Marko Geber

Thesis highlight

Several secular tailwinds support my view that Haleon (NYSE:HLN) is a solid business, and I also appreciate that the company’s leadership has proven its ability to get things done. I’d be more interested in investing if the valuation was lower, but I think it’s fair to say that investors could expect market-average returns at the current price.

Company overview

HLN is a group that operates in the consumer healthcare industry. HLN’s popular brands include the world’s number one toothpaste for sensitivity, the world’s leading multivitamin; the world’s leading Topical pain relief brand, the world’s leading Denture Care Brand and a broad range of other large-scale and prominent consumer health care brands with a dominant global and regional presence. (Source: HLN S-1)

Investments merits

Large and growing TAM

One of the biggest, most resilient and thriving markets across the FCMG sectors is the global consumer healthcare market. HLN focuses on OTC and VMS trading, which are currently worth more than £135 billion, according to HLN filings. Aside from OTC/VMS, HLN’s TAM also includes oral health, all of which have an aggregate market size of over £160 billion.

HLN’s had £41 billion in consumer sales in 2021, which represents approximately 27 percent of the global market. HLN also has a strong presence in Europe, China, and other high-growth markets, especially China. This gives them a chance to reach more households in the consumer healthcare category.

I believe there are five key drivers of market fundamentals that are shaping future growth in the consumer healthcare market. They include:

- Increased Consumer Focus on Health and Wellness: Prior to the outbreak of COVID-19, consumers were conscious of taking care of their health and wellbeing. However, with the advent of the pandemic, this trend has been accelerated. According to research conducted by HLN, (refer to S-1 filing), 79% of surveyed consumers think wellness is important and 42% make wellness a priority in their everyday lives. In comparison to two to three years ago, 71% of these consumers now prioritize their health, and 70% expect to do so in the future. These growing numbers tell us that the increase in self-care is a trend that is favorable to the sector as a whole.

- Population Aging: We’re all getting older by the minute. Statistics tell us that the number of people aged 65 years and above is predicted to increase from 9.3 percent of the global population in 2020 to 16.0 percent in 2050. This increase will definitely lead to an increased need for self-care and preventative care.

- The Emerging Middle Class: The upcoming middle class in higher-growth economies is one of the long-term growth drivers for the consumer healthcare market, as increased purchasing power has led to higher per capita usage. Upcoming and higher growth economies continue to represent a sizable opportunity for the industry’s growth. According to HLN’s S-1, the cost of OTC/VMS products in the United States was £110 per capita in 2021, while £53 was the cost per capita in Western Europe. On the other hand, per capita consumption stays low in high-growth markets like China, Central and Eastern Europe, India, and Latin America. This suggests that there are still room for HLN to penetrate in other parts of the world

- Increasing Self-Care in the Face of Increasing Public Health System Demand: Even before the COVID-19 pandemic, there has always been pressure on public healthcare. Global spending on healthcare reached $8.3 trillion, or 10% of the global GDP, falling a little bit below the GDP for the first time in five years. The COVID-19 pandemic has hurt and is still hurting global health systems. The end of the pandemic could cause a deep global economic crisis, which will always have an effect on how health care is paid for in the future. The good news is that the consumer healthcare market and, more importantly, the ability to help consumers with self-care will help to significantly reduce the pressure and burden on public health.

- Sizeable and Unmet Consumer Needs: The competition in the healthcare market is partly driven by the ability to meet consumers’ unmet needs. Trending needs such as the demand for natural ingredients, premiumization, personalized products, and emerging technologies that allow consumers to directly manage their health are all trends that HLN is addressing. I strongly believe that with all of these in place, there is a big opportunity for them to further grow.

To sum it up, HLN operates in a market that is worth over £160 billion as of 2021, and the market has been more relevant since the COVID-19 pandemic ensued. I expect that the trends of the five key drivers will continue, as this will make them dominate the market even more.

