Bim

Thesis: This Sunbelt Industrial Landlord Is Discounted

EastGroup Properties (NYSE:EGP) is a high-quality, multi-tenant industrial real estate investment trust that is currently trading at an opportunistic valuation. The REIT’s third quarter earnings report, released a few days ago, is further proof of its portfolio quality, balance sheet strength, and ability to achieve double-digit growth even when the economy is slowing.

Earlier this month, in an article titled “Bear Market Buying Strategy,” I highlighted EGP as one of the 10 high-quality dividend growth stocks I’m buying during the current bear market. As I wrote in that article:

EGP’s mostly in-house-developed industrial parks in the Sunbelt region continue to put up double-digit rent growth numbers as demand for well-located industrial and logistics space continues to outpace supply.

In what follows, I want to highlight a few takeaways from the third quarter earnings report, then wrap up with a discussion of EGP’s relative discount today.

Basic Overview of EastGroup Properties

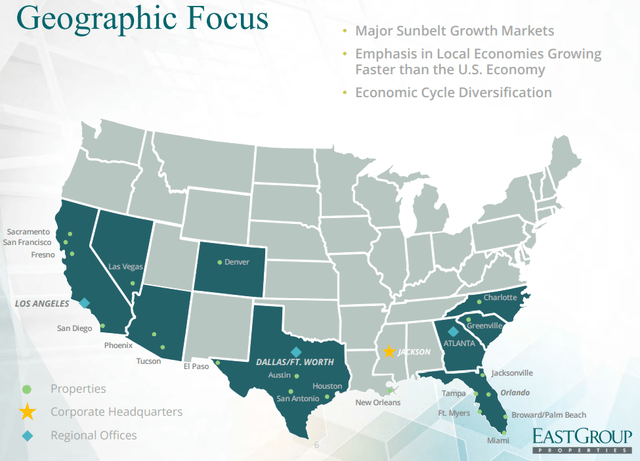

For those unfamiliar with EGP, the REIT is an owner/operator/developer of multi-tenant industrial complexes mainly concentrated in select markets in the Sunbelt.

EGP July Presentation

The REIT’s largest states by net operating income are Texas (34%), Florida (24%), California (21%), Arizona (7%), and North Carolina (6%).

EGP has three primary channels of growth:

- Organic: Raising rent rates and putting rent escalations in its leases

- Acquisitions: Buying existing properties, typically with some value-add component

- Development: Buying land and building industrial structures on them from the ground-up

Having all three of these channels is a distinct advantage for a REIT, because it means that it does not need to view properties as-is. It can buy a property and then put in its own labor and investment to improve it or add to it.

Moreover, it can also buy a vacant lot and develop a property in-house. This is an advantage because EGP is able to construct finished properties at all-in costs well below what it would cost to simply buy the same property on the open market.

In other words, EGP can develop properties at a stabilized NOI yield significantly (typically 1.5 to 2 percentage points) higher than the market cap rates of those properties. Currently, EGP has about 2.7 million square feet of projects under construction for which they expect to achieve a stabilized yield of 6.7%.

Slightly under half of EGP’s current portfolio was developed in-house.

The tenant base is highly diversified, with the top ten tenants making up only ~9% of annualized base rent. Unsurprisingly, Amazon (AMZN) is EGP’s top tenant, but it accounts for only 2.2% of ABR.

Autumn Update On EastGroup Properties

EGP’s performance in the third quarter of 2022 turned out to be as strong as its excellent second quarter results, with 14.2% FFO per share growth being the primary signifier.

Occupancy slipped quarter-over-quarter by a mere 10 basis points, largely due to newly developed properties still in the lease-up phase, but the portfolio remains nearly fully leased. This indicates the high level of demand that still exists for EGP’s well-located infill industrial sites.

