JuSun/iStock via Getty Images

“Philosophy is common sense with big words.” – James Madison

Today, we look at a diagnostic testing concern whose stock rose nearly 10% in trading Thursday on speculated interest in the firm by an activist investor. A full analysis follows below.

Company Overview:

Natera, Inc. (NASDAQ:NTRA) is an Austin, Texas-based clinical genetic testing concern that leverages its molecular and bioinformatics technology to detect proclivity to a plethora of maladies. Its product suite includes seven offerings in women’s health, two oncology tests, three organ health assays, and an out-licensed cloud-based platform to conduct the analysis. In total, the company processed 1.57 million tests in FY21. Natera was founded as Gene Security Network in 2004, changed to its current moniker in 2012, and went public in 2015 raising net proceeds of $178.5 million at $18 per share. The stock currently trades just under $39.00 per share, equating to a market cap of approximately $4 billion.

Technology

The company’s technology allows it to read DNA at a very granular level. As taught in biology class, DNA is comprised of chemical base pairs adenine-thymine and, cytosine-guanine – and it is the differing compositions of those pairs that drive biological diversity and in some cases disease. There are generally two types of genetic mutations. One is where large sections of the genome (many chemical bases) have been deleted or duplicated, while the other arises from a single base-pair alteration, known as a single nucleotide polymorphism (SNP). Natera’s technology can measure thousands of SNPs simultaneously employing massively multiplexed polymerase chain reaction, which amplifies the genetic material. The output of this reaction is then analyzed using algorithms that match it up with publicly available data on genetic variations. The company has used this cell-free DNA testing approach as the basis for its suite of diagnostics.

Women’s Health Products

Natera’s initial focus was women’s health, which is the source of a preponderance of its revenue since launching a preimplantation genetic screening test (now branded Spectrum) to detect for extra or missing chromosomes and segmental deletion in in-vitro fertilization embryos back in 2009. This offering was soon followed by what is now branded Anora Miscarriage Test, which assesses fetal chromosomes to understand the cause of miscarriage, in 2010.

Although the company does not disaggregate its revenue by product offerings, its best seller is its Panorama non-invasive prenatal test (NIPT) that detects fetal chromosomal abnormalities (e.g., Down syndrome, Edwards syndrome, triploidy, etc.) by drawing blood from the mother with 99% sensitivity and specificity of 99% for each disorder detected. Introduced in 2013, the Panorama NIPT was followed in 2014 by Panorama microdeletion panels, which screen for the five most common microdeletions that result in severe intellectual and physical disabilities, such as 1p36 deletion, Angelman syndrome, and Prader-Willi syndromes (amongst others). Both Panorama assays can be performed as early as nine weeks into gestation.

Marketed as the most accurate NIPT test in the market, Panorama is also the number one selling NIPT, despite being the fourth entrant into the market and going up against established players in the space, including LabCorp (LH), Illumina (ILMN), and many others.

Natera’s other large revenue generator in women’s health is its Horizon Carrier Screening test. It can be performed on individuals or couples either before or during pregnancy to determine if they are carriers for over 200 genetic conditions, including Cystic Fibrosis, Duchene Muscular Dystrophy, etc. Introduced in 2012, Horizon can assess the subject from either a saliva or blood sample.

The company also offers single-gene NIPT screens for 25 single-gene disorders under its Vistara banner, which was introduced in 2017. Furthermore, Natera provides a hereditary cancer screening test (Empower) that was launched in 2020 and a non-invasive paternity test using blood from the pregnant mother and alleged father (2011).

The domestic market for NIPT and carrier screens is ~$5 billion.

