LukaTDB

Dear readers/followers,

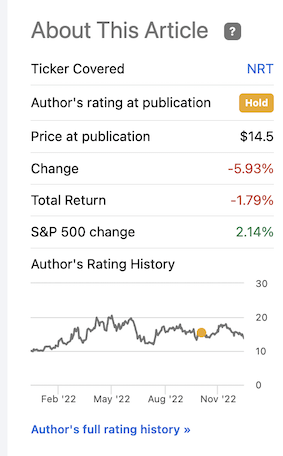

So, my take on North European Oil Royalty Trust (NYSE:NRT) actually seems to have been the correct one for the time being. Why do I say this? Because the correct take on a company at any period in time is when the RoR, regardless of period, does not result in a loss of capital.

Seeking Alpha NRT article (Seeking Alpha)

So my neutral stance in a time when the market performed better, even if the variance is small here, was the correct one mathematically.

Now, this is a complex little business – and before you go diving in, you really want to understand what’s at play here.

North European Oil Royalty Trust – Revisiting and Updating the company

So, first warnings first.

NRT is a sub-€150M nano-cap stock, which means that even native German or European investors typically overlook businesses such as this one. The reason I wrote about it in the first place was renewed interest in anything “EU” and “Gas” due to Ukraine, and the company stood out as being pretty unique.

Historically, I’ve invested in a few trusts with a similar operating model. This is a very common structure in nations like Canada, where I in my career have bought shares of the Boston Pizza Royalties Income Fund (OTC:BPZZF), The Keg Royalties Income Fund (KEG.UN), and similar plays. The reason for investing was nearly always the same. High yield in a world where yield wasn’t widely available.

I mostly left the investments, having made mostly little returns (some of the investments went into double digits), because this was prior to my current focus on valuation and quality above all. This isn’t to say such investments are bad in any way – but we need to understand and value them properly.

The purpose of this specific one is to collect, hold and verify royalties paid into the Trust by the operating companies, German subsidiaries of the Exxon Mobil Corporation (XOM), and the Royal Dutch/Shell Group of Companies (SHEL), which in turn own the company through a complex operating structure.

The company’s operating areas are found in Northwestern Germany, in an area called Niedersachsen. These areas are held through certain concessions or leases – and only in Germany. So remember, this is a German play.

As with all trusts, we’re looking at a continuous flow of cash from these resources, for as long as these resources are available. Also, remember, despite the name including oil, the company’s cash flows are almost all from gas, not oil.

Gas sales were down on a YoY basis for the 9M22 period – but this was completely offset by the current gas prices, which have more than quadrupled in less than a year.

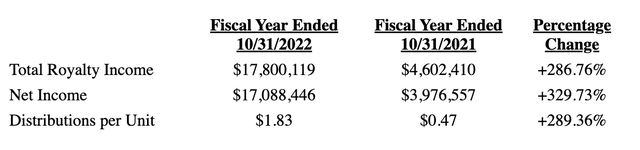

The company’s results are up 214.96% for the 9M22 period, leading to 9M royalties of close to $3.3M for the company. It’s not surprising that distributions from the company are up between 200-300% on an annual basis, given that gas prices have increased by about the same.

The company has also posted prelim full earnings for the year, and given that the company ends its fiscal in October, we can do some compare and contrast. Again, the changes are clear.

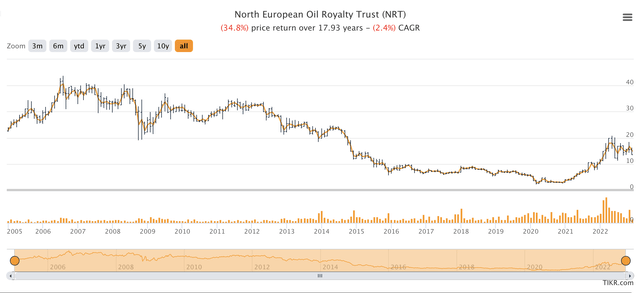

NRT has long been a bad investment. What I mean by this is that the company has been a terrible investment for the long term, losing investors money over an 18-year period.

You can make the argument that if bought cheaply, this company would have performed far better, and this would be true. For a 5-year period, NRT has been a better investment than most tech companies, and even most indexes with a triple-digit 120%+ RoR.

However, the majority of that came in the wake of Ukraine and the conflict. And while I know investors and readers who seriously consider it likely that Europe should have “foreseen” the crisis with Russia, the fact is that one really cannot foresee with clarity or certainty such geopolitical changes – and even if you argued that you could try, basing investment theses on this is entirely too uncertain for me.

Here is my current stance on how we should view the appeal of NRT.

While the company’s volumes are mostly flat or stable over time, the current energy macro that we’ve entered is one that I consider unlikely to disappear in the near term. NRT cannot be compared fairly to how gas prices were in 2012-2021, because that period did not contain the political reality of Russia being “boxed out” of European energy markets. That is where we currently area, which means that any European solution to this problem that does not include Russia is viewed far more positively than it was only a year ago. Back then, investors would likely view NRT as a potentially interesting play at dirt-cheap multiples – because Russian energy was so much cheaper and more efficient with infrastructure already in place.

