Justin Sullivan/Getty Images News

Sometimes you are right for the wrong reasons. That is what happened with our recommendation to consider taking profits on KLA Corporation (NASDAQ:KLAC). While shares are lower now than they were when we made the ‘Sell’ recommendation, the company has actually outperformed the market, and it has continued to grow it intrinsic value at such a rate that shares now look cheap again.

Seeking Alpha

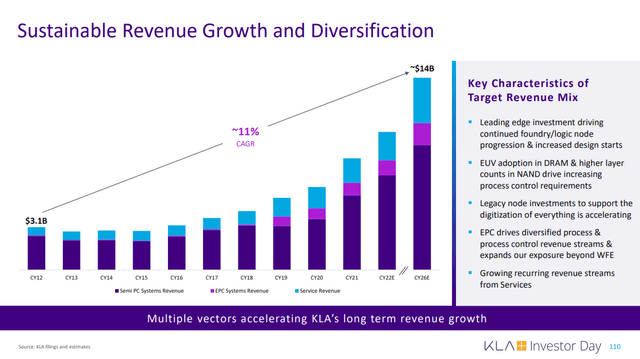

One of the reasons that the intrinsic value has caught up so quickly with the share price is that revenue has been growing really fast. Since 2012 revenue has grown at a CAGR of 12%, but that has been even faster in recent years thanks to rapidly growing EPC Systems Revenue and Services Revenue. Service Revenue is becoming quite important, and is very attractive give it can be thought of as recurring in nature. An interesting fact about it is that over the life of an average KLA tool, service revenue exceeds the initial tool sale price. It is also worth noting that >50% of the installed base is older than 18 years old, and that >80% of tools shipped in KLA history remain in production.

Financials

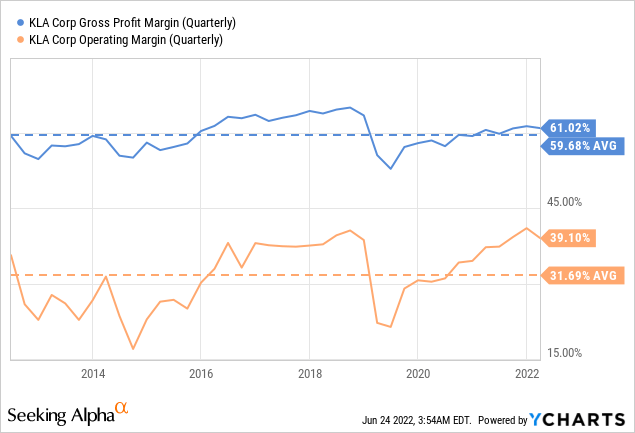

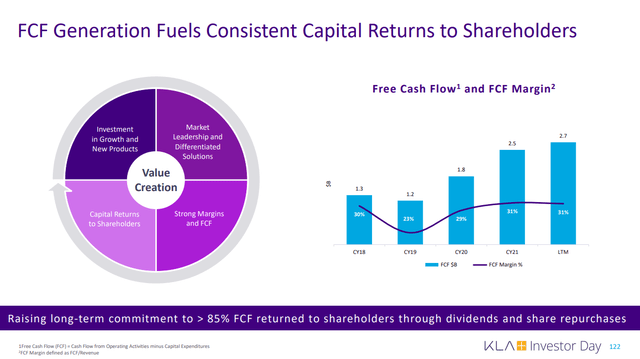

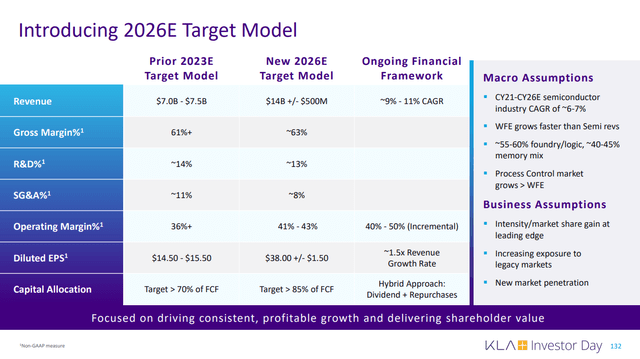

Meanwhile profit margins have remained strong, which has allowed the company to generate record diluted earnings per share and free cash flow. Its margins are some of the best in the semiconductor industry, showing the strength of the company’s competitive moat. Its industry leading margins are also the result of market leadership, product differentiation, and operational excellence.