Oncology

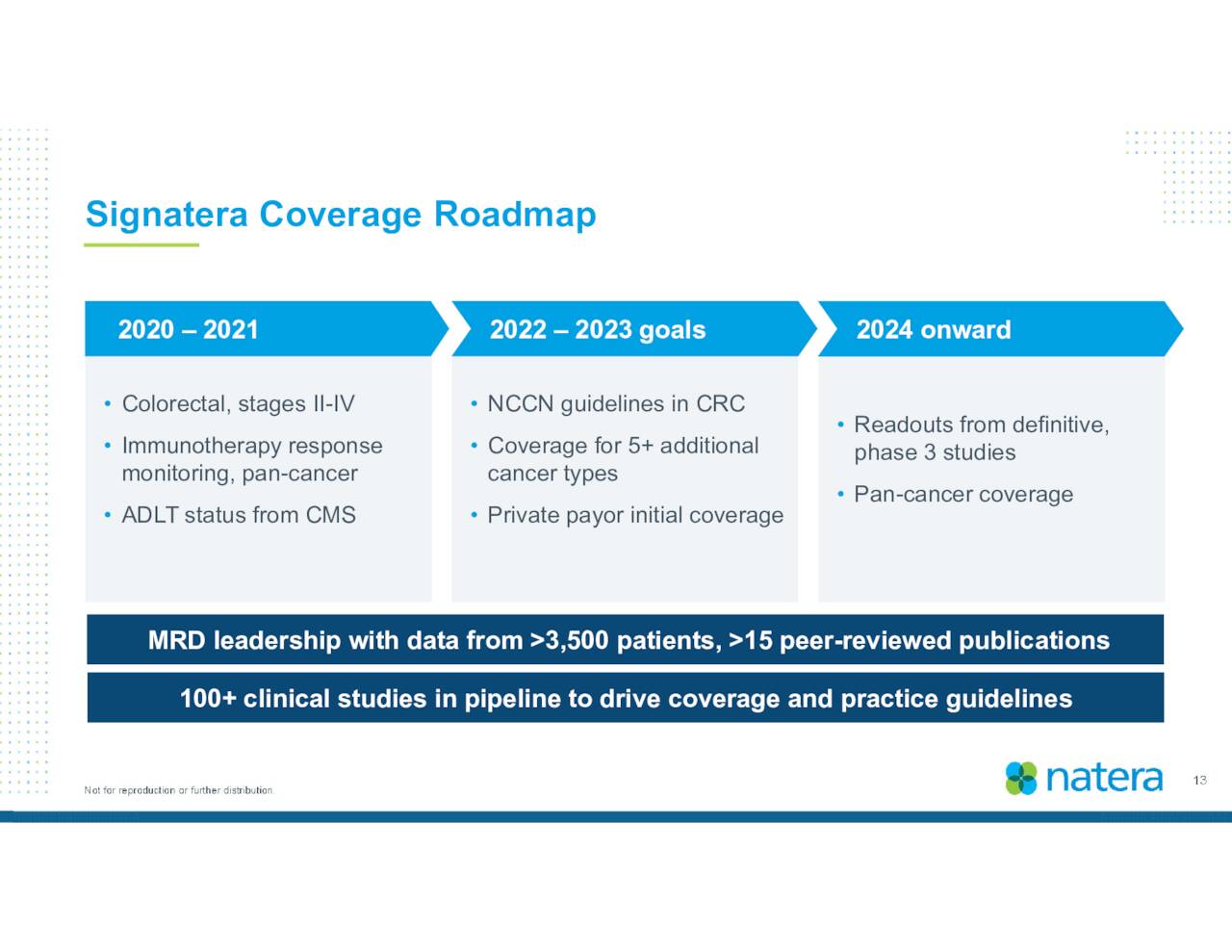

With women’s health as a foundation, Natera began branching out into other areas, including oncology, introducing tests for molecular residual disease (MRD) in 2017. MRD is the presence of small traces of cancer in the blood (such as circulating tumor DNA), which, if left undetected can result in a recurrence. To test for the presence of MRD, the company created Signatera, which provides a custom assay that measures the presence of 16 tumor-specific clonal mutations. It was followed by Altera in 2021, a genomic test that highlights alterations and biomarkers in a patient’s tumor that can be employed by oncologists to instruct treatment decisions. Although currently a small part of the Natera’s top line, the number of Signatera and Altera tests processed in FY21 more than quadrupled from FY20 to over 76,000. Management estimates the total addressable market for these two tests at ~$21 billion.

May Company Presentation

Organ Health

The other high-growth target for the company is organ health, launching its Prospera Kidney test in 2020, followed by the Prospera Heart and Lung assays in 2021. All three diagnostics measure the level of donor-dependent cell-free DNA in the organ transplant recipient’s blood, high levels of which are indicative of immune rejection. These tests are marketed as an alternative to invasive biopsies with management estimating the total addressable market for these three organs at $2.75 billion. Over 42,000 organ tests were processed by Natera in FY21, up from only 11,000 in FY20.

Constellation

Approximately 9% of Natera’s FY21 topline was generated by licensing its Constellation cloud-based distribution/analysis service so licensees can process their own tests. This line item contributed FY21 revenue of $58.3 million, up 145% over FY20.

