Bubball

Noble Absolute Return ETF (NYSEARCA:NOPE) is a new actively managed exchange-traded fund. It is one of the relatively few that is long/short. Here is the good, the bad, and the ugly.

The Good

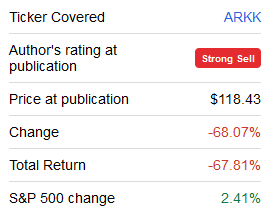

We generally share likes and certainly share dislikes. On the long side our positions don’t overlap but our exposure to energy equities does. His short ideas heavily overlap with mine. He has a massive ARK Innovation ETF (ARKK) short. I agree 100% for reasons enumerated here.

SA

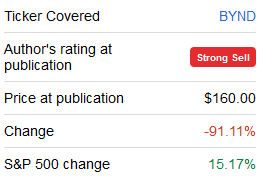

He’s short Beyond Meat (BYND). I think that stock is worth approximately $0.00.

SA

I dislike the entire idea of “fake meat.” It would be like marketing “fake romance” or a “fake sunset.” Why not… just get the real thing? It’s healthy and delicious. Ultra-processed food is far less healthy. Real food has single ingredients. Meat should be made from meat.

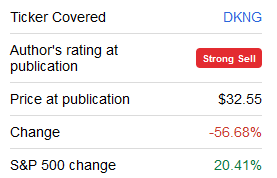

He is short DraftKings (DKNG), another where our ideas overlap:

SA

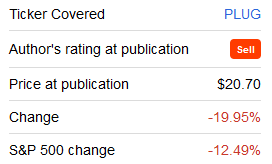

He’s short Plug Power (PLUG) which tops the list of my favorite non-profitable tech shorts. All of these are worth less and many are completely worthless.

SA

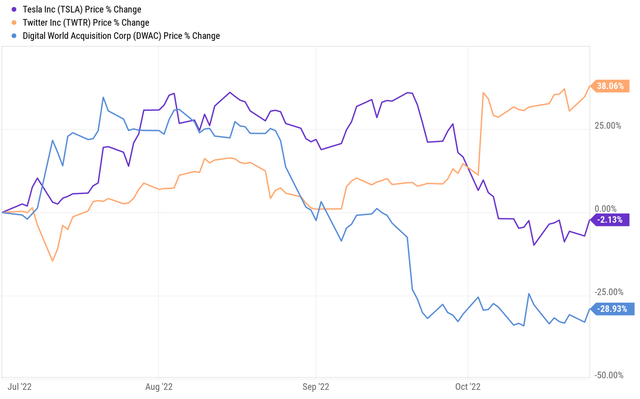

But most importantly, he’s short Tesla (TSLA) via equity and options. That’s my biggest short position paired with Twitter (TWTR), my biggest long, which I disclosed in Short Tesla (And Trump SPAC), Buy Twitter.

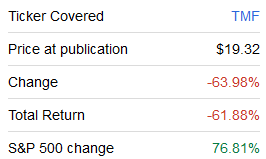

On the macro side, we have used different tools to express an overlapping bearish view on the long bond, his via owning the leveraged short ETF (TBF) while I preferred the idea of shorting the leveraged long ETF (TMF).

SA

So what’s not to like?

The Bad

No matter how good you are at security selection, sizing discipline is utterly crucial. Size matters. And it matters even more when sizing short positions. A 79% short position in TSLA and a somewhat redundant 37% short position in ARKK (which is short TSLA indirectly) is dangerous, potentially terminally so. I rarely take double-digit positions. This year I have only three – Renren (RENN), Amplify Energy (AMPY) and Twitter – and this year’s portfolio concentration is an anomaly since these three had such wildly positive expected values when we set them up. I have no double-digit short positions. They’re not the same. If TSLA pops from here, NOPE could be out of business.

The Ugly

Elon Musk is a highly volatile character. Many of the attributes that drive me to short his stock could also make it rocket – at least for a while. He’s willing to say or do anything and feels unconstrained by the law, by contracts, or by his own prior statements. To me those are negatives. To his huge fanbase they are positives. Sure Musk needs to sell billions of dollars of TSLA shares to fund his Twitter (TWTR) acquisition, but that also means that he has a massive incentive to promote the stock. If the value investing cliché is that the market is a voting machine in the short term and weighing machine in the long term, my bet is that the weighing machine would lead to a bad result for Tesla. But we already know that Musk has virtually superhuman abilities to win when it comes to the voting machine and that could continue in the days ahead.

Conclusion

While our views closely align when it comes to security selection, my concerns with position sizing make NOPE a short rather than a long. And if you short ARKK or TSLA, do so in a survivable size. Don’t take any firm risk. If you were poor and now are rich, don’t risk being poor again just because you have a strong view on any one stock.

TL; DR

Skip or short NOPE.

Be the first to comment