jittawit.21/iStock via Getty Images

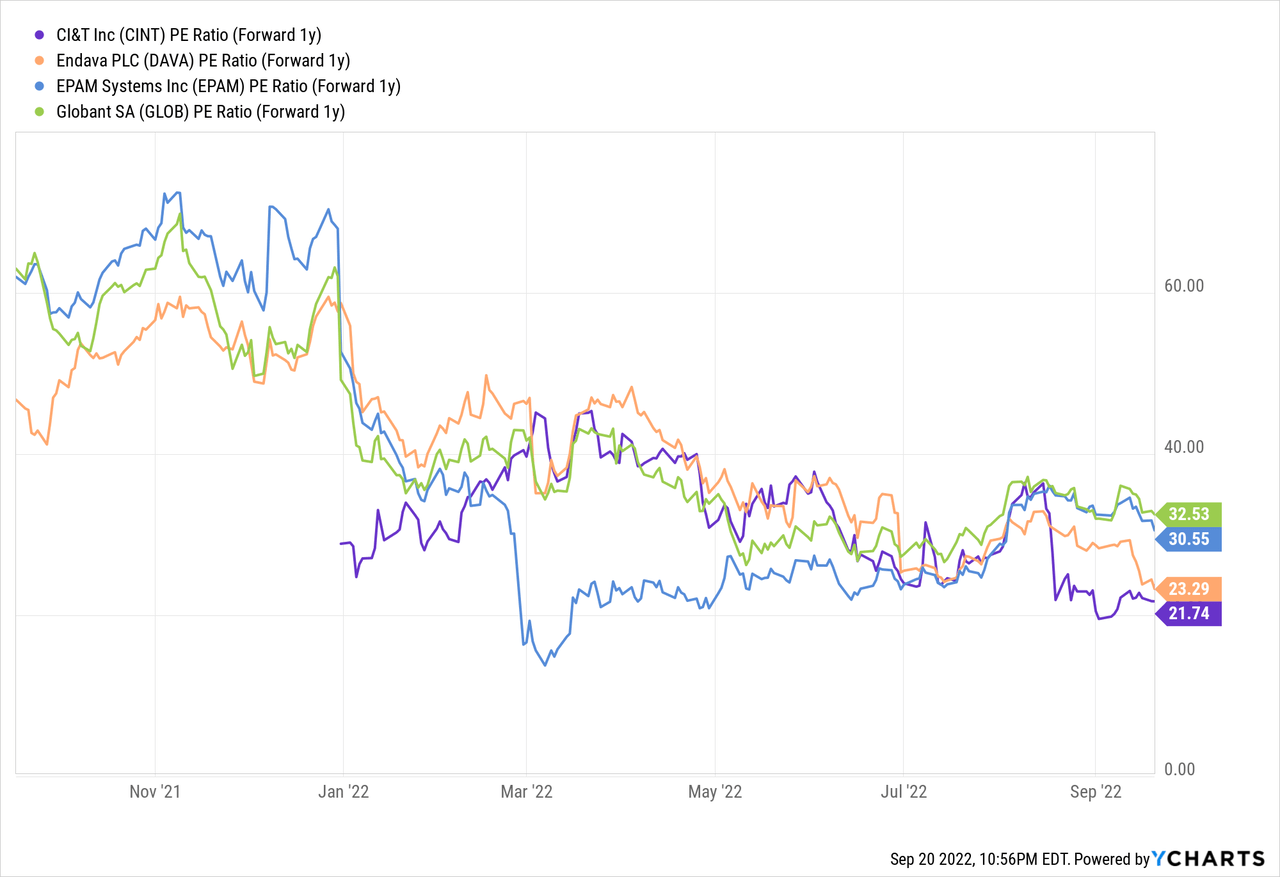

Software engineering services provider CI&T (NYSE:CINT) has had a rough go lately, suffering another quarterly earnings miss. While most of the delta was due to unfavorable FX impacts, the company was not immune from the macro headwinds, citing softer demand from its digital-native client base. As a result, the 2022 revenue guidance has been cut (even on an FX-neutral basis) alongside margins. Recent acquisitions, while positive for the long-term growth runway, could also result in near-term margin dilution, although CINT should see a recovery once it begins to realize synergies. Over the long run, the CINT bull case remains intact, in my view – the company maintains exposure to the digital transformation trend, with its high-growth LatAm client base also allowing it to sustain industry-leading growth for the years to come. The stock still trades at a relative discount to global peers such as Endava (DAVA), EPAM Systems (EPAM), and Globant S.A. (GLOB), paving the way for a re-rating as the company further builds out its post-IPO track record.

Falling Short of Expectations Amid the FX Volatility

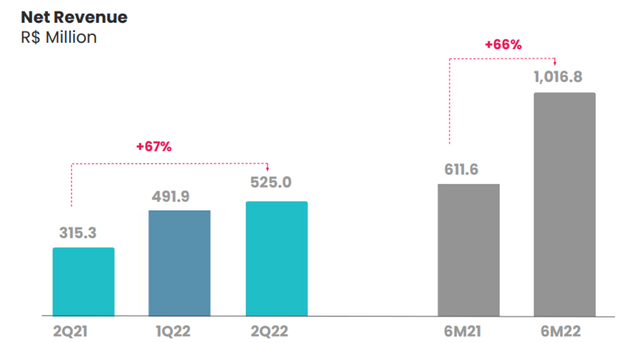

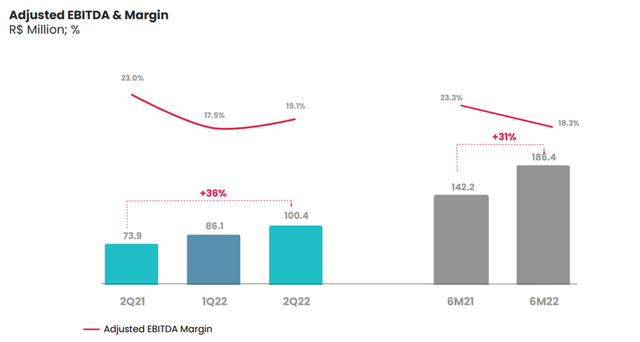

Unfavorable FX impacts clouded CINT’s Q2 2022 earnings, driving a headline revenue miss of BRL525m; without the currency headwinds, revenue would have been a solid BRL550m. While the implied ~27% organic growth was generally below peers’ >30% during the quarter, CINT’s tougher YoY comps need to be factored in as well.

