grinvalds

Shares in Semrush (NYSE:SEMR) have fallen more than 50% in the last year. Shares have fallen this way even though the company’s fundamentals have only been improving over the last year. Semrush is a fast-growing company, with a strong balance sheet and great market opportunity. If management meets current market expectations, I think Semrush can generate very attractive returns to long-term investors.

What Is Semrush?

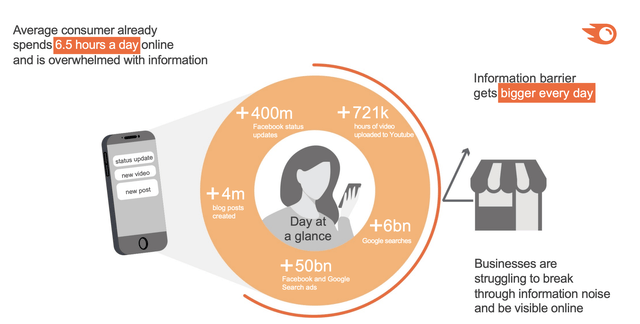

Semrush is a toolkit that allows its users to improve their online visibility. But why is Semrush useful? The average customer now spends over 6.5 hours a day online and is overwhelmed with vast amounts of information. For example, over 4 million blog posts are created every day, over 721,000 hours of videos are posted on YouTube, more than 400 million status updates on Facebook, and so on. As you see this new information, there is more and more every day. This makes it hard for normal businesses to break all this information and be visible online.

SEMR helps companies solve exactly this problem. There are over 55 tools for SEO, content marketing, competitor research, social marketing, and more at Semrush. SEMR simply helps businesses be visible online, creating customers and making more money. Semrush was founded in 2008 by Dmitry Melnikov, who is still with the company and is a COO, and owns 15.6% of the entire company. And also by Oleg Shchegolev, who is CEO and owns an astonishing 38.79% of the entire company.

Semrush is therefore a founder-led business, which is very positive. And what I really like to see is that the founders own such a large part of the company. Therefore, it will be in their self-interest that Semrush will be successful in the long run.

Why Is Semrush Useful (Semrush Q2 2022 Investor Presentation)

Market Opportunity

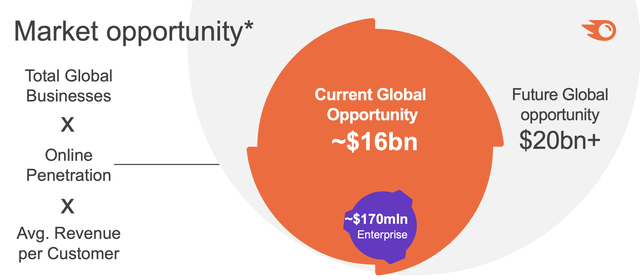

Now I would like to focus on the market opportunity that SEMR has. Right now, the company estimates it has a current global opportunity of about $16 billion. But we have to recognize that SEMR has only captured about 1% of the current market opportunity. Semrush has historically released new tools and services and this logically magnifies the market opportunity.

Moreover, the company is in an industry that grows rapidly every year, so there is definitely room to grow for SEMR. The company has a large and diverse customer base with more than 87,000 paying customers, and some of its customers also include eBay (EBAY), Facebook (META), Salesforce (CRM), Disney (DIS), and many more.

Semrush Market Opportunity (Semrush Q2 2022 Investor Presentation)

The Growth Is Fast

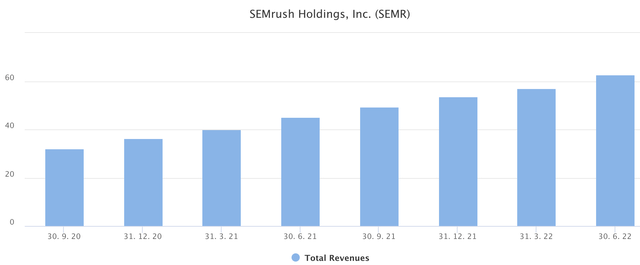

In the past five years, SEMR has grown sales by 48%+ CAGR. That’s a very fast growth, and now let’s look at the growth strategies that the company is going to use for further growth.

The first one is acquiring new customers.

