jetcityimage/iStock Editorial via Getty Images

Introduction

This article wants to offer a follow-up coverage of the article about Norfolk Southern (NYSE:NSC) that I recently published on SA to share some research I have been carrying out about North-American class 1 railroads. The series was introduced by this article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study.”

I recommend reading it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire Hathaway (BRK.A, BRK.B) owns. The approach I am taking to assess the company comes directly from what I am learning from Buffett and can, therefore, be a little bit different from other ways to value a company.

For those interested in reading the previous episodes, here are the links:

- Looking At Railroads As Mr. Buffett Does: Canadian National Railway

- Looking At Railroads As Mr. Buffett Does: Canadian Pacific

- Looking At Railroads As Mr. Buffett Does: Norfolk Southern

- Looking At Railroads As Mr. Buffett Does: CSX

- Why I Want To Buy Canadian National Railways Company

- CSX: When Traditional Metrics and Buffett Metrics Diverge

This time we are once again covering Norfolk Southern after the company reported its Q3 earnings.

Summary of previous coverage

Main valuation metrics

The most important thing I learned from Mr. Buffett is the reason why he decided he could invest in capital intensive businesses. At first he shunned them, but he then realized that high capex is not, per se, a problem. The real issue is whether or not the employed capital has a decent return on its use.

In order to assess this, Buffett has taught us to look at four aspects: earning power, efficiency, use of capital, and shareholder return.

These add up to other two key factors he usually considers: moat and macrotrends. In particular, class 1 railroads have a moat that is given by their own railway infrastructure, which is costly and difficult to replicate. As far as macrotrends go, Mr. Buffett has highlighted more than once that he sees railroads enjoying three main tailwinds against trucks:

- cost and environmental advantages over trucking

- fuel efficiency that leads to better operating costs

- increasing need for freight trains.

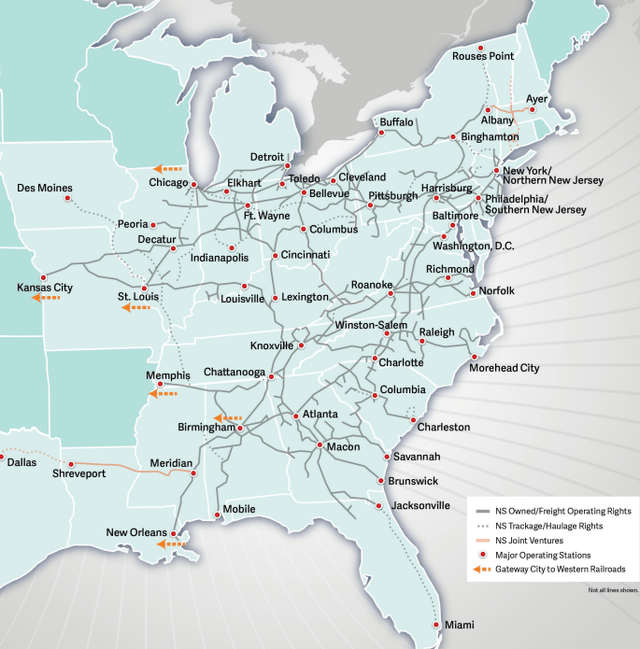

Norfolk Southern

For those who are unfamiliar with the company, Norfolk Southern Corporation is based in Atlanta and it operates 19,300 route miles in 22 states and the District of Columbia. Its footprint is in the east, with branches that reach into Midwestern and Southern States. The company operates the most extensive intermodal network in the East and is a principal carrier of coal, automobiles, and automotive parts. Coal, in particular, is quite important for the company as it is linked to the mines in the Appalachians. Intermodal is also of great importance for the company as it generates about 28% of its revenues.

Norfolk Southern Q3 Financial Report

Let’s get to the usual metrics we are learning to use in order to recap the different metrics and have a way to compare Q3 results to see how the company has performed and where it is headed to.

In 2021, Norfolk Southern reported pre-tax earnings of $3.9 billion and an interest expense of $646 million. This gave an earning power ratio of 6.04 which is a bit low for the industry but it is still high enough to believe that the company can meet its interest obligations without much pain.