KLA also benefits from strong earnings leverage, it is targeting long-term earnings growth of 1.5x revenue. It should be even higher thanks to the consistent share repurchases the company has been doing.

At its most recent investor day the company promised that for the next few years it plans to return >85% of its free cash flow to investors through dividends and share repurchases. Free cash flow has been growing significantly together with earnings.

Balance Sheet

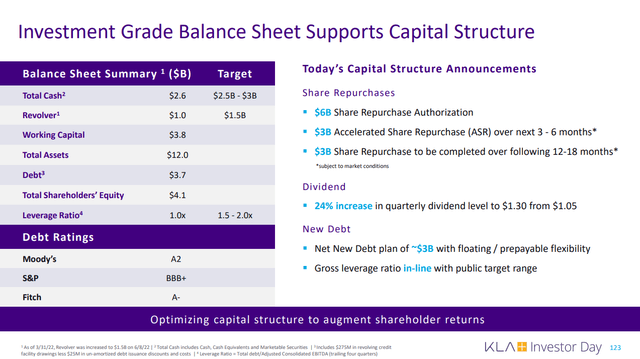

KLA’s investment grade balance sheet is quite strong, and is allowing the company to become more aggressive with its share repurchases. It is also supporting a 24% dividend increase, from $1.05 per share quarterly to $1.3.

Valuation

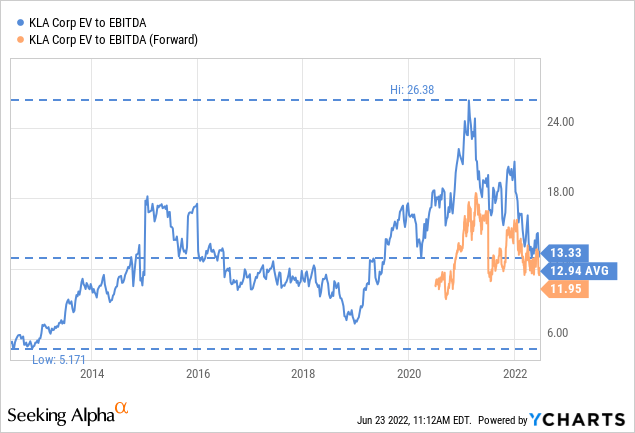

Between the share price declining, and fundamentals getting stronger, the valuation multiples have very quickly corrected. EV/EBITDA is again close to the ten year average of ~13x, and the forward EV/EBITDA is even lower.

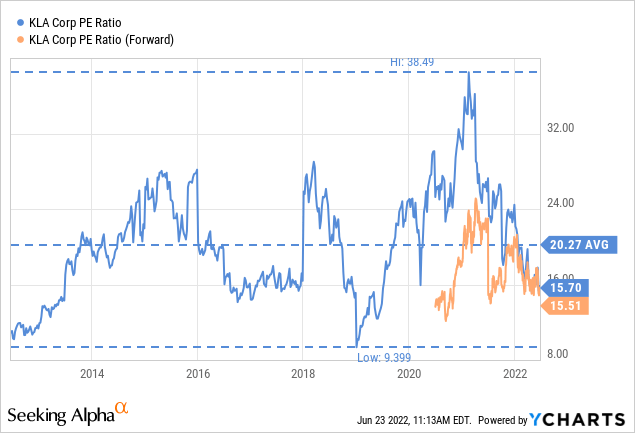

The P/E ratio has also come down dramatically, and is now at a very reasonable ~15x, both for the trailing twelve months and the forward price/earnings ratios.

