allowed to be in B- rated bonds. The current ratings allocation is:

Nuveen.com NRK

I take it from this layout that they merge the +/- ratings into one weight for that letter’s total. Having only 10% as “not rated” is very low from what I have seen.

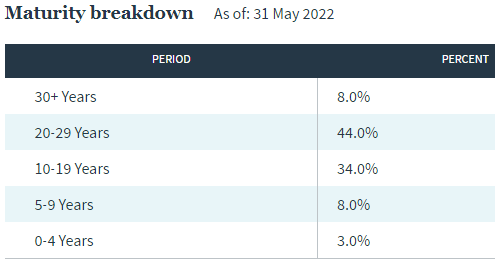

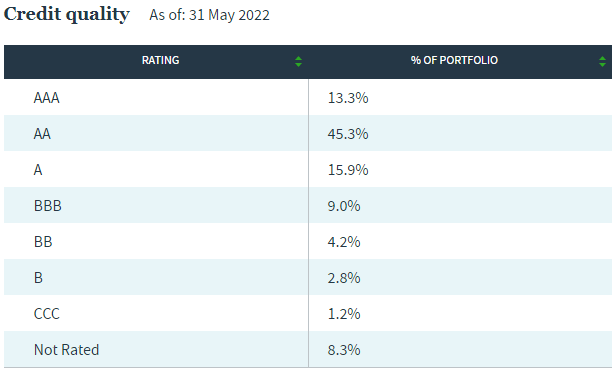

Nuveen.com NRK

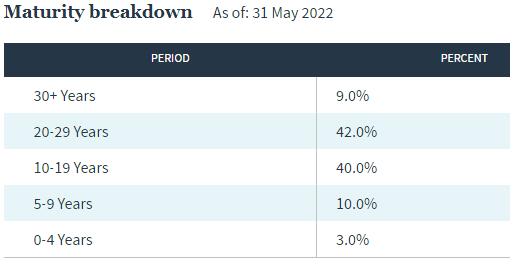

The effective maturity is 19.5 years, with a leverage-adjusted-effective duration of 13.5 years. With only 3% of the portfolio maturing in the next four years, NRK has little natural ability to buy higher coupon debt in a time when rates are climbing. About 50% of the portfolio is callable over the same time period, but that becomes less likely when rates are climbing. Currently, the average coupon is 4.25%.

Nuveen.com NRK

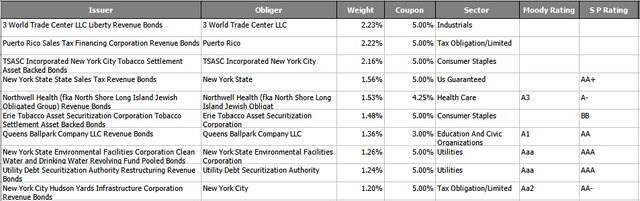

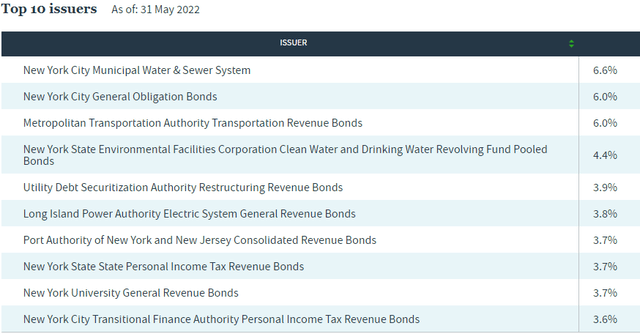

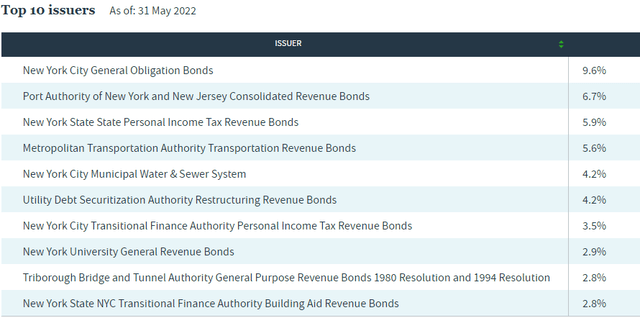

The portfolio is very dependent on bonds where a taxing authority is not the Issuer. The Top 10 Issuers are:

