AndreyPopov

Introduction

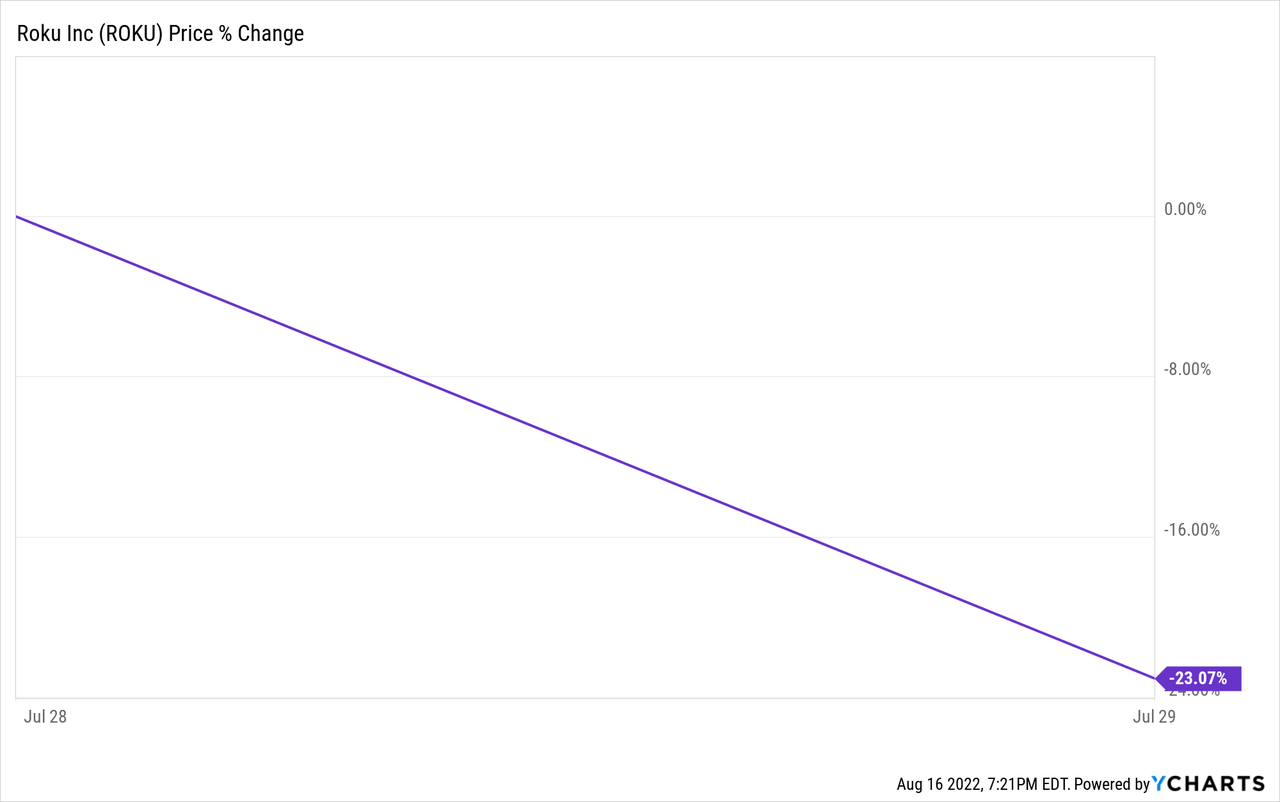

A few weeks ago, I wrote an article titled Is Roku Doomed? Roku (NASDAQ:ROKU) had just reported its earnings and those were not good. The stock nose-dived.