Broad portfolio of brands

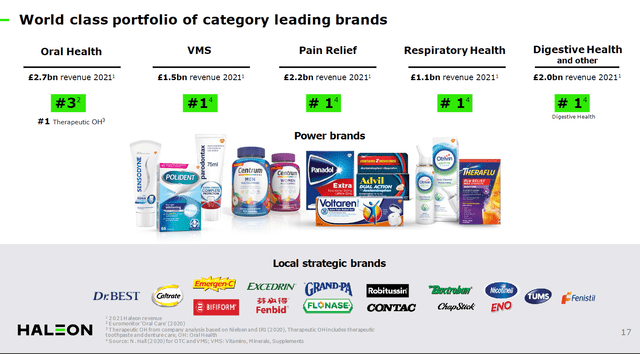

I have earlier established that HLN is one of the world’s leading consumer healthcare businesses. It might interest you to know that their business is built on a one-of-a-kind and focused portfolio of consumer healthcare brands in categories that are attractive, which will provide vast opportunities for growth. Across the key categories that HLN is a world leader in, it had an outstanding portfolio of trusted brands, with leading positions at either the local or global level. It might also interest you to know that the portfolio also includes four of the world’s top ten OTC/VMS brands by revenue.

Consumer Healthcare Capital Markets Day Feb 22

Furthermore, HLN’s portfolio also includes nine large-scale multinational power brands. Voltaren, Advil, Otrium, Sensodyne, Polident, and Centrum rank number one or number two globally in their respective sub-categories. Panadol is also a leading systemic pain relief brand outside the USA. Products like Theraflu have a strong regional presence in Europe and North America. These power brands are balanced with local strategic brands like Fenbid, Emergen, amongst others. Because of the combination of the Power and Local Brands, HLN is provided with a focused, complementary, and trusted portfolio that offers high advantages as well as meaningful opportunities for their growth.

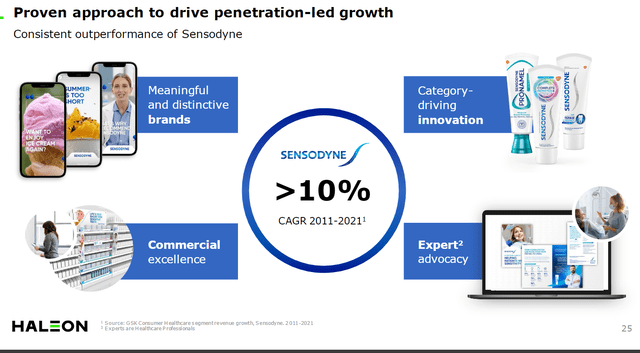

Another interesting thing to note is that HLN has a time-honored in-house scientific capability from its pharmaceutical heritage. This allows them to invent and build trust because of their engagement with the scientific community. They highlight the needs of their consumers, consumer insights, and broad engagement with the healthcare community. The double-digit growth of Sensodyne over the last decade clearly shows the huge impact of their engagement with the scientific community.

Consumer Healthcare Capital Markets Day

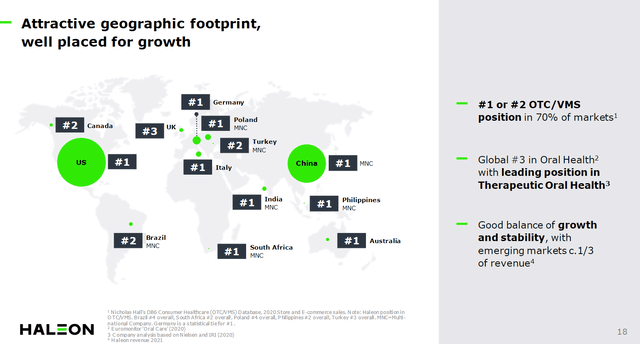

Strong distribution capacity

HLN’s presence is felt in over 170 markets and they have OTC/VMS positions in countries that represent over 70 percent of the global OTC/VMS as of 2021. Their leadership spans from the US to the European market, to India and China. Currently, HLN is also the number one multinational consumer healthcare business in China.