The company will continue to seek new customers, either those who have not yet adopted online visibility management solutions or those who currently use their version for free.

Next, there is the expansion of the use of their platform by their existing paying customer base. SEMR currently has over 87,000 paying customers and this represents a significant opportunity to increase monetization. The company will continue to introduce new premium features that will make paying customers spend more. This is also shown by the fact that SEMR currently has a Net Revenue Retention Rate of 127%, which is a pretty high number. Then they also plan to continue to innovate and develop new products and features. The more useful features and products there are on the platform, the greater the chance that the company will attract new customers.

And then SEMR wants to continue to pursue opportunistic M&A. Acquisitions are something that management has done well in the past few years and management wants to continue with them in the future. Overall, I think there are still a lot of opportunities for SEMR to continue to grow.

Semrush Quarterly Revenue Growth (Semrush Q2 2022 Investor Presentation)

I Like The Financials

Now let’s look at the financials of the company. In Q2 2022, SEMR again had record sales of $62.61 million. As for gross margins, they were almost as high as the long-term target margins of the company, namely 79.9%. Semrush is still losing money, and in this quarter, it was specifically a loss of $8.28 million in net income. But the company, with its balance sheet, can afford it. In order to grow this fast, SEMR has to spend quite significant money on marketing. In this quarter, it was $30.89 million. That’s almost 50% of total sales.

Personally, however, this number seems fine to me, as in order for customers to use SEMR, they have to have a purchased subscription, which customers can be paying for several years thanks to the fact that the company is constantly releasing new features and products.

As I mentioned earlier, the company has a very strong balance sheet. Right now, Semrush has $248.92 million in cash and $302 million in total assets. The company currently has no long-term debt and has only $84 million in total liabilities. Management could easily get rid of all the liabilities, and the company would still have $164.92 million in cash. Right now, it is estimated that SEMR could start to be profitable in 2024. Overall Semrush is currently very well off financially.

Valuation

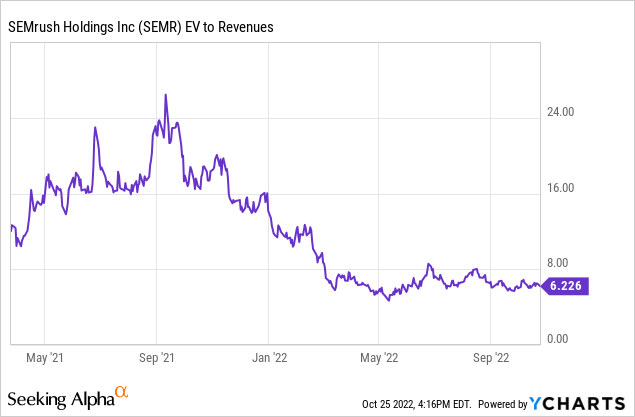

While the valuation of the company is not exactly the cheapest, it is not, in my opinion, overvalued. Currently, SEMR trades at EV/Revenues of 6.49x. This is significantly lower than it was a year ago. As for Price/Book, that’s currently 7.5x.

Now SEMR is trading at NTM EV/Revenues of 5.74x due to the fact that the company’s sales are expected to grow by 34% this year. That’s very fast growth. Overall, I think SEMR is right now trading at a reasonable valuation.

Risks

Investing in Semrush carries risks like any other investment. I’d like to introduce you to the main ones now.

The first risk that SEMR has is the company’s current non-profitability. While Semrush has a strong balance sheet, it is a risk to bear in mind in today’s macroeconomic situation.

The biggest risk the company currently has is competition. Semrush may be a leader now, in their field, but they have many mainly smaller competitors. That’s why we need to keep a close eye on the fact that management is constantly releasing new features and products. This will maintain the company’s current market leadership. These are the two main risks that SEMR has and which need to be kept in mind.

Conclusion

Semrush is a fast-growing company with a great platform. The opportunity that SEMR has is really big and growing every day. The management of the company is doing a great job and the 2 founders own over 50% of the business. This makes it in their self-interest that SEMR will be successful in the long term. The company also has a very strong balance sheet and currently has a reasonable valuation. If the management keeps executing, then I think SEMR can deliver very attractive returns to long-term investors.

Be the first to comment