Marko Geber/DigitalVision via Getty Images

Teva Pharmaceutical (NYSE:TEVA) is a health care/life sciences company in the Health Care sector. According to the Wall Street Journal, the company engages in the development and production of medicines. Its products include medicines for cardiovascular diseases, pain relievers, obesity, cancer and supportive care, infectious diseases, human immunodeficiency viruses, and colds and coughs.

Teva was a shot stock about a decade ago when the turn toward generic drug availability was becoming pronounced. But sure enough, strong pipelines out of companies like Pfizer (PFE), Merck (MRK), and Eli Lilly (LLY) turned out to be much better placed to park money for investors in the Health Care sector.

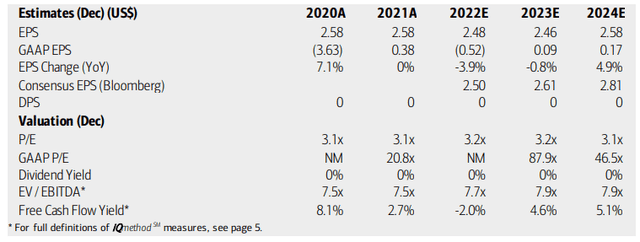

Today, Teva struggles with negative, though improving, earnings per share (GAAP) and a negative free cash flow yield, according to analysts at Bank of America Global Research. Using operating earnings, however, the stock looks cheap at just 3.2x 2022 and 2023 adjusted earnings. Moreover, the Bloomberg EPS consensus forecast calls for slowly climbing profits through 2024. Teva does not pay a dividend, however.

Teva Pharma Earnings and Valuation History & Forecast

BofA Global Research

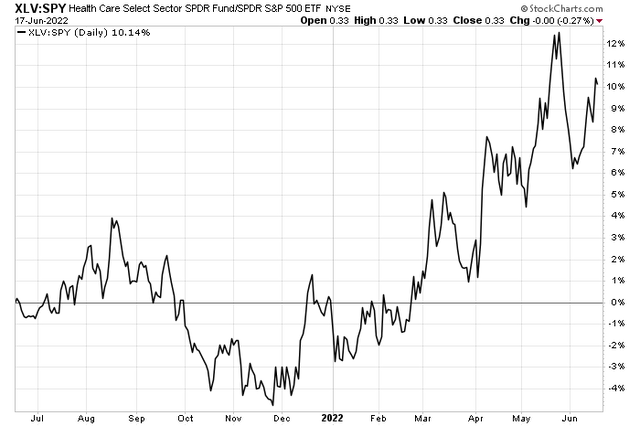

More broadly, the Health Care sector is a space in which traders might want to position money right now. There’s impressive relative strength vs. the SPDR S&P 500 Trust (SPY) over the last six months amid a risk-off environment.

Health Care Sector’s Relative Strength This Year

Stockcharts.com

Back to Teva, the $9 billion market cap company also navigates through costly opioid-related settlements and litigations. It’s also dealing with generic drug price-fixing lawsuits. These are certainly dark clouds over the once-popular drug company. BofA notes upside risks include favorable settlement terms and the possibility of unexpected new generic product launches. These were key items in last month’s earnings report and call.

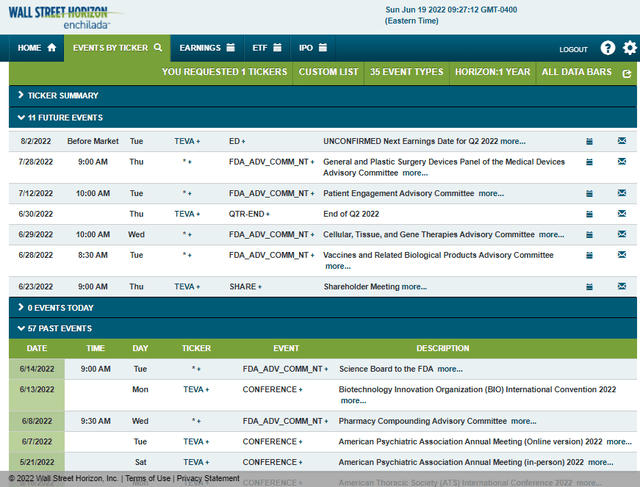

Looking ahead, Wall Street Horizon reports that Teva shareholders meet on Thursday morning. There could be market-moving news then that options traders, in particular, should monitor. Investors should also keep tabs on a few upcoming FDA meetings.

Further out, Teva’s Q2 earnings date is unconfirmed to be Tuesday, August 2 BMO.

Teva Pharma Corporate Event Calendar: Shareholder Meeting This Week

Wall Street Horizon

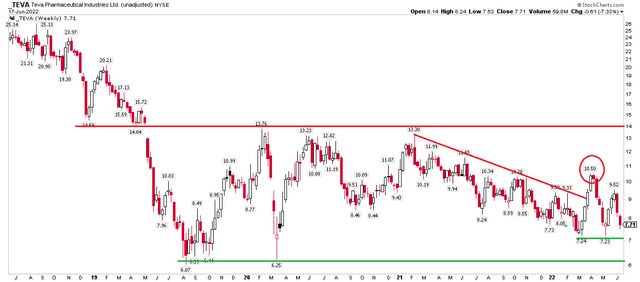

The Technical Take

Turning to the charts, more my specialty, there are some interesting features, but shares are in a downtrend overall. I see support via a double-bottom near $7.25 with tough resistance around $14. The weekly chart below shows a bearish false breakout back in April. I’d like to see TEVA rally above that before putting on a long position. If it does, however, I think the stock could get to $14. A breakdown below $7, though, might quickly lead to a retest of long-term support just above $6.

TEVA Weekly Chart: $7.25, $6 Support, $10.50, $14 Resistance

Stockcharts.com

The Bottom Line

TEVA is in no-man’s land right now. Company earnings look to improve, but shares are in a downtrend. This week’s shareholder meeting could provide clues about where the firm is headed. Technically, traders must eye the $7.25 area for support and $10.50 as near-term resistance. Scooping up shares with a stop below $7.20 could make sense for a trade.

Be the first to comment