However, one thing I didn’t like about the company was that it seemed like its debt is increasing by an amount close to what the company spent on share repurchases. In order to make it easier for new readers to catch up with what I researched, allow me to quote what I wrote about this problem that arose in the first half of the year:

In the past six months, while the net income is just $30 million more versus last year, we have a total debt that has increased by $1.34 billion bringing the total debt at $15.05 billion. What has this money been used for? If we look at the cash flow statement, we see that the company spent $1.45 billion for share repurchases over the first six months. There is no sign of the borrowed money under the investing activities, apart from a $210 million increase in property additions spending. This makes me think that most of this debt was used for share repurchases. In fact, the weighted average of outstanding shares decreased by 12.4% YoY. As far as I like buybacks, I stick with Warren Buffett in believing that they are good only when they return excess cash to the shareholders. In this case, I see borrowed cash returned to shareholders who, on the other hand, own more debt and will have to make the company pay an interest on this cash that was returned to them. I must say that I don’t like this operation, especially when interest rates are rising. Furthermore, it is to be considered whether the current share price is attractive for such a big repurchase. At today’s valuation, with a price to sales of 4.3, a price to book of 3.9 and p/e of 16.8 the shares are not exactly cheap. True, in this way the company will have to pay less dividends being thus able to increase it for the remaining shares. But, as I think it is becoming clear, it is not exactly an operation that is creating real value for the shareholders.

True, the free cash flow increased 5x from 2012 to 2021, moving up from $525.1 million to $2.5 billion and this made the company strong enough to return a lot of cash to its shareholder. However, I stick to my thoughts and I don’t consider that what the company seems to have done in the first half of the year is not as shareholder friendly as it might be perceived.

Let’s move on to the other metrics we found out. Regarding operations, we saw that in the past three years, Norfolk Southern was able to reduce its operating ratio by 530 basis points and it achieved a company record of 60.1%, which, in any case, is still above its main competitors.

Though the company has implemented PSR, this had led to a tough relationship with its workers and, as we know, Norfolk too is at odds with its employees. Recent news reported that President Biden himself is dealing with the problem.

As most railroads, Norfolk too had been hit by increasing fuel costs in the first six months of the year. This made the operating expenses increase by 21%. However, fuel surcharges were expected to have a positive impact on Q3 results and, so far, we have seen this proven true in Norfolk’s peer’s reports.

Regarding fuel efficiency, we found out that Norfolk Southern is less efficient with its 1.11 gallons per 1,000 GTMS, which is 15% more than Canadian Pacific (CP) and 32% more than Canadian National (CNI). Norfolk also has an old locomotive fleet, with 2,570 of its 3,210 locomotives (80%!) that are from 2006 or before. Also, the average age of in-service locomotives is 26.7 years and the average age to retire them is 31.5 years.

As its main peer CSX, Norfolk Southern doesn’t disclose its ROIC either. It does however say in its annual report that it is assuming a long-term investment rate of return of 8%. However, if I calculate it using the formula (NOPAT/invested capital) I got a 14% which is in line with the industry.

Q3 Results

Here we are. We can finally take a look at the new report and see what Norfolk has been up to. Let’s start from a very useful slide taken from the results presentation.

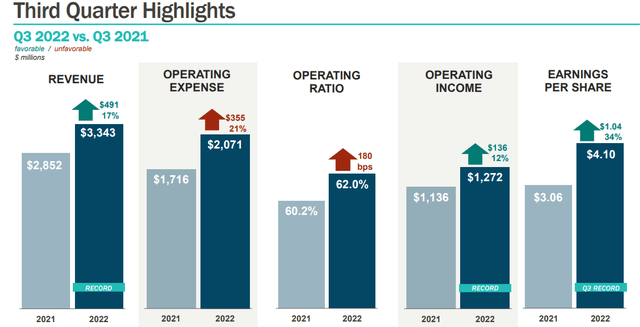

Here we see the main highlights. As we are learning, the main data these companies show are not exactly the ones we are looking for, since we are digging a bit deeper. However, it is important, in any case, to look at the general picture.

Norfolk Southern Q3 Results Presentation

As most investors were expecting, Norfolk achieved record-breaking results.

Its quarterly revenues came in at $3.3 billion – an all-time quarterly record – which is up 17%, or $491 million YoY. The main growth driver the company reported 20% increase in revenue per unit due to higher fuel surcharges and pricing. Here we have immediately checked one thing we were looking for: the impact of fuel surcharges. It worked well for Norfolk, too.

