Paul Morigi

Introduction

Last month, NovoCure (NASDAQ:NVCR) reported its Q3 2022 earnings and this is a quick overview of those earnings, but it also shows why the earnings don’t matter that much now and it’s all about the future.

The numbers

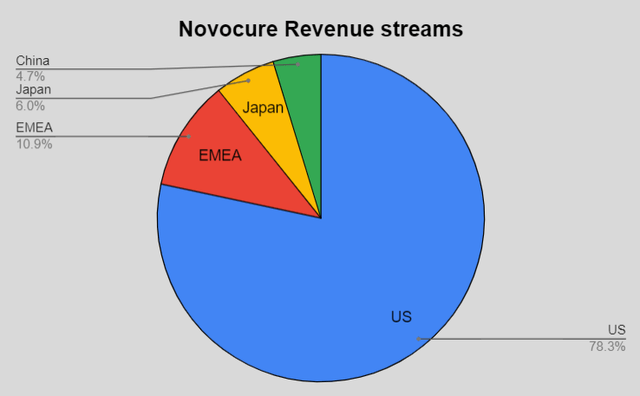

The company posted $130.99 million in revenue, a miss of $2.39 million versus the estimates and a decrease of 2% compared to the same period in 2021. NovoCure constantly switches between beats and misses and that is because of the cash collections from aged claims in the U.S. and a change of coverage in Germany. In this quarter, just like for other companies, there was also a foreign exchange headwind but it was not as big as for some other companies, as 78% of NovoCure’s revenue comes from the US.

Made by the author

Some more facts:

- The revenue from China is through the partnership with Zai Lab (ZLAB).

- Overall gross margins were 77%, which I still think is impressive for a company that is in medical devices.

- Adjusted EBITDA came in at $4.4 million.

- The company generated $22 million in cash flow from operations.

Tumor-treating fields

The main reason why NovoCure is in my portfolio is the strength of this company. Its TTF or Tumor-treating fields is a proprietary technique to treat the most severe cancers through the use of electromagnetic fields.

Initially, nobody believed that TTFs would work, but they got approved for several indications already. The most important one is for Glioblastoma or GBM. That’s a fatal form of brain cancer. TTFs can extend patients’ lives without any side effects. They have to wear a sort of helmet for at least 22 hours per day. It constantly radiates micro electricity in certain targeted areas.

NovoCure

Because of this, NovoCure is in a special situation. It can fund its pipeline internally with the proceedings of its approved indications. It had a free cash flow of $27 million in this quarter and in total more than $1 billion in cash, short-term investments and receivables, while it has $565 million in long-term debt. Very solid.

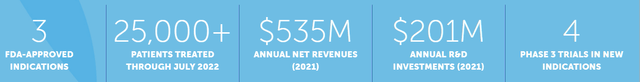

The real value of NovoCure is in its pipeline, with four clinical trials in phase 4. Non-small cell lung cancer is the main indication, with a very big market opportunity, dozens of times bigger than GBM. NovoCure can spend more than $200 million on R&D and still not burn through cash. That’s usually something only the really big players can do, but NovoCure has a market cap of less than $7.5 billion right now.

NovoCure summarizes the numbers well:

NovoCure’s Q3 2022 earnings slide deck

How TTFs work

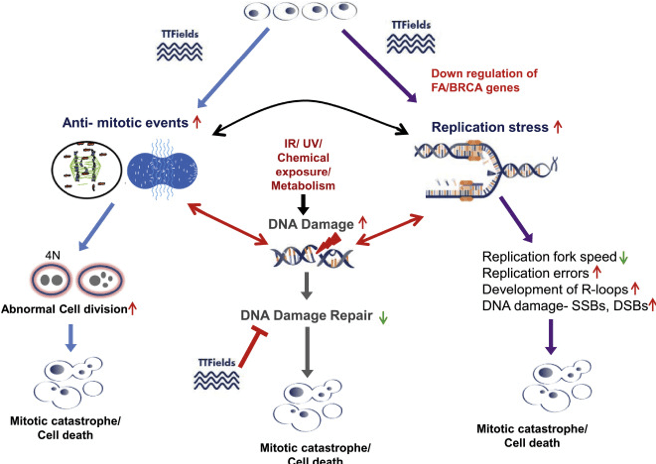

This is how NovoCure explains how its tumor-treating fields work:

Tumor treating fields uses alternating electric fields specifically tuned to target cancer cells. Once the electric fields enter the cancer cell, they attract and repel charged proteins during cancer cell division.

So, in human terms, micro-electricity is shot back and forth through the targeted area at a very high speed of 100,000 to 300,000 times per second.

If we look a bit more under the cover, we can see that the TTF technology works in three ways: it can attack the cell division of the cancer cells, attack the cancer cell membrane or help in the recovery phase of the body after chemotherapy to reduce DNA damage repair. Or schematically:

NASA Specialized Center of Research in carcinogenesis

(Source)

The first two mechanisms are already very important because they are obvious second-line treatments: once chemotherapy or other treatments like removal have shown not to work, TTFs can be used because they have no side effects and can still prolong the life of patients and in that way enhance the life quality of people who know they only have a limited time left with their loved ones.

But the third element (the attacking of damaged DNA after chemotherapy) means that NovoCure has also become an element of first-line treatment, as a so-called adjuvant therapy. Of course, NovoCure has to prove for each solid tumor disease that it can prevent or lower damaged DNA. In 2015, NovoCure could already prove for GBM that chances of relapse were at least slowed down after the use of TTFs, later, in 2019, mesothelioma followed.