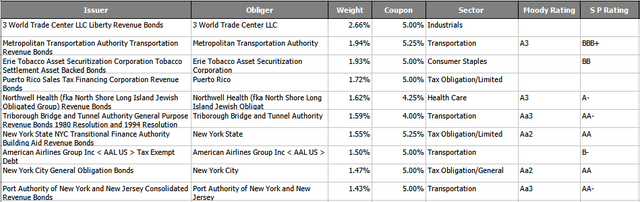

The Top 10 issues are:

Nuveen.com; compiled by Author

The Top 10 (out of 280) equals 16% of the portfolio. They also show several important features of bond ratings process:

- Not all rating agencies come up with the same rating.

- Not all bonds ask both rating agencies for one.

- Some quality issuers, like the WTC, forego the ratings expense as unnecessary.

NRK Distribution Review

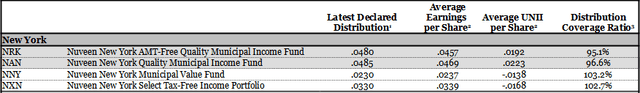

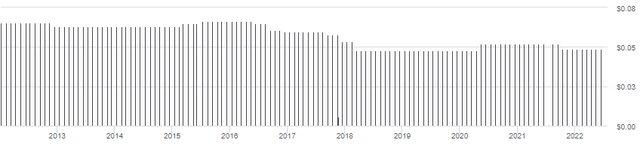

NRK has paid at a monthly rate of $.048, up from $.045, since July 2020. Recent UNII data is provided. I included all four NY CEFs.

