Sakorn Sukkasemsakorn

Written by Nick Ackerman. A version of this article was originally published to members of the CEF/ETF Income Laboratory on November 3rd, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield-traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

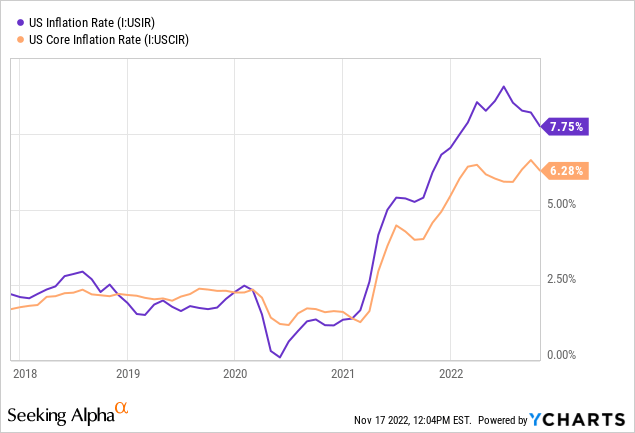

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the buying power erosion. So far, inflation appeared to have peaked, with the latest report coming in less than expected. This was after core inflation had hit a new high last month.

Before this latest report, the Fed hinted at being even more aggressive as they didn’t see the desired results. Helping add fuel to inflation is the continued strong labor market. The Fed also realizes that their interest rate increases do have a lag before playing out. However, with the latest inflation report and a cool PPI report, the next Fed meeting could have a different tone. These reports have helped push markets higher in more recent weeks.

The market initially jumped on the announcement that the pace of increases was going to slow – as expected. However, Powell then said that they now see rates rising even higher than earlier expected. That indicates they expect to continue rate hikes and don’t necessarily see a pause. That sent the market lower as it was exactly what the market did not want to hear.

This drives another reason to invest in dividend-growth stocks. Dividends might be the only form of return we see for even longer than expected due to a more aggressive Fed. Thus, why I do this screening every month in the first place – to find potential ideas that can sustain their dividend and even have the capacity to increase those dividends going forward potentially.

All of this being said is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are November’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 538 stocks at this time — from October’s 566 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

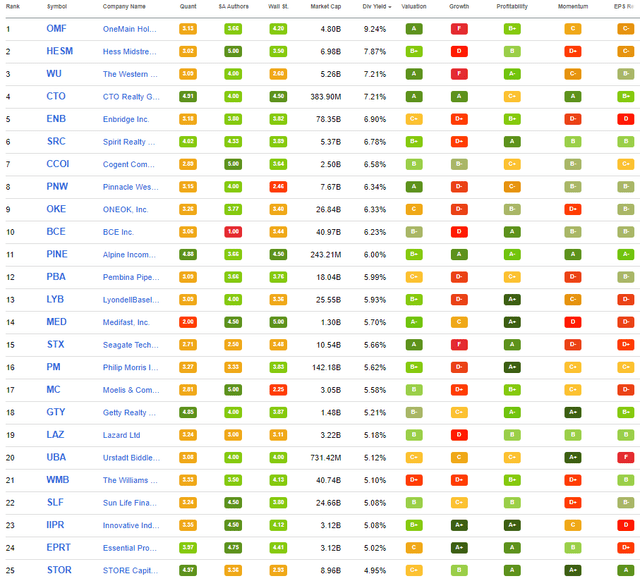

I will share the top 25 that showed up as of 11/03/2022.

Seeking Alpha Screening (Seeking Alpha)

Last month we covered Hess Midstream (HESM), so we’re giving it a break this month.

In September, we covered The Western Union Company (WU), CTO Realty Growth (CTO), Cogent Communications Holdings (CCOI) and ONEOK (OKE), meaning we will skip over these names this month until at least a quarter has passed.

Spirit Realty Capital (SRC) is going to be left off this list again because I want to see a better track record of dividend growth. They did raise their latest dividend, but I want to see more consistency. That being said, I will reiterate once again that it doesn’t mean I don’t think it is or isn’t a good investment – it just isn’t right for this list. I find that every time I exclude this name, I get messages saying “You’re wrong.”

