Andreas Haas/iStock Editorial via Getty Images

Shares of Norwegian (OTCPK:NWARF) have lost around 20% since the last time I covered the company. While I’m not seeing much reason for airline-specific pressures to be the reason behind this decline, I will be analyzing the company’s first quarter results to see where the low-cost carrier has been progressing or lacked to book progress.

Sequential Performance Puts Pressure On Norwegian Air Shuttle Stock

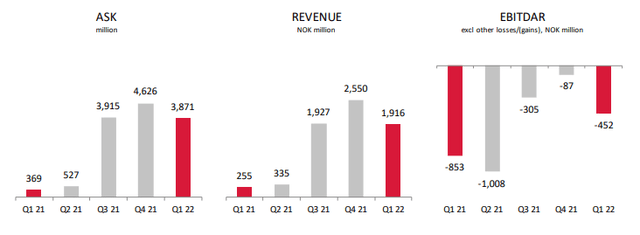

Norwegian Air Shuttle results overview (Norwegian Air Shuttle )

There’s little doubt that the sequential performance has put significant pressure on shares of Norwegian. Year-over-year, we see strong increase in capacity as well as revenues while EBITDAR improved by 47%. So, the year-over-year numbers show you the story of a different demand environment but also includes what I would deem a successful transformation as the company shrank itself focusing on the Nordic markets.

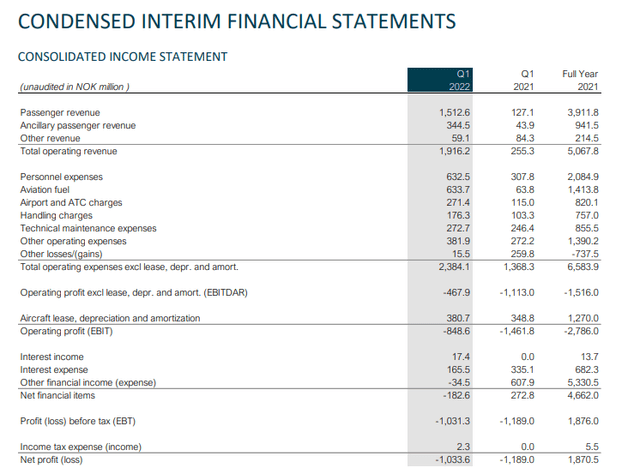

Norwegian Air Shuttle Q1 2022 results (Norwegian Air Shuttle)

Year-over-year, revenues improved by 1.7 billion NOK while costs rose by nearly a billion NOK providing a significant taper on the losses despite costs doubling in many segments related to increased flight activity and even rising tenfold for the fuel costs as there was a combination of increased fuel consumption and a surge in jet fuel prices. Year-over-year comparisons aren’t as meaningful as one would like them to be due to the change in the demand environment and if the airline transformed itself like Norwegian did, that comparison has even less meaning.

More interesting are the sequential changes. Flowing from a strong holiday season into a naturally weak Q1, Norwegian already had planned to take around 10% of its capacity out of the market. Being on power-by-the-hour contracts, I believe that Norwegian is able to take capacity out of the market more comfortably than airlines that do not have these PBH arrangements. However, there are some costs that simply stick even though you take capacity out of the market, so you are making the costs without those costs generating any value.

Sequentially, Norwegian ended up taking 26% of capacity out of the market compared to the 10% it had anticipated and that obviously provides a unit costs headwind and since this was driven by a reduction in demand due to the Omicron variant there was topline weakness as well. So, sequentially EBITDAR excluding other gains and losses went from -87 million NOK to -452 million NOK and if Norwegian would not have taken any action navigating the weaker demand in Q1 the costs would have increased by 700 million NOK.

Overall, it wasn’t a fancy quarter for Norwegian and it might have been disappointing to see that as a smaller airline the loss widened but realistically there is not much the airline could have done better.

Booking Stronger for Q2

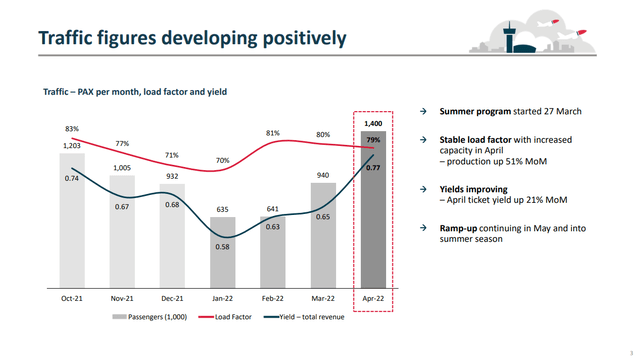

Yield improvements for Norwegian Air Shuttle (Norwegian Air Shuttle)

Revenues took a hit in Q1 due to the invasion of Ukraine, but overall things have been improving. Yields are up and load factors are relatively stable. What bodes well is that bookings are looking stronger as pent-up demand is being released into the market. From January to April, we see a very strong improvement in yield. Month-over-month, April yield showed a 21% increase. Besides that, the airline also is seeing more corporate demand than during the pre-pandemic times. The company targets a cost per available seat-kilometer of 0.40 NOK through unlocking scale benefits. The company will operate 70 aircraft by the summer and 85 aircraft by summer 2023. Those are elements that should significantly improve the company’s cost performance.

Ticker Risk: Low Price, Low Volume

Investors who are interested investing should pay close attention to the combination of low price and low volume. Due to the low volume there’s a lack of liquidity, which makes quick buying and selling and constant prices more challenging. The price being extremely low on a per share basis seemingly makes it more attractive to take speculative positions, but the lack of volume in combination with low stock prices also significantly increase risks for investors without an easy way to sell shares when volatility increases. Investors should be aware of these additional risks when making investment decisions.

Conclusion

While we can’t say much about Norwegian Air Shuttle due to the fact that the fuel price environment remains challenging and the performance is related to the ability to scale the airline which is a function of demand, I do believe that Norwegian is heading in the right direction, and it could in fact positively surprise in an environment where its unit-costs excluding fuel are significantly lower and demand remains robust.

Especially the uncertainty regarding fuel costs and absence of fuel hedging as Norwegian came out of restructuring provides a potential risk to Norwegian or any airline for that matter. Nevertheless as the airline is looking to operate Boeing 737 MAX aircraft with attractive lease rates next year and has PBH contracts for 19 of its aircraft I feel like Norwegian should be able to navigate changes in the fuel price environment as well as the demand environment quite well. Some 50% of the fuel price increases are added to the bill for the travelers, so we might be seeing a strong improvement in the overall profits and losses for the airline. What I’m liking about Norwegian at this stage are its plans for next year to operate a fleet of 85 aircraft during peak season which should provide a significant tailwind to unit cost reduction. With that in mind, I would mark shares of Norwegian a Speculative Buy. For those who are cautious about a continued strong pricing environment for tickets, shares of Norwegian would at least be a Hold.

Be the first to comment