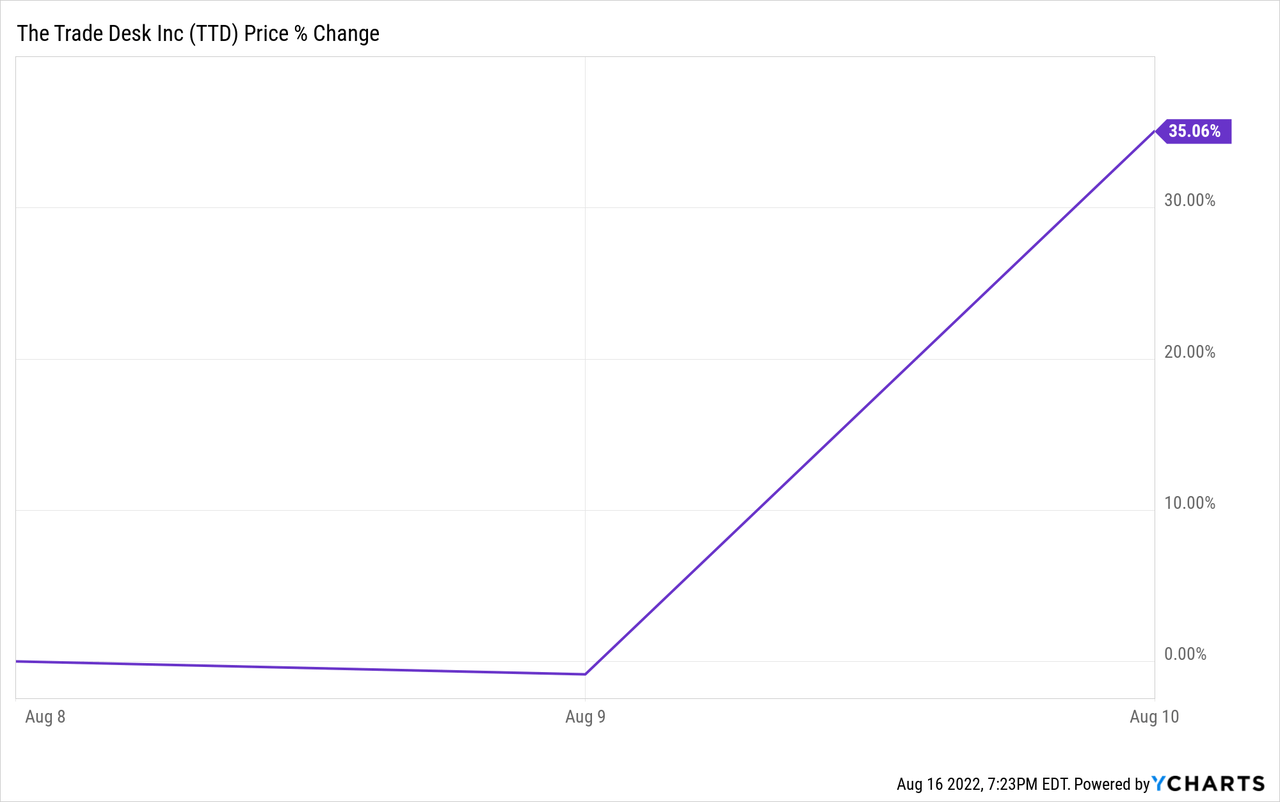

Last Tuesday, after the market closed, The Trade Desk (NASDAQ:TTD) reported its Q2 2022 earnings and the company did very well again. The stock ended the day up almost 37%.

The main reason The Trade Desk’s founder and CEO Jeff Green cited for such strong earnings? CTV, or Connected TV, Roku’s core business. How is it possible that one company has trouble and another thrives when both are in CTV?

For the Roku earnings, I refer to my previous article. In this article, I’ll first analyze The Trade Desk’s earnings and then look at the differences between the two companies.

Before we start, you will get quite a few Jeff Green quotes in this article. Usually, I paraphrase what CEOs say, but Green is always to the point and explains things very clearly. That’s why I want you to experience his own words.

The Trade Desk’s Q2 2022 numbers

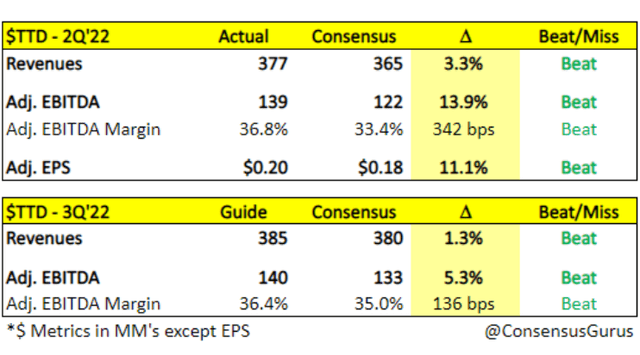

The Trade Desk’s revenue was up 34.6% YoY to $377M, beating the estimates by $11.8M or about 3.2%. That’s especially impressive if you know that the comps were very difficult, as The Trade Desk’s revenue was up 101% in Q2 2021.

