krblokhin

Shares of Northrop Grumman (NYSE:NOC) have been a remarkable outperformer over the past year, up about 34%. The worst the world seems, be it Russia launching a war on Ukraine, China sending its military across the median line of the Taiwan Strait, and even North Korea flying missiles over Japan, the better things seem to get to for NOC. In a dangerous world, there is growing demand for defense equipment, after all. While this has propelled NOC shares, the question is whether much upside remains.

(Source: Seeking Alpha)

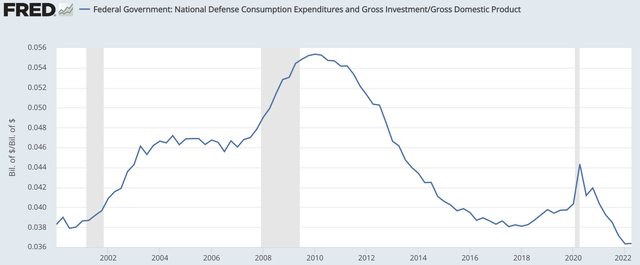

First, to be clear, the investment thesis that defense stocks should benefit from a more dangerous world is supported by the data. In a world where political parties seemingly find little to agree on, there is broad agreement that defense spending needs to go up, not only to combat threats but to restore purchasing lost to inflation. In fact, defense spending as a share of GDP is sitting at a 20-year low. Restoring this back to 2019 levels would lead to incremental $90 billion of defense spending. That is a lot of revenue opportunity for defense contractors.

(Source: St. Louis Federal Reserve)

Understandably then, the Pentagon is asking for $31 billion increase in its budget to $773 billion, but with elevated inflation, that will only keep its true purchasing power about flat. As a consequence, Congress wants to do even more. The House has passed an $840 billion National Defense Authorization bill while the Senate Armed Services Committee has advanced an $857 billion measure. Ultimately, bicameral agreement is likely to settle out somewhere between these numbers, providing a substantial boost to 2023 defense spending.

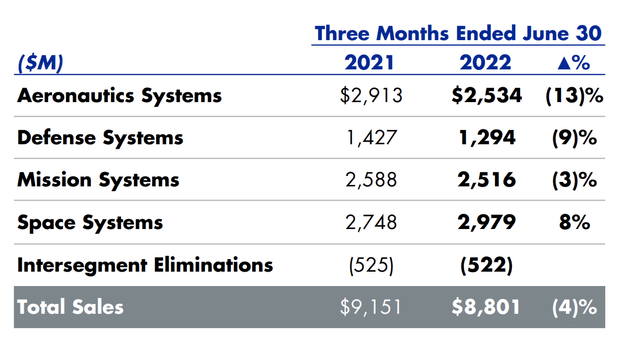

With this backdrop, I think it is safe to say the US defense industry is entering a significant upswing. The question then becomes whether Northrop Grumman will benefit from this environment. A look at its Q2 earnings results actually paint a mixed picture at first but a more positive one under the hood. Revenue actually fell by 4% while earnings per share declined over 5% to $6.06. However, a significant driver of this was ongoing supply chain challenges, which has extended production times for many manufacturers, inside and outside of the defense industry. More encouragingly, the company maintained its revenue guidance for the entire year, suggesting these supply chain challenges should pass.

Additionally, I was encouraged to see the company keep operating margins steady at 12.2%. Given supply chain problems increasing costs and reducing efficiency at factories to be able to maintain margins point to very effective cost control, and as supply chain issues fade, operating margins should be able to rise, aiding profit growth. Also on the positive side, if we factor out movements in the value of marketable securities and the pension, which are really non-operating issues, EPS would have been $6.66, or up 3% year on year. For core earnings to rise even amidst these supply chain issues speaks to the strength of Northrop’s operating performance.

As you can see from the chart below on segment results, supply chain disruptions had broad impacts, but the space division was a major standout, up 8%. Space is a major strategic imperative as we modernize our military forces for 21st century combat, and Northrop has a leading presence here, creating scope for ongoing growth.

(Source: Northrop Grumman)

Much of these space operations come from Northrop’s 2018 purchase of Orbital ATK. This makes NOC one of only two supplies of solid rocket motors alongside Aerojet Rocketdyne (AJRD). These motors are essential to intercontinental ballistic missiles, but more crucially, they power much of our space ambitions. This was a shrewd acquisition that gives NOC a foothold in a key growth area. I would note there is some speculation that this acquisition has given Northrop such an advantage that the Federal Trade Commission should try to undo it. However, CEO Kathy Warden said quite adamantly on the last earnings call, “we don’t believe this matter will have a material adverse impact to our company.” This is a risk to monitor, but given that statement, a manageable one.

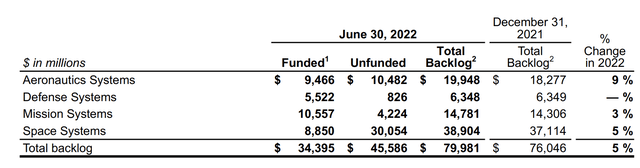

Aside from space, increasing F-35 production should buoy aeronautics systems, and this division also does critical work for NATO’s airborne surveillance program. With many European allies raising defense spending to move closer to the 2% of GDP level amid Russia’s aggressiveness, this exposure can be an additional tailwind. As you can see below, NOC’s backlog is up to $80 billion, or over two years’ revenue with broad based increases.

(Source: Northrop Grumman)

During this quarter, the company generated $13 billion orders for a 1.48x book-to-bill ratio. This ratio was flattered by supply chain problems reducing current quarter revenue, but even adjusting for this, the ratio would have been a very healthy 1.4x. This strong booking performance points to significant demand for NOC’s products and should assuage concerns about the most recent decline in revenue.

Importantly, the vast majority of its backlog outside of the Space division has been “funded.” This means that Congress has not only authorized the spending, but it has appropriated the funds to make the purchase so there is little risk of the Pentagon being unable to follow-through. With much of the Space unit’s backlog several years out, it has yet to be appropriated, but given the strategic priority placed on space, I believe there should be confidence this spending does come through.

Based on company guidance, NOC should earn about $24.80 this year. It is important to note there is uncertainty how much free cash flow the firm will generate because starting this year research and development spending has to be capitalized for tax purposes rather than expensed. There is a push to postpone implementation of this change beyond 2022, and it is likely to be an issue debated in Congress after the midterm elections. Under current law, NOC expects $1.5-1.8 billion in free cash flow, but if there is an extension, cash flow would rise by about $1 billion.

That swing speaks to how dramatic the impact the tax change is on near-term cash flow for heavy R&D spenders like NOC. This impact will fade in future years as there are multiple years of R&D spending being capitalized. Either way, the company can comfortably maintain and grow its dividend, which costs about $1 billion and was increased by 10% in May. Management is committed to returning 100% of free cash flow to shareholders, providing scope for ongoing share repurchases on top of a growing dividend.

NOC does trade at a premium valuation at about a 19.8x P/E. With supply chains recovering, a large backlog, and a leading space operation, NOC is well positioned to grow earnings. Defense spending is poised to rise mid-single digits for several years, but given its franchises, NOC should be well-positioned to outpace the overall sector’s growth, and I would expect it to generate about 10% EPS growth over the next three years.

At $490, NOC is pricing in much of the good news, but this premium multiple is justified given the secular tailwinds and NOC’s strong positioning. I believe shares can continue to grow alongside earnings, sustaining their premium multiple, which on top of the dividend provides scope for low double-digit total returns in coming years. While NOC may not repeat its 34% gains of the past year, it continues to be an attractive investment for long-term investors.

Be the first to comment