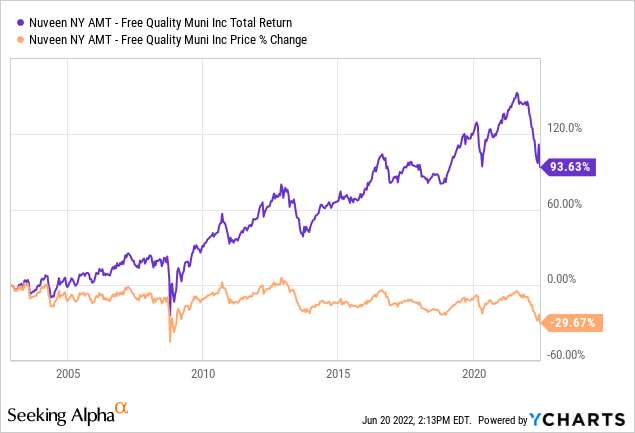

NRK price and NAV review

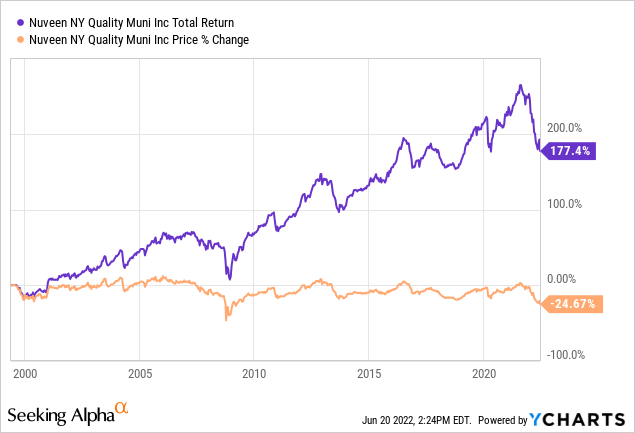

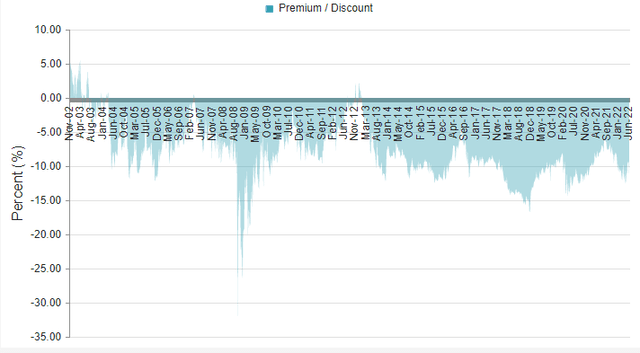

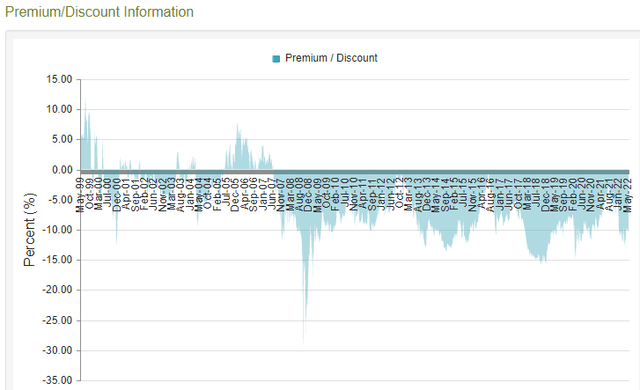

The price is down almost 30% since NRK started. Those who reinvested their payouts have seen a 3.73% CAGR, only 101bps better than those who took their payouts. The next chart provides premium/discount data.

There are at least two interpretations to the above. While the current discount is over 11%, that has not been unusual over the last seven years. Second would be the fact that sub-8% discounts have appeared several times within the past year, including briefly in early June.

Nuveen New York Dividend Advantage Municipal Fund Review

Seeking Alpha describes this CEF as:

invests in the fixed income markets of New York. The fund invests in municipal bonds, with a rating of Baa or higher. It employs fundamental analysis, with bottom-up stock picking approach, to create its portfolio. The fund benchmarks the performance of its portfolio against the Standard & Poor’s New York Municipal Bond Index and Standard & Poor’s National Municipal Bond Index. NAD started in 1999.

Source: seekingalpha.com NAN

NAN has $412m in Net Assets with a price yield of 5.2%. Nuveen charges 157bps, broken down as:

- Management fees: 93bps

- Other expenses: 7bps

- Leverage costs: 57bps for a 41% leverage ratio

NAN Holdings Review

The CEF is allowed to own up to 20% in below investment-grade bonds, with half of that allowed to be in B- rated bonds; the same as NRK.

Nuveen.com NAN

NAN holds a larger percent in non-investment-grade bonds compared to NRK. Morningstar rates NAN at A+ overall, slightly lower than the AA- they give NRK.

Nuveen.com NAN

The effective maturity is 19.2 years, with a leverage-adjusted-effective duration of 13.2 years, both slightly shorter than NRK. Like NRK, only 3% of the portfolio matures in the next four years. About 39% of the portfolio is callable over the same time period. Currently, the average coupon is 4.92%, 67bps higher than NRK. The lower portfolio rating would account for some of that “bonus” yield. This also means new rates have to potentially be higher for NAN to benefit from portfolio turnover.

Nuveen.com NAN

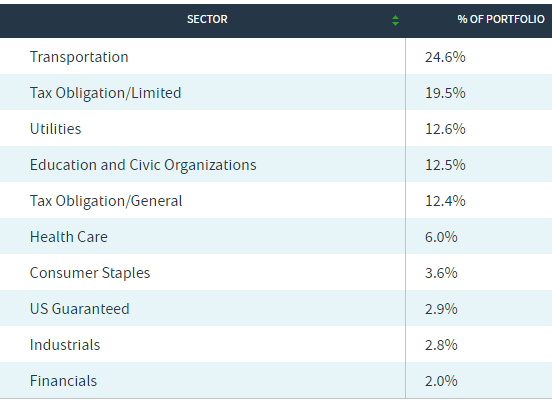

Like NRK, most bonds are backed by non-tax income streams. At 24.6%, transportation bonds are the biggest sector and mostly likely were hurt during the pandemic lockdowns; any extra worry since COVID keeps popping up. Three of the Top 10 issuers are transportation authorities.

