Tim Boyle

Nordstrom, Inc., (NYSE:JWN) a fashion retailer, provides apparels, shoes, beauty, accessories, and home goods for women, men, young adults, and children. It offers a range of brand name and private label merchandise through various channels.

Today, we are going to take a look at Nordstrom’s latest quarterly earnings report, together with selected economic indicators, to try to gauge, how the firm may perform in the near term, compared to the broader market.

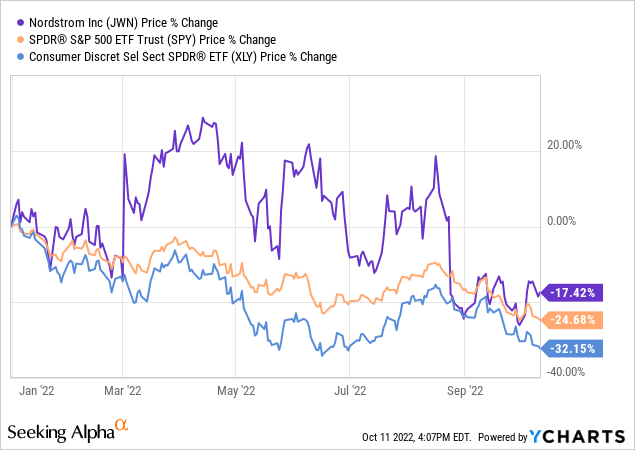

Year-to-date, JWN has lost 17% of its market value, compared to the 25% decline of the broader market (SPY) and the 32% decline of the consumer discretionary sector (XLY).

Quarterly earnings report

In this section, we are going to take a look at selected parts of the firm’s latest 10-Q filing, to understand, how the macroeconomic environment is impacting the firm’s financial performance.

Revenue

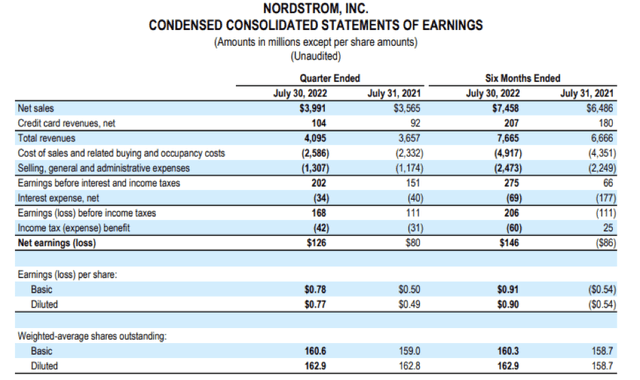

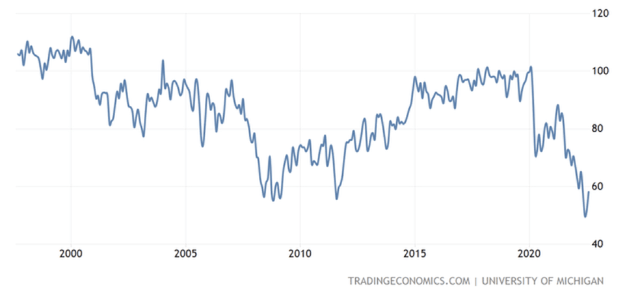

Nordstrom’s net sales have increase in the second quarter to $3,991 million, representing a 12% increase year-over-year. Total revenues have also increased to the same extent.

Condensed consolidated statements of earnings (JWN)

When looking at the sales figures, important to understand what the main drivers of growth were. The following table breaks down, how revenue has developed across segments and distribution channels.

Net sales (JWN)

Nordstrom net sales reflected an increase in both the average selling price per item sold and the number of items sold for the second quarter and six months ended July 30, 2022, compared with the same periods in 2021. Nordstrom Rack net sales reflected an increase in the average selling price per item sold, partially offset by a decrease in the number of items sold for the second quarter and six months ended July 30, 2022, compared with the same periods in 2021.

We believe that the net sales increase is impressive, in light of the current macroeconomic environment. An increase in the number of items sold indicates that the demand for JWN’s products remains high, despite the increased prices and the poor consumer sentiment.

Let us take a closer look at consumer sentiment and what it could mean for JWN’s business in the coming quarters.