The second consideration is that NRT is perfectly suited to the climate, because Germany is in near-endless need of energy – and the more that can be sourced at home, the better it currently is for the company – and the more efficient and ESG-friendly as well.

The risks though remain for the company.

First, we have the geographical area. The current asset base isn’t really the best, with 2021 reserves down to around 5,430 mmcf – and this is where the payments come from. It is what makes up the “value” in this case. If these reserves are gone, the assets are nearly worthless, and as things stand for the current viable reserves, that’s around 10 years.

However, this is of course ignoring the potential for more exploration and drilling. Going through the company’s filings and data, I find plenty of information on what was previously classified and filed as “uneconomic reserves”, due to macro. It’s likely that we’ll see a reclassification of such reserves, which will increase the lifespan.

With current energy prices, it’s also highly likely that we’ll see even higher income, and consequently, higher payouts.

However, remember – The company’s payouts are entirely variable and dependent on sales – which means that it is very little, or almost no safety to these.

Europe has its own solutions for the crisis, but the solutions will take time. The European Union is bringing a mix of North Sea Gas, Nuclear, and Pipeline expansion to the table, while at the same time trying to encourage higher state and government involvement in national energy policies and planning (Source: Europa.eu). All of these ambitions are mostly still in their infancy, but the planning across the board, not to mention that national gas reserves for say, Germany, is currently still at 90.23% (Source: Bundesnetzagentur), showcases that energy independence is not only potentially possible – it’s being made possible.

And NRT is part of this.

To conclude, 2022 is an excellent year so far – and I expect it to continue to be excellent as gas prices remain elevated.

Let’s update the valuation for this situation and for 2023E.

North European Oil Royalty Trust

The main point for NRT is the much-spoken-about dividend yield. At over 9%, it’s very elevated here compared to the usual 3-4% we usually find NRT trading at on a 10-15 year average (Source: S&P Global/TIKR.com)

My basic case for the company which influences the current valuation is as follows.

I expect the company to continue to sell gas at high prices for at least the entirety of 2023, as things are looking now. I don’t expect normalization with Russia – not for 2023, and maybe not beyond that. Not to a level where the pipes are opened up again, or where business relations to any extent are back to normalized levels. Even in the case of an end to the war, gas volumes to Europe from Russia will never, I believe, normalize.

This means that I consider the 2022A numbers a bit of a benchmark for the next year, and I expect them to stay around or about at that level, +/- 10%, which shouldn’t cause much in the way of dividend volatility for the company.

It seems doubtful to me that gas and crude volumes will be picked up again to the levels we once saw – and the longer the conflict goes on, the more certain I believe it to be that they won’t resume, because every month that passes, capacity replacements are being put into place across Europe. When it comes to oil specifically, we’ve already banned seaborne imports of crude as of December 5th, and several countries are phasing out Russian oil as early as this year – such as the UK (Source: Gov.uk).

The only areas that I believe will go back to business-as-normal are found in Eastern Europe – but even that is uncertain, given that some of the most extreme animosity towards Russia is found in exactly these geographies, with the exception of Belarus.

Based on this forecast, I don’t view the current valuation as materially unattractive, not with a potential 7-9% yield. However, it’s still a very tricky play.

Because in the end, a company is only as good as the safety I can ascertain when looking it over. Even if many things with NRT are appealing, there are a lot of fundamental uncertainties that cap the upside we’re able to consider valid for the business.

Whenever I look at a business, I look at what sort of potential investments I might go for instead. In this case, one could invest in any one global oil major, or American Midstream company, that comes at a far higher degree of safety due to a larger and more diversified asset base that isn’t reliant on such a small geographical area.

The valuation of the company cannot really be compared to anything, as I see it. We can state that, for instance, NRT trades at 10.7x sales, or an 11x P/E normalized, but this doesn’t really, to me, mean anything due to the uniqueness of the business in question (in terms of size, exposure, and the like). When it comes to a company like this, the only macro trends we should be looking at are things like prices for gas, crude, and the way the energy markets seems likely to develop. Because this is so uncertain and even industry specialists have a very hard time doing any sort of stable forecast, this is an inherently volatile and unstable investment.

For that, I apply a 30-40% discount range to the company to normalized valuations before even considering going in. I went to around 40% in my last piece – I’m lowering this now due to the energy market.

I still consider this company a “HOLD” here and say that there are better plays even for income investors.

My PT for NRT would be around $9/share – I’ve increased this due to reducing the relative discount in my DCF to around 30% due to the visibility of the energy market. But that’s as high as I’ll go here.

Thesis

My thesis for NRT is as follows:

- The company is an interesting play on a specific EU gas/Oil/sulfur asset in Germany. It’s not without its general appeal, but I would say that there’s too much risk to go fishing here, despite some improvement in price.

- I would give the company a $9/share PT to stay conservative, making this a very risky play given the correlation to energy prices.

- I consider NRT a “HOLD”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company fulfills none of my criteria at this time.

Be the first to comment