The Top 10 issues are:

Notice that World Trade Center is the largest holding in both funds. Since NAN is only 11% not AMT-Free, I suspect many of the holdings overlap, and I would have tested for that if the CUSIPs were provided.

NAN Distribution Review

NAN has adjusted their payouts more often than NRK, with the most recent being a reduction from $.52 down to $.485 last October. As shown above, NAN has a 96% coverage ratio over the last three months.

NAN Price And NAV Review

Keeping in mind that NAN started three years before NRK, its price has held up better and the spread between price and CAGR is much wider. Here the CAGRs were 4.5% (reinvested) and 2.97% (payouts taken), thus reinvesting was more important for NAN investors compared to NRK investors. The premium/discount charts show similar results.

Again, NAN is currently trading at a discount it has seen numerous times over the last seven years. Unlike NRK, the current discount near 10% is one of the smallest recently.

Comparing Both CEFs

| Variable | NRK | NAN |

| Size | $1.1b | $412m |

| Fees | 160bps | 157bps |

| Premium/Discount | -11.43% | -9.67% |

| Yield (Mkt) | 5.4% | 5.2% |

| Avg Bond Price/Coupon | $104.43/4.3% | $103.28/4.9% |

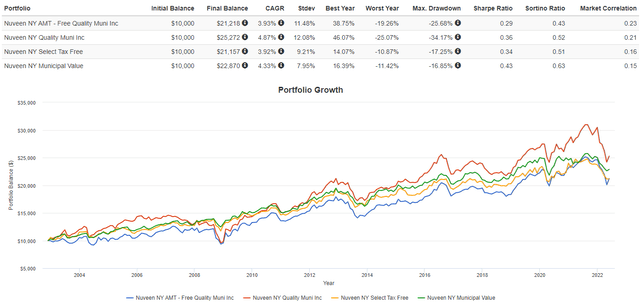

For return and risk review, I added the other two Nuveen New York CEFs:

NAN is the top performer when it comes to CAGR, with NRK trailing the others. Risk-wise, NNY is the top performer based on the Sharpe and Sortino ratios.

Portfolio Strategy

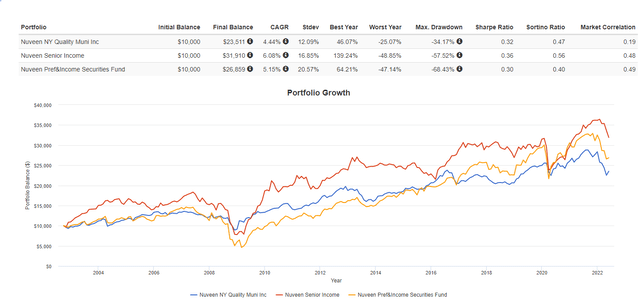

A question potential municipal bond fund buyers need to ask should be: “Is the tax benefit forfeited by receiving poorer performance?” While every investor’s tax situation differs, as does their goals and timeline, I did a quick comparison of NAN against two taxable Nuveen CEFs:

Both CEFs provided better returns than NAN; whether they were enough to offset how the payouts affected the investor’s post-tax returns would be unknown except by each investor. There are other differences besides the asset mix that should also be reviewed, not just the return.

Final Thought

“Do not let the Tax Tail wag your Investment Dog!” is an expression I heard years ago and do not always follow myself. Related is, “It isn’t what you make, but what you keep!” Trying to minimize tax payments is a good thing, just not the only thing when making investment decisions. I thought both expressions fit the point of my article.

Be the first to comment