Consumer sentiment

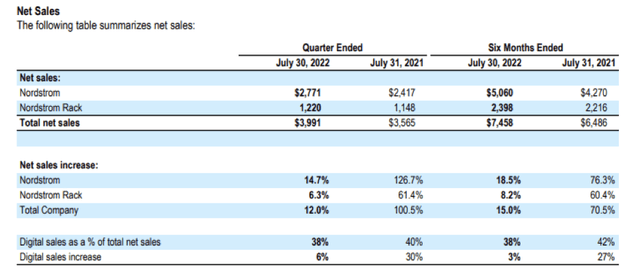

Consumer confidence – a leading economic indicator – is often used to estimate potential changes in the spending behaviour of the consumer in the near future.

Since the beginning of 2020, consumer confidence in the United States has been on a steep decline, despite the short uptick in the second half of 2020 and in August 2022.

U.S. Consumer confidence (Trading Economics)

In 2022, confidence has even fallen below the levels observed during the 2008-2009 financial crisis.

Confidence can be driven by a wide range of parameters, including inflation, energy prices, job security and it gives a measure of how optimistic or pessimistic people are about their financial outlook and the economy in general. Low readings imply that people are less certain about their financials and the strength of the economy and therefore are likely to spend less. Such trends are likely to result in reduced demand for durable, discretionary, non-essential items, resulting in a negative impact on the financial performance of the firm’s manufacturing and selling such goods.

Because of the extremely low readings of the consumer confidence indicators, we have been staying away from most consumer discretionary stocks this year. We have published several articles on Seeking Alpha, highlighting the risks associated with investing in such firms. For example:

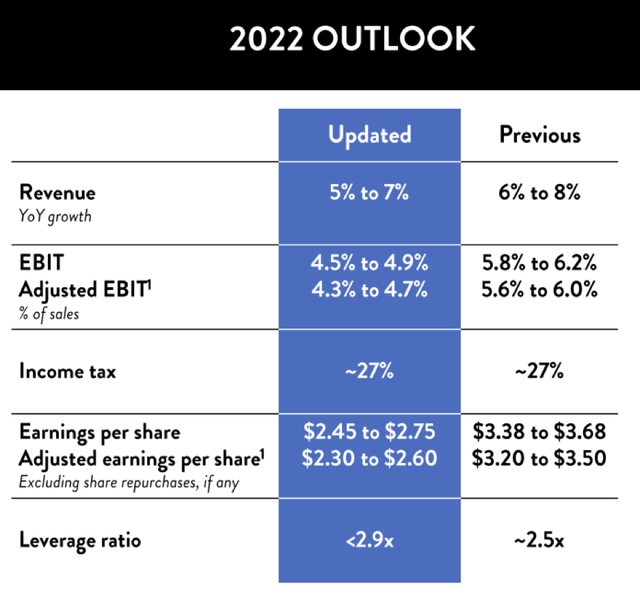

We are not the only ones, however, who believe that demand and sales may slow. The firm has updated its full year guidance, reducing both top- and bottom line estimates.

Guidance (JWN)

While we believe that the 5-7% revenue growth in the current environment is still attractive, many may also question, whether it is a realistic expectation or not. Well, Levi (LEVI) has just recently announced their earnings results and they have made a few remarks, which may signal how the demand is developing in the U.S. For example:

Wholesale net revenues grew slightly despite supply chain disruptions, as well as softened consumer demand impacting revenues starting in July […] higher in-person traffic in the current year in comparison to the prior year, as well as higher average selling prices.

These remarks also do not give clear indications about the consumer sentiment in the industry, and how long the demand can remain relatively strong, despite the rising prices.

In our opinion, consumer sentiment may also create headwinds for JWN in the near term, despite the firm’s latest quarterly figures, which have been still indicating a high demand. For this reason, we do not recommend starting a new position in JWN, as long as the consumer confidence readings do not show a substantial improvement.

The financial performance of a company is not only dictated by the sales or the demand for their products, but also by the costs associated with their operations.

Expenses

Surprisingly, JWN’s business also appears to be strong from gross profit, SG&A expenses and EBIT perspective, based on the second quarter financial figures.

