anilbolukbas/iStock Editorial via Getty Images

TH International Limited (NASDAQ:THCH) is the master franchisee of Tim Hortons franchises in China. It has ambitious plans to open over 2,750 coffee shops in China by 2026. COVID-lockdowns and rapid store openings have made the company’s financials hard to analyze. However, a poorly received SPAC transaction gives investors an opportunity to invest at discounted valuations. THCH is definitely a stock worth watching in the coming quarters.

Company Overview

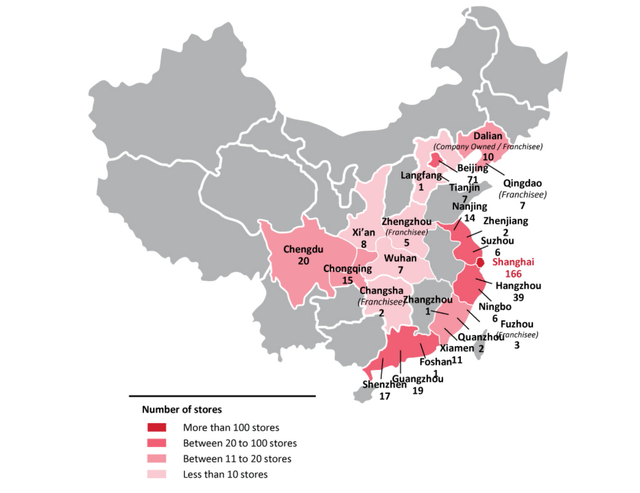

TH International Limited, or more commonly known as Tims China, is the master franchisee of Tim Hortons coffee shops in China, with more than 500 coffee shops in operation across the country.

Founded as a partnership between private equity firm Cartesian Capital Group and Restaurant Brands International Inc. (QSR), Tims China has grown rapidly since it opened its first coffee shop in China in February 2019. On October 17th, Tims China opened its 500th coffee shop in Dongguan, having added over 60 stores in the past few months (Figure 1).

Figure 1 – Tims China store count, June 2022 (THCH F1 Registration Statement)

Tim Hortons Is A Global Coffee Giant

Founded in 1964 by Tim Horton, a former Canadian professional hockey player, and entrepreneur Ron Joyce, Tim Hortons is the world’s third largest coffee and donut restaurant chain, with over 5,000 locations.

According to Tims China, Tim Hortons’ brand values of hospitality, inclusivity, and community is well aligned with the Chinese market (Figure 2). Tims China’s products are priced below that of high-end competitors such as Starbucks (SBUX) and Luckin Coffee (OTCPK:LKNCY), but above that of value brands such as McCafe.

Figure 2 – Tim Hortons Brand Value (timhortons.com.cn)

China Is The Next Coffee Frontier

While China is the one of the top consumers of most commodities and food products, coffee is not one of them. According to the United States Department of Agriculture Foreign Agricultural Service (quoted by Tims China in its F1 registration statement), in 2020, per capital annual consumption of coffee in China was only 19 cups. This is a far cry from 628 cups in United States and 494 cups in Japan.

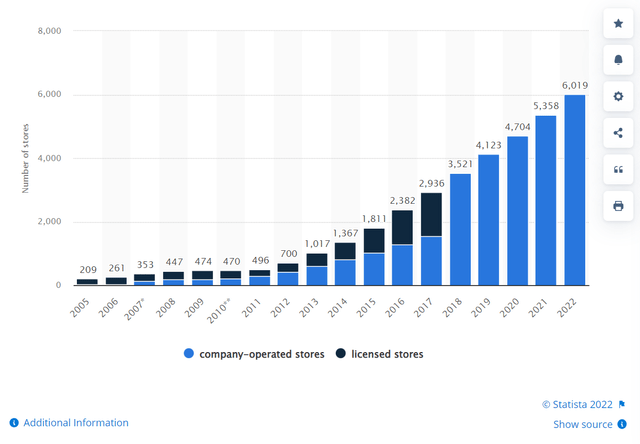

At the same time, Chinese coffee consumption is growing at a 30% annual pace, far above the global average 2%. This combination of an underpenetrated market and huge growth potential is the main reason why Starbucks has over 6,000 coffee shops in China with plans to reach over 9,000 by 2025 (Figure 2).

Figure 3 – Starbucks store count in China (Statista)

Tims China Has Ambitious Growth Plans Of Its Own…

Similar to Starbucks, Tims China has some very aggressive growth plans of its own. After hitting 400 stores in January of 2022, Tims China’s CEO commented in a globeandmail article that he plans to have over 2,750 operating coffee shops by 2026. With roughly 1,500 days until the end of 2026, that means Tims China plans to open more than 1 store every day for the next 4 years!