OneMain Holdings (OMF), Enbridge (ENB), Pinnacle West Capital (PNW), BCE (BCE) and Alpine Income Property Trust (PINE). Giving us two new names in ENB and BCE and allowing us to check in with OMF, PNW and PINE.

OneMain Holdings 9.89%

We last covered OMF in August, though it popped up on our radar again in October. Given the latest regular quarterly dividend of $0.95 and a declining share price, we are given an exceptionally high yield.

Interestingly, it is actually lower now than it had been in August. At that time, we were seeing a tempting 10.41% yield. The latest earnings rally looks to have taken these shares higher. Although, with the Fed’s latest hawkishness, we could see more lows coming across the board.

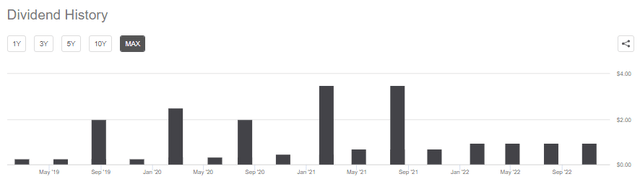

When times were good, the company was dishing out some massive specials.

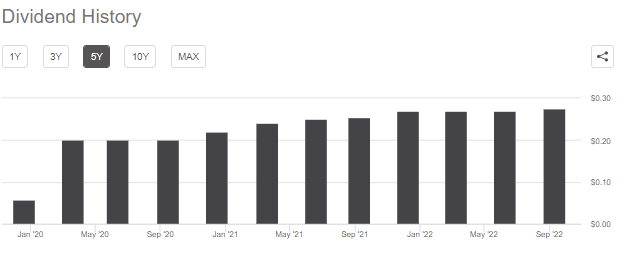

OMF Dividend History (Seeking Alpha)

This isn’t necessarily a screaming buy that is wildly mispriced, though. The reason for hesitation here is their primary line of business. In August, that was the first time I ever run across this company. This is a financial services company that provides personal loans, either secured or unsecured, to individuals. One thing that is at risk during a recession is that individuals lose their jobs and lose the ability to pay.

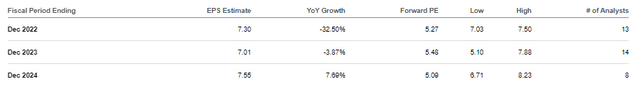

Given the risks to the economy with the Fed raising rates, we’ve already seen the forward EPS estimates come down. The last time we touched on the name, it had a forward EPS estimate of $7.67 for 2022. This has slid down to $7.30, and instead of a small increase in EPS for 2023, those estimates went from $7.75 to $7.01. Meaning that it was revised lower and is now expected to have back-to-back years of earnings declines.

OMF Earnings Estimates (Seeking Alpha)

With that, I’d still consider it a fairly aggressive play. However, higher risks can lead to higher rewards, making this a tempting play.

Enbridge 6.90% Yield

It is interesting that ENB shows up this month for two different reasons. One, because it is one of the new additions to show up – including BCE – that are both Canadian companies.

And secondly, I had a reader ask why ENB didn’t show up last month, but Pembina Pipeline Corp. (PBA) did. I considered that a more than valid question as it is quite clear ENB is a highly regarded and exceptionally managed operation. My response was that it simply comes down to the shortcomings of this screening.

At the screening last month, it appeared that ENB’s dividend safety score wasn’t high enough. REITs and energy companies (primarily MLPs, but we see it in C-corps, too) have different metrics that better reflect their special situations. A simple screening tool that utilizes a quant rating system that is not specialized for the unique reporting metrics isn’t going to necessarily be able to gauge the safety of a payout accurately. Although, that doesn’t mean we haven’t had quite a few REIT and energy names show up anyway.