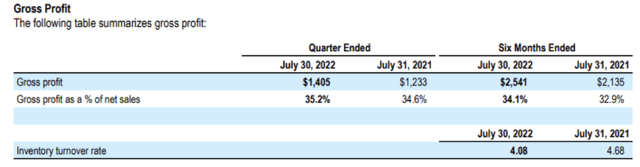

Gross profit

Gross profit (JWN)

Gross profit increased $172 for the second quarter of 2022 and $406 for the six months ended July 30, 2022, compared with the same periods in 2021, almost entirely due to higher sales volume. Gross profit margin increased 65 basis points as a % of net sales for the second quarter of 2022 and 115 basis points as a % of net sales for the six months ended July 30, 2022, compared with the same periods in 2021, due to leverage on buying and occupancy costs, partially offset by higher markdown rates for the second quarter of 2022. Ending inventory as of July 30, 2022 increased 10% which is in line with the 12% increase in sales for the second quarter of 2022 compared with the same period in 2021. Inventory turnover rate, which is calculated using trailing 4-quarter average inventory, decreased primarily due to excess inventory levels across all channels as a result of supply chain disruptions and softening customer demand trends.

It’s important to highlight the remark with regards to inventory.

Many firm’s this year have been struggling with inventory management issues. Retailers like Walmart (WMT) and Target (TGT) had to use significant discounting in order to get rid of their excess, obsolete inventory. On the other hand, we believe that JWN is in a better position. While inventory levels have increased, and the turnover has decreased in the second quarter, these changes are not dramatic. While, in our opinion, the changing consumer behaviour may also force JWN to use discounting to reduce their inventory levels, it may not be as severe as for the previously mentioned firms.

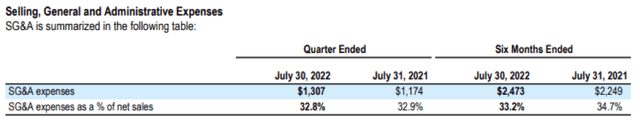

SG&A Expenses

SG&A (JWN)

SG&A increased $133 during the second quarter of 2022, and $224 for the six months ended July 30, 2022, compared with the same periods in 2021, primarily due to variable costs on higher sales volume and higher labor expense. SG&A rate decreased 15 basis points during the second quarter of 2022, and 150 basis points for the six months ended July 30, 2022, compared with the same periods in 2021, primarily due to leverage on higher sales, partially offset by higher labor expense.

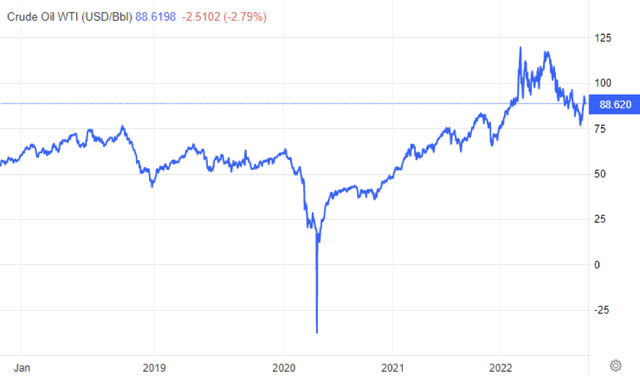

Further, it’s important to note that elevated energy prices have resulted in increasing transportation and shipping costs for many firms in the past quarters. While oil prices have come off of their peaks, they remain elevated.

WTI price (Trading Economics)

Further, the recent announcement by OPEC+ makes the uncertainty around energy prices even higher. For this reason, we believe that JWN’s margins may see a contraction in the coming quarters.

To close off this section, we have to understand, how all these factors have eventually impacted the firm’s net income.

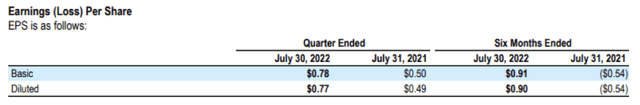

Earnings per share

EPS (JWN)

Earnings (loss) per diluted share improved $0.28 for the second quarter of 2022 and $1.44 for the six months ended July 30, 2022, compared with the same periods in 2021. The improvement in the second quarter of 2022 was primarily due to higher sales volumes compared with the same period in 2021.

While many firms have been struggling year-to-date with declining demand and contracting margins, JWN has presented surprisingly attractive figures for the latest quarter. Although we believe that macroeconomic headwinds may negatively impact the company’s financial performance in the near term, we do not recommend selling JWN’s stock now, based on their latest results.