Non-GAAP EPS came in at $0.20 versus the consensus of $0.18. On a GAAP basis, the company lost $0.04 because of a large performance-driven stock package that Jeff Green got. That’s non-recurrent, so it can be mostly ignored. Jeff Green is The Trade Desk, and while I would have problems with other CEOs, this huge stock-based compensation based on a 5-year performance is not a red flag in this case. Ideally, you never want that, but this is the Michael Jordan of ad tech and Jordan didn’t exactly play for peanuts either.

The Trade Desk had guided for $121M in adjusted EBITDA for Q2. Analysts know the company and aimed a bit higher, at $123.3M. But the number came in at $138.9M. That means management beats its own guidance by 14.8% and the analysts’ consensus by 12.7%.

When we break it down across the several segments, you can see this:

From a channel perspective, CTV via a wide margin, led our growth again during the quarter. Exiting Q2 video, which includes CTV represented a low-40s percentage share of our business and continues to grow rapidly as a percentage of our mix. Mobile represented a high-30s percentage share of spend during the quarter, and display and audio continued to represent about 15% and 5% of our business respectively.

(CFO Blake Grayson on the earnings call)

Something that didn’t change but is still worth pointing out is the strong customer retention of over 95%. That has been the case for more than 8 years now, which shows how sticky The Trade Desk is.

You also don’t have to worry about the financial position of The Trade Desk. It has $1.2B in cash, equivalents and short-term investments, and no debt. Very strong.

The Trade Desk always guides with ‘at least’, which I like. This time, they guided for at least $385M of revenue in Q3, a bit higher than the $382.3M consensus.

When it comes to (adjusted) EBITDA, the consensus stood at $133M. The Trade Desk guided to approximately $140.0M. ConsensusGurus made a neat summary, with all green:

Management’s comments

It’s always a pleasure to listen to Jeff Green, The Trade Desk’s founder and CEO, as he knows so much about ad tech and knows how to explain the complicated details to a public of interested people that don’t live and breathe ad tech like he does.

While the earnings call was live, I listened and made a tweet storm of 30 tweets with what was said. You can find it here.

But of course, I will structure that a bit more here.

Operating expenses

Let’s start with what was probably the only negative one can find in this quarter, the operating expenses. They went up 45%, more than revenue grew. That’s not really something to worry about, though. The company invested extra in the team, especially in sales, marketing, technology, and development. There was also a headwind from the return of in-person events that came back. This is what Blake Grayson says about attracting more talent right now:

…there are many of our peers that might have more resources, that are pausing, hiring or cutting investments because they invested too aggressively. We didn’t get ahead of ourselves the last couple years like – it sounds like many companies did.

Why The Trade Desk is winning

We have seen that the environment is tough, but The Trade Desk does very well nonetheless. Why?

Jeff Green first points at JBPs, which stands for joint business plans. JBPs are long-term deals with big brands that commit to increasing their spending on The Trade Desk’s platform. In other words, these are multi-year contracts. According to Green, the speed of signing these deals has accelerated significantly in the first half of the year.

Green also identified three other important reasons why The Trade Desk is winning:

1. The extreme tailwind of CTV. Worldwide, there is a shift to CTV advertising and it’s probably the fastest transition in history. It’s going much faster than anyone could have expected and,

2. Partly because of CTV, the walled garden platforms (Green called out Google) lose some of their power. Because they were the only option, they could use ‘draconian’ rules but advertisers don’t want that anymore. With CTV, there is an alternative now.

3. There is also more and more regulatory pressure on walled gardens, especially Google (GOOGL) (GOOG), not just in the U.S. but worldwide. The reason is the same worldwide: Google’s ad monopoly position that it abuses to squeeze the competition. Jeff Green also clearly explained why The Trade Desk is gaining market share compared to Google:

I believe Google’s biggest obstacle to compete in programmatic and in CTV is their lack of objectivity. By contrast, we don’t own any inventory and we can partner with everyone in CTV. That gives us a level of objectivity that Google can’t overcome as long as it owns YouTube and its search engine, its core assets and continues to operate on both the buy side and the sell side.

And Green really didn’t spare Google:

I do get concerned about what Google has done to make it much harder for companies smaller than The Trade Desk to compete in the open Internet. I’m concerned that the press and regulators are too focused on what assets Google owns or should own and instead should apply more scrutiny to Google’s behaviors, their incentives, their structure and their tactics.