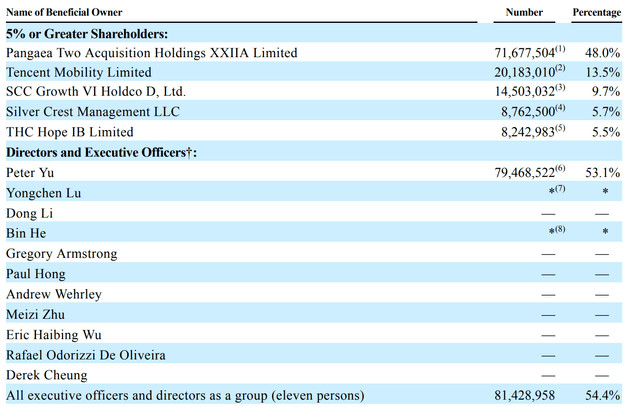

…And Is Backed By Blue Chip Investors

Tims China is backed by a number of blue-chip investors including Cartesian (through Pangaea funds), Sequoia China (through SCC funds), Restaurant Brands (through Tim Hortons Restaurants International), Tencent, and Ascendent Capital Partners (sponsor of the Silver Crest SPAC). Figure 4 shows Tims China’s significant shareholders, post the de-SPAC transaction.

Figure 4 – Tims China is backed by blue-chip investors (THCH F1 registration statement)

De-SPAC Was A Disaster

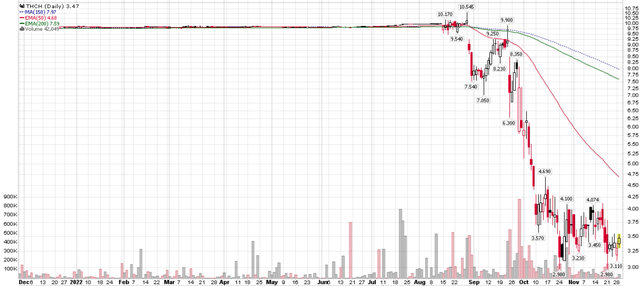

To say the Tims China / Silver Crest SPAC transaction was not well received is a huge understatement. Figure 5 shows the stock price performance of THCH since the de-SPAC.

Figure 5 – THCH shares plunged post de-SPAC (stockcharts.com)

Of the 34.5 million shares originally outstanding in the Silver Crest SPAC, 34.1 million shares exercised their right to redeem their shares for ~$10.037 per share.

Financial Performance Weak And Hard To Analyze

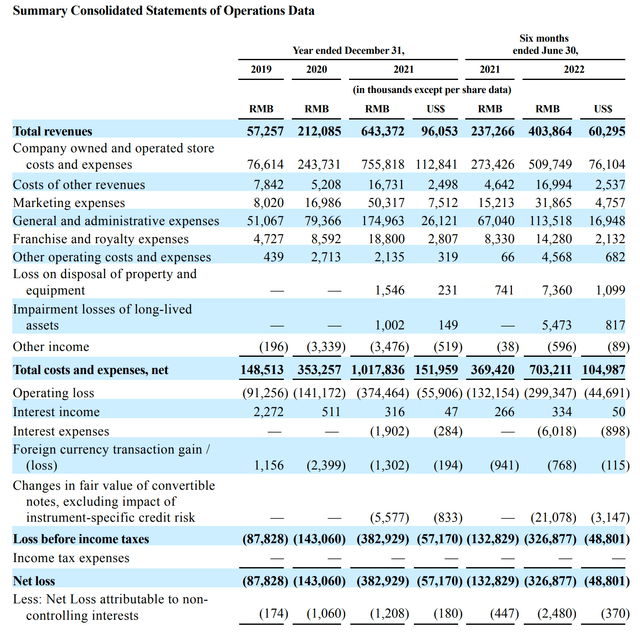

Due to Tims China’s fast growth, its financial statements are rather difficult to analyze. For example, according to the company’s latest Form F-1, Tims China generated revenues of $60.3 million in the 6 months to June 30, 2022, a 70% growth YoY (Figure 6). Unfortunately, the company recorded an operating loss of $44.7 million, as costs far outstripped revenues, even at a restaurant level.

