imaginima

Background

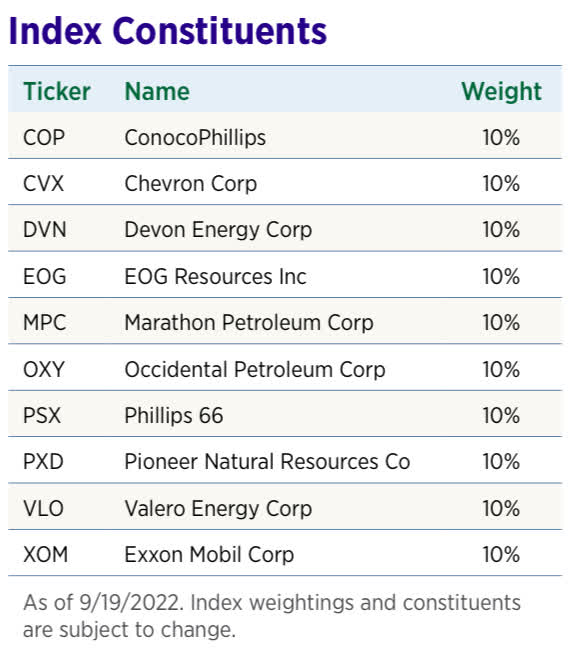

The MicroSectors U.S. Big Oil Index 3X Leveraged ETN (NYSEARCA:NRGU), which tracks the Solactive MicroSectors™ U.S. Big Oil Index, includes 10 highly liquid stocks that represent industry leaders across today’s U.S. oil (energy) sector. The index’s underlying composition is equally weighted across all stocks, providing a unique performance benchmark that allows for a value-driven approach to investing. While the performance of indices weighted by market capitalization can be dominated by a few of the largest stocks, an equal-weighting allows for a more diversified portfolio within a sector. The ETN seeks a return on the underlying index for a single day. The ETNs are not “buy and hold” investments and should not be expected to provide a leveraged return of the underlying index’s cumulative return for periods greater than a day.

Risks

Let’s first understand risks investing in a concentrated leveraged ETN’s like NRGU.

You may lose some or all of your principal – Since the 3X ETNs are exposed to three times the risk of any decrease in the level of the Index, if the combined value of the stocks in the Index drop by over 33%, then effectively the 3X leveraged ETN loses close to 100% of the value.

Correlation risk – A high degree of correlation exists with the stocks in this ETN as it is focused on the oil sector and they will move together in the same direction most of the time.

Long holding period risk – The 3X ETNs are intended to be daily trading tools for sophisticated investors and are designed to reflect a leveraged long exposure to the performance of the Index on a daily basis. NRGU returns over different periods of time can, and most likely will, differ significantly from three times the return on a direct long investment in the Index. Also, the Index is potentially volatile as it includes only a small number of constituents (10); any Index volatility would be magnified by the leverage.

Leverage risk – NRGU is three times leveraged and, as a result will benefit from three times any positive, but will decline based on three times any negative, daily performance of the Index. However, the leverage of the 3X ETNs may be greater or less than 3.0 during any given Index Business Day. Volatility of the Index level may have a significant negative effect on the value of NRGU.

The Index has a limited actual performance history – The Index was launched in March 2019. Because the Index is of recent origin and limited actual historical performance data exists with respect to it, your investment in NRGU may involve a greater risk than investing in securities linked to one or more indices with a more established record of performance.

Concentration Risk – All of the stocks included in the Index are issued by companies in the energy sector. As a result, NRGU will not benefit from the diversification that could result from an investment linked to an index of companies that operate in multiple sectors. Each of the 10 Index constituents represents 10% of the weight of the Index as of each monthly rebalancing date. Any reduction in the market price of any of those stocks is likely to have a substantial adverse impact on the Index Closing Level and the value of NRGU. Giving effect to leverage, negative changes in the performance of one Index constituent will be magnified and have a material adverse effect on the value of NRGU.

Expenses

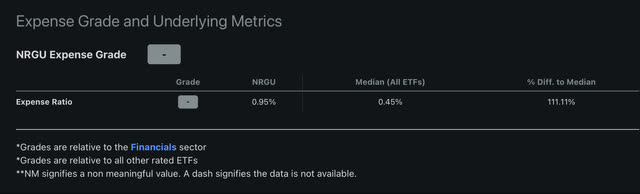

Annual Expense are 0.95% which are more than double the median expense for exchange-traded funds (“ETFs”), and there is no dividend.

Annual Expense (Seeking Alpha)

Holdings

Top holdings of NRGU are close to equally weighted and rebalanced frequently.

NRGU Holdings (Bank of Montreal )

Technical Analysis

Below is the chart of NRGU with the 20 weekly moving average. NRGU has bounced after a double bottom. The gains have been impressive in a short time period.

Following is comparison of equally weighted holdings versus NRGU. The equally weighted non-leveraged holdings dropped 66% while NRGU dropped 98% when crude had briefly gone negative. Since then, an equally weighted non-leveraged portfolio would be up 387%. NRGU is up almost 3600%.

Equally weighted holdings vs NRGU (Author )

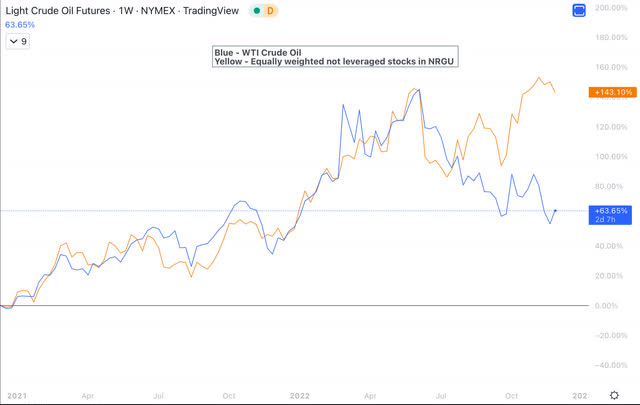

Equally weighted constituents of non-leveraged stocks in NRGU closely followed price of crude oil until July 2022. This huge gap between the equities in NRGU and oil is not positive for NRGU and it is likely to come down.

Chart Crude Oil vs Equally weighted stocks in NRGU not leveraged (Author )

Conclusion

Leveraged ETNs are risky investment vehicles, especially this one that has only 10 equally weighted oil sector stocks. NRGU is primarily for short term trading. Based on the chart setup, differences between the crude oil price chart and the price of oil sector stocks, it would be prudent to wait for a better buying opportunity for NRGU.

Be the first to comment