Torsten Asmus

A surprisingly controversial debate broke out in recent days when Joe Biden said there was no inflation. He was, of course, referring to the month over month reading which showed a slight decline in prices. The BLS measures inflation on a monthly basis and while the 12-month year-over-year comparison showed an 8.5% increase the monthly price was flat on a month over month basis.

Twitter seemed especially argumentative about this point. I know, I know – it’s shocking to hear that people on Twitter argue. But it seemed politically motivated to me and so here’s a dollop of apolitical perspective on this debate.

There are a bunch of problems with this focus on monthly inflation. First, we adjust inflation data specifically because short-term data is very noisy. For instance, the BLS prefers to look at core inflation readings that strip out volatile items like food and energy.

This is because focusing on short-term volatile items can give you a false understanding of what’s really going on with longer-term trends. This doesn’t mean the headline reading is meaningless – it just means that you can get a better perspective using core. Core inflation was actually up modestly this month.

In addition to focusing on core items that reduce the volatility of short-term data the BLS specifically states that longer-term trimmed mean measures are more reliable:

So Biden committed two statistical inflation sins here. Not only did he use headline inflation, but he used the short-term version to present that data. In other words, he didn’t use the trimmed mean data, and he used the short-term data. Double no-no when presenting the data in an objective manner.

This is part of why Biden’s comments were controversial. He seemed to be distracting from the long-term more reliable trend data to promote a narrative based on the less reliable short-term trend data.

Now, this doesn’t mean that the monthly data is completely meaningless. After all, the long-term trend could be exaggerating the narrative at this specific juncture. That is, if inflation has peaked, as I believe it has, then talking about 8.5% inflation is a rear-view mirror talking point and can make people feel worse about things than they really are and will be.

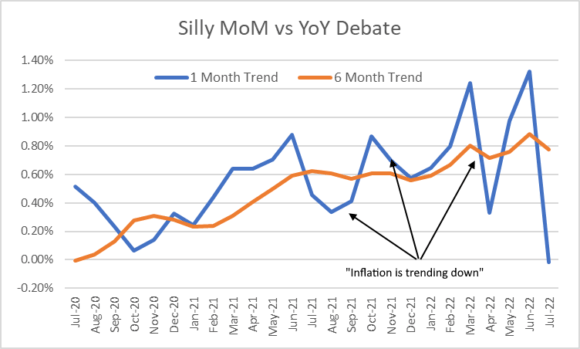

On the other hand, it’s the weighted average of the data that matters most. So, for instance, inflation has been trending higher for most of the last 2 years. If you’d used a 6-month measure of inflation to define the current trend then you’d have been more worried about potentially entrenched inflation. On the other, other hand, if you’d used monthly readings, you would have consistently said inflation was starting to trend down, when in fact that was just short-term noise.

MoM vs. YoY debate (Author)

Of course, if the weighted change had been more significant this month then Biden might have a stronger argument. For example, if inflation was -10% on a monthly basis then the weighted long-term average would have shifted materially lower and that might be cause for serious alarm.

This was essentially what happened in late 2008 during the financial crisis and it was an unusual period where short-term data was not just noisy data, but a real sign of serious problems. That’s obviously not what’s happening now.

So yes, it’s reassuring to see inflation moderating on a monthly basis. But the long-term trend in long-term trimmed mean data is still high so it’s far too early to celebrate.

So, now when you decide to present inflation data at this week’s BBQ with your friends you can provide a more pragmatic perspective by emphasizing that while the monthly inflation reading was 0%, it’s generally more reliable to use a long-term trimmed mean measure to give us a broader perspective of the broader trends in inflation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment