John Pennell/iStock via Getty Images

The Q1 Earnings Season for the Gold Miners Index (GDX) has begun, and the first company to report its results is NovaGold (NYSE:NG). While it was a more expensive quarter vs. Q1 2021, this can be attributed to another busy year, with Barrick (GOLD) and NovaGold looking to prepare the project for an updated Feasibility Study, subject to approval by the Donlin Gold LLC Board.

While the project is peerless in North America due to its enormous scale, NovaGold does not control its own destiny at Donlin, and we still don’t have a definitive start date. Given that other developers can fund their projects independently (debt/equity) without a partner, and many miners are generating significant free cash flow and paying dividends, I see better opportunities elsewhere in the sector.

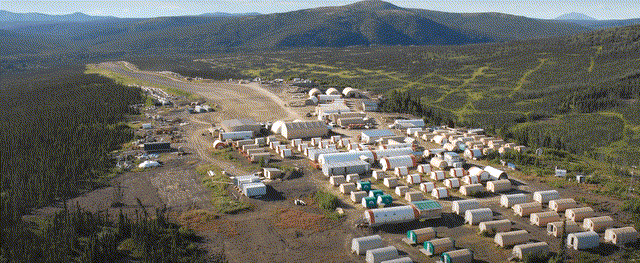

Donlin Project – Alaska (Company Website)

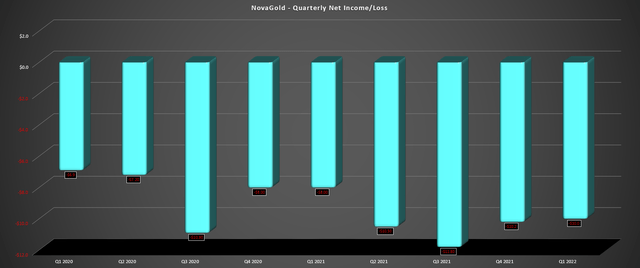

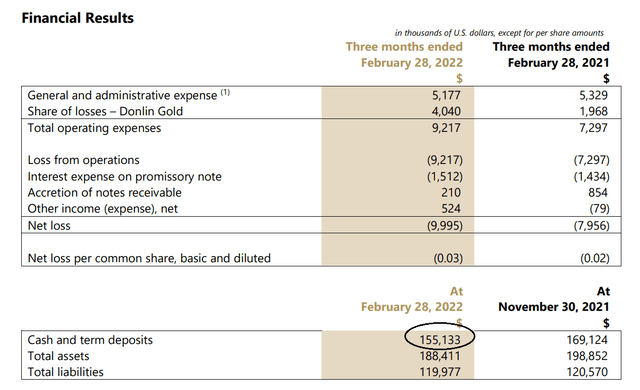

NovaGold released its fiscal Q1 2022 results this week, reporting a net loss of $10 million, a slight increase from the year-ago period. This was based on roughly flat general & administrative expenses [G&A] in the period of ~$5.2 million and due to the earlier start to the drilling season in 2022. However, despite the continued net losses, which are to be expected from a development-stage story, the company continues to hold a strong cash position and has more than enough capital to get through 2022 without additional share dilution. Let’s take a closer look at the year ahead:

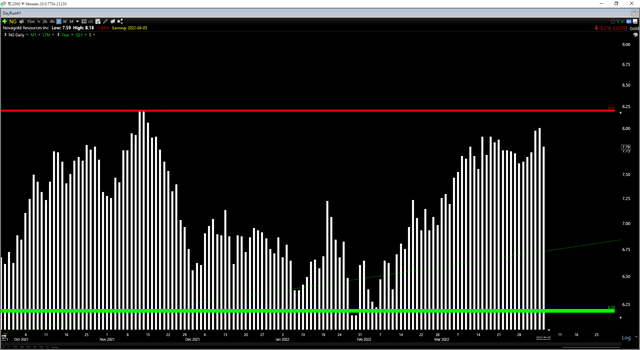

NovaGold – Quarterly Net Income/Loss (Company Filings, Author’s Chart)

While 2021 was a very busy and successful year for the Alaskan Donlin Project (50% Barrick / 50% NovaGold), with several high-grade intercepts reported, 2022 is expected to be just as busy. In fact, Donlin Gold LLC (Barrick/NovaGold split) plans to embark on its largest drill program in a decade, with three drill rigs operating as of January. The planned budget for the year is $60 million, with NovaGold’s portion of this to be $30 million. The plan is to drill 34,000 meters of tightly spaced grid drilling in-pit and below-pit as complete fieldwork for the Alaska Dam Safety Certifications.