The revenue miss led adj EBITDA to also miss expectations at BRL100m, as margins reached 19.1% and gross margins stood at 35.0% for the quarter. In contrast, adj EPS of R$0.39/share outperformed at +4.8% YoY (or $0.08/share on a USD basis and +12.7% YoY), although this was largely due to a one-off accounting change. While management has started excluding acquired intangible amortization from adj net income for the latest quarter, the prior quarter’s numbers were left unchanged. In effect, the EPS numbers will not be comparable YoY until next year, so investors will need to manually adjust out the impact or use the adj EBITDA comp as a baseline.

Revenue and EBITDA Guidance Trimmed

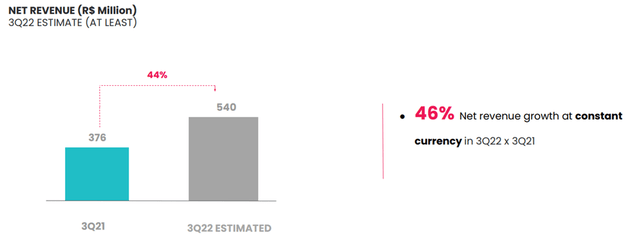

Following the Q2 miss, it came as no surprise that CINT revised its Q3 2022 revenue outlook lower to >R$540m (+44% YoY or +46% YoY in constant currency terms), while its full-year outlook now points to revenue growth of >49% YoY (well below the prior >59% YoY) and +55% YoY in constant currency terms. While FX again played a part (guidance assumption is now at 5.1 BRL/USD vs. the prior 5.2 BRL/USD), the latest downward revision reflects demand weakness across its digital-native client base as well. M&A is another factor to watch out for – while CINT has established a solid track record of integrating acquisitions, there is always execution risk (particularly employee churn), so the inorganic contribution could be a swing factor in the near term.

Similarly, management also cut its full-year margin expectations by 1%pt to >19% (down from >20% previously), as FX headwinds and increased SG&A expenses are set to weigh on profitability. Recent acquisitions also pose a material risk to the margin profile, given the acquired businesses run at lower margins than the core CINT business. This is more near-term risk than a long-term one, though, as management intends to extract synergies and bring margins up towards the group average over time. The implications on project ramp-ups across digital-native and startup companies (mid-teens % revenue contribution) will also be worth watching, particularly given the more challenging funding environment today.

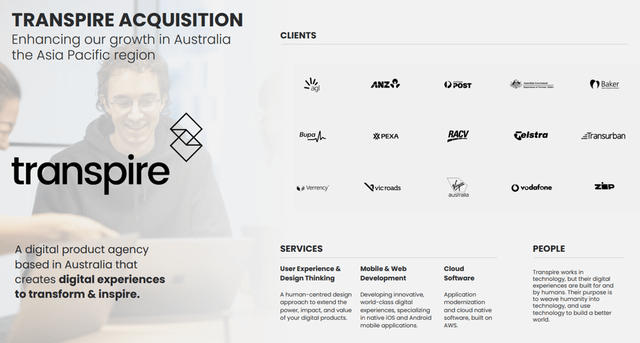

Expanding into the Asia Pacific with Transpire Acquisition

Outweighing the downbeat earnings report was CINT’s opportunism on the M&A front, following up the acquisition of tech solutions providers Box 1824 with Australian digital tech consultancy firm, Transpire. The latter is a testament to the quality of the CINT M&A pipeline – Transpire’s clients include the likes of Vodafone (VOD) and Virgin Australia (OTCPK:VBHLF), with revenue generation at A$15.5m (or $10.9m) on a trailing twelve-month basis.

In total, CINT will pay an enterprise value of A$23.4m (or $16.4m) for the acquisition, implying a reasonable ~1.5x EV/Sales valuation (well below where CINT stock trades). The Transpire acquisition has not yet closed and, thus, has not been included in the updated guidance numbers for now. While there will likely be some near-term margin dilution as CINT integrates these acquisitions, the addition of Transpire fits in nicely with the broader strategy of strengthening its international presence and gaining regional expertise while also adding to the existing talent base. Given the reasonable deal price as well, I expect the acquisition to pay off over the long run.

Bull Case Intact Despite the Near-Term Headwinds

While CINT’s underwhelming Q2 2022 results will weigh on sentiment for a while, the structural bull thesis remains intact amid growing demand for IT services globally. In sum, CINT offers exposure to attractive secular tailwinds, including rising enterprise-level digitalization in LatAm, as well as near/offshoring opportunities with multinational clients. The acquisition of Transpire Technology is a positive step in this regard, supplementing the additions of Somo Global and Box 1824 in enhancing CINT’s service offerings and competitiveness.

In the near term, however, investors will have to stomach some margin dilution, in addition to the ongoing FX volatility; CINT should see a recovery, though, once it extracts synergies. While some relative valuation discount was previously justified due to the lack of an execution track record as a listed company, the current gap seems too wide and should narrow over time as CINT continues to deliver peer-leading growth.

Be the first to comment