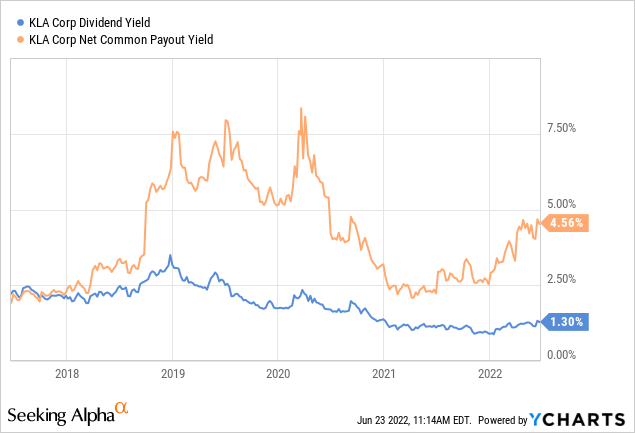

The dividend remains low, but when combined with net share repurchases, the net common payout yield is actually very decent at ~4.5%. It is also important to remember about the dividend, that while relatively low, it has been growing at a fast pace, approximately a 15% CAGR since 2006.

Another way to look at the valuation is based on what the company is guiding for in earnings for 2026. It is expecting diluted EPS of $38 +/- $1.50, based on that and the current share price we can see that it is trading at ~9x this estimate.

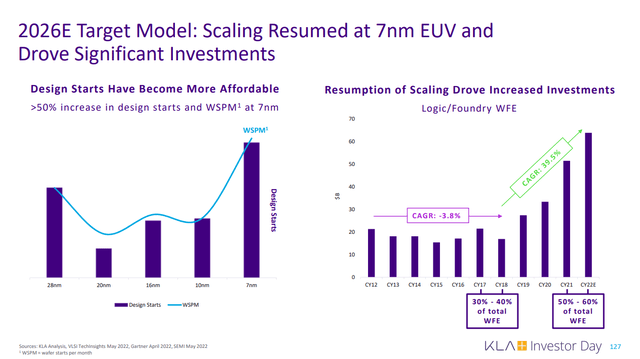

One of the reasons the company is so confident about its growth prospects is that after stalling for a few years, Moore’s Law is scaling again, driving increased investments in logic/foundry WFE.

We are a bit more cautious compared to the company, and in our model we only assume diluted EPS growing at ~9%, therefore not incorporating operating leverage. For the first three years we use average analyst estimates as compiled by Seeking Alpha, and we use a GDP-like 3.5% terminal growth, even though semiconductors are growing faster than GDP. We discount everything with a 10% rate, and get a net present value of $443. This is higher than the current share price despite using conservative assumptions. We therefore believe shares are now under-valued.

| EPS | Discounted @ 10% | |

| FY 22E | 20.85 | 18.95 |

| FY 23E | 24.11 | 19.93 |

| FY 24E | 24.87 | 18.69 |

| FY 25E | 27.11 | 18.52 |

| FY 26E | 29.55 | 18.35 |

| FY 27E | 32.21 | 18.18 |

| FY 28E | 35.11 | 18.01 |

| FY 29E | 38.27 | 17.85 |

| FY 30E | 41.71 | 17.69 |

| FY 31E | 45.46 | 17.53 |

| FY 32 E | 49.56 | 17.37 |

| Terminal Value @ 3.5% terminal growth | 762.39 | 242.92 |

| NPV | $443.98 |

Risks

The two main risks we think investor should consider before buying KLA are the risk of building over-capacity by the industry, something that has happened in the past and which has led to strong cyclicality of earnings for the companies involved. The other important risk is the growth deceleration that could result if the economy enters a recession.

Conclusion

We believe KLA has caught on with its valuation, and then some, making shares under-valued at current prices. The future looks bright for the company, and it has a number of tailwinds in its favor, including the renewed scaling of Moore’s Law that is driving increased investing in the semiconductor industry. Shareholders are expected to be rewarded with increased share repurchases and dividend increases. We are correcting our previous call to take profits in KLA, and believe investors can be justified by fundamentals in purchasing the shares at current prices.

Be the first to comment