Leonid Ikan

(Note: This article was originally published in the marketplace newsletter on December 2, 2022.)

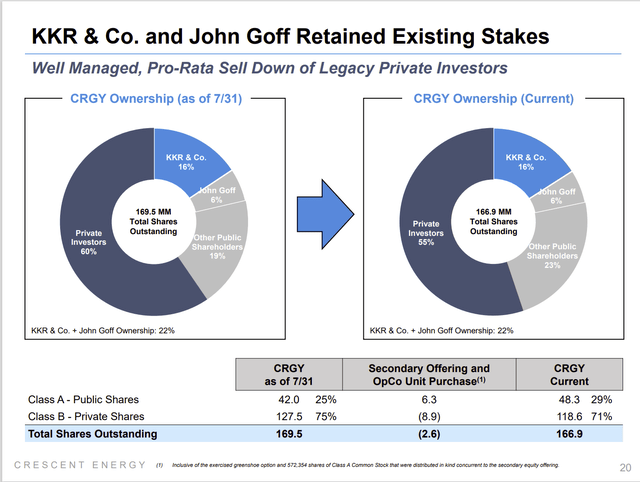

Crescent Energy (NYSE:CRGY) management recently showed that they were on top of one of the most important issues to public shareholders. That issue is when private shareholders want to sell their shares to the public. This company was structured to allow the sale of private holdings to the public when those shareholders want to. But handling that larger public float often involves a time period of weak stock price performance until a new equilibrium between demand and supply is reached. This company appears to have found a formula to shorten that weak performance period.

Crescent Energy Capital Structure And Secondary Offering Strategy (Crescent Energy November 28, 2022, Corporate Presentation)

What management clearly did is repurchase and retire some of that secondary offering to decrease the needed demand for what became a now smaller secondary offering while also benefitting shareholders from a lower number of total shares (private and public) outstanding.

This fits into the management guided program of using an amount of free cash flow to both return money to shareholders and fund share repurchases. There are going to be more secondary offerings until the private shares are down to zero. So, the strategy shown above will come in handy to lessen the effect of more shares in public hands.

Since Mr. Market loves a growth story, the above maneuver also helps to make the quarterly comparisons stronger as the income is now spread over less shares outstanding. Clearly one of these made a very small difference. But there are also clearly more on the way as more private shares convert.

The reason for the private shares and the corporate structure is often to delay the recording of the sale for tax purposes. But even that delay has a limit. So, the conversion of more shares in the future is generally a certainty. Still, that structure is often an advantage when a company has a consolidation strategy as this company appears to. The ability to offer a price plus a way to delay the payment of taxes can be a huge advantage in a bidding situation.

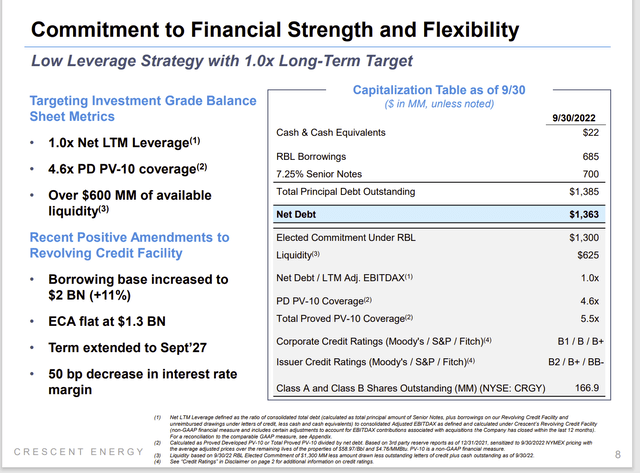

Crescent Energy Debt Strategy And Key Debt Ratios (Crescent Energy Corporate Presentation November 28, 2022)

Clearly management is not going to succeed in the typical way of using a lot of debt and then quickly deleveraging. Instead, the company’s debt strategy is far more conservative. Management has made a priority of repaying the bank line while making sure any bond offerings mature well into the future.

The initial company goal of a leverage ratio of 1 has clearly been met. Now the next goal is to maintain that leverage ratio at considerably lower prices. Probably along with that goal is the attainment of an investment grade rating of the debt. Since this company is a fairly new public company, with a lot of acquisitions, the investment grade rating will likely happen after there is a sufficient company record as it is currently structured.

This is a very different proposal to make money than one usually sees with KKR. But then again, this industry is known for its low visibility and very high volatility. Management has long noted that there are a lot of sellers in the industry and not a lot of buyers. So, the way to make a lot of money is to purchase bargains and then improve operations so those bargains are worth more. To that extent management has really focused upon distressed or unnatural sales.

