tolgart/iStock via Getty Images

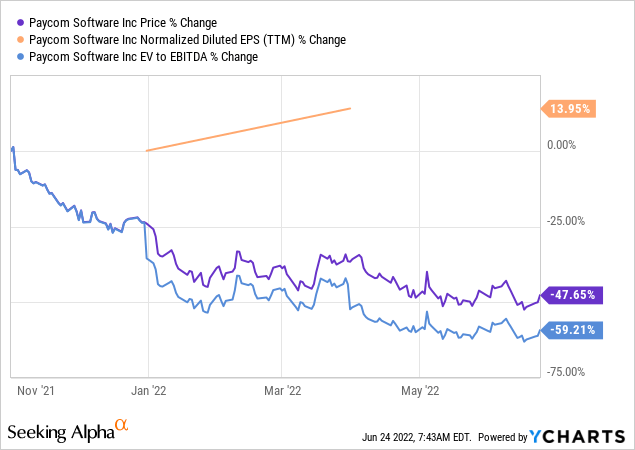

Paycom Software (NYSE:PAYC) forms part of the 25 stocks shortlisted by analysts at Credit Suisse whose share prices fell while earnings gained. Thus, as shown in the chart below, the company has suffered from a drawdown of -48% which lowered its EV/EBITDA multiple by 59%, while earnings improved by nearly 14%.

Therefore, my aim with this thesis is to chart an investment case for the company by going through the financial results of the first quarter of 2022, the guidance for the whole year as well as touching on product strength.

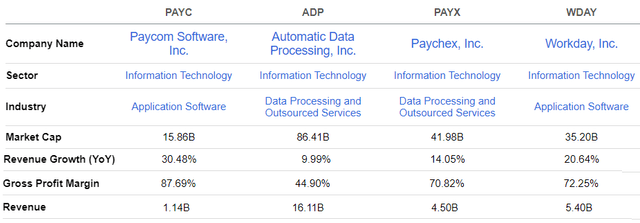

I start by comparing growth and profitability metrics with others operating in the HCM (human capital management) field.

Comparison with Peers

A comparison reveals that the company is growing at 30.5%, or more rapidly than its peers. Another noteworthy point is its superior gross margins of 87.7%, which is way higher despite the much lower revenue base. Now, gross profits are obtained by subtracting the cost of revenues from sales generated over a one-year period and, as a software company, Paycom’s higher margins can be explained by better product integration, possibly due to the different modules which comprise its HCM like recruitment, payroll, or benefits management being more integrated with each other compared to competitors.

Comparison with peers (www.seekingalpha.com)

I confirmed Paycom’s better integration on the Gartner product review website, where the company’s technology was mentioned as being “Easier to integrate and deploy” when compared with alternatives and competitors.

Pursuing further, better integration also signifies a better user experience whereby one can seamlessly navigate through all the modules either on a laptop or smartphone without noticing any change in look and feel. It also makes the task of the sales team much easier as they can more easily demonstrate different product features to potential clients. This may be the reason why the company has seen its SG&A (Sales General and Administrative) expenses as a percentage of revenues fall, from 50.6% in Q3-2021 to 38.3% in the last reported quarter, in a period marked by rising wage inflation.

Along the same lines, with a platform that is already integrated, there is less need to make tweaks to adjust for new customer requirements thereby implying fewer research expenses. Thus R&D as a percentage of revenues has also gone down during the last three quarters.

Now, with both sales, administrative and research expenses decreasing (in relative terms), operating margins have doubled from 16.9% in the September 2021 quarter to 35.72% in Q1. These margin gains have led to three straight earnings beats.

The Downside Risks

However, despite all these beats, Paycom’s shares have slid by more than 22% during the last year as shown by the orange chart below compared to less than 20% for Invesco QQQ Trust (QQQ) which mostly holds mega-cap tech stocks.

Comparison with the QQQ (www.seekingalpha.com)

This difference in performance basically shows two things.

First, this is a market that is radically different from the bull one which has been in place for the last ten years and where technology stocks, especially the big ones, have dominated others. The reason for this domination mainly lies in the ability of tech companies to deliver double-digit growth by taking advantage of cheap money or funds borrowed at low-interest rates.

Cheap money also made it easy for them to raise equity through public offerings and prioritize growth, often at the expense of profitability. Now, with the Federal Reserve raising interest rates rapidly, the availability of cheap money to sustain growth is being questioned. However, this is not the case for Paycom which is achieving profitable growth but has nonetheless been impacted by the contagious effect from the wider tech sector.