Before concluding our article, we would like to highlight a few other factors that should be taken into account, when making an investment decision.

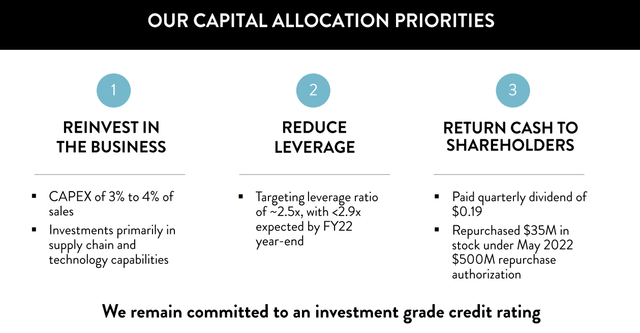

Capital allocation priorities

The following slide summarizes the priorities that Nordstrom has set for their capital allocation:

Capital allocation priorities (JWN)

We like that they focus on these three core areas. In our opinion, in times of downturns and challenging environments, it usually pays off to improve the efficiency of the firm by investing in technology capabilities. Second, we also believe that reducing debt could lead to more financial flexibility in the near term, which can be crucial in a volatile market.

Last, but not least, the firm’s commitment to return value to its shareholders, both through dividends and share buybacks, is attractive. In our opinion, even if earnings decline in the near future, JWN will be able to maintain its dividend (as the current payout ratio is only 16%), while repurchasing a part of its shares.

Selected financial ratios

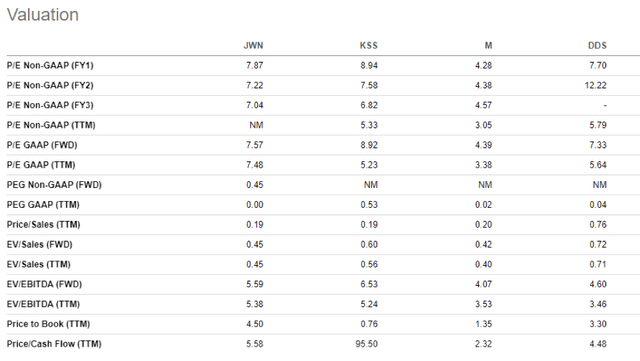

Valuation

While the firm’s stock is trading at significantly lower multiples than the consumer discretionary sector median, it is trading about in line with other department stores.

Valuation comparison (Seeking Alpha)

In our opinion, the current valuation, taking into account the capital allocation priorities, is justified, however the risks need to be understood.

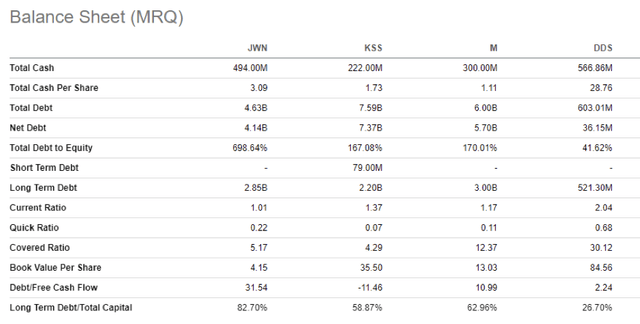

Balance sheet ratios

Liquidity ratios like the current ratio or the quick ratio indicate, how well the firm can cover its current liabilities with its current assets. If these ratios are below one, it can be an indication that the financial flexibility of the firm is somewhat limited.

Balance sheet (MRQ) (Seeking Alpha)

While the current ratio is just above one, the quick ratio is significantly below it. In the current, uncertain market environment, we are not confident in investing in firms that do not show significant flexibility. While their ratios, relative to those of the other players in the field, are not materially better/worse, we do not recommend starting a new position in JWN now.

To sum up

Strong financial results in the second quarter, fueled by increased pricing and high demand. Despite the worsening macroeconomic environment, margins have widened in Q2.

On the other hand, to account for potential headwinds in the near term, the firm has lowered its guidance for the second half of the year.

From a valuation and capital allocation perspective, the firm looks attractive.

Currently, we rate Nordstrom’s stock as “hold”.

Be the first to comment