Consumer Healthcare Capital Markets Day

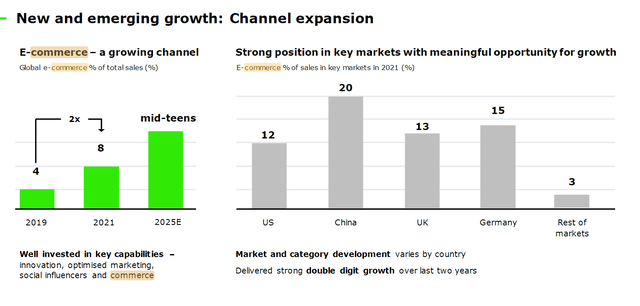

E-commerce represents new growth opportunities

HLN has made a lot of investments in digital infrastructure and media channels. In fact, HLN was an early adopter of Tech Stack by Google (GOOGL) (GOOG), which helps them access and directly own the audience’s data. They also use Publicis’ People Cloud to focus on relevant data so as to better connect with their audiences. All these enable HLN to build important, long-term relationships with their consumers. The increase in HLN’s investment into all of these platforms has created a more reliable, trusted, efficient, and connected path to their consumers. More importantly, positive results have been seen from all these investments.

Consumer Healthcare Capital Markets Day

Valuation

Price target

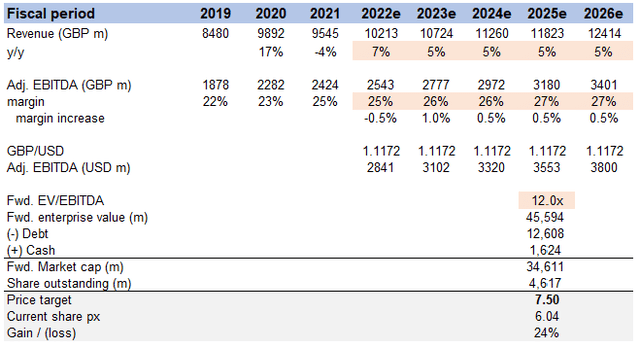

My model suggests a price target of ~$7.50 or ~24% upside in FY25 from today’s share price of $6.04. This is based on the assumption that revenue growth will grow at mid-single digits over the mid-terms until 2026e, EBITDA will sustain at current levels, and that the forward EV/EBITDA multiple will be 11x in FY25e.

Image created by author using data from HLN’s filings and own estimates

For FY22e, I used the mid-point of management guidance during 2Q22, which was organic annual revenue growth of 6 to 8% and a slight decline in adjusted EBITDA margins. Moving forward from FY22e to FY26e, I assumed revenue would continue to grow in the mid-single digits based on management’s mid-term guidance and adj. EBITDA margins would increase slightly over time due to management’s margin expansion investment.

As for valuation, HLN currently trades at 11.6x forward EBITDA, just slightly below its historical average. Assuming the macro environment recovers, I assume HLN will trade back to its average.

Risks

Highly Competitive Market

Competition is found in literally every market, and the consumer healthcare market is no different. Brands are constantly making themselves look more marketable through scientific claims, consumer-driven innovations, premiumization and distinguished branding. Traditional FCMG capabilities like consumer and channel marketing are also things that the competition leverages on.

Increased dependence on retail channels

The global market where HLN sells its products is intensely competitive due to rising levels of trade concentration and the prevalence of large-scale retailers. As the retail industry continues to consolidate, HLN will have to rely more and more on a smaller number of retailers, some of which may have and maintain greater bargaining power.

Conclusion

To summarize, I believe investments at the current valuation should provide investors with market-like returns and would be a more appealing investment if the valuation was lower. The key things to monitor are whether HLN can continue to increase penetration rates like it did in the past and if management guidance is credible in the near term.

Be the first to comment