Second, its valuations remain high with its forward P/E multiple of 49.26x which is above the IT sector median by a whopping 190%. Now, in a market where investors now lay more emphasis on value or stocks with lower price to earnings multiple, companies like Paycom are being punished as there are doubts as to whether they can continue delivering the same level of earnings to justify their high valuations when going forward.

In light of the above arguments, more value-focused investors may prefer to ignore the stock, but for those who are patient enough to identify opportunities in these uncertain times, I assess whether Paycom’s revenue model possesses pricing power, or the ability to raise prices rapidly in order to cover costs.

Identifying Opportunities

With consumer confidence being low and recession risks starting to take center stage among market participants, there are doubts whether corporations will continue spending, in turn impacting demand for many items including software. Here, contrarily to Automatic Data Processing (ADP) which is increasing prices aggressively, Paycom’s executives seem to have a different approach as they increase charges only if they are able to increase the return on investment for a client.

Still, they are seeing better revenue growth (as per the above peer comparison table), especially at a time when the cost of doing business is going higher with the effect being felt more by small companies, which form part of the business segment which happens to form the bulk of Paycom’s clients. At this point, it must be mentioned that, while it caters mostly to the need of small to medium-sized businesses which do not have the financial capability to sustain a full HR team, Paycom’s marketing efforts also targets larger employers (above 1000 employees) where its self-service module is getting more traction.

Thinking aloud, the fact that the company is able to grow rapidly without any aggressive price increase does suggest a differentiated business model, one which relies on driving wider adoption of products among the existing customer base. As a matter of fact, 98% of its first-quarter revenues consisted of recurring revenues or an increase of 30% from 2021. This ability to squeeze more sales out of existing customer relationships is a big positive not only in terms of constituting a more stable revenue stream but also for profitability reasons as fewer marketing man-hours have to be spent on generating new sales leads.

Valuations and Key Takeaways

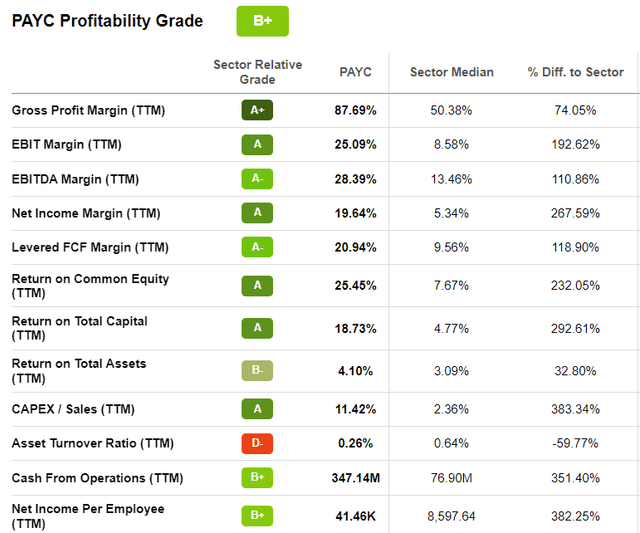

Thus, emphasizing profitability, Paycom’s EBITDA margins are expected to reach 40% (mid-point) for 2022, compared to 28.5% in 2021, or an increase of 40.3%. This would represent an exception in a business environment where the talk is mostly about earnings squeezes, especially for those companies that do not have pricing power. Tellingly, a 40% EBITDA margin would represent nearly three times the IT sector median of 13.46% as per the table below. Moreover, with its EBIT (operating) margin already being on the high side, Paycom’s overall profitability grade actual profitability grade of B+ could be upgraded at the start of 2023 after it publishes full-year 2022 financial results.

Profitability grades (www.seekingalpha.com)

Coming back to valuations, an increase in EBITDA by 40% would conversely reduce the forward EV/EBITDA to 17.5x from 29.19x assuming the enterprise value remains constant. At the same time, with most software companies expected to face margins pressures, the average sector EV/EBITDA should rise above the current value of 11.56x, thereby raising the median valuation. This would in turn make Paycom more attractive from a valuation perspective.

Thus, with higher EBITDA leading to lower valuations (EV/EBITDA) from 2023 and after a 48% dip from its all-time high, Paycom is a buy. As per momentum indicators, the company could rise up to the $290 level in the short term. I am also bullish as the cash position has improved significantly from $278 million at the end of December to $360.8 million in March 2022, with a debt of $102.3 million, signifying that Paycom is net cash positive.

Finally, after comparing with peers, Paycom distinguishes itself by its better growth and profitability metrics and makes for a solid investment case. This said, its uptrend will not be a smooth one and will be highly volatile, especially at times when the Fed increases rates or provides updates around quantitative tightening, which is about reducing the money supply.

Be the first to comment