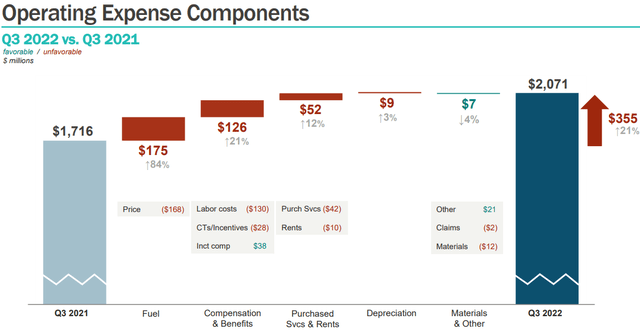

However, their railway operating expenses were $2.1 billion, which, as the graph shows, is a $355 million increase (or 21%) YoY. It means that fuel prices and labor costs, as well as the less considered impact that slower train velocity has on costs, had an impact that was not completely offset by the above-mentioned measures. As a consequence, this quarter the railway operating ratio went once again up, standing at 62%, which is more than its main peers. We can see this situation through the waterfall chart below, which shows that price and compensation & benefits did have a meaningful impact. Probably, the issue about labor conditions is not over yet and the company, together with its peers, will have to figure a way to improve working conditions and wages.

Norfolk Southern Q3 Results Presentation

Let’s get to the bottom line of the report: diluted earnings per share were $4.10, up 34%, or $1.04 YoY. However, Norfolk disclosed that while there was a $0.28 impact from the wage accruals pertaining to a prior period there was also a $0.58 benefit from a state tax law change.

Key metrics

Earning Power

We have already seen that the operating ratio went up. Let’s focus now on earning power which measures the strength a company has to meet its interest requirements in any economic condition. If we look at the TTM pre-tax earnings, Norfolk has $4.2 billion, while its interest expense in the same time period amounts to $680 million. This gives us a ratio of 6.17 which is just a tick higher compared to the 6.04 we saw in the previous quarter. It is not a big change, even though it is in the right direction. Remember that we have Canadian National that is now at a stunning 13.

Fuel efficiency

We saw that Norfolk was the least-efficient railroad among the ones we have covered so far as per fuel efficiency. Once again, Norfolk didn’t perform well, with a 1.10 gallon of fuel consumed per thousand GTMs, with a slight improvement compared to the 1.13 of Q3 2021. The average train speed increased from 17.5 mph in Q2 to 19.1 mph. However, if we compare this quarter with the same quarter in the prior year, we see that last year the average speed was 20.7 mph. Last year, Norfolk’s trains were faster and consumed just a bit more.

Use of capital: return on investments and shareholder return

ROIC is one of the most important metrics to look at in order to assess how well a company is employing its capital. For capital intensive businesses, this metric becomes even more important. However, Norfolk doesn’t disclose its ROIC. This is why we have to calculate it with the formula (ROIC=NOPAT/invested capital). Before the earnings report the result was 14%. Now, if we use the TTM data, we are before a 13.8% ROIC, which is slightly below its peers.

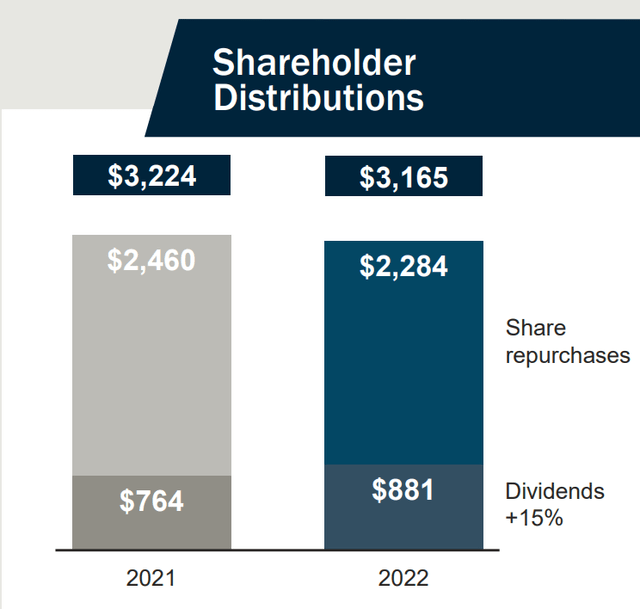

Regarding shareholder distributions, I see as a positive fact that while Norfolk Southern increased its dividend by 15% YoY, it seems to be slowing down on share repurchases, which, in my opinion, could lead to a problem for the company, as I explained above. With a dividend yield of 2% and a free cash flow yield of 4.5%, the company has enough room to support a growing dividend without reaching a dangerous payout ratio and pay down some debt instead of raising it in order to fund share repurchases.

Norfolk Southern Q3 Results Presentation

Conclusion

As I explained in my previous article, there are reasons to believe that Norfolk has some upside. Since then, the stock is up 16.5% and it has outperformed the broader market. This wipes away some margin of safety and leaves my model with a 13% upside in a normal scenario, which, in my opinion, is not a very interesting upside for this kind of investment. In addition, I still don’t see any sign about a new way to handle share repurchases. This is why I confirm my hold rating.

Be the first to comment