Figure 6 – THCH Consolidated Financials (THCH F1 registration statement)

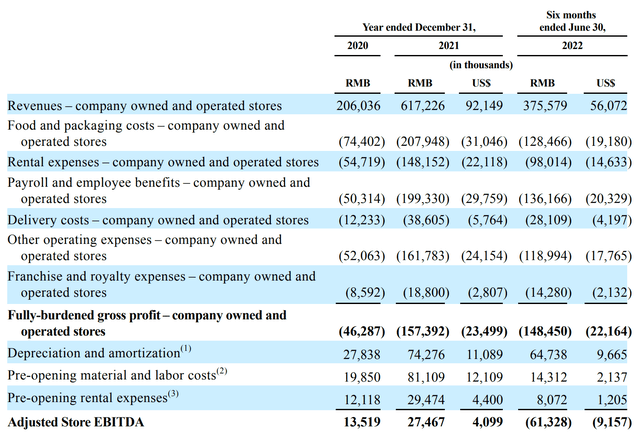

However, looking at the results in more detail, we can see that the restaurant level results were actually not that bad. Tims China was profitable at an adjusted EBITDA level in 2020 and 2021, and H1/2022’s adjusted EBITDA loss is probably due to the heavy level of COVID lockdowns experienced in Shanghai and surrounding areas, where many of the company’s stores are located (Figure 7).

Figure 7 – THCH adjusted EBITDA (THCH F1 registration statement)

Furthermore, with over 400 stores opened in the past 2 years (Tims China opened its 100th store in October 2020), the company is no doubt carrying a lot of opening and ramp-up expenses with revenues yet to catch up.

However, Valuation Starting To Look Interesting

However, if we look at Tim China’s valuation, things are starting to look interesting. Recall that Tims China has over 500 coffee shops across China and is looking to rapidly grow to over 2,750 stores within 4 years.

At the current market cap of $500 million, this equates to less than $1 million per existing store, or $180,000 / store in 2026, assuming the company achieves its target of 2,750 stores by the end of 2026 through self-funded growth.

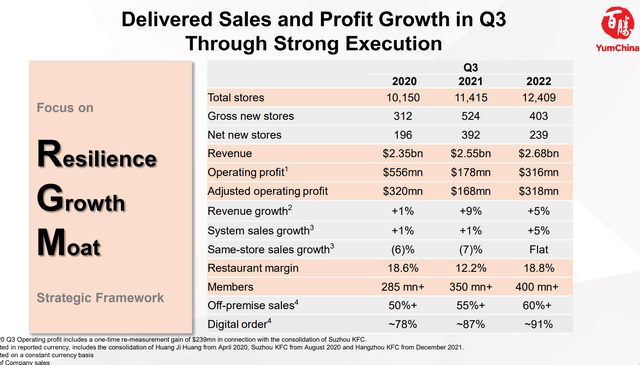

For comparison, Yum China Holdings, Inc. (YUMC), the current market leader in the Chinese restaurant space, has a market cap of $21 billion and 12,400 stores, or a per store value of $1.69 million.

Granted, Yum China has been operating in China since the late 1980s and has strong operating margins of almost 12% versus negative operating margins for Tims China (Figure 8). However, this does highlight the potential for improvement in Tims China results.

Figure 8 – Yum China should be a goal of what Tims China wants to be (YUMC investor presentation)

Hopefully, as the company reports financial results in the coming quarters, Tims China will give more details on the financial performance of its coffee shops by cohort, so analysts can better estimate the profitability of seasoned stores versus stores still in ramp-up mode.

China Reopening Is An Opportunity And A Risk

In recent weeks, I have written several articles highlighting the rebound potential in Chinese equities, as China inevitably has to loosen COVID restrictions. Chinese protests in multiple cities in the past week add to the sense of urgency. While reopening will be a long and bumpy path, I believe it is a matter of when, not if. Tims China, as a fast-growing coffee-shop concept, stands to benefit on any eventual re-opening plans.

On the other hand, if COVID restrictions are not loosened in the coming quarters, we should expect further weak financial performance from Tims China. Fortunately, the company has $290 million in cash and investments as of June 30, 2022, and several deep-pocketed investors such as Tencent (OTCPK:TCEHY) and Sequoia, that can hopefully step up to fund any cash shortfalls the company may face before it turns an operating profit.

Conclusion

TH International Limited is the master franchisee of Tim Hortons franchises in China. It has ambitious plans to open over 2,750 coffee shops by 2026. COVID-lockdowns and rapid store openings have made THCH’s financials hard to analyze. However, a poorly received SPAC transaction gives investors an opportunity to invest at discounted valuations. TH International Limited is definitely a stock worth watching in the coming quarters.

Be the first to comment