JHVEPhoto/iStock Editorial via Getty Images

Earnings of Wintrust Financial Corporation (NASDAQ:WTFC) will likely remain flattish this year before increasing next year. Loan growth will likely play a pivotal role in boosting earnings through the end of 2023. Further, the moderately rate-sensitive margin will benefit from the rising-rate environment. On the other hand, the provisioning expense will likely remain above normal during the second half of 2022, which will drag earnings. Overall, I’m expecting Wintrust Financial to report earnings of $7.41 per share for 2022, down by just 2% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate mostly because I’ve revised upward the loan growth estimate following the second quarter’s phenomenal performance. For 2023, I’m expecting the company to report earnings of $8.78 per share, up 18% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Wintrust Financial.

Loan Growth to Decelerate

Wintrust Financial’s loan book grew by a remarkable 5.1% in the second quarter of 2022, or 20% annualized, which beat my expectations. Growth will most probably slow down in the remainder of the year as the second quarter’s growth rate is unusual for the company given its history. Further, higher interest rates will dampen credit demand. The upper limit of the Fed funds rate is now at 2.5%, as opposed to the average of 0.96% during the second quarter of 2022. Moreover, the management also mentioned in the latest conference call that it expects lower, mid-to-high-single-digit loan growth for the remainder of the year.

