24K-Production/iStock via Getty Images

Introduction

As a dividend growth investor, I constantly seek additional opportunities to increase my income stream. Sometimes I add to existing positions when I find them attractive. On other occasions, I start new positions when I can achieve some exposure to industries I lack exposure to. Hopefully, the higher volatility can offer some attractive options.

One of the most exciting industries nowadays is the space industry. It is part of the industrial sector, and most companies in the industry focus on government spending with limited corporate clients, but it changes as the prices of launches decline. Northrop Grumman Corporation (NYSE:NOC) is a leading company in that industry, and I will analyze it in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows Northrop Grumman is an aerospace and defense company worldwide. The Aeronautics Systems segment:

designs, develops, manufactures, integrates, and sustains aircraft systems… Its Defense Systems segment designs, develops and produces weapons and mission systems… The Mission Systems segment offers cyber, command, control, communications and computers, intelligence, surveillance, and reconnaissance systems… Its Space Systems segment offers satellites and payloads, ground systems, missile defense systems, and interceptors.

Fundamentals

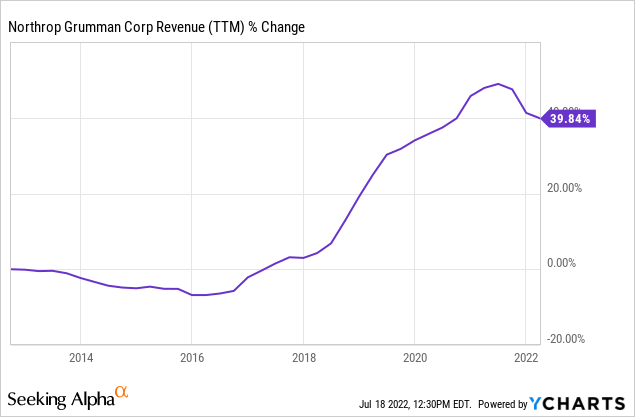

Revenues have increased over the last decade by almost 40%. The increase in sales came in the previous five years following a stagnation in the first five years. The company relies primarily on government contracts, growing organically and using M&A. Northrop Grumman acquired Orbital ATK in 2018 for $9.2B. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Northrop Grumman to keep growing sales at an annual rate of ~4% in the medium term.

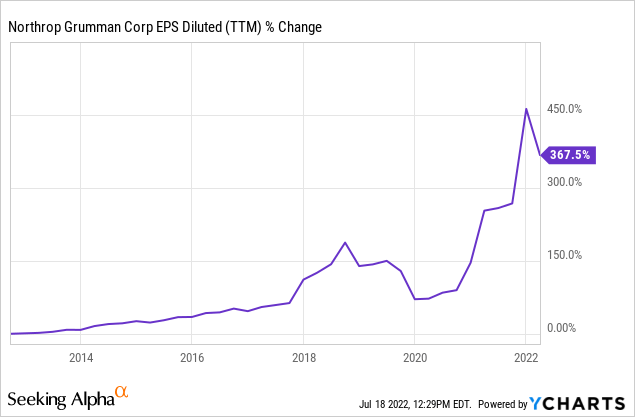

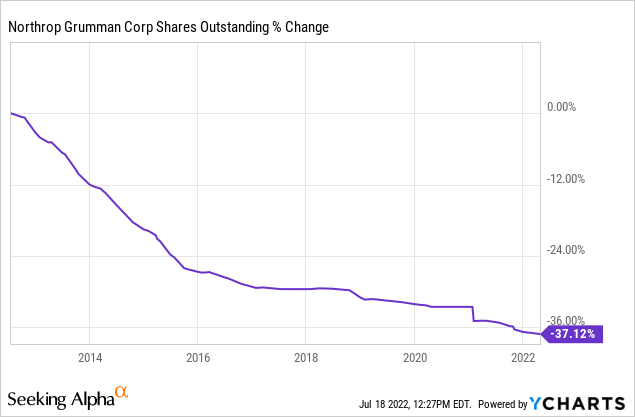

The EPS (earnings per share) has increased much faster during the same time. In the past decade, the EPS has increased by 367%. The EPS growth is attributed to the sales growth, the highly aggressive buybacks, and the profit margin doubled during that period. As to the future, the analyst consensus, as seen on Seeking Alpha, expects Northrop Grumman to keep growing EPS at an annual rate of ~5% in the medium term.

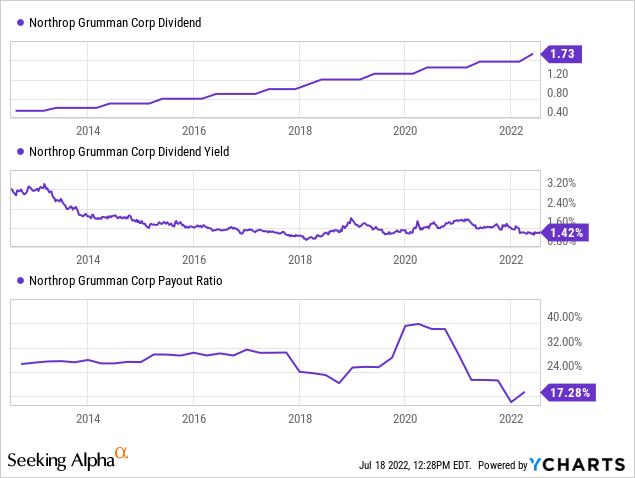

The dividend of Northrop Grumman is relatively safe. The company is paying less than 20% of its EPS in dividends, allowing it to be very flexible. The current yield is not too enticing, just shy of 1.5%. The company has been increasing the dividend annually for 14 years and hasn’t decreased it for more than 30 years. Investors should expect future increases to be in the high single digits, in line with the EPS increase.