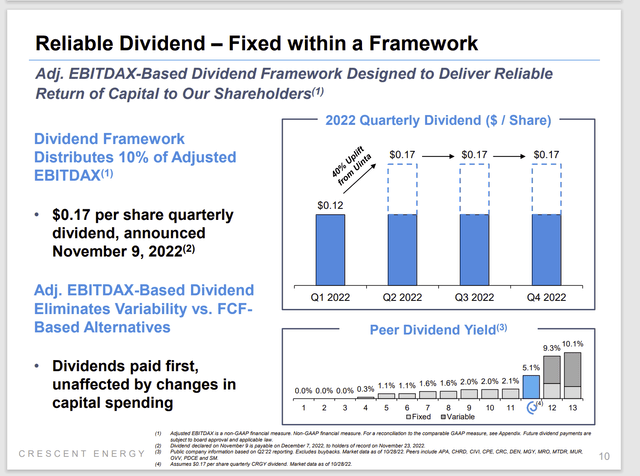

Dividend Strategy

The major shareholders know the importance of a dividend that can be maintained throughout the industry business cycle. Therefore, in an environment with robust commodity prices, investors can expect a low payout ratio because that cash flow can quickly disappear in a downturn.

Crescent Energy Dividend Strategy (Crescent Energy November 2022, Third Quarter Earnings Conference Call Corporate Presentation)

It still remains to be seen how well this works during an industry downturn. However, it also appears to be off to a good start. The amount appears to be a low enough percentage to allow for share repurchases when more shareholders want to sell their shares as well as a continuing program to make accretive acquisitions.

At the same time, management is increasing financial flexibility by repaying the bank line (probably down to zero eventually). That would allow the flexibility to pay the dividend “by borrowing” during a downturn if management believes such a strategy is desirable.

A lot of managements have given into market demands by paying dividends that are variable (while soaking up a lot of cash flow). Giving into short term market demands like that can be hard on the long-term value of the company because the market also likes a growth story. So, if the company does not grow, then when the dividend period ends with the next cyclical downturn, that stock could find itself discounted to its peers because of the lack of growth.

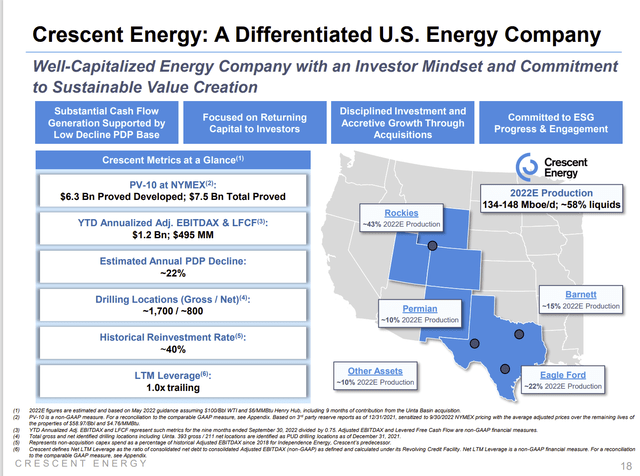

The Business

Management appears to have initially focused upon a lot of established production from sellers that needed to sell.

Crescent Energy Map Of Operations (Crescent Energy Third Quarter Earnings Conference Call Slides November 2022)

Since then, management also picked up some properties where some reasonable profits can be made by drilling new wells. Those new wells will have a higher decline rate in the first year as is typical throughout the industry. But the atypical amount of established production will allow for a low corporate decline rate unless drilling activity picks up substantially. That low decline rate means relatively low maintenance capital costs and hence a larger percentage of free cash flow.

The acquisition pace is likely to slow in the currently robust commodity price market because those robust prices have raised seller expectations. Nonetheless, it is still possible for a bankruptcy property to become available that is attractive.

Probably it is more likely that noncore assets will be sold in the current environment as well as some acreage swaps to improve acreage positions. The strategy of growth by acquisition tends to be a counter-cyclical strategy. So, it is imperative that the strong financial ratios be maintained. Otherwise, acquisitions will not be possible at a time when prices are likely the most favorable.

The Future

The company has recently completed a spate of acquisitions. Therefore, the financial statements really need to clean up after that much activity. Otherwise, it’s hard to tell the one-time optimization expenditures from the continuing expenditures.

So far, costs appear to be more than reasonable. The actual strategy has yet to “play-out”. But the financial risk is unusually low for a KKR-backed company. That makes this issue attractive to a wider variety of investors than would usually be the case. The income from the dividend is also at a decent level and it is likely to grow fast because of the acquisition strategy. That is something that income investors often do not have a choice of every day.

The major investors may or may not achieve their investment goals. But the strong finances and the low payout ratio help limit the downside potential of this stock. The upside potential can be debated. But with KKR involved and the strategy management intends to pursue indicates a lot of upside potential.

Be the first to comment