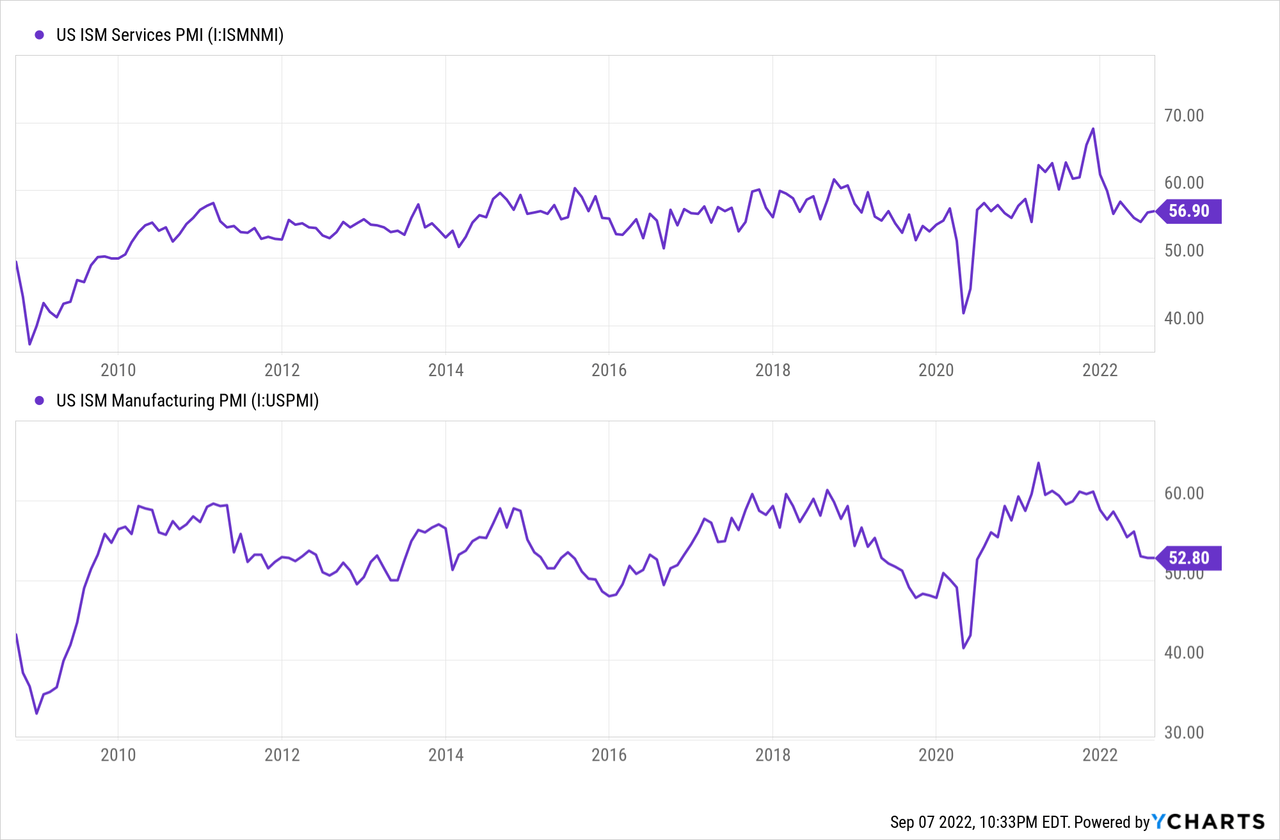

However, certain economic factors other than interest rates can sustain loan growth. Wintrust Financial’s loan portfolio is well-diversified geographically, but by loan segments, it’s concentrated in commercial and commercial real estate loans. Therefore, the purchasing managers’ index is a good gauge of credit demand. As shown below, both the services and manufacturing indices are above 50, which indicates that economic activity is expanding.

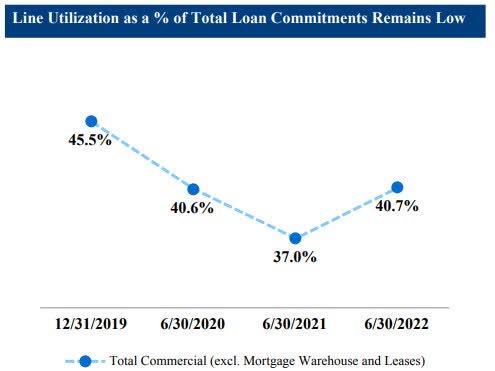

Moreover, the commercial line utilization is still much below the pre-pandemic level. This means there is an opportunity for loan growth.

2Q 2022 Earnings Presentation

Considering these factors, I’m expecting the loan portfolio to grow by 9% (annualized) every quarter till the end of 2023. In my last report as well, I estimated loan growth of 9% (annualized) a quarter. However, I’ve significantly increased the full-year loan growth estimate for 2022 because of the surprising performance in the second quarter of 2022.

Meanwhile, I’m expecting other balance sheet items to grow in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 23,668 | 26,643 | 31,760 | 34,541 | 38,476 | 42,058 | ||||

| Growth of Net Loans | 10.1% | 12.6% | 19.2% | 8.8% | 11.4% | 9.3% | ||||

| Other Earning Assets | 4,685 | 6,935 | 9,801 | 12,252 | 11,363 | 12,421 | ||||

| Deposits | 26,095 | 30,107 | 37,093 | 42,096 | 44,532 | 48,677 | ||||

| Borrowings and Sub-Debt | 1,213 | 1,783 | 2,638 | 2,426 | 2,446 | 2,674 | ||||

| Common equity | 3,143 | 3,566 | 3,703 | 4,086 | 4,503 | 4,935 | ||||

| Book Value Per Share ($) | 55 | 62 | 64 | 71 | 77 | 84 | ||||

| Tangible BVPS ($) | 44 | 50 | 52 | 59 | 65 | 72 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Variable-Rate Heavy Loan Portfolio Makes the Margin Moderately Rate Sensitive

Around 77% of total loans will re-price or mature within one year, according to details given in the earnings presentation. This proportion of loans includes variable-rate loans which made up 60% of total loans.

On the other hand, the large balance of investment securities will hold back the average earning-asset yield in a rising-rate environment. The securities portfolio, which made up 13% of total earning assets, had a long duration of 7.42 years, according to details given in the presentation. As a result, it can be safely assumed that most of the portfolio will not re-price upwards this year as market interest rates rise.

Further, interest-bearing deposits, excluding certificates of deposits, made up a sizable 58.8% of total deposits at the end of June 2022. These deposits will re-price soon after every rate hike.

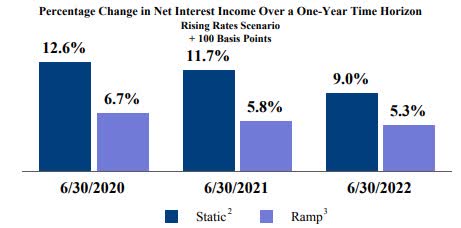

The results of the management’s interest-rate sensitivity analysis given in the presentation showed that a 100-basis points hike in interest rates can boost the net interest income by a moderate 5.3% over twelve months.

2Q 2022 Earnings Presentation

Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022. As I’m expecting interest rates to plateau in early 2023 before declining in the latter part of next year, I’m anticipating the net interest margin to remain almost unchanged next year.