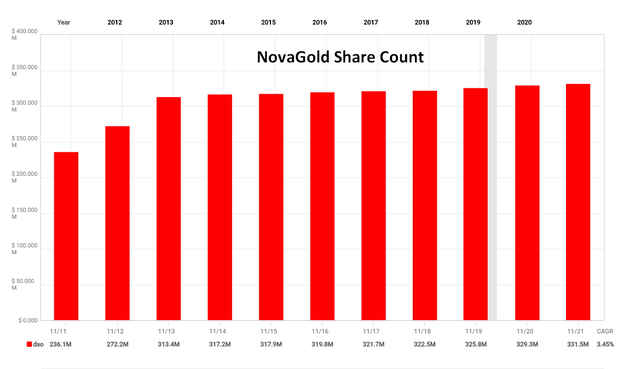

NovaGold Shares Outstanding (FASTGraphs.com)

Normally, with a budget of this size for a developer, investors would be staring down additional share dilution, but NovaGold has managed to limit share dilution over the past decade. This was achieved by selling its 50% stake in the massive Galore Creek Project to Newmont (NEM) in 2018 for an upfront payment of $100 million and total consideration of up to $275 million. Given that an additional payment of $25 million is due in Q3 2023 from Newmont, NovaGold should see a good chunk of this year’s spending replaced (~$46 million).

NovaGold – Financial Results (Company News Release)

Even if we see a similar budget in 2023, NovaGold should have over $120 million in cash next summer, giving it lots of room to continue to advance its share of the Donlin Project. This is a nice differentiator for NovaGold relative to other developers, given that most developers are diluting shareholders at a pace of 10% per annum at a bare minimum, at least until they’ve secured all their funding for a construction decision.

Having said that, while NovaGold certainly wins in this department (limited share dilution), there are a couple of negatives worth discussing. Before discussing them, though, let’s look at why this asset is so special and why NovaGold commands a market cap of ~$2.6 billion, well above its peer group of development-stage companies in the gold space.

Donlin Project (Company Technical Report)

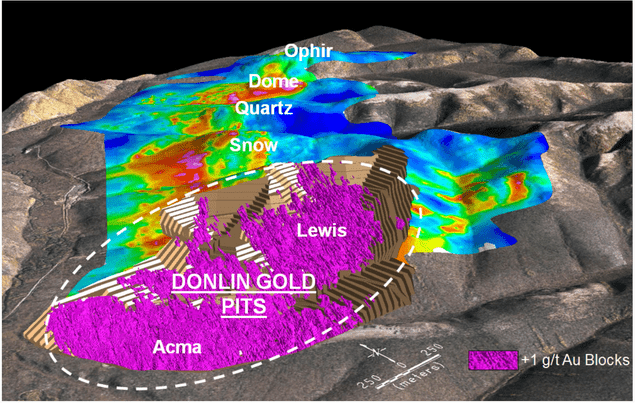

Donlin Project

The Donlin Project is located in Southwestern Alaska, and placer gold was initially discovered more than a century ago at Snow Gulch, a tributary of Donlin Creek. As it stands, the project is home to a mammoth-sized resource of ~34 million ounces of gold at 2.09 grams per tonne gold, and the most recent study envisions a ~25-year mine life, with a processing rate north of 53,000 tonnes per day. This would give the Donlin Project a similar processing rate to Canada’s largest gold operation: Canadian Malartic.

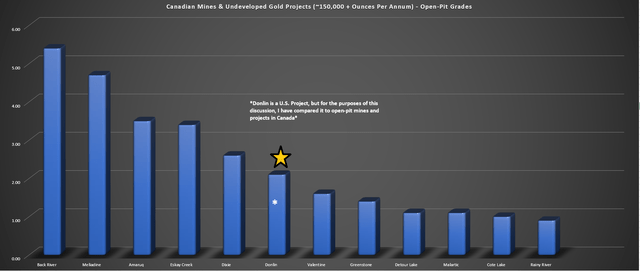

Donlin Project – Grades vs. Canadian Mines/Projects (Company Filings, Author’s Chart)

The major difference for Donlin, though, is that the project boasts an impressive grade of ~2.1 grams per tonne gold in the reserve category, and just shy of 2.3 grams per tonne gold in the Measured & Indicated resource category. Hence, it could produce nearly double what Canadian Malartic produced during its peak years, given that it will benefit from having industry-leading grades for an open-pit operation. The chart above shows how Donlin stacks up from a grade standpoint relative to other open-pit mines and undeveloped projects in Canada, clearly displaying that Donlin is one of the more impressive projects globally among open-pit operations/projects.