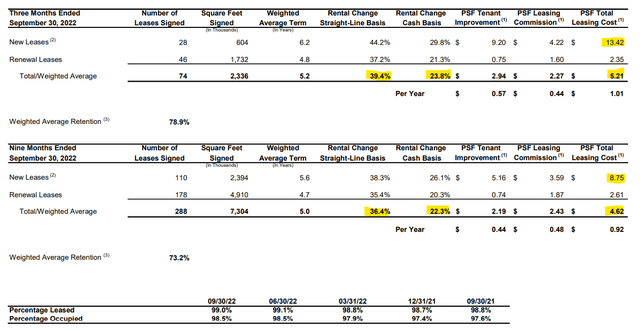

Just look at the leasing spreads (new rent rate compared to old rent rate) for the REIT’s new and renewal leases signed in Q3. On a cash basis, rent growth came in at a blended ~24%, slightly stronger than the average of the last three quarters. Likewise, straight-line rent (inclusive of future rent escalations) of ~39% was also stronger by three points than the YTD average.

EGP Q3 2022 Supplemental

EGP did pay up a bit for this rent growth via higher leasing costs, mainly for new leases. Notice on the far-right column that Q3’s leasing costs jumped during the quarter, almost entirely due to higher tenant improvement costs for new leases.

This could be a quirk of the particular spaces or tenant needs for which new leases were signed during the quarter. Or it could be higher costs associated with inflation, accounting for the higher costs of transforming a space to fit tenants’ needs. It’s difficult to say whether this higher tenant improvement cost will prove to be a blip or a trend. It’s something to watch.

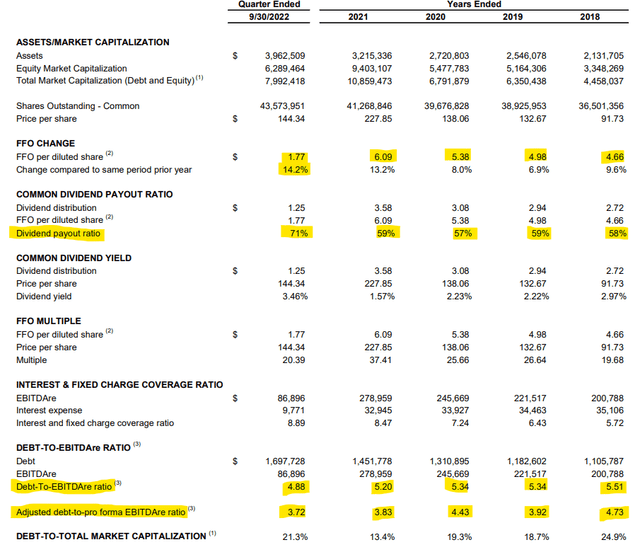

Below we find a fuller picture of EGP’s financial performance over the last several years:

EGP Q3 2022 Supplemental

First, I’ll point out that FFO per share growth in 2021 and 2022 has been about 50% higher than its level from years prior. Though a recession could bring down that growth, the supply-demand dynamics in the industrial space are only slightly softening as of now. Vacancy is expected to remain low and rent growth strong, even if not quite as strong as it has been the last year and a half.

Second, though EGP’s dividend payout ratio appears to be higher than usual in Q3, that is primarily due to the recent 13.6% dividend increase.

Third, notice at the bottom that EGP’s debt to EBITDA ratios (reported and adjusted) are lower today than at any time in recent years. Management has done a good job of battening down the hatches of the balance sheet in preparation for a rising interest rate/recessionary environment.

Though EGP still commands a relatively low weighted average interest rate on unsecured debt of 3.82%, it is admittedly quite a jump from 2021’s ultra-low weighted average rate of 2.4%. That’s due in some small part by EGP’s securing of $125 million of unsecured debt during Q3 at a weighted average interest rate of 4.04% (still significantly below the average BBB bond yield during the quarter!).

EGP also agreed to terms on more unsecured debt during the quarter as follows: “$75 Million has an 11-Year Term and a Fixed Interest Rate of 4.90% and $75 Million has a 12-Year Term and a Fixed Interest Rate of 4.95%.”

Even so, interest and fixed charge coverage (which are the same because EGP has no preferred equity) are higher today than they were at the end of 2021 – ~8.9x today versus ~8.5x in 2021.

For the full year, EGP now expects FFO per share growth of 13.8%, which slightly exceeds 2021’s showing of 13.2% FFO/sh growth.