That said, ENB is quite a solid operation that has rewarded shareholders handsomely over the years. With their earnings coming up tomorrow (11/04/2022), we will have a better idea of how they are operating in this environment of higher energy prices. Though, as a pipeline company, they should be fairly limited in terms of their impact relative to commodity prices that can be volatile.

This is a pipeline company that has delivered growing dividends through thick and thin, fueled by the growth in their earnings over the years. Worth noting that since this is a Canadian company, they are paying in CAD. So dividend charts that show USD will make it appear they pay a variable dividend, but it is due to the CAD/USD conversion changes.

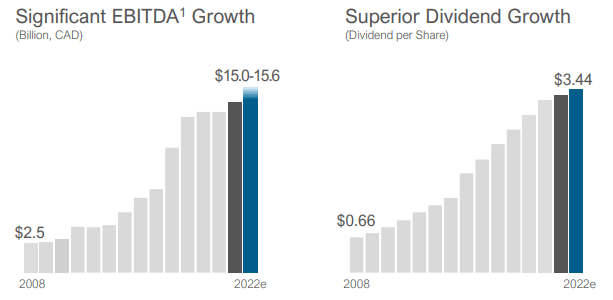

ENB EBITDA and Dividend Growth (Enbridge Presentation)

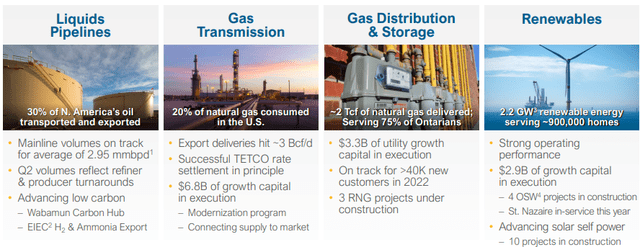

While most investors focus on the pipeline business, they also have a robust and consistent utility business. That can help provide more stable earnings as well. The focus on pipeline operations is rightfully so, as it is by far the largest component of the company.

Additionally, like all energy companies these days, they’ve been adopting and spending more on renewable projects too. ENB really just has it all going on, and that diversification can help drive it into the future.

ENB Business Segments (Enbridge Presentation)

BCE 6.23% Yield

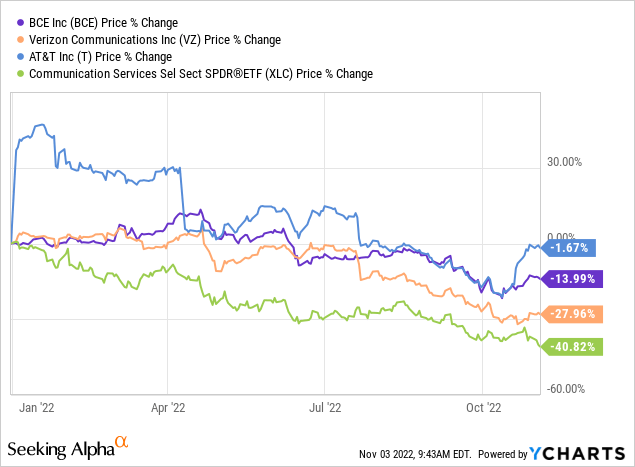

The other Canadian company to show up on this list is BCE, a telecommunication company. Despite being a Canadian company, it has still been weaker on a YTD basis. While BCE doesn’t seem necessary as popular as these U.S.-counterparts, it still is discussed quite regularly by the dividend crowd.

Verizon (VZ) and AT&T (T) have also been weaker but have been holding up considerably better than the rest of the sector. That being said, names such as Alphabet (GOOG) (GOOGL) and Netflix (NFLX) are also components that make up the largest weighting of the XLC.

Ycharts

T’s latest results had blasted the stock higher, which had otherwise been running right in line with BCE.

BCE pays dividends in CAD, so once again, we would see what looks to be variable payouts due to CAD/USD conversions. However, they’ve been raising their payout fairly regularly starting in 2005.

BCE is a name that I’ve always been interested in, but due to holding VZ and trading around with T, I just haven’t found space in my portfolio.