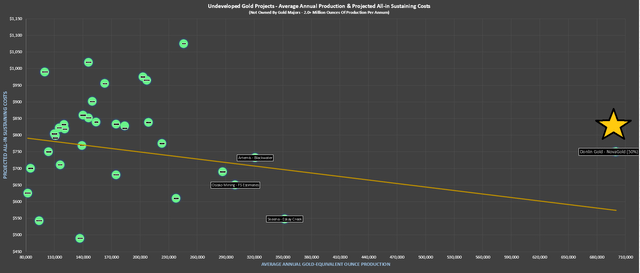

Donlin Project (50% Share) vs. Other Undeveloped Gold Projects (Company Filings, Author’s Chart)

If we compare Donlin to solely undeveloped gold projects, it’s quite clear that the project is a massive outlier, and the project is shown based on solely NovaGold’s 50% share in the above chart. As is visible from this chart of more than 20 projects, Donlin’s production profile dwarfs that of its peers, and the project is also estimated to have industry-leading costs (sub $800/oz). On a 100% basis, the most recent study suggested that Donlin Gold would produce ~1.4 million ounces of gold per annum over its first ten years, translating to a ~700,000-ounce production profile for NovaGold based on its 50% ownership.

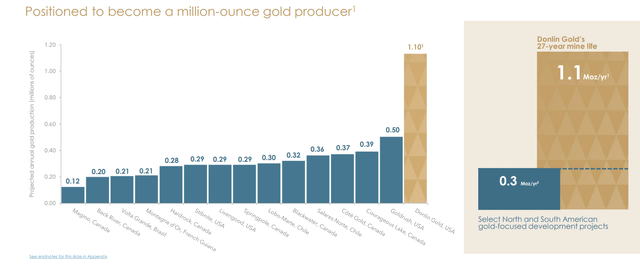

Donlin Project – Life of Mine Production vs. Other Projects (Company Presentation)

To put this production profile in perspective, NovaGold’s share of Donlin alone would be larger than Agnico Eagle’s (AEM) production from its LaRonde Complex and Meadowbank Complex combined. When it comes to comparing Donlin to other undeveloped projects, NovaGold’s share of Donlin would come in above that of Blackwater (~300,000 ounces), Back River (~200,000 ounces), and Valentine (~170,000 ounces) combined. This metric alone suggests that NovaGold should trade at a premium to some of its developer peers, given that its production profile is unrivaled in North America.

So, what are the negatives?

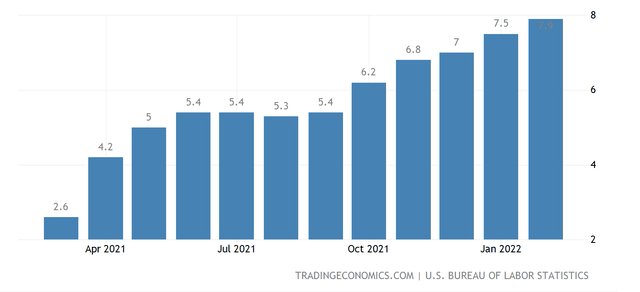

While Donlin boasts a near-unrivaled resource base and is located in a Tier-1 jurisdiction, the project is not cheap to build, and this isn’t helped by inflationary pressures. In fact, the most recent capex bill was estimated at ~$7.4 billion, but this was based on Q1 2020 pricing. Unless one has been living under a rock and has missed the past two years of inflation readings, I think it’s ambitious to assume that we haven’t seen cost creep given higher labor, fuel, and materials prices.

Inflation Readings – United States (U.S. BLS, TradingEconomics.com)

When it comes to real-world examples of projects under construction, the inflation has been worse than what we’ve seen in many cases, with massive cost blow-outs at Argonaut’s (OTCPK:ARNGF) Magino, IAMGOLD’s (IAG) Cote, and moderate cost increases at other projects like Seguela (FSM), and Red Mountain (OTCQX:AOTVF). At Magino and Cote, costs have come in more than 40% higher than initial estimates. While it’s difficult to estimate what level of cost creep Donlin will see if an updated study were done today with Q2 2022 pricing, I imagine the upfront cost would come in north of $8.5 billion.