In the third quarter, same-property NOI growth came in at 8.7%. For the full year of 2022, EGP expects to achieve same-property NOI growth ranging from 8.3% to 9.3%. That’s a nice improvement from 2021’s likewise strong 5.7% SPNOI growth rate.

That being said, EGP’s management team has chosen to slow down further investments for the time being due to “the global economic unease.” They, like almost everyone else in the economy, seem to foresee either a recession or simply some economic weakness to come in the near future. As such, their caution strikes me as prudent and warranted, even though no weakness has shown up in their own properties as of yet.

Bottom Line: A Relative Value

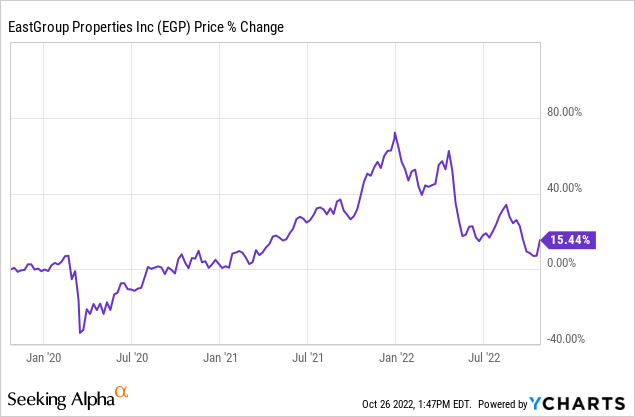

To demonstrate EGP’s relative value proposition today, consider this. The stock price is up about 15.5% over the last three years…

…but from EGP’s Q3 2019 earnings report to its Q3 2022 earnings report, revenue is up 49.7%, FFO per share is up 38.3% (from $1.28 to $1.77), and the dividend is up 66.7% (from $0.75 to $1.25).

From then to now, debt to EBITDA is basically flat: 4.87x in Q3 2019 and 4.88x in Q3 2022. However, because of a combination of rent increases and a decline in interest rates on EGP’s debt, the fixed charge coverage ratio rose from 6.7x in Q3 2019 to 8.9x in Q3 2022.

And yet, in October 2019, EGP traded at a price to FFO of 26.8x, whereas today it trades at a price to FFO of 22.2x.

While EGP is by no means dirt cheap on an absolute basis, its valuation looks low relative to its historical valuation as well as to its strong, double-digit growth rate of 12-13% in recent years.

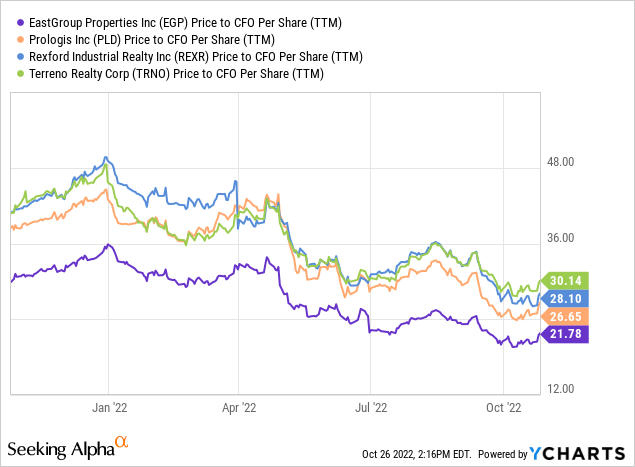

It also looks cheap relative to peers, such as Prologis (PLD), Rexford Industrial Realty (REXR), and Terreno Realty (TRNO), although admittedly EGP always trades at a discount to these peers.

While the heavy focus on the West Coast and particularly Southern California and the Inland Empire probably grant EGP’s peers a warranted premium, EGP’s concentration in the Sunbelt should be considered a strength going forward, as the area is faster growing than California.

In short, EGP is a wonderful REIT trading at a fair price. Between its 3.3% dividend yield and forward growth rate of probably 8-10% per year, the REIT is likely to achieve double-digit returns even without multiple expansions. But if (when?) interest rates drop from here, I believe EGP’s FFO multiple will rise, giving even more upside.

Be the first to comment