2023, a pivotal year

If you ask me why I’m invested in NovoCure, this is by far the most important reason:

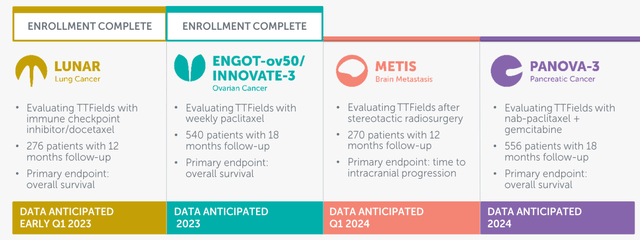

NovoCure Q3 2022 earnings call slides

NovoCure has four Phase 3 studies for its TTFs for different indications. The biggest by far is the LUNAR study for non-small cell lung cancer. This is a gigantic market.

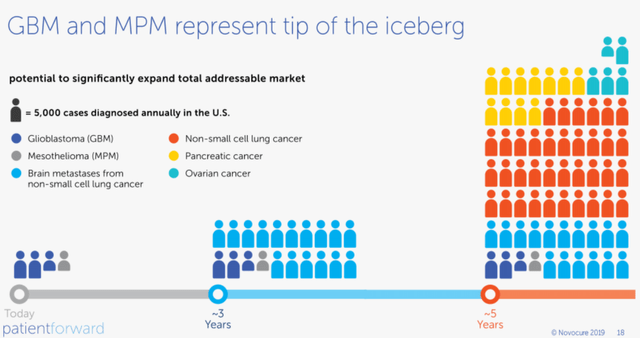

For years, NovoCure used these slides in its earnings slides. Not anymore, so I just take an old one.

NovoCure

If you compare NovoCure’s current addressable market (left) and its addressable market if these four studies are successful (right), you understand that NovoCure’s stock could do very well over the coming year if the studies are successful. NovoCure estimates that the TAM could multiply by 20 just with what’s already in phase 3.

You can see the biggest market of all is non-small cell lung cancer. Lung cancer is the most common cause of cancer-related death worldwide, and 85% is non-small lung cancer. That’s the LUNAR study, of which the results are expected in early 2023, most likely in January.

Of course, this remains risky as FDA approval is always necessary. But these are not drugs, like for many biotechs, but medical devices. That means that the chances of side effects are substantially smaller, even more because of the multiple approvals NovoCure’s TTFs already have.

In April of 2021, the stock made a 50% jump in one day, when the company announced that a DMC or data monitoring committee, which follows up all clinical studies, recommended after a routine control that the trial duration should be shortened from 18 to 12 months and with fewer patients for LUNAR.

On top of that, NovoCure didn’t have to proceed with the study with 534 patients as it previously had to but only with 276, so 50% of the original. The DMC said that it would be unethical for patients randomized to the control arm. That means that the interim results are so overwhelmingly positive that the DMC wants to give NovoCure the possibility to bring its TTF for non-small cell lung cancer to the market as soon as possible.

In my opinion, chances are very high that TTFs will be approved for non-small cell lung cancer.

What management said on the call

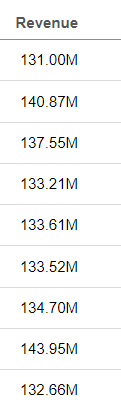

Management shared that Optune for GBM is now prescribed for 40% of newly diagnosed cases and it sees ample room for improvement there. To be honest, Optune has been rather stagnant. It’s great that it funds the pipeline, but its sales have not really grown lately, as can be seen in the last nine quarterly revenue numbers.

Seeking Alpha Premium

Of course, it’s a tough market, as its patients only use Optune for longer survival, not for a cure and therefore, the motivation on the side of both patients and doctors is not always optimal. On top of that, patients constantly die, so they have to be replaced.

The company has set up a new center in the US to drive awareness about TTFs. Despite the overwhelming scientific evidence, still many doctors and patients remain skeptical. NovoCure wants to change this and make revenue for Optune grow again. It also launched a new website to make people more aware, TTFields Therapy

TTFields Therapy by NovoCure

The company also did a small study (just 25 patients) with stronger radiation. Of course, keeping the temperature under control is key, but NovoCure found a way. The survival rate of the small study was 4.5 months extra versus 2.2 months now. Of course, a bigger study would be needed, but this is good news, both for the company and of course patients. For the company, it could motivate more patients to use Optune.

For the rest, there was not that much really important news. The reimbursements in Germany will take longer, and they will start in France. But the big thing remains the 2023 results.

As Executive Chairman William Doyle said on the conference call:

For the last 10 years, NovoCure’s primary focus has been treating patients with glioblastoma. The top line readouts from both the pivotal LUNAR and INNOVATE-3 studies next year should be transformational for our company and potentially enable tens of thousands of patients to utilize our therapy for treatment of non-small cell lung cancer and ovarian cancer.

CEO Asaf Danziger added:

I would like to echo Bill’s anticipation for the upcoming pivotal readouts. 2023 will be a very exciting year.

Conclusion

The most important catalysts for NovoCure are the upcoming results of the phase 3 studies, which can multiply the company’s addressable market. In five weeks or so, we will probably already know more. I think it’s very likely the LUNAR study and the others following, show positive results. That’s why I will add a bit to my position, which is still relatively small.

In the meantime, keep growing!

Be the first to comment