This is not an unreasonable cost for a project with more than 33 million ounces of gold in reserves and a likely all-in cost to extract that gold that’s likely to come in below $1,000/oz. However, NovaGold cannot build the project on its own, given its current cash balance and access to capital, and that means that it does not entirely control its own destiny at Donlin. The good news is that Barrick Gold can easily afford to fund a large portion of the project, given that it’s generating ~$2.0 billion in free cash flow per annum. So, assuming Barrick decides to green-light Donlin, there is a path forward to production post-2027.

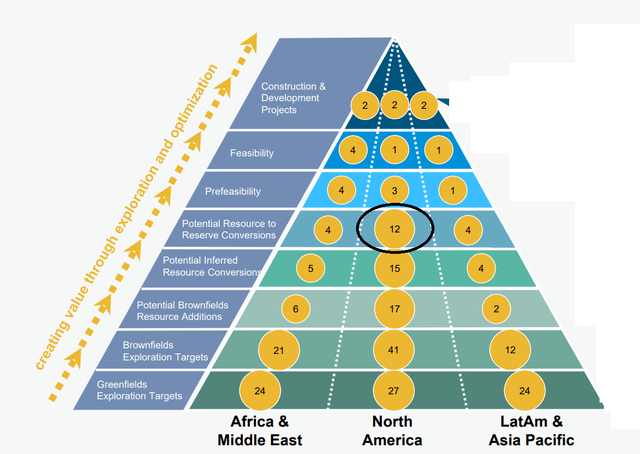

Barrick Gold Project Pipeline (Company Presentation)

However, if we look at Barrick’s project pipeline, Donlin is a few spots from the top and well behind higher-priority and higher-return projects like Goldrush/Fourmile, a third shaft at Turquoise Ridge, Zalvidar Chloride Leach, Pueblo Viejo’s Mine Life Extension Project, and Robertson, Getchell, and REN. This doesn’t mean that NovaGold won’t get built this decade, but I don’t see Donlin as a must-build project for Barrick.

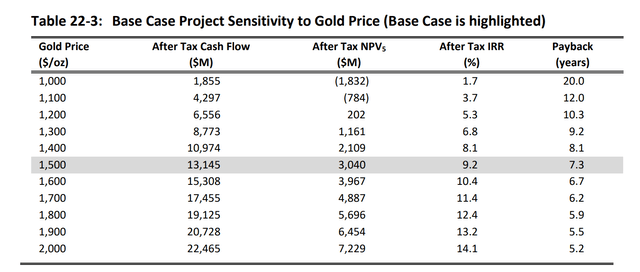

Donlin Project – Economics (Company Technical Report)

In fact, from an internal rate of return standpoint, I would argue that Donlin comes in a little low and below what I would expect most major producers are targeting to justify building projects (15% plus). This is because, despite its massive resource base, it has an After-Tax NPV (5%) of just ~$5.7 billion at a $1,800/oz gold price and a 12.4% After-Tax IRR. It’s important to note that the above figures are stale, and we could see a slight degradation in these figures after factoring in higher capex to build the project, and higher operating costs due to higher labor/fuel/consumables costs.

Barrick is generally known for being very conservative, so I would assume the company is looking at Donlin under a more conservative assumption than the $2,050/oz needed to get to a 15% IRR. Besides, even at stale capex figures, Barrick would need to outlay more than two years of free cash flow generation to build its share of this project (FY2021 free cash flow: ~$1.9 billion). Obviously, if the project can remain in production past 2060, this is a great investment, but there are other exceptional projects out there, either not owned by Barrick that it could own or in its portfolio, that might take priority over Donlin.

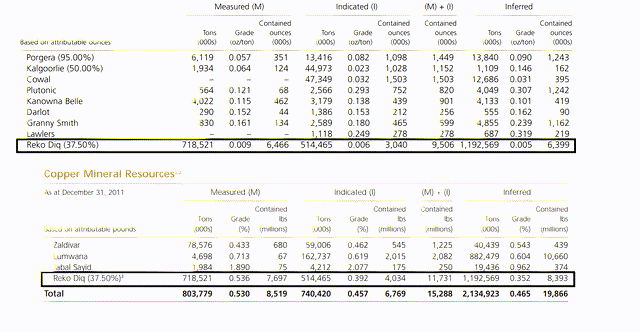

Reko Diq Resource Base (Barrick Annual Report 2011)

The other recent development worth noting that may not work in Donlin’s favor is the agreement at Reko Diq, a project that now has a new lease on life. While Reko Diq may not have Donlin’s scale, it is a very impressive project, with ~31.3 billion pounds of copper and ~25.3 million ounces of gold, plus an additional ~22.4 billion pounds of copper and ~17.1 million ounces of gold in the inferred category. This was a high-priority project for Barrick before a legal dispute delayed plans. The priority to get this into production last decade isn’t surprising because the Feasibility Study suggests the potential for the project to produce 265,000 ounces of gold and up to 425 million pounds of copper per annum at industry-leading margins.