Alpine Income Property Trust 6.09% Yield

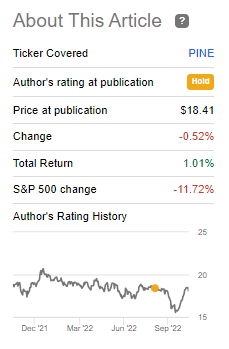

PINE is a name that first showed up in August. This was a small REIT I had never run across before. Naturally, as an income investor, REITs catch my attention. I went on to do a further dive into the name. Since then, the price of the shares dropped rapidly and then rebounded. At this time, it had outperformed the broader market quite materially since that coverage.

PINE Performance Since Coverage (Seeking Alpha)

My ultimate takeaway was that being a small REIT meant more potential growth and potential reward going forward, being small is also a huge risk too. This leaves them in a less diversified position with a relatively lower number of holdings. On a brighter note, most of these names are investment-grade tenants.

External management is also a consideration before jumping in. Although, the bright note on that is they intend to transition to an internal management team when the REIT grows larger. The external management team is also a big owner of PINE, which further diminishes the potential conflicts that can happen with external managers.

Since our last visit on the name, PINE went ahead and bumped up their dividend again. They’ve been bumping regularly, but it has been on an irregular schedule thus far.

PINE Dividend History (Seeking Alpha)

Their latest earnings show that this latest increase is well supported. The guidance of $1.73 to $1.75 also supports that growth can continue into the future. That was a material jump in guidance that they had given previously.

Pinnacle West Capital 5.14% Yield

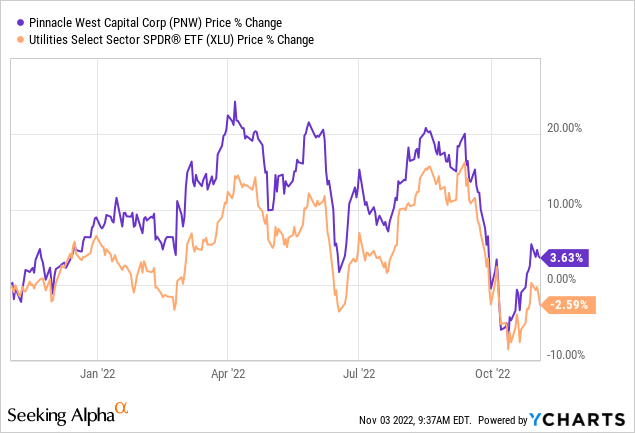

It has been a little while since PNW has shown up on this list. We would have to go back to May 2022 as the last time we touched on this name. Since then, the yield has come up as the price of this electric utility company has fallen even further. This was a utility company that last year was hurt by the outcome of Arizona regulators on their rate case.

Utilities were a strength in 2022 but have become much weaker more recently. For what it’s worth, PNW has slightly outperformed over the last year relative to XLU. So buying this name after the initial drop from the downgrades sparked by the Arizona regulators still meant you did relatively well.

Ycharts

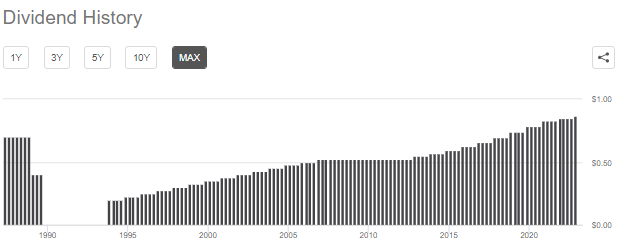

This also didn’t stop last year nor this year’s dividend increase.

PNW Dividend History (Seeking Alpha)

This is a good sign that the management team at the company is still comfortable with where they are financially. With earnings out Nov. 3 morning, they showed a beat on both EPS and revenue, which backs up this confidence.

This name continues to be a utility name that catches my attention, but with several utility holdings already, I’m not in a rush to add more. That puts it in the same situation as BCE. It is attractive but would overlap with other currently held names, giving me pause to consider adding even further exposure to the sector.

Be the first to comment