Share Price Performance

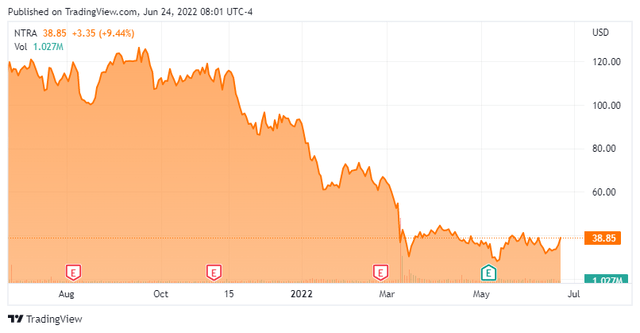

As can be gleaned from the product overview, Natera is growing like a weed, with FY21 total revenue up 60% to $625.5 million and product revenue up 54% to $567.1 million. With this type of growth and the announcement concurrent to the company’s 2Q21 earnings report that its NIPT unit was cash flow neutral, the market bid shares of NTRA to an all-time high of $129.09 in September 2021, at which point it was trading at 20x FY21 revenue. Soon thereafter, anything biotech-related began to swoon.

Furthermore, despite its Panorama NIPT product suite achieving cash flow neutrality, Natera is a wildly unprofitable concern, losing $468.2 million from operations in FY21 (versus a loss of $216.3 million in FY20) and requiring four additional equity raises totaling net proceeds of $1.15 billion since its public debut in 2015. With the risk-off trade coming into vogue toward YE21, shares of NTRA suffered further devaluation.

May Company Presentation

However, there were issues specific to Natera that were also contributing to its poor performance. First, because these tests were being billed in some instances – at least in the opinion of third-party payers – without medical need, many payors began requiring prior authorizations from healthcare providers before they would approve reimbursement in late 2017. The prior authorization process is time-consuming, acting as a deterrent. At this point, a non-profit dubbed My Genome My Life was formed to assist healthcare professionals in the prior authorization process free of charge. Seemingly connected to Natera, this non-profit has issued an eyepopping 1.8 million prior authorizations since inception with only three employees listed. The organization is allegedly run by a woman who uses an alias, whose real name shared an address with Natera’s head of sales when it was formed. If these purported connections to My Genome My Life have merit, Natera may have some ethics questions to answer (at a minimum). It has vigorously denied any wrongdoing. However, the company suffers from a checkered past, including paying an $11 million fine to settle Department of Justice fraud allegations of improper sales and billing of Panorama NIPT between 2013 and 2016.

Then in early January 2022, the New York Times printed a derisive article on microdeletion tests, stating that positive results are incorrect 85% of the time. Furthermore, in March of this year, CareDx (CDNA) won its $45 million false advertising case against Natera. The jury found that Natera and its senior executives “intentionally and recklessly misled the transplant community by deliberately engaging in false advertising in the promotion and marketing of its Prospera kidney transplant rejection assessment test.”

Then in March 2022, Hindenburg Research issued a short report on Natera, echoing the previous issues plus allegations that it was double billing patients for microdeletion screenings and employing other untoward marketing practices. The review also brought notice to the fact that it licenses all its sequencers for its NIPT screens from competitor Illumina, leaving it vulnerable. This report caused a 33% one-day plunge in Natera’s stock to $36.80 a share.

In April 2022, the FDA issued a warning stating that NIPTs may produce false results.

Although it has bounced approximately 33% off its lows, Natera’s current share price of $39.00 represents an approximate 70% drop from its all-time high.

1Q22 Earnings & Revised Outlook:

May Company Presentation

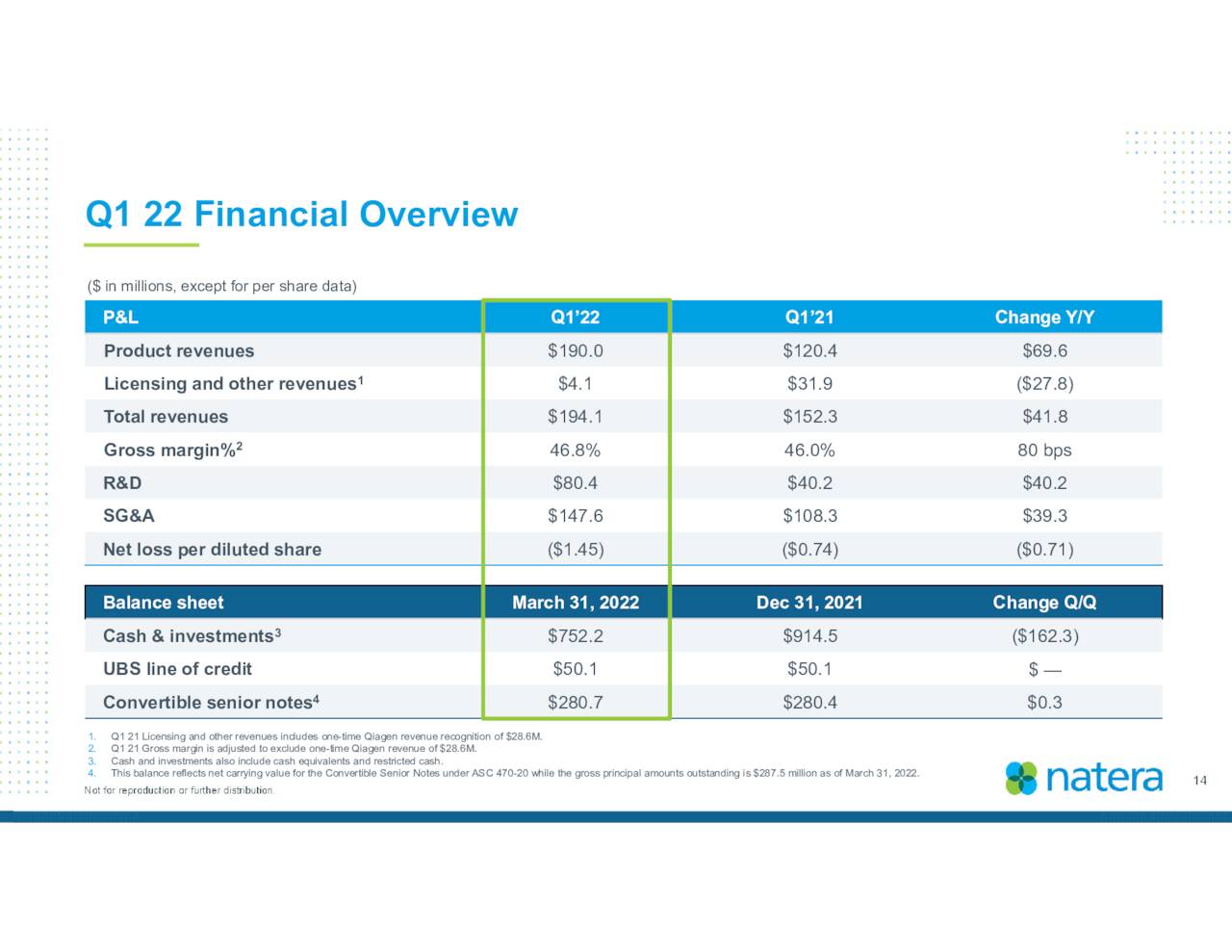

With that as the backdrop, the company reported better than expected financial results on May 5th, 2022, producing a 1Q22 GAAP loss of $1.45 a share on revenue of $194.1 million, representing a $17.5 million topline beat versus Street expectations and a 27% improvement over the prior-year period.