Barrick has expressed its interest in copper, and from a capex standpoint, I would expect this to be cheaper to build than its share of Donlin. This does not mean that Barrick will shelve Donlin, and maybe the company is ambitious to look at building both projects. Still, with another very attractive project moving into the pipeline, inflationary pressures likely to push upfront capex higher, and the fact that we still don’t have a definitive date on construction at Donlin or a complete green-light, I think it’s safe to assume Donlin will not produce its first ounce of gold before 2028.

Q4 Conference Call Discussion Copper

Question: “You’ve talked about copper as a strategic assets previously talking about an M&A context. Is it fair to — I mean, I’m just trying to get an idea of what the copper, like it doesn’t really explicitly say your tenure profile what the copper production would look like? Should we expect that to grow beyond the 500 million pounds, it’s sort of into the back half of the decade with these investments that you are making at Lumwana right now and could potentially make as you say, you might have to make a decision on the super pit”?

– Anita Soni, CIBC

Answer: “So for me, we have every intention of growing our business, both in copper and in gold or in gold and then in copper. And the principal behind Barrick’s business philosophy is high-quality assets. That’s our focus. And so that’s what we’re hunting, whether it’s gold or copper.”

– Mark Bristow, Barrick Gold CEO

Summary & Technical Picture

Obviously, if the Donlin Project heads into production in 2028, NovaGold will have a share of more than $1.3 billion in annual revenue at current gold prices, which will translate to a much higher market cap. However, there’s no guarantee that Donlin does head into production, and a lot can happen in a six-year period. In fact, we may see the current gold market reach its peak and have topped by 2028, which could mean that producers no longer trade off fundamentals and are being thrown away like they were in the 2012-2015 period. For this reason, I am most interested in developers entering production by 2025 or producers churning out free cash flow already.

Besides, from a valuation standpoint, I think there are more attractive bets out there. This is because, even at a $1,800/oz gold price and assuming a 5% haircut to the previous After-Tax NPV (5%) figure to account for inflationary pressures (~$5.4 billion vs. ~$5.7 billion), NovaGold trades at ~1.0x NPV (5%) at a fully diluted market cap of ~$2.68 billion based on 50% ownership of Donlin. When there are diversified producers out there that have strong margins, growth profiles, and generous dividend/buyback programs trading near ~1.15x P/NAV like Agnico Eagle (AEM), I think it’s difficult to justify paying a similar valuation for NovaGold.

Finally, if we look at the technical picture, NovaGold is up 30% from its recent lows after finding support at its multi-year support level at $6.20. This rally has pushed the stock into the upper-third of its expected short-term trading range, with resistance at $8.20. Based on my criteria, which requires a 5 to 1 reward/risk ratio to enter positions in small-cap names, NovaGold is now outside of its low-risk buy zone, which came in at US$6.50 or lower. This doesn’t mean that the stock can’t go higher, but with a current reward/risk ratio of 0.25 to 1.0, I don’t see any reason to chase the stock above US$8.00.

Donlin Project – Exploration Upside (Company Website)

There’s no disputing that NovaGold owns a 50% ownership of an incredible project; the issue I see is that it’s unlikely to head into production in the next five years, and this could be an opportunity cost. The reason is that many producers are generating significant amounts of free cash flow at today’s prices and are likely to pay out special dividends if gold heads above $2,100/oz. NovaGold is not in a position to do this, given that it won’t be free cash flow positive before 2028, in my opinion.

Hence, for investors that must have exposure to Donlin’s massive resource base, I think the best way to get exposure to the project is through Barrick, which allows one to be paid to wait but still have exposure to Donlin if it is ultimately green-lighted. Meanwhile, investors get exposure to a very solid management team, a high single-digit free cash flow yield, and diversification benefits (copper/gold exposure + multiple mines). Having said all that, if NG were to dip below US$6.50 and closer to support, I would see this as a low-risk buying opportunity.

Be the first to comment