hrui

Despite Northland Power’s (OTCPK:NPIFF) negative stock price evolution, here at the Lab, we would like to reaffirm our positive long-term view of the company. Before going into the analysis, we suggest our readers check upon our previous analysis:

- Mare Evidence Lab’s initiation of coverage called An Interesting Opportunity

- Looking ahead the Q2 results: Still Positive

Today, there are many crucial key takeaways to emphasize:

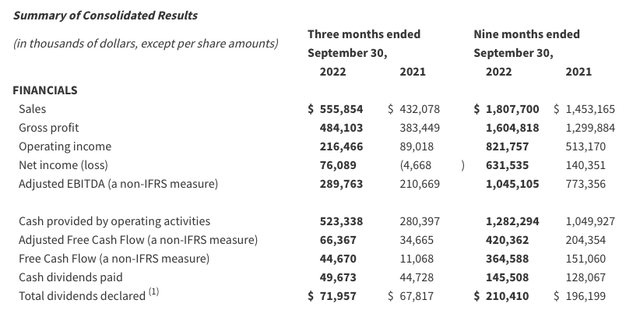

- Starting with the Q3 results, at a glance, the company positively impressed the financial community in almost every line of its P&L and BS. Speaking of numbers, top-line sales increased by 28% and the company’s adjusted EBITDA reached $290 million, signing a plus of 37%;

- The company’s operating leverage works out thanks to the favorable energy pricing environment but Northland Power was up even in the electricity production that reached 2.129GWh compared to the 1.815GWh recorded in the same quarter last year;

- Cross-checking Wall Street numbers, consensus EBITDA was forecasting $278 million with an EPS estimate of $0.21, and again, the company managed to beat expectations signing an earning per share of $0.33;

-

Still related to the EBITDA, the main beats were offshore and onshore renewable divisions. A strong performance was also recorded by the thermal generation segment;

-

In the half-year Q&A, the company’s CEO said that “the revised guidance ranges may be subject to the further upside should power prices in Europe. However, given this is difficult to predict and there are a number of factors that impact our results, we do not incorporate this potential upside for Q3 or Q4 in our guidance”. Today, we know that Northland Power will reduce its debt exposure, paying down more debt in the 2022 last quarter. This is due thanks to the strong cash flow from operations in its core activities. Numbers in hand, in Q3 2022, the company recorded an FCF per share of $0.19 from $0.05 in the same quarter in 2021. Indeed, we should now incorporate the potential upside;

- On the debt side, despite a rising interest rate environment, the company managed to lower its interest expenses. In Spain, the all-in interest rate was reduced from 2.1% to 2%. The Spanish debt restructuring will enhance cash flow generation over the medium term as well as optimize its tax payment. This procedure followed the Gemini debt, and again Northland Power partially reallocated lower-cost senior debt replacing higher-cost junior debt;

- Northland Power reaffirms its 2022 guidance. The outlook was already reviewed upwards in the Q2 presentation.

Northland Power financials in a snap

Source: Northland Power Q3 press release

Conclusion and Valuation

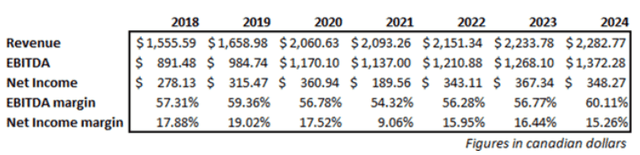

As already mentioned, we continued to be positive about NPI’s future. Aside from its financial targets, offshore wind might drive growth in the short-medium term horizon. This is also coupled with financial flexibility that might drive M&A acceleration. A few Wall Street analysts are pointing out cost inflation expectations, given the long duration of onshore/offshore wind development. Despite that, Northland Power’s valuation is more reasonable than its closest peers and the company is currently offering an interesting dividend yield (higher than 3% at today’s price). Therefore, we reiterate our buy rating target and we already know that the company will achieve better numbers than our model suggests. As a consequence, we should increase our target price; however, given the current market discount, we decide to maintain our C$51 target price. In detail, the company is expecting adj. EBITDA “to be in the range of $1.25 billion to $1.35 billion“. With Northland Power’s project pipeline and an EBITDA forecast of C$2.5 billion in 2025, we believe that its valuation is not justified.

Mare Evidence Lab’s previous estimates

Source: Mare Evidence Lab’s previous estimates

Additional risks to our buy rating include power prices, regulation, execution, currency development, and supply bottleneck.

Be the first to comment