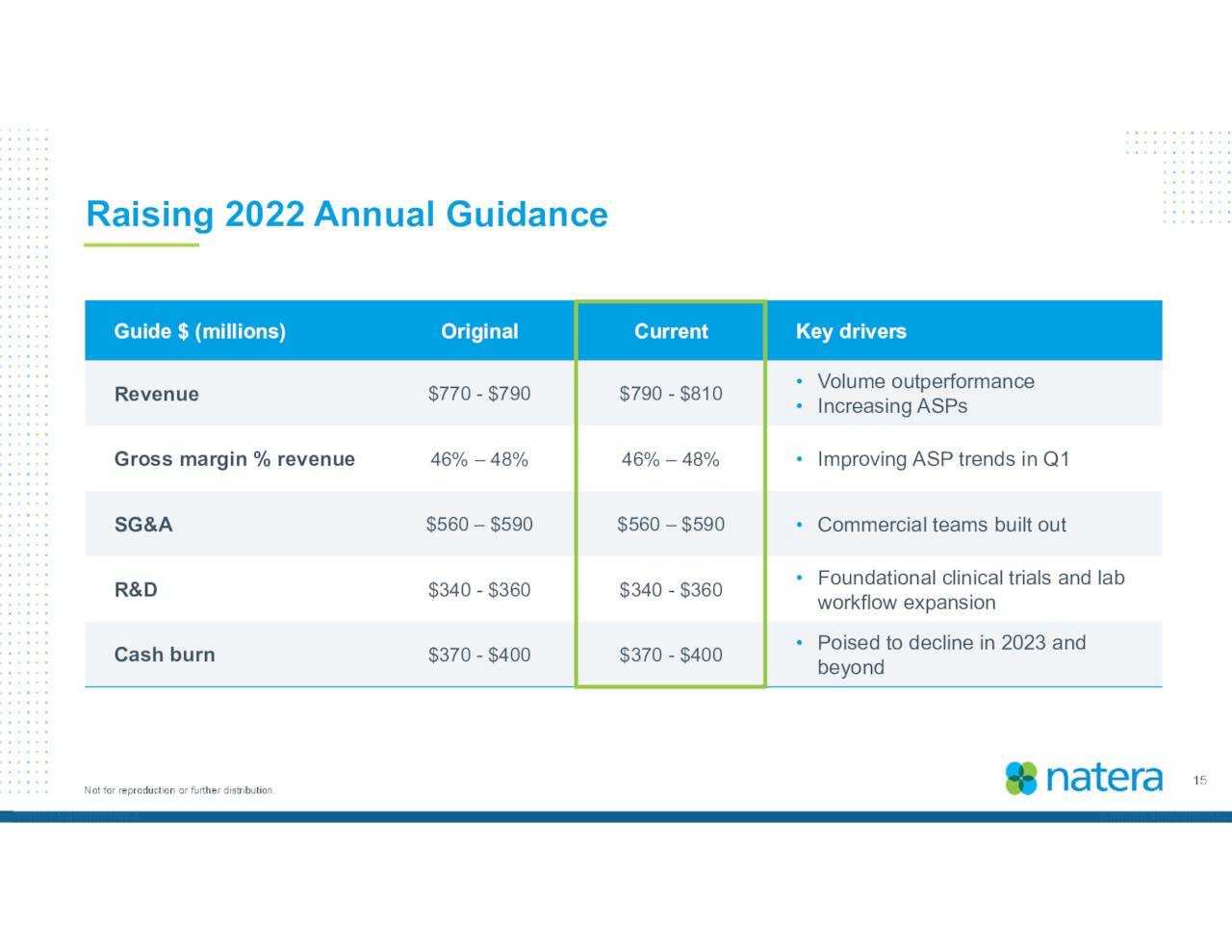

May Company Presentation

Furthermore, management increased its outlook for FY22, raising its revenue projections from $780 million to $800 million with 47% gross margin, although its expected cash burn of $385 million did not change – all based on range midpoints. That said, Natera predicted that breakeven cash flow will be achieved when revenue reaches $1.4 billion and gross margin touches 55%, which appears many years away.

Balance Sheet & Analyst Commentary:

Thanks to its numerous equity capital raises, Natera held cash and short-term investments of $752 million and debt of $330.8 million as of March 31, 2022. With its cash burn of $335.2 million in FY21, the company was in decent financial stead but needs to cauterize its bleed.

Despite the negative short report and the market’s pivot away from companies that are not going to earn a profit anytime in the near future, Street analysts are very bullish on Natera, featuring four buy and seven outperform ratings against only one hold with a median twelve-month price target just under $75 a share. They expect the company to lose $5.87 a share on revenue of $805.4 million in FY22, followed by a loss of $5.05 a share on revenue of $1 billion in FY23, representing 29% and 24% increases at the top line (respectively), but little progress at the bottom line.

Further expressing the bullish stance on Natera, Founder and Chairman Matthew Rabinowitz purchased 219,820 shares at an average price of $28.74 on May 12, 2022. Additionally, CEO Steven Chapman has agreed to take all his compensation in stock during 2022.

Verdict:

Much in same way the success of Microsoft (MSFT), Cisco Systems (CSCO), and Intel (INTC) contributed to the ridiculous valuations of the late 1990s and very early 2000s, the success of Amazon (AMZN) and Google (GOOG, GOOGL) have contributed to the ludicrous valuations of the early 2020s. Amazon is arguably the greatest success story of the 21st century, but it now trades at less than two times FY22 revenue.

To suggest that Natera – obviously in a different stage of its life cycle – deserves to trade at a now revised 4.7x FY22E revenue (down from 20x) is patently absurd, especially when the cost of money is no longer free. The company has no chance to earn money until at least FY25. It’s growing revenue quickly, but investors should first and foremost evaluate companies on their bottom lines. Before the overall market slide and recent Natera-specific negative press, Street analysts featured price targets that represented price-to-FY22E sales of 25 a short three months ago. It can be argued that none of these Street analysts were around 20 years ago when valuations attained this level of irrationality.

Natera is a fast-growing company, but because its gross margins – at a forecasted 47% – are nowhere near the ~80% of pharmaceutical concerns that justify a five times revenue multiple, it does not deserve a drug company valuation in my opinion.

The company definitely could use an activist investor to help right the ship. Outside this, with allegations of inaccurate tests and billing fraud in the background, despite its significant pullback and insider buying, there is likely further downside in shares of NTRA.

“If you’ve got the truth you can demonstrate it. Talking doesn’t prove it.” – Robert A. Heinlein

Be the first to comment