Lemon_tm

Article Thesis

Meta Platforms, Inc. (NASDAQ:META) reported its third-quarter earnings results on Wednesday afternoon. The company missed earnings estimates widely, although it at least was able to beat revenue estimates. Overall, there were some positives and negatives in the report. Management will have to show that it’s serious about bringing down costs going forward, but the very low valuation could result in attractive total returns going forward.

What Happened?

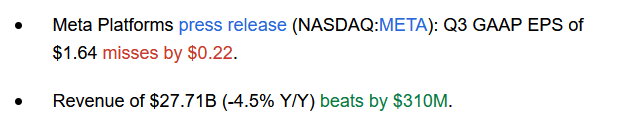

The headline numbers of Meta Platforms’ third-quarter earnings release can be seen in the following screenshot from Seeking Alpha:

Seeking Alpha

The company saw its EPS come in more than 10% below expectations, which is far from great. That was partially offset by the company’s stronger-than-expected revenue growth rate, although the combination of higher-than-expected revenues and lower-than-expected profits means that margins compressed more than what was forecasted.

The initial market reaction was very volatile; at the time of writing shares are down 12% after hours, but that could easily continue to change as investors and analysts seek to make up their minds about the positives and negatives in this report.

The Good And Bad Items From The Report

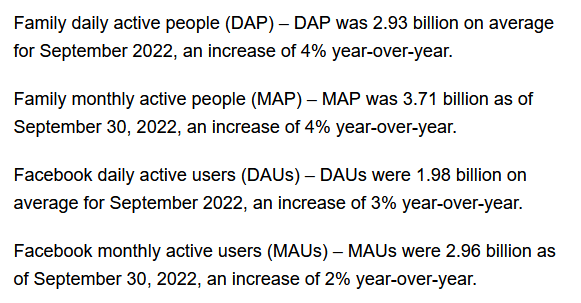

Starting with the user data, Meta managed to squeeze out some growth compared to the previous year’s period:

Seeking Alpha

4% year-over-year growth is far from exciting, and well below the growth rate Meta Platforms has delivered over the last couple of years. That was expected, however, and is hardly a surprise. First, the comparison to last year’s quarter was tough due to the pandemic impact – in 2020 and 2021, when many consumers were locked down or staying at home due to the pandemic, there was a high incentive to create a social media account to stay connected and to be entertained. Among those that were not active on social media in those times, most likely aren’t interested in being on social media at all.

It’s thus still a rather solid feat by Meta that it was able to grow its user count at all, considering the circumstances in 2021. It also is worth noting that Meta’s very large user footprint, with more than 3 billion monthly users, already encompasses a very large portion of the eligible global population, thus it’s relatively likely that growth will not explode upwards going forward, either – the law of large numbers dictates that maintaining high relative growth rates becomes harder and harder, the larger a company gets.

User count growth is one portion of Meta’s revenue growth picture, with revenue per user being the other one. On that front, Meta didn’t perform well. It managed to increase the number of advertisements it’s showing to users, as that metric was up 17% year over year. But Meta did not manage to earn more per ad – instead, revenue per ad was down 18% year over year, which is a serious concern, I believe.

To some degree, this can be explained by the fact that the ongoing economic slowdown is squeezing consumers’ ability to pay for discretionary consumer goods, which means that those companies that place ads on Meta’s platforms will have a harder time selling stuff to consumers, thereby incentivizing these businesses to spend less per ad. At the same time, the lower revenue per ad might also be a symptom of a wider issue – with more and more ways to advertise online, businesses might be less willing to pay premium prices for ads on Meta’s platforms going forward. I thus believe that investors should keep an eye on this, to see whether the trend reverses towards higher or at least stable revenue per ad impression once the economy is in a better position again, or whether this could be a longer-term trend.

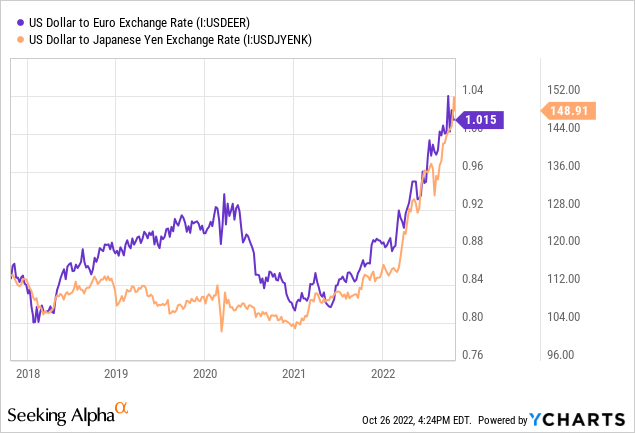

As a global company with users and ad partners all around the world, Meta Platforms naturally is exposed to currency rate movements. With most of META’s 3+ billion users being located outside of the U.S., a strengthening U.S. Dollar has a significant negative impact on Meta’s reported results. Revenues generated in euro, yen, etc. are suddenly worth considerably less once denominated in USD, following the recent rise in the USD versus other currencies:

The yen, for example, has weakened by a dramatic 20%+ so far this year, relative to the USD. At unchanged currency rates, Meta’s results would thus have been considerably better. The fact that most expenses are denominated in USD, due to engineers, etc., being located in the U.S., means that the currency rate impact on profits was even more pronounced.