In addition to dividends, Northrop Grumman returns capital to shareholders via buybacks. Buybacks are an excellent tool for growing companies to supplement the EPS growth by decreasing the number of shares. Over the last decade, the number of shares has declined by almost 40%, increasing the EPS significantly. The company announced another $500M buybacks plan in November.

Valuation

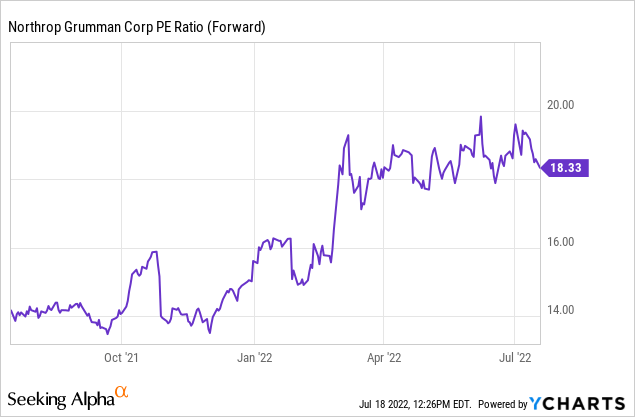

The company is trading for a P/E (price to earnings) ratio of 18.3. It is the P/E ratio when considering the forecasted EPS for 2022. The company has seen its P/E ratio expanding over the past several months. The main reason was the conflict in Ukraine which promotes higher defense spending. While 18 is not a high P/E, it is not attractively valued when considering the forecasted growth rate.

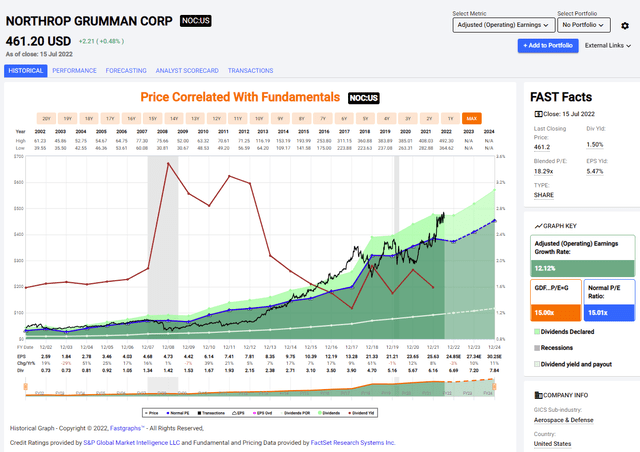

The graph below from FAST graphs emphasizes Northrop Grumman’s valuation is not attractive now. Over the past two decades, the average P/E ratio of the company was 15. Therefore, the current P/E of 18 is slightly higher. When looking at the growth rate over that period, it is higher than the forecasted growth in the medium term. Thus, while the company is not expensive, it is not attractive enough from a valuation point of view.

To conclude, Northrop Grumman is a great blue-chip company. The company is steadily growing its sales, which leads to EPS growth. The EPS is used for dividend payments and aggressive buybacks. However, these great fundamentals come for a valuation that is not attractive as the company seems slightly overvalued.

Opportunities

Space is becoming a prominent business for Northrop Grumman, and the company forecasts it will be the most prominent business segment in 2022 in terms of sales. It is a growing business with forecasted sales of $11B, and the company expects to achieve a 10% operating margin. We see some projects online, most notably the James Webb Space Telescope.

The focus on space will also help the company diversify its client base. Right now, the U.S government accounts for more than 80% of the company’s sales. The civilian space industry is being slowly built, and companies want to own data and collect it using satellites. As launching payloads to space becomes cheaper, educational institutions will also be able to send micro-satellites and expand their research using Northrop Grumman’s technology.

The conflict in Ukraine is another growth opportunity for Northrop Grumman. NATO members are sending danced weaponry to Ukraine, increasing the demand for these systems. Moreover, these countries now realize the Russian threat and have increased their defense budget. Higher defense budgets in Europe should allow Northrop Grumman to increase sales and lower its dependence on the U.S government.

Risks

Defense budget cuts in the future are a risk for the long-term growth trajectory. At the moment, with the conflict in Ukraine, any budget decreases seem unlikely. Yet, we invest for the long-term. The company relies heavily on the U.S government, and if the political atmosphere pushes for more American isolationism, we may see slower growth for defense contractors such as Northrop Grumman.

Inflation is another risk for the company. The company has a backlog of orders and has agreed on pricing depending on its forecasted expenses. Higher costs of materials and labor may pressure the company’s margins. A 9.1% inflation was probably not forecasted, and it may pressure the margins a bit in the short and medium term.

Competition is another risk for Northrop Grumman. The company competes with other prominent names in the defense and aerospace industry. Some, like Raytheon Technologies (RTX) and Lockheed Martin (LMT), are much larger than Northrop Grumman, which gives them an advantage. The competition means that there may be pricing pressure and that the company must constantly innovate to secure contracts.

Conclusions

There is no doubt that Northrop Grumman is a good company. The company offers excellent execution and solid fundamentals that lead to consistent dividend payments and buybacks. The company also has significant growth opportunities as governments in the west plan to increase their defense spending, and Northrop Grumman will capitalize on it.

On the other hand, there are risks to the investment thesis. Inflation, competition, and reliance on a single prominent client can slow growth. Moreover, the valuation is not attractive at the moment. Therefore, I believe that Northrop Grumman is a HOLD at the current price, and investors should wait for a P/E ratio of 15.

Be the first to comment