CFO Blake Grayson added:

We also benefit from the diversity of our business model, including not only the breadth of advertisers and verticals we represent, but also the range of inventory we have access to across the open internet, which provides a long-term durability we are proud of. During the quarter, we benefited from a digital advertising environment that is shifting increasingly towards data driven buying and measurable results.

Macroeconomic headwinds

The Trade Desk bucked the trend in advertising and grew despite the challenging macroeconomic circumstances. Jeff Green pointed out that The Trade Desk was born during the financial crisis and gained a lot of market share during the pandemic. He added:

So, while we can’t control the macroeconomic environment, the pace at which we are signing new and expanded customer agreements indicates that we are becoming an indispensable partner in their business growth and we anticipate grabbing land regardless of the macroeconomic environment.

He particularly pointed out CTV:

And in large part that’s because as marketers become more deliberate with their budgets, they are prioritizing, advertising that delivers the highest return and CTV has moved up the priority list.

Why doesn’t Roku do better then?

If you see that The Trade Desk does so well because of CTV, the logical question then is why Roku, which is specifically focusing on CTV, didn’t have better earnings results. The answer is that Roku is a different company in several ways.

1. A part of Roku’s revenue is from hardware. While this is a loss leader to get into people’s homes, it’s still a significant part of the revenue. But it’s a drag on the overall revenue now. In the last quarter, Platform revenue was up 26% YoY in the latest quarter but hardware sales were down 26% YoY.

2. The different model of advertising Roku works with. Jeff Green answered the question that could have been about Roku, although it was not named:

Well then why isn’t everyone in CTV seeing the same sort of growth that you are seeing? There are a couple reasons for that one.

There are some companies that are deployed the walled garden strategy, which is that I have something special either on my operating system or on my channel, and you should buy that exclusively through me. And as I mentioned in the prepared remarks, no one in CTV has a position that is strong enough to be draconian the same way that you can in other parts of digital like search or social or some of those others.

Roku uses the walled garden technique for its operating system. Even though they are by far the biggest CTV player, they still might not be strong enough to be a walled garden. The question then is if this will remain like that or not? PC and mobile evolved to just a few big players that control the Operating Systems. Will CTV follow? If the answer is yes, I think Roku has a big chance of succeeding.

Green goes on contrasting the walled garden approach with what The Trade Desk does:

So as a result those tactics, I think are proving more difficult as more and more choices are coming online. So a platform that sits objectively and helps people choose across the 20, 30, 40 places where you can buy, I mean, think of your own habits as a consumer, you were probably watching CTV on two or three apps five years ago. Now you’re probably watching them on seven, eight, nine, 10 plus that fragmentation creates a greater need for somebody to centrally partner with all of them measure, reach, and frequency and performance across all of them, and has to have a business model that is eligible to partner with everybody.

So that’s why I would argue that we have outperformed everybody else is that unique position and that unique strategy that we’ve deployed.

Roku also pointed to the scatter market as a reason for the weakness. It’s based on the traditional model where you buy things upfront and there is a middle market for things that don’t work out or have to be adapted and that is the scatter market. Jeff Green gives the contrast with what The Trade Desk does.

Separately from that is a spot market. And what I would call the spot market is the programmatic market that we operate in. And so when people talk about scatter and spot, especially because when they’re talking to people in the financial industry, they can draw analogies to equities.

That don’t seem that different, but really what we’re talking about in television one is very closely associated with the upfront market, which was invented in the 60s. The other one we’re talking about digital that brings all of the data and decisioning to bear that, that the internet can really offer that is what makes it so television is going to get better and better, which is there are going to be fewer ads. They are going to be more relevant. There are going to be highly effective. And that funds content at a rate that has never been seen before, that can only be done by a spot market and a forward market, not a legacy upfront market and scatter market.

So those are the reasons, why there’s a big difference in rhetoric around scatter versus spot. The spot market is amazingly strong, the strongest it has ever been.

Green also said this about the difference in model:

You have a party or an event, where you commit dollars to advertising for the better part of the year with the absence of data and transactions like it’s just – in a way it’s even strange that as an industry it’s still happens that way.

This is something to think about when it comes to Roku.

Conclusion

The dynamics for Roku and The Trade Desk are different, although The Trade Desk and Roku both should benefit from the secular trend to CTV. Roku goes for a walled-garden approach, while The Trade Desk fights for the open internet. It makes The Trade Desk more robust and Roku more subjected to the macroeconomic environment.

In the meantime, keep growing!

Be the first to comment