Provisioning to be Above Normal in the Second Half of 2022

Non-performing loans were 0.20% of total loans, while allowances were 0.68% of total loans at the end of June 2022. This coverage seems a bit tight in light of a high inflation environment which is proving to be stressful for borrowers. Therefore, I’m expecting the provision expenses to be higher than normal in the last two quarters of 2022. Further, the anticipated loan additions will require additional provisioning for expected loan losses.

Considering these factors, I’m expecting a net provision expense of around 0.31% (annualized) of total loans in the second half of 2022, which is higher than the historical average. For 2023, I’m expecting the net provision expense to make up 0.19% of total loans, which is close to the last five-year average.

Expecting Flattish Earnings for 2022

The anticipated loan growth and margin expansion will likely support an increase in earnings this year and the next. On the other hand, higher provision expenses will likely drag earnings this year. Overall, I’m expecting Wintrust Financial to report earnings of $7.41 per share for 2022, down by just 2% year-over-year. For 2023, I’m expecting earnings to increase by 18% to $8.78 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 965 | 1,055 | 1,040 | 1,125 | 1,370 | 1,592 | ||||

| Provision for loan losses | 35 | 54 | 214 | (59) | 85 | 80 | ||||

| Non-interest income | 356 | 407 | 604 | 586 | 524 | 495 | ||||

| Non-interest expense | 826 | 928 | 1,040 | 1,133 | 1,177 | 1,272 | ||||

| Net income – Common Sh. | 335 | 347 | 272 | 438 | 436 | 516 | ||||

| EPS – Diluted ($) | 5.86 | 6.03 | 4.68 | 7.58 | 7.41 | 8.78 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Wintrust Financial, I estimated earnings of $7.03 per share for 2022. I’ve increased my earnings estimate because I’ve revised upwards my loan growth estimate following the second quarter’s phenomenal performance. Further, I’ve reduced my non-interest expense estimate because the company has shown greater expense discipline than I anticipated so far this year.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Price Upside Warrants a Buy Rating

Wintrust Financial has a long-standing tradition of increasing its dividend every year. Given the earnings outlook, I’m expecting the company to increase its quarterly dividend by $0.02 per share in the first quarter of 2023. This will lead to a full-year dividend of $1.44 per share, which implies a payoff ratio of 16%. In comparison, the payout ratio averaged 17% in the last five years. My dividend estimate suggests a forward dividend yield of 1.7%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Wintrust Financial. The stock has traded at an average P/TB ratio of 1.49 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 41.1 | 44.0 | 48.5 | 52.1 | 58.9 | |

| Average Market Price ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historical P/TB | 1.81x | 1.95x | 1.43x | 0.92x | 1.33x | 1.49x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $65 gives a target price of $96.7 for the end of 2022. This price target implies a 13.7% upside from the September 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.29x | 1.39x | 1.49x | 1.59x | 1.69x |

| TBVPS – Dec 2022 ($) | 65.0 | 65.0 | 65.0 | 65.0 | 65.0 |

| Target Price ($) | 83.7 | 90.2 | 96.7 | 103.2 | 109.7 |

| Market Price ($) | 85.0 | 85.0 | 85.0 | 85.0 | 85.0 |

| Upside/(Downside) | (1.6)% | 6.1% | 13.7% | 21.4% | 29.0% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.7x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 4.40 | 5.86 | 6.03 | 4.68 | 7.58 | |

| Average Market Price ($) | 74.6 | 85.8 | 69.3 | 47.9 | 78.2 | |

| Historical P/E | 17.0x | 14.7x | 11.5x | 10.2x | 10.3x | 12.7x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $7.41 gives a target price of $94.3 for the end of 2022. This price target implies a 10.9% upside from the September 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.7x | 11.7x | 12.7x | 13.7x | 14.7x |

| EPS 2022 ($) | 7.41 | 7.41 | 7.41 | 7.41 | 7.41 |

| Target Price ($) | 79.5 | 86.9 | 94.3 | 101.7 | 109.1 |

| Market Price ($) | 85.0 | 85.0 | 85.0 | 85.0 | 85.0 |

| Upside/(Downside) | (6.5)% | 2.2% | 10.9% | 19.6% | 28.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $95.5, which implies a 12.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 14.0%. Hence, I’m maintaining a buy rating on Wintrust Financial.

Be the first to comment