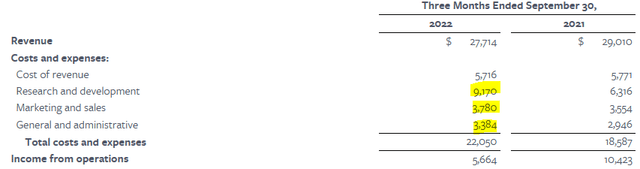

Profits were down by close to half year over year, as META’s operating margin for the quarter was 20%, versus 36% one year earlier. The currency rate impact played a role, but Meta also was impacted by an issue that has been visible in other tech companies’ recent results as well – the company is spending too much on its employees. Meta’s employee count rose 28% year over year. I do believe that this is way too much and that a company that is growing its core business only slightly should not be growing its employee count by nearly as much as 20%. Management is not focused enough on efficiency – hopefully, that will change going forward, as the C-Suite realizes that it has been overspending despite growth slowing down.

The company saw its cost of revenue drop slightly, which is a solid result considering revenue was down slightly as well. Other expenses rose, however. The biggest increase, by far, was seen in Meta’s R&D expenses, which climbed by a massive 45% year over year. When we consider that Meta was by far not skimping on R&D in the past, this rise seems quite questionable. It can be explained by the company’s ambitions in the Metaverse, which require considerable upfront investments that primarily come in the form of research and development. But it’s not guaranteed that these heavy investments will pay off, which is why I can understand that some investors are anxious about the expense trend. I’m willing to give META’s CEO Mark Zuckerberg the benefit of the doubt when it comes to the Metaverse vision, as he clearly has proven to be visionary in the past, but I’d nevertheless like to see some consolidation when it comes to R&D spending.

Marketing, sales, and G&A expenses rose as well, although by far not as dramatically as R&D spending did. There most likely is potential for Meta to trim expenses in these areas, as tech companies generally were very generous both when it comes to salaries and when it comes to office perks in the past. During a tougher economic environment, they hopefully will be inclined to become more efficient and to trim some unnecessary costs – similar to what happened in the oil industry during the pandemic, for example, which has made these companies leaner and stronger. Meta’s leadership has made some statements hinting at that in the earnings release, as the expense guidance range has been lowered and since the company will spend some money on consolidating its office facility footprint.

Unfortunately, the company still expects that its total expenses will rise next year, with forecasted growth of 13% (to $96 billion – $101 billion) being quite meaningful. Between a hopefully improving economic picture in 2023, with easing inflationary pressure, and with currency rates likely being less of a headwind next year (the dollar can’t strengthen forever), Meta might be able to grow its revenue more than that next year. But that’s far from guaranteed, thus it is possible that operating margins have not bottomed out yet. In that case, profits might decline to some degree next year, at least on a company-wide basis, while Meta’s EPS performance could be better due to the impact of buybacks.

Speaking of buybacks, Meta has spent $6.4 billion on buybacks during the third quarter. That was less than during the previous quarter, but still makes for a pretty sizeable 7% annual buyback pace – that’s around twice as much as Apple has managed to do in the past. As cash generation remained strong, with operating cash flows coming in at $36 billion so far this year, it seems likely that Meta will continue to spend billions on buybacks, especially if its shares were to continue to head lower.

META: Very Cheap, But Execution Risks Are Considerable

At the after-hour price of $113 per share, Meta is trading for just 11.5x this year’s expected net profit. When we account for Meta’s net cash position, the valuation is even lower. With META down more than 70% from its highs, the market is clearly accounting for major issues when pricing Meta’s shares. And that makes sense, at least to some degree – the success of the Metaverse strategy is, so far, not proven, and the expense growth rate is a major issue that needs to be addressed.

That being said, if Meta manages to reverse course when it comes to overspending on employees, and when/if the Metaverse strategy pays off, Meta could be a highly rewarding investment. If revenue growth resumes, as CEO Mark Zuckerberg believes will be the case soon, and if stronger expense controls result in margin expansion, Meta could generate considerable profit growth going forward. Add the impact of buybacks and potential multiple expansion tailwinds, and Meta clearly has a lot of potential over the coming 3 to 5 years. In the very near term, however, until management has cracked down on expense growth, the company’s share price could continue to flounder.

I own a position in Meta and will continue to do so, but will keep a sharp eye on management’s comments regarding improving efficiency. If the expense growth trend does not reverse in the medium term, I will reconsider owning shares of Meta.

Be the first to comment